Readers Commentaries

Due to time constraints, I am sharing recent Readers' comments today rather than placing them in a Readers Journal format. As always, there is a rich haul of interesting commentaries.

Alberto R.

Thank you so much for the latest great articles posted on your site. This specific paragraph sent my brain on a trip:

Have Americans essentially surrendered to adolescent fantasies? In pondering Jon H.'s commentary, I have to wonder: why would Americans knowingly blow their capital on an essentially worthless consumer binge?

Here are 5 thoughts that flashed through my mind while reading the above:

A large number of Americans:

1) Spend countless hours every day staring at the TV instead of reading or talking to their family about the daily matters that are important to a regular family. I have learned that only a few programs on TV will teach you something worth watching, and for that reason I could go for weeks, and sometimes even months without turning on my 32 inch CRT TV (emphasis on CRT and not flat screen). I do share some good cartoons with my children though...and I explain to them every wrong message I catch on them while watching.

2) Do not eat dinner together with their family every night. I think this is very important for the unity of a family. I was taught this way in a home where food was not abundant, but it was shared together as a family, and we talked to each other every night.

2) Do not have a monthly home expense budget. They spend more money than they earn in material items they really do not need, and they can't accept to live within their means. (Reading "How our parents shopped" would be a wake up call for many. For me, it showed me that I can live with even less than I do now)

3) Purchased an overpriced house or refinanced and pull all their equity out to spend it in not needed material items. At this time they are either under water, or in the process of loosing the house, or renting every room in the house to another family to be able to make the mortgage payment which just had a reset. I have wanted to buy a larger house for years now, and I kept wondering how can people afford the houses at those prices, and then go in and remodel the entire house in a couple of months. I thought: What am I doing wrong here? I bought my house in 1995 for 1/4 of 2006 peak's price in my area, and it has taken me until now to change the things I added to my wish list when we bought it.

4) Have one or more car payments that eat up a considerable portion of their monthly income. They have to have that new car at any expense. On this topic I always remember coach Jack Fullerton at the Orange County Commonwealth Investment Club. He explained a while back how much buying a new car today really costs you versus investing the money in real estate. The number was close to $1 million compounded over the years. I wish I had these numbers as they were written in the projector screen.

A great book a read years ago :The Millionaire Next Door" tells you how rich people view cars as liabilities and they do not buy them new or finance them. They choose to wait until the car has lost a considerable part of its market value and they buy it for cash for the lowest possible price. Again, financial intelligence vs instant gratification.

5) Eat out constantly because they do not have time to cook a meal at home or they are just too lazy to do that. It is easier to drive through any fast food place than to spend 30 minutes and cook a simple and healthy meal from scratch. Charles, this was covered in great detail by an article you posted a couple of months ago. This one shows a total lack of sacrifice to even take care of your most important asset "your own health".

Fortunately self-education, discipline, and lots of sacrifice allowed my family today to be excluded from all of these issues.

Thank you again for your time and for having a site that makes us think, learn and grow constantly. I appreciate it very much and I will continue to be a contributor hopefully for many years to come.

P.S. A note about home prices:

I do not know about Northern CA where your home is, down here in OC we are starting to see some large and quick home price drops. In West Anaheim where I live, a typical 3BR/2BA house with around 1300 sq.ft (at the peak of market) was selling for a range of $560k to $615k depending on the condition of the house.

Today the lower part of the spectrum in this 1955 neighborhood is starting to show up in the MLS for under $400k. As a matter of fact there are 3 to 4 listed right now for under $350k. Even one in a corner of a main avenue Brookhurst for $330k. These are 2003 prices! Very interesting.

Cesar in South Florida

Be who you are and say what you feel because, those that mind don't matter and, those who matter don't mind. DR SEUSS

We are in the crapper, Charles. I'm in south Florida, and let me tell you working people and rich people are losing everything here home, cars, boats, business, equipment. There is no money, business are broke cites are broke even if they lower the interest rates big deal we have to have work or business going on so that we can pay the borrowed money back.

The thing is that we can't pay back the money that we already borrowed, how can we borrow more? We are so over built with residential and commercial now and there is no other sector to turn to. The tourist seasons have been get shorter and shorter, just more chickens scratching s*** with more chickens.

Johnn K.

From the Pogo cartoon strip long ago:

"we have met the enemy and he is us"

I think that sums it up.

The reason we have a government of imbeciles, morons, idiots, is because we elect those who are most like ourselves. Government by the stupids elected by the stupids. In a democracy we elect those who will give us what we want. We don't want pain, we don't want to save, we don't care about the future. Our legislators don't either. They buy us off.

The reason this great country is going down the toilet is that we have squandered what the Founders gave us. They gave us a Republic and slowly and surely it was corrupted into a common democracy and a nanny state. Now it's mob rule by the majority. Those who live off the teat of the nanny government outnumber those responsible for feeding the nanny. People will vote themselves more benefits and more entitlements whenever they can. Human nature.

Just listen to the politicians from both parties. There's no program too grand, too expensive that we can't as a nation give to the people. No one talks about responsibility. Yes we have rights, we have liberty, but we also must have responsibilities.

The great experiment started 200 years ago is starting to wind down.

John P.

Yes, the public knows that we are broke. More importantly the public knows that we are broken as a people. This became apparent to me the week after Katrina when I asked an Army Chief Warrant Officer, in uniform, what he knew about the Katrina relief efforts. What I got was a 30 minute unsolicited rant about how the Iraq war was lost already and he kept re-upping simply to try and keep the younger kids alive. This was a guy who had served in Beruit when Reagan was playing with battleships.

I think people deeply and fundamentally understand that they are playing a poker game against a rigged deck. They are well aware that they too can get rich or get kicked off the bus at any time and their efforts to the contrary may not change that outcome significantly. They understand that playing fair is a suckers game yet most of them continue to play fair anyway.

They all have seen somebody they know make it rich on the worst kind of speculation and graft. All you have to do is to know a real estate agent or a building contractor. The real estate agents require no education, skills or work ethics other than the ability to prosper in junior-high social environment. The building contractors almost universally hired subcontractors that ran crews consisting entirely of illegal immigrants doing slapdash work. They inexplicably got rich while guys with masters degrees drive cabs.

Most importantly the money system is broken. The money that they labor heavily for is handed out at 2 percent interest rates to banks to play games with the stock market. Watch the daily stock charts for two weeks and it's obvious the big boys are rigging the game. The prices of food, housing, health care, clothes and education rise noticeably every year and then CNN announces that there is no inflation because iPods are cheaper.

The jobs that their dads worked 40 hours every week doing now only offer either 30 or 50 hour weeks; nothing in-between. Busting your hump and saving up doesn't matter because your money is worth less every day and either the doctors or the divorce judge can take away everything you worked for in a minute. Money is about as fragile as potato chips and is better spent than saved. Spend it before they take it is the rule.

This is going to be a very bad, bad year. The cheap oil is gone, the climate is out of control and the financial world is in chaos. Good luck making sense of it.

Michael Goodfellow

I'm surprised you are surprised by this (demise of dairies in Hawaii). We don't have any farms in Manhattan either, althought the climate would support it, and there are plenty of people there! The economy has a better use for that land, namely skyscrapers.

It would be more interesting if the farms are disappearing for some other reason. For example, if restrictive zoning or environmental considerations had made them unprofitable (increased costs of using them for agriculture.) I'm surprised that doesn't happen here on the California coast.

I thought everything in Hawaii is imported, including nearly all of the food. Why make an exception for milk?

Hawaii is far more dependent on tourists from Asia (and the strength of their economies) than it is on cheap oil. I haven't done the math, but I'm pretty sure if you figure the capacity of a cargo ship (in gallons of milk or anything else), and the amount of fuel it burns coming from Asia or the U.S., you'll get an absolutely trivial price per gallon or pound of finished product. Not even a penny per pound, I'm guessing.

Harun I.

Funny you should mention adolescence. About a year ago I quipped to my wife that it appeared that many Americans were stuck in adolescence.

As for dis-intellectualization, in terms of the common definition of intellect, I cannot think of any society in history where the "masses" were or are intellects, or so inclined.

However, I do not necessarily agree with the common definition intellect. Is the individual who finds calculus easy but can't get his car to run smart? I would venture yes and no. Is the mechanic who can fix the calculus whiz's car but doesn't know about the existence of calculus smart? Again, I would venture yes and no. I would posit that, in people with full mental faculty, that intelligence may vary more so in type than degree, i.e. task specific.

There are few Renaissance men.

Can we be both intellectual and immature? I believe so and therefore your reference to adolescence (or the rejection of adulthood) is probably more apropos than intellectualism or a lack thereof.

K.K.

You wrote:

"Let's start with a pernicious truth about credit: if you don't have any, then you'll never be able to obtain a home mortgage. Like any good pusher, the lending industry must first create a need, and then be the only source to fill it. In this case, the "need" is a high credit rating, for without a good credit rating, you will be unable to qualify for a conventional (low interest rate) mortgage. So how do you establish good credit? By taking on debt. There is no other way."

It is a myth that you need to take on debt to get a good credit score. You do need "credit" but you don't need to take on "debt".

K.K. (with no debt and a credit score over 800 for the last decade)...

You need to use credit to have a real high credit score (I charge a couple thousand every month) but it does help a little to have credit cards even if they have never been used in years (If you have a lot of accounts for a lot of years without ever having a problem it really helps the score).

I met a math guy that works at Fair Issac a few years back (he was dating a friend of a girlfriend) and he said that they are not supposed to talk about the model, but he told me that the Chevron and Nordstrom cards that I got in 1983 and have not used since 1985 were helping my credit score more than they were hurting it (I asked if I should cancel them).

Michael Goodfellow

Do you really want a world in which the business looks down it's nose at the consumer and says, in effect, "you aren't smart enough to buy my product?" That's what you are implicitly recommending when you say lenders should judge the creditworthiness of borrowers. I prefer the attitude "you're an adult -- manage your money like an adult!"

Also, even if all banks judged all borrowers accurately and responsibly, and never used this for redlining poor areas, and no loan sharks or other predatory lenders sprung up to serve this demand, you are still asking for an unequal situation. You are saying "merchants should be saints, and consumers can still be idiots."

Many on the right come at this from a moralistic, "law and order" perspective. I see it as an evolutionary problem. If you want people to learn, you have to make some distinction between the ones who do it right and the ones who fail. If you remove the penalty for failure, you remove the benefit of success as well. You don't get any improvement if there's no penalty for failure. Or no opportunity for risk.

You are really pushing for a system where a poor person can't get in over their heads, but they also can't take a loan for night classes or to start a new business. You'll be worse off with that system than the one we have, where we loan money easily, and expect people to go bankrupt if they botch it up.

Thank you, readers, for such stimulating commentaries.

NOTE: I will be away from my desk until March 3, but will try to post regardless.Email will be read but I may not be able to respond in a timely fashion; my apologies in advance.

Add this site to your reader with these feeds: RSS feed Atom feed

Permalink to this entry

NOTE: contributions are humbly acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, Somesh G. ($50), for your exceedingly generous contribution to this humble site. I am greatly honored by your contribution and readership. All contributors are listed below in acknowledgement of my gratitude.

Wednesday, February 27, 2008

Tuesday, February 26, 2008

2009: Revenge of the Debt Junkies

Here is a scenario which I call "The Revenge of the Debt Junkies." Many other observers also anticipate this scenario, but some might well be surprised by the fierce power of the tsunami of bankruptcies which I see heading for shore in 2009.

The scenario (which might also be called "turnaround is fair play") begins with this notion: For every action, there is an equal and opposite reaction. In this case, the action is unrestrained bank greed, which was protected by changes in the bankruptcy law adopted by the Republican Congress.

The idea behind these changes was simple: consumers could all too easily renounce debt, and the lending industry pushed Congress into making it more difficult to renounce what had been borrowed in good faith. Unsurprisingly, the reformers made no effort to explore who had been dumb enough to offer credit to those consumers who were so predictably uncreditworthy.

In other words, the banks formulated the status quo in this way: We the lenders can be utterly irresponsible in offering credit to consumers who show little or no evidence they can responsibly pay off the debt we have extended them. We are utterly blameless when the easily foreseen defaults emerge; the fault is all the consumers.

Wait a minute: doesn't it take two to tango? Who forced the banks to offer stupendous loads of credit to uncreditworthy consumers?

This tightening noose didn't satisfy the bankers' greed, however; they also instituted an array of immensely profitable policies designed to gouge unwary consumers.

Chief among these strangleholds is the "deposit-debit shuck and jive." Your deposit to the bank only clears in 3 to 5 days, but your checks (debits) to your account clear instantly. Thus the hapless consumer can deposit funds far in excess of the checks and charges he/she intend to make, but still be nailed with three, four or even five $35 "overdraft fees" as their debits are recorded against "insufficient funds."

For reasons far too mysterious for mere mortals to grasp, deposits seem to languish in some sort of financial purgatory for days (and no, these are not checks drawn on foreign banks) while charges are amazingly recorded in real time.

Our credit union doesn't seem to have this peculiar "differential" in processing, but plenty of commercial banks seem to suffer from this odd affliction--for example: Isle bank fees up 14.2%, to $117.6M:

An Advertiser review of filings with the Federal Deposit Insurance Corp. and the Securities and Exchange Commission shows that Hawai'i's eight largest banks collected a total of $117.6 million in fees in 2007, which was up 14.2 percent from the previous year's $103 million.

The increase comes as banks' profits from their core business of making loans to businesses and homeowners has cooled.

Gosh, do ya reckon that 14% increase in fees flows to the bank's bottom line?

Another classic revenue enhancer is the "we stick together gotcha." If the consumer makes a late payment to credit card 1, then he/she may well find a huge jump in the interest rates being charged on credit cards 2 and 3, even though those companies always received timely payments.

The reason given is "a change in risk characteristics," but why does this policy give off such a noxious stench? As a matter of fact, credit card issuers need not give any reason for jacking up interest rates; they can do so at any time without any other reason than, well, because we decided to.

There are many other examples of pure, distilled, heady greed which the banking industry has managed to codify or protect via their lapdogs in Congress.

But now the "equal and opposite reaction" is making itself known. In response to howls of outrage from consumer advocates, the Democratic-controlled Congress is making noises about rewriting some of the more onerous (to consumers) sections of the bankruptcy laws.

And before you blame the lawyers, please note the "banker written and approved" bankruptcy laws actually increased the costs of declaring bankruptcy, making the process longer, harder and more expensive for the consumer. Simplifying the bankruptcy laws would actually lower legal fees for those declaring bankruptcy.

What is the psychology of debt renunciation? I suspect the average consumer tries to hold the whole game together as long as possible, but the loss of a home via foreclosure might well trigger a desire for complete renunciation of all debt and a "fresh start."

I also have to wonder if consumers might well begin rebelling against being a debt serf/debt junkie for the foreseeable future, and decide that "turnaround is fair play," i.e. renouncing the debt owed to rapacious bankers and lenders is merely an equal reaction to the industry's greed.

The bankers/lenders hold most of the cards in this game, but the consumers have one ace up their sleeves: they vote. Will the new president and Congress of 2009 hear the roars for relief, and perhaps for revenge?

That seems like a reasonable bet; and if so, the vast stone moats which protected the bankers' unlimited ability to increase profits at the expense of consumers may well be turned into barriers which lock the bankers into a prison of their own greed-obsessed design: for every action, there is an equal and opposite reaction.

NOTE: I will be away from my desk until March 3, but will try to post regardless.Email will be read but I may not be able to respond in a timely fashion; my apologies in advance.

NOTE: contributions are humbly acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, G.D.F. ($25), for your many generous contributions to this humble site. I am greatly honored by your contributions, encouragement and readership. All contributors are listed below in acknowledgement of my gratitude.

Monday, February 25, 2008

Pushers, Lenders and Debt Junkies

Is the analogy that lenders and banks are essentially pushers and Americans are debt junkies over the top? Perhaps not.

Let's start with a pernicious truth about credit: if you don't have any, then you'll never be able to obtain a home mortgage. Like any good pusher, the lending industry must first create a need, and then be the only source to fill it. In this case, the "need" is a high credit rating, for without a good credit rating, you will be unable to qualify for a conventional (low interest rate) mortgage.

So how do you establish good credit? By taking on debt. There is no other way. It's a pretty sweet setup: if you ever want to buy a house via a mortgage, then you have to open and use credit accounts--the more the better in terms of establishing a high credit score. Having one revolving credit account (say, a Sears charge card) isn't going to do much for your creditworthiness; better to have a half-dozen credit accounts which you pay on time like clockwork. That establishes you can handle debt responsibly.

You know what lowers your credit rating? A bunch of unpaid loans, to be sure, but having no credit cards or other loans (consumer debt, auto, etc.) also marks you as a credit risk. No credit history? You're a risk. Thus paying in cash one's entire life will insure that mortgage lenders will cast a gimlet eye on your application.

The "pusher"--the lending industry--now has an unbeatable sales pitch: if you ever want to own a piece of the American Dream, come open a bunch of credit accounts. And like any good pusher, the initial offers are beguiling indeed.

A popular technique is the "student credit card" which is showered on college students like nickel bags of dope. Give the kid a $300 or $500 limit and he or she will run it up to the max in no time. Then, of course, the price of the "product" --in this case, debt-- quickly jumps. Now you nail the kid with $35 overlimit fees, and $35 late fees. It doesn't take long for the lender to recoup $300 in interest (the rates are 18% to 24%, or even higher if the local law allows) and fees--and the new debt junkie has barely paid off any of the principal.

Let's say the new debtor manages to avoid the snare by paying off the balance every month. The pusher then ups the "free money" in ever more enticing amounts. Now that you're proven yourself so responsible, now we're giving you $5,000 limit and a 9.75% rate--our very best!

If you never use your account, then you get credit score demerits; having credit without running up debt is a big negative. And of course other pushers (lenders) will glom on to the new "responsible" debt junkie, too, offering up $20,000 auto loans, more credit cards, "cash-back" credit cards and all the rest of the glittering array of consumer credit "products."

Sure, there will be people who are immune to the bewitchments of easy credit; but they will get their comeuppance when they try to get a mortgage. No way, fool! Either load up on consumer debt or forget qualifying for the mortgage.

Now let's take the "responsible" junkie--and yes, there are plenty of heroin addicts who maintain careers and apparently "normal" lives. In our analogy, the responsible borrower is offered more and more debt at lower and lower rates--until finally (the lender hopes), their "pay every bill off in full every month" discipline finally cracks.

The auto loan at 3.99%--who can resist? The $25,000 credit card limit --who can resist? And once you enter that dark wormhole, the offers get even better: pay off that other credit card balance with a new account with us, for only 3.99%.

This is how the lender-pusher expands the customer base of debt junkies. Responsible borrowers are offered more and more debt at lower and lower rates to encourage their debt habit. It's almost like the Peter Principle: you will be offered more debt until your ability to resist its allure is exceeded.

But fall behind on your payments, and the pushers' "enforcers" will have you by the throat in no time. First, the pushers nail you with exorbidant "late fees" and "over-limit fees." Then ,because you've revealed yourself as a "poor credit risk" (never mind who extended you all that credit in the first place), then your once-low interest rates are dialed up to the maximum.

And even if you've made your payments to Lender 1 on time, Lender 1 will jack up your interest rates because you were late paying Lender 2. This is how the pushers hang together and support the industry objective, which is millions of debt junkies caught in a spiral of ever-higher principal amounts even as they make their monthly payments.

Say the pushers get their hooks in good and deep into a 25-year old debt junkie--if the poor devil is paying rthe monthly minimum. he will pay off his last credit card at 62 years of age or so--some 30 years hence. Talk about a sweet setup for the pushers! Throw in the late fees and other junk fees and the sky-high interest, and the pusher will reap $20,000 pure profit on a $10,000 balance.

And always, the carrot remains just tantalizingly ahead: you need credit to get a mortgage. With no credit, you get a low credit score; and with a low score, you can't get a mortgage. Once you establish credit, then the deals get better and better until that euphoria--of a quick purchase, of a new car, of whatever your heart desires--surges, and the deal is done. You're hooked now on credit, and the addiction cannot be easily revoked.

NOTE: I will be away from my desk until March 3, but will try to post regardless.Email will be read but I may not be able to respond in a timely fashion; my apologies in advance.

NOTE: contributions are humbly acknowledged in the order received. Your name and emailremain confidential and will not be given to any other individual, company or agency.

Thank you, William S.. ($15), for your second generous contribution to this humble site. I am greatly honored by your contribution and readership. All contributors are listed below in acknowledgement of my gratitude.

Thursday, February 21, 2008

What the Public Knows

Longtime correspondent Jon H. opened an intriguing line of inquiry with this no-holds-barred commentary:

"Could the public be smarter than we realize? As a nation, we are broke. Our government is broke, the banks are broke, the consumers are broke.

Perhaps deep down people realize that their future is bleak. They have been spending like there is no tomorrow because they know that there is no tomorrow. Shoot the wad, blow the savings, cash in the equity, for tomorrow we will be out on the street. Incomes are falling, jobs are disappearing, prices are rising, so what hope is there that we will ever recover from this mess?

Live for today. Spend it if you have it. Eat, drink, and be merry because the lights will go out on the party at any moment. Greed and denial have gripped the nation and we are eating our seed corn. After 9/11 we were told to go shopping! We were not told that we should make any sacrifices, that we should tighten our belts and get out of debt. Nor were we told that we should mend our ways and stop aggravating the rest of the world with our arrogant attitude that we are the richest nation in the world when, in fact, we are the biggest debtors. Our national credit card is maxed out and the rest of the world humors us by allowing us to pretend that we are still number one. We are the crazy aunt in the attic who is living on generosity of strangers.

And below the surface we know this is true. We have had a sneaky suspicion that we were deluding ourselves. The great American dream of having it all and having it now is not based in reality. Hard work, perseverance, thrift, and a sense of unity under our laws and Constitution is what made us a great nation in the past. All that has been squandered in the past seven years. So as with Joseph’s interpretation of the dream in the Bible, are we now destined to suffer seven years of poetic justice? Maybe that realization is beginning to sink into the collective psyche. And that is where we are at as many fellow citizens lose their homes and we watch the banks’ posteriors pucker up. That depressing mood is descending upon us and we know the game is over.

It’s only a possible explanation of what is happening, but it makes some sense."

Thank you, Jon, for putting into words what many would view as taboo: that is, the American public knew darn good and well the last seven years of "prosperity" was bogus and they blew their equity anyway living larger than they, and the nation, could afford.

Is there any evidence reality is sinking in? Frequent contributor Harun I. sent in this story on people charging stuff against their 401K retirement funds: A new debit card that lets consumers use ATMs to withdraw money from their 401(k) plans is drawing a sharp reaction from financial planners.

"What the public knows" is important because whatever solutions are proposed must win the political backing of the populace. So far we've seen the public reject various bailouts of speculators and homeowners who bought houses with no money down and either inadequate or fraudulent income.

But has the public accepted that belt-tightening and reduced spending is the only way to balance the private and national imbalances? There is little to no evidence that the public is ready to accept higher taxes or huge spending cuts to the entitlements they and their families receive.

Blaming Wall Street is like shooting fish in a barrel. Does Wall Street shoulder much of the blame for the fiscal fiasco engulfing the nation and indeed, the planet? Of course. Time for Wall Street to Pay.

But let's not forget nobody forced town leaders in Norway or anyone else into buying the risk-larded debt instruments peddled by Wall Street. Come on--was everyone born yesterday? Do you just ignore that 100-page disclaimer in the back? Was there no other more understandable debt you could invest in, such as straight-up (i.e. not a derivative) government or corporate bonds? Did money managers in Berlin, Beijing, New York, etc. have to buy Wall Street's garbage? No, they did not.

The book Fiasco: The Inside Story of a Wall Street Trader laid out the whole Wall Street methodology of gaming and hiding risk inside complex derivatives--and the book has been freely available since the mid-90s.

By all means, we must allow insolvent investment banks to fail--along with mortgage lenders and everyone else who is now facing catastrophic losses on risky investments/debt.

There is a peculiar blindness to the entire blame-game as it is now playing out.

1. The government regulators who should have limited the most obvious excesses of the past seven years did virtually nothing. Why? Because they are controlled by politicos or their top-level appointees. The FDIC, the Fed, the Treasury Department--they're all run by appointees who serve at the pleasure of the Executive Branch.

Why is there no political outrage that the governmental agencies tasked with protecting the banking system and the public utterly failed to perform their duties?

One possible answer is the public has completely absorbed the Reagan-era ideology that all government is bad/wasteful/needless. Reagan famously mocked all government agencies equally with his standup line, "Hi, I'm from the government, and I'm here to help you." Heh-heh.

Yes, many agencies are pork-riddled complete wastes of time and money. (Let's start with Homeland Security, TSA, the Pentagon's private armies in Iraq, Medicare fraud and waste, and. . . well, fill in the blanks. The list is endless.) But the financial regulatory agencies spend a nearly infintesimal percentage of the Federal budget and perform a staggeringly important function. Yes, it's easy--and important--to blame Wall Street, but to wag our fingers at Wall Street greed and duplicity while ignoring government's role in enabling the excesses to occur--that is blindness:

You Get the Government You Deserve:

"Have you heard any presidential candidate from either party explain why the appropriate response to the mortgage debacle is to let the culpable parties pay the price for their mistakes? Nothing teaches you about debt like losing your home to foreclosure. I'm still waiting for that speech. (OK, Ron Paul has probably given it -- which is one reason he'll never get more than 10 percent of the vote.)

Everyone loves small government in theory. We're tired of being told that the coffee we're about to enjoy is hot. But then we burn ourselves and expect someone to show up with ice. You can't have it both ways. "

In other words, when government could have stepped in and limited the damage for mere pennies, nobody cared. Now that the damage is in the hundreds of billions, then suddenly everyone wants a government-funded "fix."

Talk about having a monkey on your back (slang for a heroin addiction). The monkey here is risk: risk which is private when the real estate and stock markets are hot and every player is making big money suddenly becomes public when the markets tank and losses mount, and calls rise for the "gummit" (i.e. the taxpayers) to shoulder the losses and risks.

Nice--but isn't that rather obviously wrong? Why should the taxpayers pay even one cent to accept private risk and debt? And wrong not just for two-bit speculators who bought three houses with nothing down, but also wrong for the bigtime speculators who "earned" billions in Wall Street bonuses every year.

2. There is a strange dichotomy playing out as various groups alternately demonize and sentimentalize both the rich and the poor speculators. As we all know, the "high ground" in America today is victimhood: whoever claws their way to the top of the "victim" scrum is declared the moral victor.

So we have voices sentimentalizing the poor fools who bought an overpriced house with nothing down and insufficient income as "victims" of lenders. It's getting crowded up on that scrum, because it's already jammed with other "victims" of banks and Wall Street.

Then we have the heads of JPMorgan Chase et. al. going on about how the "innovations in the industry" are so grand for America. I want to gag every time I hear about those wonderful glorious "financial innovations" which have essentially bankrupted the nation. This too is an attempt at sentimentalizing industrial-strength greed as "good for America." Sorry, we aren't buying.

We also have to endure the insipid sentimentalization of home ownership, as if that financial decision possessed some sort of alchemical magic which instantly transmogrifies the mortgage holder into a wealthy, happy citizen.

Demonizing Wall Street or the housing bubble speculators is a dead-end, too. People are greedy and want something for nothing. The madness of crowds took over and a bunch of folks got burned, just as they did in the Tulip Mania of 1600-Holland. Wagging our fingers in indignation is a waste of motion; just let them take their losses and get on with their lives and businesses. (That's what bankruptcy is all about.)

3. Have Americans essentially surrendered to adolescent fantasies? In pondering Jon H.'s commentary, I have to wonder: why would Americans knowingly blow their capital on an essentially worthless consumer binge?

One possibility (raised here most recently in an exchange with contributor Michael Goodfellow) is that Americans feel entitled to the same lifestyle a previous generation enjoyed in the 1950s, when one wage provided enough purchasing power for a nice big suburban home and most of the luxuries we have come to take for granted.

With inflation and global wage arbitrage a reality since the 1970s (and the emergence of Japan as a global economic powerhouse), now it takes two wages to buy a reduced version of that 1950s-early 1960s "golden age" when the U.S. wage earner's purchasing power was much higher than it is today.

In other words, like spoiled children, Americans have pouted, "But I deserve more!" and as a result they spent their "seed corn"/capital on a futile attempt to match the lifestyle of a previous (strong dollar, low inflation, cheap housing and cheap energy) era.

Knowing full well we were already tipsy on debt, we refused to sober up but instead staggered over to the bar to get completely plastered. Now we have a hangover and are whining: but the liquor was so cheap, and tasted so good! I felt so euphoric!

Are we really that callow as a nation that we didn't know overindulging on debt and spending borrowed money was not a wise idea? Or are we fundamentally gripped by the adolescent fantasy that we should be able to indulge without consequences, and now we are resentful that there are consequences?

I don't claim to have an answer, but Jon H.'s commentary opens many doors of inquiry, all troubling.

If we as a nation can't own up to adult life, i.e. consequences were earned and must be paid/accepted, then what sort of political "fix" will the public demand? And who exactly is supposed to pay for it? Those who didn't get drunk on debt and spending? Those who lived in cheap apartments and saved their money? Those who didn't join the mad crowd?

Or even worse: will today's hungover Americans demand that non-U.S. central banks lend us the money, and then demand that their own children and grandchildren spend their lives paying the stupendous bill for their own poor judgment? That is essentially what the Federal Deficit does, pitilessly, stupidly, cruelly.

NOTE: I will be away from my desk until March 3, but will try to post regardless. Email response time will be degraded, I am afraid; my apologies in advance.

NOTE: contributions are humbly acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, Alberto R. ($20), for your on-going, near-miraculous generous support of this humble site. I am greatly honored by your contribution and readership. All contributors are listed below in acknowledgement of my gratitude. Read more...

Wednesday, February 20, 2008

Are Americans Inherently Anti-Intellectual?

Is the U.S. a deeply anti-intellectual, anti-learning culture, and thus a deeply ignorant one? Every few years comes a book which argues persuasively, "yes." This year's entry is The Age of American Unreason . Longtime correspondent U. Doran alerted me to the book via this story link: Susan Jacoby: Bemoaning an America that values stupidity.

A generation ago the book du jour chastising the dumbing down of America was The Closing of the American Mind which judging by sales on amazon.com remains very much in the public consciousness.

I asked frequent contributor Michael Goodfellow for his take on the issue, and he responded with a number of fresh points of view:

"This has been commented on a lot recently on the Net. I agree with some of the sentiment expressed here:

embrace your inner moron!

There are more sources of information than ever if you want it. And it's not clear that we're really worse off in terms of intellectual health than before. American pop culture has been idiotic for decades, and people have moaned about lack of knowledge on the part of the public for decades as well. Interestingly, I remember reading a comment about 19th century England after the Sherlock Holmes stories were first serialized. The upper classes weren't celebrating that ordinary people were reading -- they were complaining that people who should be working were wasting their time reading novels!

Here's an analogy for you. If we were asking about American physical health, we'd be talking about increased obesity, lack of exercise, poor diet, etc. You could make the same comparisons about average American intellectual life, as the Jacoby article does. On the other hand, if you were asking about American athletics, you'd be talking about the increased numbers of serious athletic programs from grade school to college, the increased number of people who take athletics seriously, the improved training methods and broken records in practically every sport. In other words, nothing but serious improvement.

Again, you could say the same about serious intellectual life in this country. There's more and more to do and learn, better ways to do it, our best universities are world class, and there's never been more possibilities for making a living at intellectual pursuits. The results are obvious in science and technology. I'm not familiar enough with the arts to even guess at whether you can say there's been an improvement, but there's certainly more of it, from serious art to commercial art down to YouTube.

So overall, I'd say at worst, there's a widening split between the part of the country that enjoys intellectual activity, and the average person who doesn't. I really blame the school systems for that, not any increase in anti-intellectualism in the population. It's amazing anyone gets through K-12 public education in the U.S. and still wants to learn anything.

There is another interesting point of view I've heard on all of this. The story is that originally education was seen as "male" and had status. When mandatory education became widespread in the 19th century, and many cheap school teachers were needed, it was mostly women who filled that role. And so education became seen as "female", and its status dropped. For boys, education was some boring, spinster schoolmarm who slapped your wrist with a ruler if you didn't sit still. Within 50 years, the entertainment industry had converted the college professor from a "wise man" image to an overeducated dunce with no common sense -- a bit of a clown. The overall culture followed that same line, with women reading and men avoiding books.

That trend continues, with women outnumbering men in college. The change is that more women than ever go into fields requiring formal education, and fewer men are doing that. There's this "war against boys" argument about schools, and some moaning about the lack of careers for men involving work with your hands.

I don't know how seriously to take all of this, but it's certainly possible that the "dumbing down" of the culture she notes is partly a war of the sexes phenomenon. Certainly a lot of the stuff she scolds about, from video games to stupid movies, are "boy" things. Of course, it could be she's reacting to that in-your-face "boy" culture, rather than a more classically "girl" culture, not any actual decline."

Thank you, Michael, for the thought-provoking commentary.

I would add a couple of (free association) points:

I wonder if some of what is labeled "anti-intellectualism" is in a broader sense an anti-elitist world view which can be traced back to the American Revolution and a distrust of monarchy, nobility, centralized state churches and other political elites-- and foreign powers.

It is noteworthy that even our most patrician presidents, those born into the equivalent of landed gentry or nobility such as the two Roosevelts, had the ability to evince "the common touch" via "fireside chats" (FDR) or trust-busting (Teddy R.) and war-fighting (no sitting back safely behind the lines for Teddy--that's the spirit!)

So in this sense a distrust of any elite, political, spiritual or intellectual, is perhaps a healthy cultural trait.

I also wonder if the culture isn't caught up in this common mind-trap: expectations which are rising even faster than improvements. Thus two generations ago in the 60s, many slow-learning kids were simply dismissed as "dumb" and nobody thought it was cruel or wrong to do so. Many other kids barely made it out of high school while others simply dropped out. This was generally accepted as the norm.

At the other end of the spectrum, the U.S.'s failure in the 50s to keep abreast of Soviet space advances triggered a stupendous handwringing which launched nationwide improvements in science, math and even physical education/fitness programs.

Has anyone looked at their 5th grader's homework? It is challenging, especially in math. One can (and perhaps should) quibble with the textbooks, but in general the material being presented to pre-high schoolers is of high quality from what I have seen here in California. (School district quality varies everywhere, of course.)

That said, it is a worthwhile exercise to ask if our educational system is truly on track to turn out a populace prepared to be gainfully employed in a global economy in which many will be competing against workers in other countries, i.e. globalization.

What is rarely mentioned in the screeds is the U.S.'s ability--despite all the real negatives outlined in these books--to turn out a number of citizens who can think independently of group-think and who continue to learn throughout their lifetimes.

I do find it disturbing that the electronic clatter of TV, iPods, texting, video games et. al. is inherently more engaging than a book even as it scatters the mind of the multi-tasking user and lowers the ability to concentrate/focus. The multi-deviced teenager often has a very low threshold for "boredom" which translates into an inability to focus on anything long enough to learn it well.

Not all kids are drawn to this electronic overlay of competing inputs; some prefer quiet reading, playing music, building things, engaging in real sports and activities rather than video-enactments, etc. It might be best to reward these kids and encourage them, and accept that the rest will have to discover later in life that programming their iPod is not a marketable skill. They will adapt (go to community college or university, learn welding, etc.) when they tire of poverty and teenagehood.

In the meantime, many parents, teachers and school districts are doing their best to fight the anti-intellectual trends and to instill lifelong habits of critical thinking and basics such as reading and math in kids who would otherwise prefer to play around with their electronic toys all day.

And let's not forget that knowledge is an essentially "adult" function. In America's youth-obsessed culture of permanent rebellion against adult expectations and mores, that means the "cool thing" to do is do whatever adults criticize, i.e. watch TV all afternoon while listening to your iPod and texting friends (while not experimenting with unsafe sex and drugs, of course).

If only ageing Baby Boomers were to adopt the electronic lifestyle and lecture kids of today to stop wasting their precious entertainment time on studying and learning--well, learning might well instantly become cool. There is little more repellent to a teenager than a stoned parent bragging about how many tunes they have on their iPod and how they're texting all day long while they hog the Playstation. That might be enough to spark an entire generation of Unrepentant Intellectuals.

NOTE: contributions are humbly acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, Don E. ($13), for your on-going, near-miraculous generous support of this humble site. I am greatly honored by your contribution and readership. All contributors are listed below in acknowledgement of my gratitude. Read more...

Tuesday, February 19, 2008

Hyperinflation or Deflation?

Longtime correspondent Cheryl A. posed this cogent question after reading System Instability, Redundancy and the Domino Effect:

"Regarding today's column: If I understand correctly, you speak of an implosion in about 4-5 years. Are you referring to a deflationary implosion? Is this similar to what Puplava refers to as a hyperinflationary depression in 2010-2012, except that you believe the price of oil and food will fall?"

Yes. As we all know, there are two "dominant paradigms" which are called upon as models of the near future: a Weimar Republic-type hyperinflation, in which the central banks attempt to re-inflate a bubble via pushing mountains of fiat money into the system, and a Japan-style deflation, in which the central bank pushes interest rates to near zero but people refuse to borrow more, or are so strapped they can't borrow more even if the money is nearly "free."

If we start with the supposition history doesn't repeat, it echoes, we should be wary of "mapping" the present with an overlay of the past (which had its own unique features) and expecting a near-perfect match.

I have been working recently with the idea that neither "hyperinflation" nor "deflation" as concepts do justice to what lies ahead, though each retains some utility. I have been deploying "purchasing power" as perhaps the more powerful concept, for this enables us to see that we might be able to buy more or less of specific classes of goods and services at the same time, regardless of whether money supply is expanding (inflationary) or contracting (deflationary).

Put another way: how useful is it to term an era "deflationary" if your purchasing power for essentials is plummeting? How useful is it to term an era "inflationary" if your purchasing power is rising for essential items?

As always, the categorical answer might be too reductionist to have any value. The human mind prefers a simple, global answer, i.e. one which "makes sense of the entire world." Complexity is confusing, and so we avoid it whenever possible. We seek instead the single causal factor which underlies the complexity. This works for systems such as planetary motion, but less well in systems with millions of interactions, i.e. the immune system and markets.

It might be more fruitful to turn away from seeking "global answers" and look to market forces, which tend to seek equilibrium. Let's take skyrocketing food prices as an example. We all know rising demand for grain-fed meat in China and U.S. demand for biofuels has been rapidly driving the cost of grains and soybeans up.

To my amazement, many seem to take it as an article of faith this trend cannot reverse. But a funny thing happened on the way to an irreversable trend: farmers decided to profit from skyhigh prices by bringing marginal or fallow land into production:More Grain Production Sought.

China has a very entrepreneural culture and in some ways, an entrepreneural economy. With the cost of food rising--recent headlines are full of stories like this-- "Soybean and soybean oil futures in Chicago soared to a record on speculation demand from China will climb after winter storms damaged the nation's rapeseed crop"--will China's farmers respond in some fashion? Do you think it possible that some youth who left the farm for a $150/month factory job hears about the small fortunes being reaped back home and decides to quit and grow the "hot" crop of the day for a much better wage than can be had in a factory?

Has China already completed every possible step in the long process of raising agricultural efficiency and yields? That would be hard to believe. Yes, the dust storms in the dry north are worsening, and everywhere the air, land and water are being threathened by industrial pollution. These problems have been covered here in depth for years. But China is a big country, and the south has plenty of water. To predict China's food production can't possibly rise to meet demand, or that demand won't fall as prices rise is to ignore ag commodity history.

For a history of grain's wild price swings, please read Merchants of Grain (recommended here by frequent contributor Albert T.). Grain prices have and will remain volatile for a number of reasons, most relating to supply and demand which are in constant flux.

The same is of course true for copper (high demand based on construction), oil and every other commodity. As prices rise, new supplies are sought and demand gets crimped.

The global grain bubble: As prices soar, riots rise. But it's not for lack of crops. The cause? A rush to biofuel and grain-fed meat. Let's suppose that a global recession will cut oil demand by a lot more than is currently assumed. Recall that prices in a relatively open market are set on the margin. Thus it is the shortfall or surplus of a few million barrels a day which sets the price on the 80 million barrels a day the world consumes.

When conservation measures cut demand in the U.S. by millions of barrels a day in the 70s and again in the 80s, the price of oil declined. When the Asian Contagion lowered demand for oil in southeat Asia, the price collapsed to $10/barrel in 1999. Yes, I am well aware of Peak Oil, but I have been alive long enough to see many trends which seems fixed break down and reverse as the market sought equilibrium.

So oil demand drops 8 million barrels a day and the price falls in half. What happens to biofuels? They're no longer economical (if they ever were). Ethanol production sags and suddenly there's a glut of corn.

Coal is now shooting up as China's attempts to fiddle with inflation by controlling prices has led to shortages. Recall that manufacturing is a huge consumer of electricity in China. So what happens as the U.S. and the rest of the world slip into recession? Maybe the factories lay off one shift, and other less efficient factories are shuttered. Demand for electricity drops. Then demand for coal drops.

Maybe food prices will continue jumping by leaps and bounds; crop failures could easily make it so. So if we declare "deflation", what does that mean if your money buys less and less food and energy every month?

Conversely, if we declare "inflation," but bumper crop yields cuts the price of grain in half, and a global recession drops oil demand by 10% ( 8 million barrels a day), slicing the price of oil in half, then we can purchase more food and oil with less money, i.e. our purchasing power has increased despite "inflation."

This is why I am wary of declaring "one size fits all" concepts in a complex world. No one knows if rents will rise or fall as the housing bust creates new demand for rentals and millions of empty dwellings are put on the market. Rising demand could raise prices for rentals, while expanding supply of new rentals (formerly spec homes and condos) could drop prices at least in those areas which have abundant supplies of bubble-era housing.

Tight money doesn't mean speculators won't be buying condos to rent out; it simply means they will be purchased for cash, or 20 cents on the dollar. If the investor's cost basis is low enough, then he/she can drop the rents slightly below market to attract tenants.

Conversely, "low interest" loans won't attract investors if rents won't cover taxes, interest and maintenance costs.

My point? Look to market forces and purchasing power before placing too much predictive weight on either "deflation" or "inflation." Based on market forces and the idea that this recession will not be brief or shallow, but deep, long-lasting and global, I expect demand for all commodities and services to shrink significantly just as supplies increase to meet the predicted (and now phantom) demand.

I also expect oil exporters which rely on oil revenues to fund their welfare states/subsidized food and energy to create a feedback loop of ever-rising inventories and ever-falling demand which will drop oil lower and lower as the recession takes its toll on the global economy.

This is just one of many such feedback loops of supply and demand which will play out as equilibrium is sought on a global scale. In the sense that money is also a commodity, then feedback loops of supply and demand for money will also play out. My prediction was based on the notion that equilbrium is 4-5 years away, and that it won't be reached until all bad debt/worthless securities/properties on the planet are written off/sold off/renounced.

Permalink to this entry

NOTE: contributions are humbly acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, Narendra P. ($49), for your extremely generous support of this humble site. I am greatly honored by your contribution and readership. All contributors are listed below in acknowledgement of my gratitude. Read more...

Monday, February 18, 2008

Is the Market About to Crash?

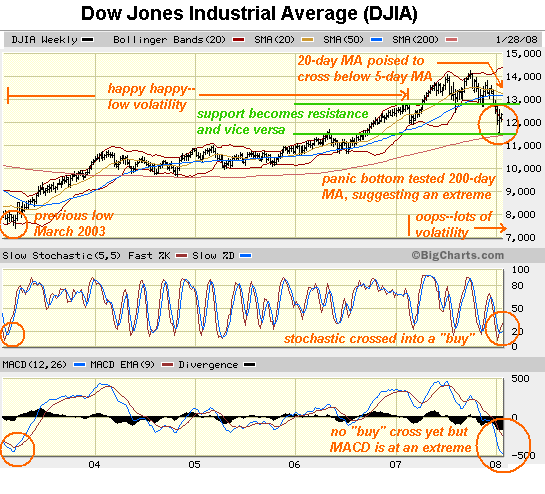

In true contrarian fashion, I wondered here on January 30 if the market was poised to rebound: We Told Ya So--But So What?. We all know the credit/debt financial bubble is popping, and that its demise is long in coming and richly deserved--but as observers, we also have to look at the stock market stripped of "fundamental" beliefs about what it "should" do.

Here is the chart I posted on January 30. Since then, the market has more or less continued to noodle around:

Courtesy of frequent contributor Harun I., here is an updated chart of the Dow in a shorter time frame. Please note Harun is not responsible for my interpretive comments on the chart:

The most striking points about this chart are (in my amateur opinion):

1. the close correlation of recent price action to fibonacci projections

2. the divergence of MACD, ADX and DMI. That is, these indicators of trend have reversed from downtrends into uptrends. If price confirms that divergence, then that reversal bears close scrutiny.

3. a wedge (or flag) has formed around a key support/resistance level (about 12,700). Price tends to break up or down in a new trend from such a formation.

In correspondence with Harun, I noted that market participants seem indecisive--the decline of the green DMI (strength of trend) line certainly suggests this.

Harun made these cogent observations:

"The decline of the green ADX line and the historical peaks of DMI in many of the markets we are watching is indicative of a non-trending state and a cyclical peak and therefore counter-trend strategies have a higher probability of success. This also means that support are resistance areas are now significant in terms of timing and time frame.

The most important observation though is your understanding of the psychological state of market participants, i.e., they are indecisive. This may cause, as you say, certain things to consolidate or rally unexpectedly as market participants react disproportionately to the news. Weak shorts will cover and cause the market to surge higher unmasking more stops. Of course the opposite is possible and should be guarded against.

Price is now oscillating in a range set at the beginning of the previous year which indicates that the gains of last year were lost."

If the market drops below that February 2007 low (about 12,000), then that would suggest the next leg down had begun. Alternatively, if the DJIA rises above the 12,700 resistance, that would suggest a near-term uptrend is in place.

How on Earth could the market rally when the U.S. is in recession and the financial house of cards is toppling? Good question, and I don't claim to have an answer.

But in the spirit of inquiry and contrarian exploration, let's consider what it's like for managers of serious money--not just hedge funds, but insurance portfolio and mutual fund managers.

The Fed is lowering interest rates by half-point shots every meeting, it seems, driving short-term yields ever lower. To leave your money in short-term cash is a good way to get near-zero or even below-zero returns. That may be a winning strategy in the long run, but you're not here "for the long run"--you're here to beat alpha, or you'll get fired for "underperformance." That's the way the game is played.

The bond market's had its big run from last summer, and the emerging markets--hot as a pistol the last few years--seem to have caught the flu when the U.S. markets sneezed. Europe? Looks topped out and vulnerable. Japan? Some exposure might be good, but as a manager you need some place to plant serious dough, not 5% of your portfolio.

So what's the largest, most liquid stock market on the planet? The U.S. market. And were there any reason to suspect it might have bottomed, and a positive return could be gained... you'd be all over it. Given the dearth of alternative opportunities in the $5 billion to $100 billion range, you'd have to be all over it if you wanted to keep your job.

But who's got cash to invest? Well, somebody has over $3 trillion under the mattress, so to speak--this is from Credit Bubble Bulletin, by Doug Noland, courtesy of frequent contributor U. Doran:

"Total Money Market Fund assets (from Invest Co Inst) jumped $26bn last week (6-wk gain $275bn) to a record $3.388 Trillion. Money Fund assets have posted a 29-week rise of $804bn (56% annualized) and a one-year increase of $995bn (41.6%). "

So we have the players, and the cash. Now why invest in selected U.S. companies? From the money managers' point of view, consider how few major U.S. multinationals have exposure to this credit/debt meltdown. IBM? Zero. Apple? Nada. Proctor and Gamble? Not worth mentioning given its global reach and size. Most of these corporations earn more overseas than they do in the U.S., and they have no credit risk worth mentioning.

Sure, we know the world economy will follow the U.S. into recession, but on a relative performance basis, you could certainly make the argument that major U.S. multinationals and tech companies will weather the downturn much better than other global firms, and perhaps better than commodities, which are exquisitely sensitive to drops in demand--which is precisely what happens in recessions.

Would you like to bet that the winter wheat crop will disappoint, and wheat will double to $20/bushel? What if the crop exceeds expectations? The it's $5/bushel wheat, here we come. In any event, most managers of serious money are precluded from even speculating in commodities and currency futures.

So what's my point? Only that in times of uncertainty and high volatility, then active portfolio management is necessary to catch the trends. Take a look at this chart of the DJIA in the 70s. Note its extreme fluctuations in price:

Now in nominal terms, the 1966 "buy and hold" investor was made more or less whole again in 1973 and 1977--that is, the DJIA returned to about 1,000. But adjusted for dropping purchasing power, the "buy and hold" investor lost 2/3 of their money by the time the Bear Market finally ended in 1982.

Was ignoring trends a wise investment/preservation of capital strategy? It's something to ponder as we look ahead and try to conserve what investments/purchasing power we still have.

Permalink to this entry

NOTE: contributions are humbly acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, Matthew G. ($50), for your very generous support of this humble site. I am greatly honored by your contribution and readership. All contributors are listed below in acknowledgement of my gratitude. Read more...

Saturday, February 16, 2008

Saturday Quiz: 19th Century French Author

Question: Which French author scandalized 19th century France with his naturalistic depictions of Parisian slums and their rough-talking, drunken, dissolute, often-promiscuous residents?

Here's the answer.

As you might have guessed, I am reading one of his most admired books (in translation).

Readers Journal is updated! Check out the stimulating array of experiences, commentaries and ideas from twelve fellow readers.

To whet your appetite, here are some brief excerpts from various contributors:

Fast forward to today. I recently had a falling out with a good friend, with whom I've played music with for almost ten years, The reason? I made the statement that behind each foreclosed home is a real estate agent who didn't do their job and failed in their fiduciary relationship with the buyer....

You nailed it again. Throughout the mass delusion my wife and I have been aghast as old freinds, neighbors and family bought into the morally bankrupt rational of "its just monopoly money" or "its different this time"... I think you have hit upon the criminal nature of our mass delusion. We have to admit our mistake in order to move on....

As with everything I read about this topic, though, I want to tear my hair out about the ten-ton elephant in the room that is being ignored. No one ever mentions or tries to seek out what I think would be a very telling statistic: How many of these defaults are Single-Family Owner-Occupied dwellings? (Not merely listed that way for under-writing purposes, but in actuality.)

The Mortgage Bankers Association of America estimates that anywhere between 30 and 70 percent of properties now in default are NOT S-FO-O. That is a crazy point spread which tells two different very different stories....

However, there is a broader issue here we must face, which goes beyond the individuals who were actively engaged in some degree of fraud. Namely, the entire credit bubble would never have occurred if society itself wasn’t complicit....

I have been following the posts and indeed things are becoming increasingly unstable. But from our studies in nature, i.e. chemistry, we should understand that all things are seeking equilibrium. In some cases equilibrium is achieved through an exothermic reaction....

On the subject of Government waste, I can't even began to tell you the frustration I face everyday on needless waste of our Government. I think there is a fatal flaw in the way system was designed. It forces us to be wasteful rather than thrifty. All departments are awarded for spending the budget not saving it....

Have a headache? (short satirical video with music)

I agree with your moral argument, but you might as well rail against the tide. The "your loss is my gain" ethic is already firmly embedded - witness the growth in popularity of poker and gaming, or trading existing financial assets (as opposed to issuing IPOs of productive new companies)....

Looking at life (mine) with the reasonable honesty I do, I learned along time ago that the only true way to really learn things is to immediately admit your mistakes or misconceptions and own up to the mistakes and drop the misconceptions....

And if that isn't enough to spark your thinking, here is a stunning new essay by Protagoras: Letter from a Constituent .

We are honored to host Protagoras' many insightful and satiric essays here on oftwominds.com.

NOTE: contributions are humbly acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency. Thank you, Wesley C. ($25), for your generous support of this humble site. I am greatly honored by your contribution and readership. All contributors are listed below in acknowledgement of my gratitude. Read more...

Friday, February 15, 2008

Ethics: a Non-Issue in America

I find it curious that lying, fraud, sins of omission and misrepresentation play absolutely no part in the national debate on how best to "save" at-risk homeowners and lenders.

This is curious for a number of reasons. Certainly one is the high degree of religious conviction and belief Americans report to hold.

According to author Richard Bitner's website The Mortgage Insider, "Nearly three out of every four subprime mortgages originated by brokers were misleading or fraudulent." (Bitner's book Greed, Fraud & Ignorance: A Subprime Insider's Look at the Mortgage Collapse was recommended here this week.)

Never mind expecting calls that fraud should be pursued as a crime--how about expecting someone to simply voice that it was wrong?

As outlined in Bitner's excellent book, fraud and misrepresentation of risk was the game played by everyone from the anxious-to-get-rich-quick borrowers to the anxious-to-make-billions investment banks which packaged the risk under the phony guise of low-risk AAA ratings issued by a handful of powerful fraudsters, a.k.a. the ratings agencies.

Yet pundits and politicos are falling all over themselves in a frenzy to "save" the players large and small from any consequences of their fraud.

Since I am tired of waiting for some well-regarded pundit or politico to state the obvious, then I have to: everyone who committed fraud, omitted the truth or misrepresented the risks of a debt instrument committed a serious ethical breach (and a crime). Each person who did so deserves the consequences of their unethical conduct. They do not deserve to be "saved" by taxpayers.

I am not suggesting criminal charges, though those would be richly deserved by players large and small alike. I am simply suggesting that we as a nation should state that fraud is wrong and should not be rewarded. The market will deal out the consequences if we just don't intervene.

I want to reiterate a point made earlier this week in Greed, Fraud and Duplicity: How the Housing/Lending Bubble Inflated, which is fraud can be quantified by the dollar amount but the ethical lapse/moral bankruptcy is the same regardless of the fraud's dollar cost.

Thus, the person with no assets and modest income cheated on their subprime loan application. The Wall Street investment banker had the opportunity to cheat on a much larger scale--purposefully packaging high-risk debt into CDOs willfully misrepresented as"low-risk" AAA instruments--but the truth is, each player cheated and lied to gain wealth or credit which they would not have gained had the truth been told. In this way each player, rich and poor, are equivalently morally bankrupt.

Plenty of people refused to lie or misrepresent the truth, and of course they were unable to borrow vast sums of money or sell misbegotten CDOs for millions in profit. So why should honest people be punished by being taxed to save their willfully fraudulent fellows? Isn't this Completely Backward Justice? Shouldn't those who knowingly misrepresented the facts for their personal financial aggrandizement realise some consequences? Or is "do the crime, serve the time" only for petty drug criminals?

Again, what I find most curious is how a supposedly religious society which claims high ethical standards is concerned not with questions of lapsed ethics or condemnations of outright fraud but with a frenzied rush to shield the wrongdoers from any consequences of their actions.

I wonder if a complete cleaning-of-the-slate financial depression which wipes out trillions of dollars of wealth might eventually re-set the nation's broken moral compass.

I know the standard line is "oh, heck, lying and cheating for personal gain is just human behavior, and this bubble was no different." Nice, but should we then accept grand-scale moral bankruptcy as the "natural state" of this Union? Should we collectively sigh and dismiss it with, "Oh well, everybody cheats on their taxes." Actually, not everyone cheats on their taxes. So who is quickest to forgive the cheater? Another cheater, of course, for he/she has already excused his/her own moral bankruptcy.

As a counter to this "we accept human greed and ethical weakness as really OK because we're all equally morally bankrupt" I quote from Lincoln's Second Inaugural Address. Lincoln was referring to God's punishment for the sins of slavery:

"Yet, if God wills that it (the Civil War) continue until all the wealth piled by the bondsman's two hundred and fifty years of unrequited toil shall be sunk, and until every drop of blood drawn with the lash shall be paid by another drawn with the sword, as was said three thousand years ago, so still it must be said 'the judgments of the Lord are true and righteous altogether'. "

Financial fraud does not hold a candle to the immense sin of slavery, yet the principle--that perhaps this nation has earned the destruction of wealth that has just barely begun--is something worth pondering. Call it God's judgment or Karma with a capital K, but if you believe in a moral Universe then the unrestrained greed, corruption and fraud of the past seven years will have consequences no matter how many Americans scurry around excusing each other, begging to be saved from the consequences of their financial crimes and ethical bankruptcy.

Please note I am not calling for or hoping for Financial Armageddon. I am simply positing that the consequences of systemic fraud may well play out regardless of the machinations underway to "protect" and "save" those who lied and misrepresented.

In non-moral terms, the obvious consequence is a loss of trust in institutions such as credit agencies and eventually in the entire U.S. credit/financial structure. To restore that trust requires invoking something analogous to ethics, even if you prefer to call it some other word.

"Trust, but verify" was the operative phrase of the Reagan years. How can a buyer of a CDO or credit-swap derivative based on hundreds of loans which are riddled with fraud and misrepresentation from the application on up to the credit rating "verifiy" the AAA-rating of the risk they are about to purchase? They cannot. Read these two books and you'll understand just how bankrupt the entire system truly is:

Fiasco: The Inside Story of a Wall Street Trader

Greed, Fraud & Ignorance: A Subprime Insider's Look at the Mortgage Collapse

NOTE: contributions are humbly acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, Ian M. ($10), for your much-valued support of this humble site. I am greatly honored by your contribution and readership. All contributors are listed below in acknowledgement of my gratitude. Read more...

Thursday, February 14, 2008

A Systemic Waste of Taxpayer Treasure

Frequent contributor Dorothy S. recently wrote about her experience of needless waste in the Veterans Administration. Like the elephant in the room nobody talks about, we all know our Federal and local government agencies are often larded with just this sort of heedless waste. Even more galling, when this is pointed out, we're often told, "it's not worth our time to be more efficient."

"This letter is to gripe about our government's waste problem. Now keep in mind that this particular incident is small in nature, but multiply it out and you have a lot of wasted money.

My father died last October from ALS. He was a veteran and the Veterans Administration took excellent care of him. As the disease progressed the VA gave us many special devices to help our father with his disabilities. Two items in particular were a top of the line, brand new wheelchair and an electronic communication device (a mini computer basically). My father's disease progressed rapidly and both items were never used.

After he died we called the VA and asked where we could send the items back. To our surprise they didn't want them back. We were shocked. I'm sure other vets could use these things. So I went online to see how much they cost. The wheelchair was $375.00 and the communication device was $3000.00.

So my mother and I donated both items to other ALS patients and we're happy they're being used by people who need them, but it upsets me that the VA didn't want them back. This is our money after all. Our taxes go for every expenditure our government makes. I would never run my household like this although I know that most American households do run like our government does. Which is how we have come into our current national crisis.

Which brings me to the topic of the upcoming tax rebate we are suppose to get this year which will miraculously make all of our problems go away. All my friends are tickled pink about it and I'd like to strangle them. It's not that I don't like getting money. But this money is not free like most Americans think. I know that this "rebate" is really our goverment going into more debt which will cause one of four things to happen: (emphasis added-CHS)

1) I will have to pay more taxes in the future to pay down this debt.

2) Watch the goverment try to inflate it's way out of it while eating away at my savings.

3) A combo of options 1 and 2.

4) Option three plus the added bonus of our goverment collapsing causing either Russia or Dubai to take over. I'm thinking this is probably the most likely outcome.

Quite frankly, I'd rather they keep my $600. I don't want to learn to speak Russian.

Thanks for letting me vent."

Great commentary, Dorothy--thank you.

The ways governments blow money are legion. The list is tiresomely long: fraudulent contracts, bridges to nowhere, goods left to rot in warehouses, sprawling computer systems which never work, outdated-the-day-they-fly weapons systems like the B-1 bomber, medicines which don't work for most patients, operations which do more harm than good, and on and on in a mind-numbing profusion. To note but two examples:

Proposal to curb waste in government contracts would not apply to overseas work:

"The number of companies reporting internal fraud in their handling of government contracts has declined sharply. In 1987, contractors voluntarily reported 44 instances of fraud or abuse to the Justice Department. By 2002, the number had dropped to eight. Last year, contractors reported three instances of fraud.

The more notorious recent cases of overseas contract fraud involve:

--Bribes of jewelry, computers, cigars and sexual favors for military personnel by Philip H. Bloom, a U.S. businessman living in Romania whose companies made more than $8 million in Iraqi reconstruction money. Three U.S. Army Reserve officers were later indicted or accused of steering contracts to Bloom between 2003 and 2005 in return for an estimated $1 million in cash and gifts.