The pool of greater fools willing and able to buy assets at higher prices with leveraged free money has been drained by six years of credit/risk expansion.

Is the top in U.S. stocks in? The consensus is "no"--corporate profits are rising, the U.S. economy is recovering and has reached "escape velocity," i.e. it can continue expanding even as the Federal Reserve ends its monetary stimulus (QE) and plans the first increase in interest rates since the zero-interest rate policy (ZIRP) was launched in response to the Global Financial Meltdown.

Many observers have noted that global capital flows (from the risky periphery to the less-risky core) favor U.S. stocks and bonds--another reason to see the 5.5-year rally continue to new highs.

The case for the top being in rests on three pillars: extremes in monetary manipulation (oops, I mean policy), sentiment, leverage and liquidity, the rise of the U.S. dollar and the diminishing returns on monetary stimulus and the repression of interest rates.

A number of chart-oriented sites have made the technical case that extremes in sentiment, valuation and leverage will unwind as gravity reasserts itself. Various cyclical analyses also suggest that the current Bull rally is getting long in tooth and due for a reversal.

For an abundance of charts that call into question the consensus narrative of "onward and upward forever," please click through the excellent websites of John Hampson and Lance Roberts.

While conventional pundits are falling over themselves in their haste to issue soothing claims that a stronger dollar is good for corporate profits and the stock market, these feel-good analyses ignore the one key dynamic of a stronger dollar: profits earned in other currencies will convert to fewer dollars as the dollar strengthens. I have covered this dynamic for many years.

This means corporate profits earned overseas will decline as soon as the effects of the stronger dollar filter through to profit statements--that is, by next quarter. Given that up to 50% of global corporate profits are earned overseas, this is not a trivial dynamic.

The fact that the global economy is stumbling into recession is also ignored by those who see corporate profits rising forever. With roughly half of profits of global companies coming from overseas markets, how can a global recession not impact U.S. corporate profits?

If the stock market is indeed a discounting mechanism that prices in developments six months' out, then the hit to profits from the stronger dollar and flagging overseas sales should impact stock prices today, not in three months.

The most interesting case for the top being in is diminishing returns:

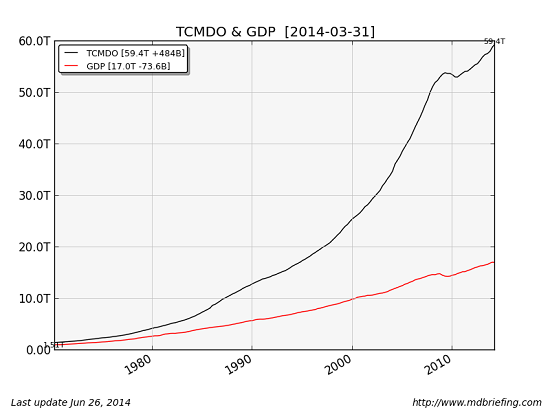

Total credit and GDP: rapidly increasing credit has a diminishing return as measured by GDP growth.

The Fed's balance sheet and the S&P 500:

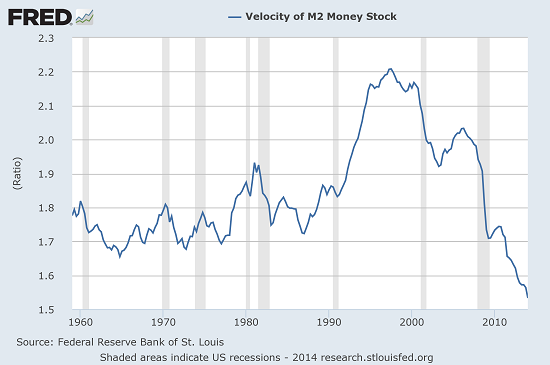

Money velocity: diminishing returns:

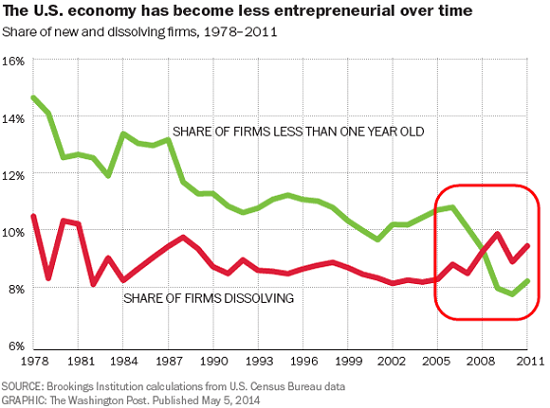

Small biz: fading at the margins:

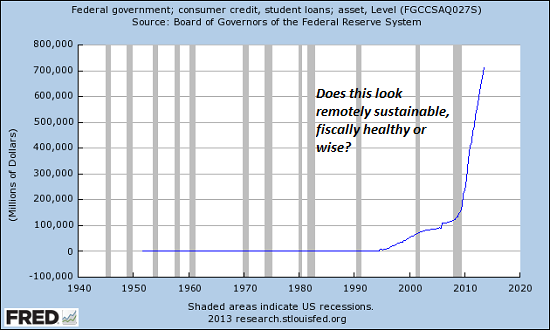

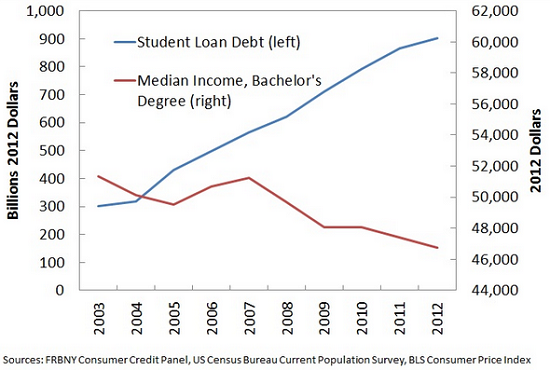

Federal student loans: soaring costs, diminishing returns on the degrees being bought:

The return on a college degree? Diminishing faster than you can say "default":

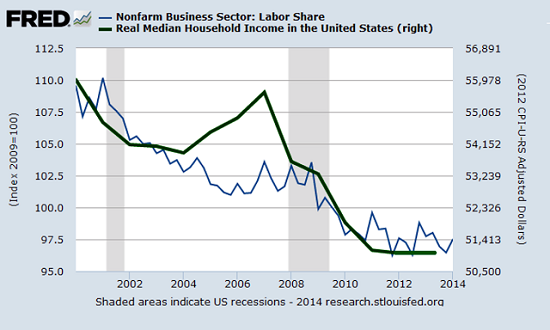

Labor participation and real median income: diminishing returns on all the outlandish money pumping and Federal deficit spending:

The "easy fixes"--unleashing a tsunami of cheap credit, dropping interest rates to near-zero--only work when creditworthy borrowers have productive uses for the new credit. If the cheap credit is used by marginal borrowers for speculation, the returns on those fixes are highly vulnerable to collapse once asset bubbles and risk-on carry trades pop.

Extending credit to marginal borrowers does not magically transform the borrowers' creditworthiness. All monetary easing and other stimulus does is expand the risk of a credit collapse by expanding the debt extended to risky borrowers. Marginal borrowers will still default as soon as making debt payments becomes painful/impossible; if you want evidence for this, consider how many subprime borrowers defaulted after getting lower rates on their mortgages.

Lowering interest rates does not magically make marginal borrowers creditworthy, or magically make speculative bets productive. In these two important ways, the "fixes" cannot fix what's broken. What they have done is enable more of what has failed spectacularly: extend credit and leverage to speculators who have ramped risk-on assets to the moon because cheap credit and low interest rates have enabled lucrative leveraged betting.

The fantasy was that all this cheap credit would magically flow into productive expansion of the real economy; instead, it fueled carry trades and an expansion of incredibly risky credit to subprime borrowers buying vehicles, homes with 3% down payment, etc.

The "recovery" constructed on this expansion of risk has built-in limits: once speculative trades reverse or blow up, the process reverses, and assets must be liquidated to escape the tightening noose of leverage. Once all the marginal borrowers have purchased vehicles, taken on student loans and bought houses and stocks on speculation, the pool of greater fools dries up and the deleveraging of assets purchased on margin/credit unleashes a feedback loop: selling begets more selling.

Those who believe the stock market can continue rising despite the end of the Fed's "free money for financiers" programs are implicitly claiming that the pool ofgreater fools is still filled to the brim. Simply put, speculating with leveraged free money and extending credit to marginal borrowers is not sustainable or productive, and the stock market seems poised to reflect three dynamics:

1. reversion to the mean and the unwinding of extremes

2. the decline in corporate profits resulting from a stronger U.S. dollar

3. the pool of greater fools willing and able to buy assets at higher prices with leveraged free money has been drained by six years of credit/risk expansion.

Get a Job, Build a Real Career and Defy a Bewildering Economy(Kindle, $9.95)(print, $20)

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible.

And like most of you, the way I've moved toward my goal has always hinged not just on having a job but a career.

You don't have to be a financial blogger to know that "having a job" and "having a career" do not mean the same thing today as they did when I first started swinging a hammer for a paycheck.

Even the basic concept "getting a job" has changed so radically that jobs--getting and keeping them, and the perceived lack of them--is the number one financial topic among friends, family and for that matter, complete strangers.

So I sat down and wrote this book: Get a Job, Build a Real Career and Defy a Bewildering Economy.

It details everything I've verified about employment and the economy, and lays out an action plan to get you employed.

I am proud of this book. It is the culmination of both my practical work experiences and my financial analysis, and it is a useful, practical, and clarifying read.

Test drive the first section and see for yourself. Kindle, $9.95 print, $20

"I want to thank you for creating your book Get a Job, Build a Real Career and Defy a Bewildering Economy. It is rare to find a person with a mind like yours, who can take a holistic systems view of things without being captured by specific perspectives or agendas. Your contribution to humanity is much appreciated."

Laura Y.

Gordon Long and I discuss The New Nature of Work: Jobs, Occupations & Careers(25 minutes, YouTube)

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

| Thank you, Clyde D. ($50), for your splendidly generous contribution to this site-- I am greatly honored by your steadfast support and readership. | |