The acceleration of non-linear consequences will surprise the brainwashed, loving-their-servitude mainstream media.

Linear correlations are intuitive: if GDP declines 2% in the next recession, and employment declines 2%, we get it: the scale and size of the decline aligns. In a linear correlation, we'd expect sales to drop by about 2%, businesses closing their doors to increase by about 2%, profits to notch down by about 2%, lending contracts by around 2% and so on.

But the effects of the next recession won't be linear--they will be non-linear, and far more devastating than whatever modest GDP decline is registered. To paraphrase William Gibson's insightful observation that "The future is already here — it's just not very evenly distributed": the recession is already here, it's just not evenly distributed-- and its effects will be enormously asymmetric.

Non-linear effects can be extremely asymmetric. Thus an apparently mild decline of 2% in GDP might trigger a 50% rise in the number of small businesses closing, a 50% collapse in new mortgages issued and a 10% increase in unemployment.

Richard Bonugli of Financial Repression Authority alerted me to the non-linear dynamic of the coming slowdown. I recently recorded a podcast with Richard on one sector that will cascade in a series of non-linear avalanches once the current asset bubbles pop and the current central-bank-created "recovery" falters under its staggering weight of debt, malinvestment and speculative excess.

The core dynamic of the next recession is the unwind of all the extremes:extremes in debt expansion, in leverage, in the explosion of debt taken on by marginal borrowers, in malinvestment, in debt-fueled speculation, in emerging market debt denominated in US dollars, in financial repression, in political corruption--the list of extremes that have stretched the system to the breaking point is almost endless.

Public-sector pensions are just the tip of the iceberg. What happens when the gains in equities and bonds that have nurtured the illusion that public-sector pension funds are solvent and can be funded by further tax increases reverse into losses?

Pushing taxes high enough to fund soaring public pension obligations will spark taxpayer revolts as the tax increases will be monumental once the delusion of solvency is stripped away in the upcoming recession.

The entire status quo rests on the marginal borrower/buyer. All the demand for pretty much anything has been brought forward by the central banks' repression of interest rates and the relentless goosing of liquidity: anyone who can fog a mirror can buy a vehicle on credit, get a mortgage guaranteed by a federal agency, or pile up credit card and student loan debts.

Those with stock portfolios can gamble with margin debt; those with access to central bank credit can borrow billions to fund stock buy-backs or the purchase of competitors, the better to establish a cartel or quasi-monopoly.

What's not visible in all the cheery statistics is how many enterprises and households are barely keeping their heads above water as inflation shreds the purchasing power of their net incomes. Inflation is supposedly tame, but once again, following Gibson's aphorism, inflation is already here, it's just not evenly distributed.

While employees with employer-paid health insurance are dumbstruck by $50 or $100 increases in their monthly co-pays, those of us who are paying the unsubsidized "real cost of health insurance" are being crushed by increases in the hundreds of dollars per month.

The number of cafes, restaurants and other small businesses with high fixed costs that will close as soon as sales falter is monumental. Add up soaring healthcare premiums, increases in minimum wages, higher taxes and junk fees and rising rents, and you have a steadily expanding burden that is absolutely toxic to small businesses.

The first things to go are marginal employees, overtime, bonuses, benefits, etc.--whatever can be jettisoned in a last-ditch effort to save the company from insolvency. The first bills cash-strapped households will stop paying are credit cards, auto loans and student loans; defaults won't notch higher by 2%; they're going to explode higher by 20% and accelerate from there.

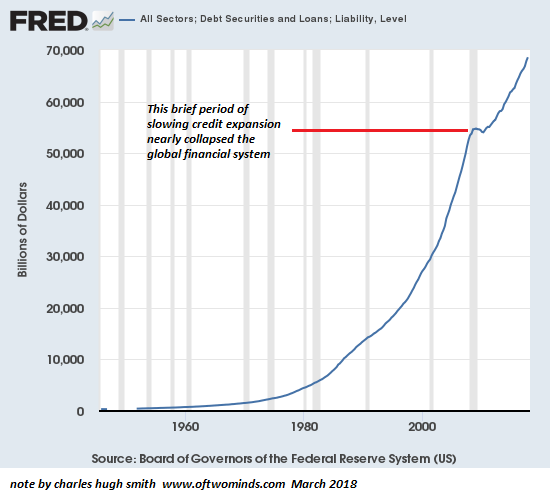

Here are a few charts that reveal the extremes that have been reached to maintain the illusion of "recovery" and normalcy: total credit has exploded higher, after a slight decline very nearly brought down the global financial system in 2008-09:

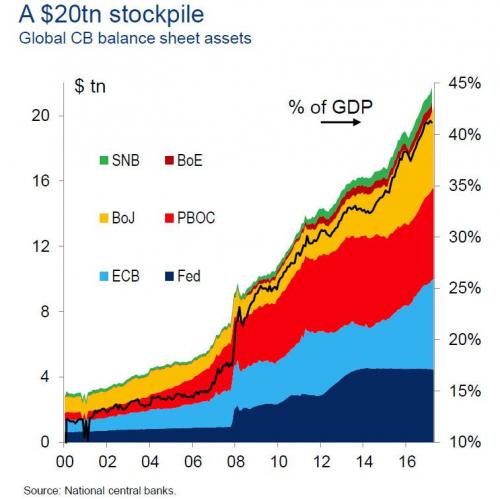

The massive expansion of assets purchased by central banks will eventually be slowed or even unwound, removing the rocket fuel that's pushed stocks and bonds to the moon:

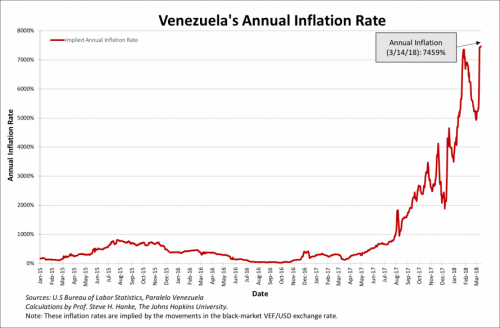

As governments/central banks borrow/print "money" in increasingly fantastic quantities to keep the illusion of "recovery" alive, the currencies being debauched lose purchasing power. Venezuela is not an outlier; it is the first of many canaries that will be keeling over in the coal mine.

Wide swaths of the economy won't even notice the recession devastating the rest of the economy, at least at first. Public employees will be immune until their city, county, state or agency runs out of money and can no longer fund its obligations; shareholders of Facebook et al. who cashed out at the top will be doing just fine, booking their $18,000 a night island get-aways, and those few willing to bet on declines in the "everything bubbles" of real estate, stocks and bonds will eventually do well, though the Powers That Be will engineer massive short-covering rallies in a last-ditch effort to mask the systemic rot.

The acceleration of non-linear consequences will surprise the brainwashed, loving-their-servitude mainstream media. The number of small businesses that suddenly close will surprise them; the number of homeowners jingle-mailing their "ownership" (i.e. obligation to pay soaring property taxes) to lenders will surprise them; the number of employees being laid off will surprise them, and the collapse of new credit being issued will surprise them.

Don't be surprised; be prepared.

My new book Money and Work Unchained is $9.95 for the Kindle ebook and $20 for the print edition.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, Vera K. ($5/month), for your wondrously generous re-subscription to this site -- I am greatly honored by your steadfast support and readership.

| |

Thank you, John H. ($5/month), for your splendidly generous pledge to this site -- I am greatly honored by your support and readership.

|