Cities' "Doom Loops" Are Even Worse Than You Imagined

This is why those who understand these dynamics are getting out, even though the city was their home.

A correspondent who prefers to remain anonymous sent me this account of the "doom loop" that is playing out in many American cities. The correspondent makes the case that the Doom Loop is not limited to specific cities, but is a universal dynamic in all US cities due to the core causes of the Doom Loop: financialization and the multi-decade decay of cities' core industrial-economic purpose / mission.

I have edited the text slightly, with the correspondent's approval.

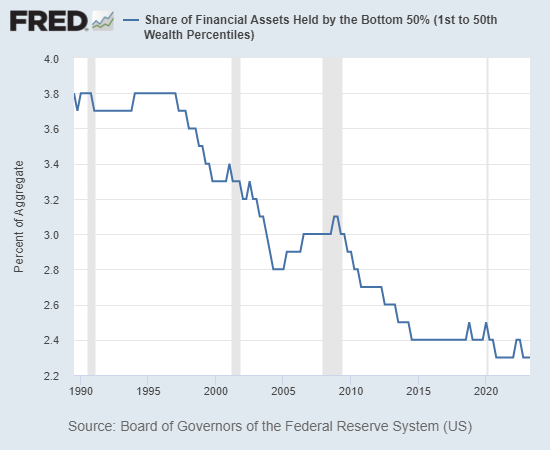

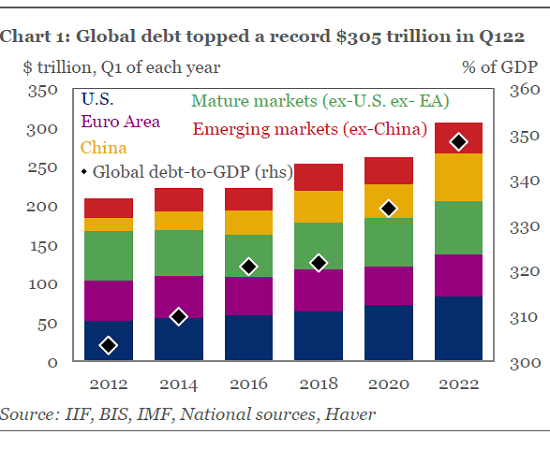

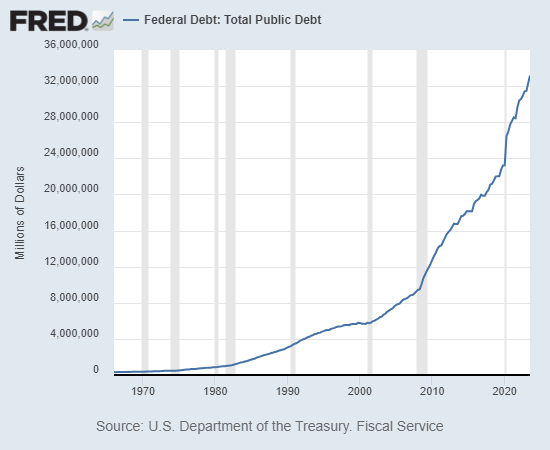

The context of the Doom Loop is the process and politics of this decay are the second-order results of central bank easy money (free fiat). That led to financialization becoming the city's core function and the subsequent loss of the city's previous mission. The people living in cities just haven't gotten the message yet.

As such, there is no reversing the process until the centralization of capital itself is reversed.

The typical media articles on metropolitan "doom loops" make it seem like not every city is headed down the path. Now that financialization does not require a physical presence, every city above a certain size will share the same experience. There will be local variations which impact the trend, such as a potential utility as a large pool of voters (i.e. a vote farm), but the decline is part and parcel of financial 'virtualization.'

It is inevitable.

Even hosting one of the twelve central reserve banks won't save you.

The process when a city loses its purpose but persists due to inertia follows this basic pattern:

1. Corporate consolidation costs the city its financial base as Fortune 100 corporations are sold to conglomerates closer to the centers of finance.

This is one more second-order effect of easy money: global corporations can easily finance the acquisition of multi-billion dollar companies.

2. In the past, cities received huge government subsidies for re-development, but none for ongoing maintenance. All the redevelopment projects looked great at first, but with little funding for maintenance, they've gone downhill and many are now dangerous.

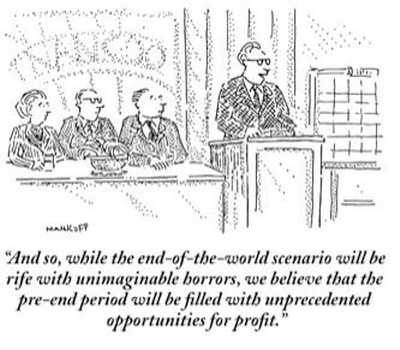

Today, the only redevelopment is done by the billionaire class who make most of their money from (surprise) finance. Once the billionaire loses interest, it's gone, too.

I would rather find myself in a developing-world city than an American downtown, at least there would be people around. Many American downtowns are literally apocalyptic.

3. Major league sports are increasingly an exercise in force protection. It's like going inside a forward firebase in Iraq. People still get shot in the stands from guns fired outside the bubble. Unsurprisingly, some major league teams are exploring space outside the cities despite their stadiums being only 20 years old.

4. When federal agencies build new facilities, they're essentially fortresses with direct entrance/egress from the highway. They add little to nothing to the surrounding economy.

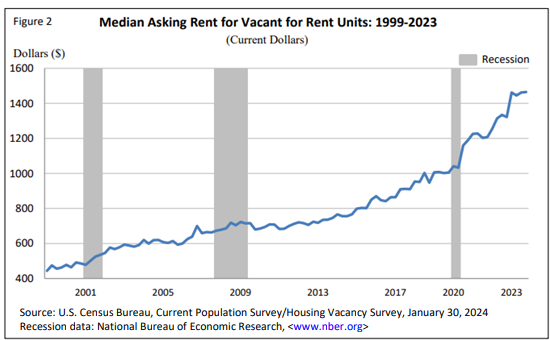

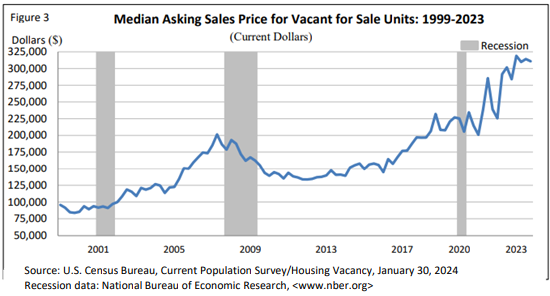

5. Real estate, sales and personal property taxes in cities are typically the highest within the state. As tax revenues decline, cities' political leaders increase business taxes and start floating ideas such as taxing non-profit organizations: a financial death spiral indeed. Should taxes increase, organizations and companies have said they will leave.

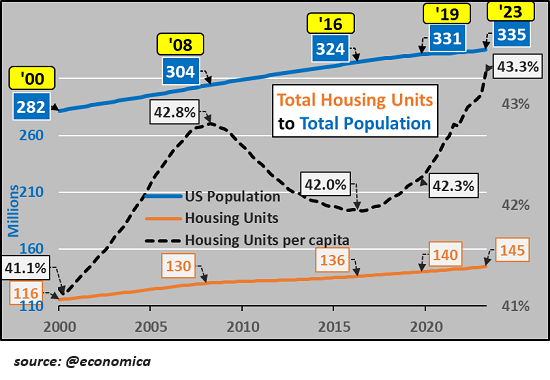

6. In the industrial economy, the core purposes of cities were derived from advantageous locations and key transportation assets (first water, then rail, then roads, and later aviation). In the information age, those benefits are diminished or gone. As a result of their transportation advantages, cities became manufacturing and warehousing hubs. Those too are diminished or gone.

7. Cities have lost their core economic purpose and are choking on their high legacy costs. The proposed substitute purposes--entertainment and bourgeois lifestyles--are not true substitutes. Fine dining and secure condos with delivery do not replace actual economic functions.

8. Making matters worse, the upper-middle class doesn't want affordable housing in their enclaves, as it lowers property values. So the workers needed to keep the city functioning can no longer afford to live there. Yes In My Backyard (YIMBY) movements to promote affordable housing are not enough.

9. Much of the politics the media focuses on are a consequence of decline, not a cause, and the net result of all the in-fighting is some version of stasis: all sorts of solutions are proposed, but since none address the core sources of decline or the cities' high legacy costs, they boil down to rearranging deck chairs on the Titanic.

This is why those who understand these dynamics are getting out, even though the city was their home.

Of related interest:: The Real Estate Nightmare Unfolding in Downtown St. Louis:

The office district is empty, with boarded up towers, copper thieves and failing retail--even the Panera outlet shut down. The city is desperately trying to reverse the 'doom loop.'

My recent books:

Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site.

Self-Reliance in the 21st Century print $18, (Kindle $8.95, audiobook $13.08 (96 pages, 2022) Read the first chapter for free (PDF)

The Asian Heroine Who Seduced Me (Novel) print $10.95, Kindle $6.95 Read an excerpt for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal $18 print, $8.95 Kindle ebook; audiobook Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $9.95, print $24, audiobook) Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel) $4.95 Kindle, $10.95 print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print) Read the first section for free

Become a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, A.M.S. ($5), for your very generous contribution to this site -- I am greatly honored by your support and readership. |

Thank you, Tristam W. ($5/month), for your marvelously generous subscription to this site -- I am greatly honored by your support and readership. |

|

|

Thank you, David L. ($70), for your splendidly generous subscription to this site -- I am greatly honored by your support and readership. |

Thank you, Jason C. ($7/month), for your superbly generous subscription to this site -- I am greatly honored by your support and readership. |