The Ghetto-ization of American Life

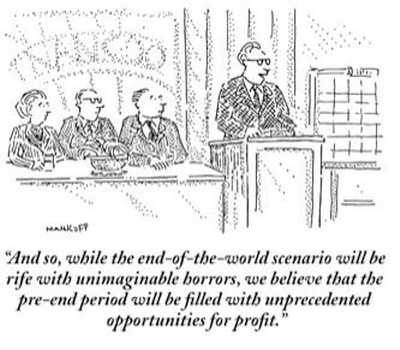

Behind the facade of normalization, even high-income lifestyles have been ghetto-ized.

Consider the defining characteristics of a ghetto:

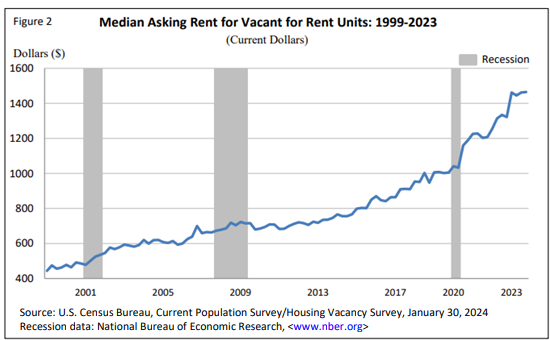

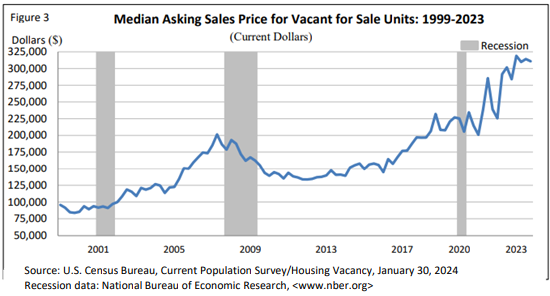

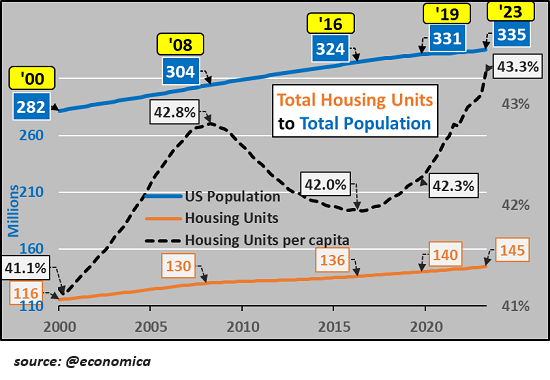

1. The residents can't afford to live elsewhere.

2. Everything is a rip-off because options are limited and retailers / service providers know residents have no other choice or must go to extraordinary effort to get better quality or a lower price.

3. Nothing works correctly or efficiently. Things break down and aren't fixed properly. Maintenance is poor to non-existent. Any service requires standing in line or being on hold.

4. Local governance is corrupt and/or incompetent. Residents are viewed as a reliable "vote farm" for the incumbents, even though whatever little they accomplish for the residents doesn't reduce the sources of immiseration.

5. The locale is unsafe. Cars are routinely broken into, there are security bars over windows and gates to entrances, everything not chained down is stolen--and even what is chained down is stolen.

6. There are few viable businesses and numerous empty storefronts.

7. The built environment is ugly: strip malls, used car lots, etc. There are few safe public spaces or parks that are well maintained and inviting.

8. Most of the commerce is corporate-owned outlets; the money doesn't stay in the community.

9. Public transport is minimal and constantly being degraded.

10. They get you coming and going: whatever is available is double in cost, effort and time. Very little is convenient or easy. Services are far away.

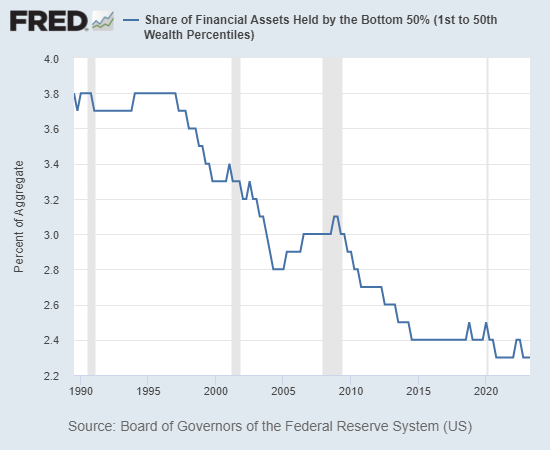

11. Residents pay high rates of interest on debt.

12. There are few sources of healthy real food. The residents are unhealthy and self-medicate with a panoply of addictions to alcohol, meds, painkillers, gambling, social media, gaming, celebrity worship, etc.

13. Nobody in authority really cares what the residents experience, as they know the residents are atomized and ground down, incapable of cooperating in an organized fashion, and therefore powerless.

I submit that these defining characteristics of ghettos apply to wide swaths of American life. Ghettos are not limited to urban zones; suburbs and rural locales can qualify as well. The defining zeitgeist of a ghetto is the residents are effectively held hostage by limited options and high costs: public and private-sector monopolies that provide poor quality at high prices.

Daily life is a grind of long waits / commutes, low-quality goods and services, shadow work (work we have to do that we're not paid for that was once done as part of the service we pay for) and unhealthy addictions to distractions and whatever offers a temporary escape from the grind.

We've habituated to being corralled into the immiseration of limited options and high costs; the immiseration and sordid degradation have been normalized into "everyday life." We've lost track of what's been lost to erosion and decay. We sense what's been lost but feel powerless to reverse it. This is the essence of the ghetto-ization of daily life.

Behind the facade of normalization, even high-income lifestyles have been ghetto-ized. But saying this is anathema: either be upbeat, optimistic and positive or remain silent.

What's worse, the ghetto-ization or our inability to recognize it and discuss it openly?

My recent books:

Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site.

Self-Reliance in the 21st Century print $18, (Kindle $8.95, audiobook $13.08 (96 pages, 2022) Read the first chapter for free (PDF)

The Asian Heroine Who Seduced Me (Novel) print $10.95, Kindle $6.95 Read an excerpt for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal $18 print, $8.95 Kindle ebook; audiobook Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $9.95, print $24, audiobook) Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel) $4.95 Kindle, $10.95 print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print) Read the first section for free

Become a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, A.M.S. ($5), for your very generous contribution to this site -- I am greatly honored by your support and readership. |

Thank you, Tristam W. ($5/month), for your marvelously generous subscription to this site -- I am greatly honored by your support and readership. |

|

|

Thank you, David L. ($70), for your splendidly generous subscription to this site -- I am greatly honored by your support and readership. |

Thank you, Jason C. ($7/month), for your superbly generous subscription to this site -- I am greatly honored by your support and readership. |