The master narrative of the global economy shifted six years ago from “China will push global growth for decades to come” to “the central banks can push global growth for decades to come.”

Time after time we’ve witnessed enfeebled global markets jolted out of terminal declines by central bank pronouncements and new money-printing policies. Never mind that the European Central Bank’s (ECB) Mario Draghi had no concrete proposals in hand when he announced the ECB would “do whatever it takes” to save the European Union from the financial consequences of its reckless abandonment of risk management; the mere announcement was enough to trigger a massive reversal in global markets.

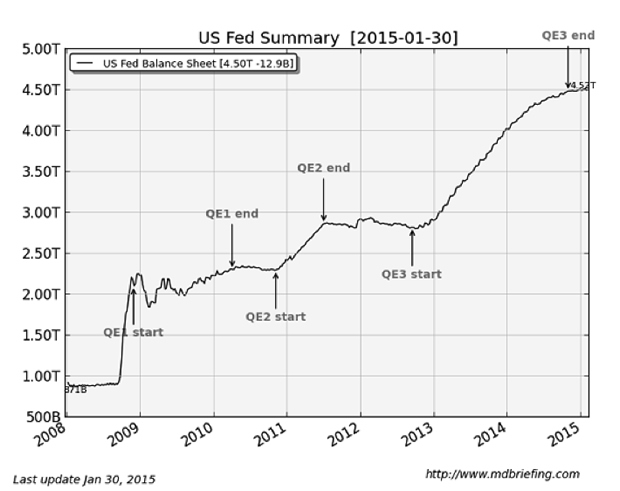

The major central banks have tag-teamed one rally in global stock and bond markets after another: the U.S. Federal Reserve goosed markets in 2008, 2009, 2010, 2011, 2012 and 2013, only ending its various quantitative easing (QE) money-emitting programs in late 2014.

The ECB saved the day with Draghi’s “whatever it takes” PR gambit and more recently with its own QE money-printing program.

The Bank of Japan (BOJ) injected monetary amphetamines into global markets with Abenomics, a last-ditch effort by the BoJ and the government of Japan to crush the value of the Japanese yen and import inflation.

The People’s Bank of China (China’s central bank) has kept the credit spigot open wide for years, unleashing one of the greatest credit expansions in recent history.

China’s central bank balance sheet has doubled since 2009, but the star attraction in China’s debt bubble is bank credit. Compare China’s bank credit with that of the U.S.. Measured in dollars, the U.S. GDP is $17 trillion and China’s GDP is $10 trillion; measured in purchasing power parity (PPP), the two economies are roughly the same size.

The remarkable success of grandiose pronouncements, money-printing programs and serial expansions of credit raises a key question: how many more “saves” can the central bank bazookas fire that will have the desired effects of maintaining perceptions of central bank omnipotence and pushing global markets ever higher?

The Dow Jones Global Index (DJW) offers a snapshot of global markets. Since the last big central bank “save” in 2012, the index has lofted ever higher, staying comfortably above the 50-week moving average (MA).

But this era of central bank-induced euphoria appears to have ended in mid-2014; since then, price and key indicators have trended down. Recently, price has slipped beneath the 50-week MA and is struggling to overcome this line that was once support and is now resistance.

Though central banks have continued their ceaseless public-relations campaigns and kept various credit and money spigots wide open, this chart strongly suggests the central bank bazookas are losing their effectiveness. Iin other words, the returns on both PR and money/credit issuance are diminishing rapidly.

These diminishing returns may result at least partially from the end of the Federal Reserve’s massive monetary/credit expansion, which is reflected by the Fed’s balance sheet (courtesy of Davefairtex/mdbriefing.com):

After quintupling from $871 billion in 2008 to $4.5 trillion, the balance sheet has leveled off as the Fed ended its QE program.

Other central banks have kept their money-printing/credit spigots wide open, but it's looking like the Fed’s decision to end large-scale money-issuance of U.S. dollars into the global economy cannot be replaced with euros, yen and renminbi (a.k.a. yuan).

Saved by Cheaper Energy?

The astonishing collapse in oil prices has provided an unexpected (by most analysts) tailwind to the world’s manufacturing/consuming economies, even as it has dealt a crushing hammer-blow to oil-producing/exporting economies.

While there are obvious pluses and minuses to the cost of oil falling in half (when priced in U.S. dollars), the fact is that the major manufacturing/consuming nations have far larger economies than the oil producing/exporting nations (the one exception being the U.S., which is both a major producer and major importer of oil). So the advantages of lower oil prices for manufacturing, transportation and end consumers on a global basis outweighs the damage to the energy sector globally, which is roughly 5% to 10% of global GDP, depending on the current prices of energy:

Though many mainstream media sources are claiming oil will decline to $30 or even lower, and stay there for years, others are skeptical of this “cheap oil forever” projection based on the rising cost of extracting oil globally. Since the majority of the cheap-to-extract oil has already been pumped, what’s left costs more to extract when measured in energy (energy returned on energy invested—EROEI) or money.

Since oil is priced on the margin, relatively modest changes in supply and demand can move prices far more than many expect. The recent uptick visible in this chart suggests those expecting oil to drop to $30/barrel and stay there indefinitely might well be as wrong as those who thought oil would hover around a permanently high plateau around $90 - $100 last summer.

While the tailwind of lower energy costs has been welcomed in most of the world, the economics of oil do not lend much support to the expectation of $30/barrel oil lasting indefinitely. Lower prices will eventually cause producers to shut-in wells, rapidly reducing supply, while rising consumption in oil-exporting nations will continue to reduce the quantity of oil available for export.

In other words, it’s not just the quantity of oil that’s being produced globally that counts—it’s the quantity that’s available for export that really matters.

The tailwinds of lower energy prices might be as ephemeral as the tailwinds of hot air (PR pronouncements of the “whatever it takes” variety) issued by central banks.

The Destabilizing Rise of the U.S. Dollar

Just as the collapse in oil prices was not controllable by central bank jawboning or emissions of money/credit, it appears the strengthening of the U.S. dollar—a move that has destabilized emerging market economies and currencies—is not entirely in the control of central banks:

I have covered the dynamics of this destabilization in several prior articles over the past several months, including The Dollar May Remain Strong For Longer Than We Think and The Consequences Of A Strengthening US Dollar.

In essence, carry trades (i.e. borrowing in one currency and investing the proceeds in another currency) that were profitable when the dollar was weakening have reversed, turning into losing trades.

The more the dollar rises, the greater the losses in these carry trades, and the greater the incentive for those still in the trade to sell emerging market assets and currencies.

The flood of dollars unleashed by the Fed’s QE programs washed over the entire globe, encouraging people in emerging markets to take loans denominated in dollars. Now those loans are increasingly burdensome, as it takes ever-larger sums of local currency to service the dollar-denominated debts.

In response to these massive outflows of capital, emerging nations must raise interest rates to offer incentives for capital to stay put, which then causes the cost of new loans (and doing business in general) to quickly rise to painful levels.

As the currencies suffering outflows decline against the dollar, imports become more expensive and exports lose value when traded for dollars. It’s a triple-whammy for emerging nations: their borrowing costs are soaring, the capital leaving to pay off dollar-denominate debt leaves them starved for investment capital, and their imports rise in cost as their exports earn less.

As I have often noted, the failure to address the structural problems that caused the Global Financial Meltdown of 2008-2009 effectively transferred systemic risk to the enormous foreign-exchange (FX) market, which is connected to virtually everything in the global economy.

This is one key reason for the diminishing returns of central bank policies: all central banks have succeeded in doing is pushing the systemic risk into an arena they do not control.

In Part 2: What Will Happen Next For The US Dollar we explore just how far the destabilizing effects of currently in play in the currency markets -- currency wars, Triffin's Paradox, increased FX volatility -- are likely to threaten the global economy. It's very important to appreciate how the consequences of such global destabilization are not as controllable as relatively stable stagnation we have become used to over the past several decades.

In short, buckle up.

Click here to access Part 2 of this report (free executive summary; enrollment required for full access)

This essay was first published on peakprosperity.com where I am a contributing writer.

Get a Job, Build a Real Career and Defy a Bewildering Economy (Kindle, $9.95)(print, $20)

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible. And like most of you, the way I've moved toward my goal has always hinged not just on having a job but a career.

You don't have to be a financial blogger to know that "having a job" and "having a career" do not mean the same thing today as they did when I first started swinging a hammer for a paycheck.

Even the basic concept "getting a job" has changed so radically that jobs--getting and keeping them, and the perceived lack of them--is the number one financial topic among friends, family and for that matter, complete strangers.

So I sat down and wrote this book: Get a Job, Build a Real Career and Defy a Bewildering Economy.

It details everything I've verified about employment and the economy, and lays out an action plan to get you employed.

I am proud of this book. It is the culmination of both my practical work experiences and my financial analysis, and it is a useful, practical, and clarifying read.

Test drive the first section and see for yourself. Kindle, $9.95 print, $20

"I want to thank you for creating your book Get a Job, Build a Real Career and Defy a Bewildering Economy. It is rare to find a person with a mind like yours, who can take a holistic systems view of things without being captured by specific perspectives or agendas. Your contribution to humanity is much appreciated."

Laura Y.

Gordon Long and I discuss The New Nature of Work: Jobs, Occupations & Careers (25 minutes, YouTube)

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

| Thank you, Paul L. ($250), for your outrageously generous contribution to this site-- I am greatly honored by your steadfast support and readership. |