Since the stock, bond and real estate markets are all correlated, it's a question with no easy answer.

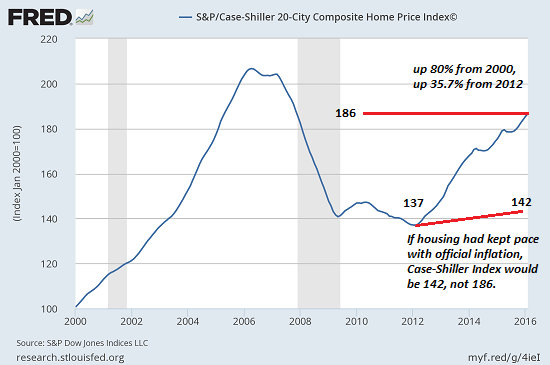

Everyone who's not paid to be in denial knows stocks, bonds and real estate are in bubbles of one sort or another. Real estate is either an echo bubble or a bubble that exceeds the previous bubble, depending on how attractive the market is to hot-money investors.

Here's a look at the inflation-adjusted S&P 500 (SPX) and margin debt: yep, a bubble.

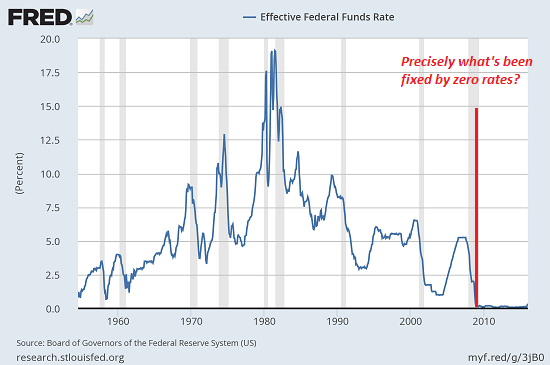

With the Fed funds rate pinned to near-zero, bonds are in a bubble as well.

One of the consequences of eight years of central bank easing and intervention is that these asset classes are tightly correlated. Free money for financiers has sought a yield wherever it can find one, and the result is every asset class with a yield has become tightly correlated.

This moots the time-honored strategy of managing risk by shifting capital from an over-valued asset class into an under-valued asset class. When all the major asset classes are in bubbles, there is no "cheaper" asset class to shift capital into.

The only asset classes that are not in bubbles don't offer yields: precious metals and commodities are value plays or scarcity plays, but institutions that require a yield may not be able to shift much capital into these value/scarcity plays.

Hot money, however, can buy precious metals, oil futures, bitcoin, etc. The problem is the markets that capital will flee once the overlapping bubbles pop are worth tens of trillions of dollars each, and the markets that are not correlated to stocks/ bonds /real estate are an order of magnitude smaller.

Privately held gold at today's prices is worth around $3 to $4 trillion (if memory serves, all gold including the reserves held by nation-states is worth about $7.5 trillion at today's prices), which is a fraction of the global bond, stock and real estate markets.

The market cap of all bitcoins is around $10 billion, and of all Ethereum currency is $1 billion-- numbers so small they wouldn't even be visible in a pie chart of the hundreds of trillions of global financial wealth.

Where will the money fleeing deflating bubbles go? Since the stock, bond and real estate markets are all correlated, it's a question with no easy answer. What would $10 trillion seeking safe haven do to small asset classes such as precious metals, bitcoin, and tradable (liquid) sectors of the commodities markets?

If the bubbles in bonds, stocks and real estate all pop, what markets will be left that can absorb trillions of hot money sloshing around? the short answer is: none.

The chaos that will arise as trillions of dollars, yen, yuan and euros, etc. try to crowd through the fire exits as the asset bubbles pop will be monumental, and the the spikes in small asset class prices as the hot money floods in will be equally monumental.

Join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

Join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

My new book is #8 on Kindle short reads -> politics and social science: Why Our Status Quo Failed and Is Beyond Reform ($3.95 Kindle ebook, $8.95 print edition)For more, please visit the book's website.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, Michael J.R. ($100), for your outrageously generous contribution to this site-- I am greatly honored by your longstanding support and readership.

|