So let's imagine a scenario in which tens of trillions of at-risk wealth suddenly seek an alternative--any alternative to staying in an asset class that's circling the drain.

As my colleague Davefairtex observed recently, the paint isn't quite dry on bitcoin and the expanding host of other cryptocurrencies. Initial enthusiasm for the latest cryptocurrency that's going to eat bitcoin's lunch generates outsized returns for early investors, but as glitches in the vision arise, the bubble of initial euphoria pops.

Differing visions of bitcoin's future have divided its community of participants and miners, and hard forks have split other cryptocurrencies into competing camps.

Meanwhile, the spectre of outright bans on bitcoin and cryptocurrencies by nations such as China adds uncertainty to the entire sector. Many observers expect that China's increasingly pervasive attempts to staunch the flow of capital out of China via capital controls will lead inevitably to strict limits on bitcoin or even a total ban on bitcoin transactions and mining in China.

Since the majority of mining and transactions occur in China, severe limits or a ban would have an outsized impact on the bitcoin community. Many observers foresee the potential for a massive decline in the price of bitcoin should such a ban be imposed.

As if all these issues didn't generate enough uncertainty and skepticism, it seems as if every time the general public starts getting interested in cryptocurrencies, another exchange is hacked or another entry in the cryptocurrency sweepstakes blows up, sending the sector back into the "untrustworthy" abyss.

But this minefield shouldn't blind us to the possibility of a path to $10,000 bitcoin. Skepticism is always prudent in any financial matter, especially a speculative one, so put on your skeptical thinking cap and follow along.

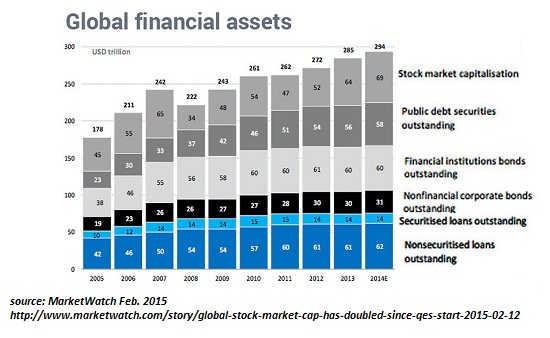

The problem is everything is now speculative. Do you really think the $100 trillion private-sector bond market (i.e. the bet that debtors will pay back what they borrowed with interest) is "safe," as in guaranteed, bullet-proof, no serious loss of capital is possible, etc.? How about the $60 trillion sovereign (government) bond market?

The problem with sovereign bonds is governments with central banks can create "money" out of thin air to pay interest and redeem maturing bonds, but this devalues the currency. So getting back 100% of your nominal investment doesn't mean you're whole; if the currency the bond is denominated in fell 50%, bondholders suffer a 50% loss in the purchasing power of their initial capital. Ouch. How is that not speculative?

How about the $70 trillion in global stocks? Yes, we all "know" that stocks will never go down ever again because central banks can keep inflating new credit bubbles indefinitely--but let's not kid ourselves: history tells us that stocks remain a speculative gamble.

How about the $62 trillion in unsecuritized debt instruments? How much of this debt is collateralized by fast-dying malls, bubble-priced real estate, or Unicorn-type valuations in other assets?

Take a gander at this chart of financial assets, roughly $300 trillion, and note that this doesn't include real estate, housing, etc. Global real estate is estimated at $217 trillion, roughly two-thirds of financial wealth.

Together, these assets add up to over $500 trillion.

Once again, the larger context here is: all these assets are speculative. Yes, even real estate. Consider this, if you missed it: When Assets (Such as Real Estate) Become Liabilities.

Then there's the currency market. Care to argue that currencies are non-speculative investments? Is that why Chinese wealth is gushing out of the yuan, because it's so guaranteed to never lose purchasing power? Is that why the euro fell from 1.40 to 1.05, because it's a guaranteed safe investment? Venezuelans learned the hard way that fiat currencies when mismanaged by the issuing nation/central bank can destroy wealth on an unimaginable scale.

So now let's turn to bitcoin, with a market cap of about $14 billion, down from a recent high of $18 billion. Now compare that to $500 trillion. If we take 1 measly little trillion, bitcoin's entire market cap is 1/70th of that.

So let's imagine a scenario in which tens of trillions of at-risk wealth suddenly seek an alternative--any alternative to staying in an asset class that's circling the drain. We're accustomed to "rotation," the nice little game where bonds can be sold and the capital invested in real estate or stocks, or vice versa.

We're less accustomed to all the conventional asset classes toppling like dominoes. Where do the fleeing trillions go when stocks, bonds and real estate are all going down in a chaotic sell-off? Gold and silver are time-honored safe havens, but it's not too difficult to foresee the potential for limits or bans on gold, or supply constraints. Some percentage of investors will consider alternatives.

In such an environment of a crowd rushing for increasingly narrowing exits, what thin slice of institutional and individual investors will take a chance that bitcoin might hold or even increase its value as a major currency melts down, or some other global financial crisis unfolds?

Shall we guess 1/10th of 1% of the panicky fleeing wealth will take the chance that bitcoin will be a safer haven than the conventional assets that are cratering?

So 1% of the $300 trillion in financial assets (setting aside the $200 trillion in real estate for the moment) is $3 trillion, and a tenth of that is $300 billion.

So what happens to bitcoin's price if $300 billion rushes through the wormhole? On the face of it, market cap would go up 20-fold from current levels. Since the number of bitcoin is limited to around 18 or 19 million (subtracting those bitcoin lost forever to hard drive crashes, etc., and those yet to be mined), price would also have to rise 20-fold.

OK, so 1/10th of 1% of global financial wealth flowing into bitcoin strains credulity. Let's make it 1/20th of 1%, or $150 billion. That still pushes bitcoin's market cap and price up 10-fold.

That's the pathway to $10,000 bitcoin. Unlikely, you say? Perhaps. But if you're of the mind that $500 trillion in current assets might be revalued considerably lower in a global crisis, then a tiny sliver of that fast-evaporating wealth finding a home in bitcoin (or other cryptocurrencies) doesn't seem all that farfetched.

You want farfetched, how about $3 trillion in panicky fleeing capital flooding into bitcoin? Yes, a whole, gigantic, enormous 1% of speculative financial "wealth" and "money" seeking a home in cryptocurrencies.

(It's worth doing the same exercise with gold, only substitute $6.4 trillion in market cap (i.e. all the non-central owned bank gold) for bitcoin's $14 billion market cap.)

Cryptocurrencies are intrinsically volatile and speculative. Anyone pondering them must keep this firmly in mind at all times. There is no "guaranteed" safety or guaranteed anything. Everything that appears solid can melt into thin air (to borrow Marx's phrase) without advance notice.

Disclosure: the author has a tiny speculative position in bitcoin. This is not a recommendation to anyone to speculate in any financial instrument, including cryptocurrecies. Please read the site's full disclosure here: HUGE GIANT BIG FAT DISCLAIMER.

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

Check out both of my new books, Inequality and the Collapse of Privilege ($3.95 Kindle, $8.95 print) and Why Our Status Quo Failed and Is Beyond Reform ($3.95 Kindle, $8.95 print). For more, please visit the OTM essentials website.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, CJeffrey C. ($50), for your stupendously generous contribution to this site -- I am greatly honored by your steadfast support and readership.

|

Thank you, James L. ($5/month), for your supremely generous subscription to this site -- I am greatly honored by your support and readership.

|