After 11 years of "the Fed is the market" expansion, the Fed has now reduced its bloated balance sheet by 6.7%. This is normal, right?

So here we are in Year 11 of the longest economic expansion/ stock market bubble in recent history, and by any measure, the hour is getting late, to quote Mr. Dylan:

So let us not talk falsely now

the hour is getting late

Bob Dylan, "All Along the Watchtower"

the hour is getting late

Bob Dylan, "All Along the Watchtower"

The question is: what would happen if we stop talking falsely? What would happen if we started talking about end-of-cycle rumblings, extreme disconnects between stocks and the real economy, the fact that "the Fed is the market" for 11 years running, that diminishing returns are setting in, as the Fed had to panic-print $400 billion in a few weeks to keep this sucker from going down, and that trees don't grow to the troposphere, no matter how much the Fed fertilizes them?

When do we stop talking falsely about expansions that never end, and stock melt-ups that never end? Just as there is a beginning, there is always an ending, and yet here we are in Year Eleven, talking as if the expansion and the stock market bubble can keep going another eleven years because "the Fed has our backs."

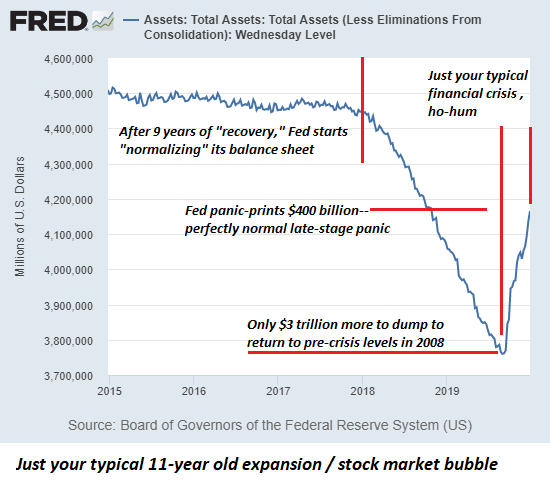

Take a quick glance at the chart below of the Fed balance sheet and tell me this is just the usual plain-vanilla, ho-hum, nothing out of the ordinary Year 11 of a "recovery" that will run to 15 years and then 20 years and then 50 years--as long as the Fed panic-prints, there's no end in sight.

So after 9 years of "recovery," the Fed finally starts reducing its balance sheet, peeling off about $700 billion over the course of 18 months.

Nice--only $3 trillion more to dump to return to the pre-crisis asset levels of less than $800 billion. In other words, the Fed's "normalization" was a travesty of a mockery of a sham, a pathetically modest reduction that barely made a dent in its bloated balance sheet.

Knock a couple trillion off and we'll be impressed with your "normalization."

But wait--what's this panic-printing expansion of $400 billion practically overnight? Is this just your typical "mid-cycle adjustment" in Year 11 of a 25-year expansion / stock market bubble? Or is it an "early cycle adjustment" because the Bull Market Bubble will run 50 or 100 years without any pesky recessions or crashes?

After 11 years of "the Fed is the market" expansion, the Fed has now reduced its bloated balance sheet by 6.7%. This is normal, right? Just your typical "mid-course adjustment," right?

Clearly, we can't stop talking falsely now because acknowledging the precarious state of the expansion and bubble is too dangerous: merely acknowledging reality might trigger a collapse.

But really: if everything is nominal, why did the Fed respond to an unannounced financial crisis with such panic? Why panic-print over $400 billion in a few weeks if everything is running hot and true?

Do your own analysis of this chart, but please stop talking falsely about how much longer this can run on Fed panic-printing: the hour is getting late.

My recent books:

Will You Be Richer or Poorer? Profit, Power and A.I. in a Traumatized World (Kindle $6.95, print $11.95) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($6.95 (Kindle), $12 (print), $13.08 ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the first section for free (PDF).

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, John H. ($50), for your phenomenally generous contribution to this site-- I am greatly honored by your steadfast support and readership.

|