With the reflation euphoria running full blast, maybe central banks will finally get all that inflation they've been pining for. So let's ask cui bono--who will benefit from inflation?

The Super-Rich love inflation and the money-printing that generates it. Longtime correspondent Michael M. explains the dynamic behind billionaires' adoration of inflation:

"Why does a game of Monopoly work? Because there is a zero-boundary for every player's net worth.

If you were given endless credit (so negative net worth is allowed without limit), the game becomes pointless.

Is there also an upper bound at Monopoly?

Well, the bank at Monopoly can run out of money, I had that happen a few times while playing. But we didn't treat it as an upper boundary, but wrote the richest player an IOU and took that amount of cash bills from him and put them back in the bank to continue.

Rolling it around in my head, how else could you solve that problem? Confiscate the same amount from every (remaining) player and put it back in the bank instead? That would be pointless if most wealth is with one player and you want the game to continue.

Another option is to go Keynesian [in its true practical implementation] and confiscate 10% of each player's net worth to "re-liquidate" the bank. This is very similar to "printing money," just more explicit. Now we're getting somewhere.

But that's linear (a fixed percentage), so why not go with progressive confiscation rates, and take a higher percentage of the wealthier players' net worth?

Wait a second, did I just stumble over the reason why the filthy rich love Keynesian economics? Because printing money only "taxes" everybody linearly, which is much better for the rich than progressive taxation, which is the global standard in income tax policies."

Let's explore this profound insight a bit more. Modern Monetary Theory (MMT) holds that central banks/states can print as much money as they want without any adverse effects. From this, it's a small step to sending every household a monthly stipend (Universal Basic Income--UBI) paid by freshly issued currency.

Given the unfairness of the income tax system, as the super-rich buy tax breaks, tax shelters and subsidies via lobbying and political contributions, it's just one more tiny step to eliminating income taxes entirely and printing all the money the state needs.

Why would this enrich the super-rich and impoverish the rest of us? Printing money in excess of the goods and services being generated creates inflation, which is a "tax" on all cash and wages, both of which have been losing ground for decades.

Inflation is best defined as a loss of purchasing power. With 10% inflation, $1 only buys 90 cents of real-world goods and services. Thus it's the exact equivalent of a 10% tax not just on wages but on all cash.

The super-rich don't rely on wages or cash savings; they own productive assets whose yields rise with inflation. The super-rich own apartments, so they can jack rents up 10%, matching inflation. They own assets which tend to retain their purchasing power even as inflation reduces the purchasing power of cash and wages.

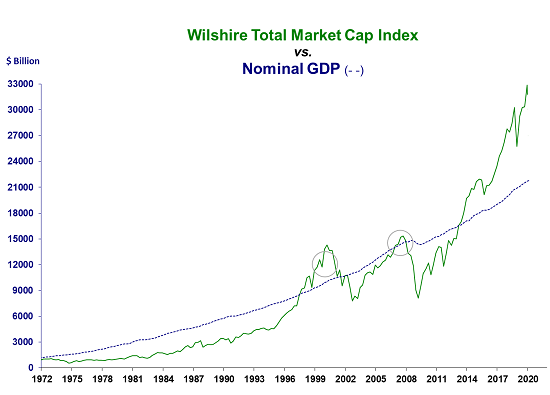

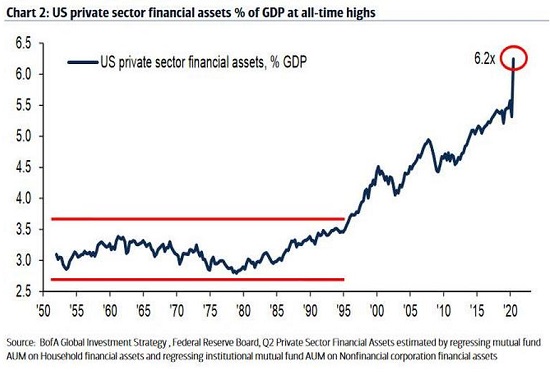

Markets place a premium on any assets that keep pace or outpace inflation, so the value of the assets owned by the super-rich soar, further enriching the few who own these assets.

Asset inflation benefits the super-rich more than anyone else because they own the vast majority of these assets. So money-printing and the inflation it generates is a win-win for the rich. The "tax" rate of inflation / money-printing barely touches their incomes or wealth, both of which are tied to assets that rise along with inflation. All that money-printing pushes the value of their assets higher, making them even richer, which the inflation "tax" impoverishes everyone who depends on wages and cash.

No wonder the super-rich love MMT, money-printing and Keynesian giveaways of freshly printed currency--inflation makes them richer while it makes everyone else poorer. Going back to Michael's analogy of a Monopoly game: inflation takes 10% of every player's cash, but doesn't touch their property holdings. So the wealthiest players' net worth is barely dinted while players with fewer assets will find it difficult to survive as their cash is "taxed" away by inflation.

My new book is available! A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet 20% and 15% discounts (Kindle $7, print $17)

Read excerpts of the book for free (PDF).

The Story Behind the Book and the Introduction.

Recent Podcasts:

AxisofEasy Salon #29: A Deep Dive into the Network State (1 hr)

My COVID-19 Pandemic Posts

My recent books:

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook coming soon) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($5 (Kindle), $10 (print), ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the first section for free (PDF).

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Gordon P. ($5/month), for your superbly generous pledge to this site -- I am greatly honored by your support and readership. |

Thank you, John Z. ($50), for your magnificently generous contribution to this site -- I am greatly honored by your support and readership. |