Eventually the younger generations will connect all the economic injustices implicit in 'OK Boomer' with the Fed.

Much of the cluelessness and economic inequality behind the OK Boomer meme is the result of Federal Reserve policies that have favored those who already own the assets (Boomers) that the Fed has relentlessly pumped higher, to the extreme disadvantage of younger generations who were not given the opportunity to buy assets cheap and ride the Fed wave higher.

OK Fed: you've destroyed price discovery, driven housing out of reach of all but the wealthy and hollowed out the economy, all the while patting yourselves on the back for being so smart and fabulous.

OK Fed: you've waged generational war without even acknowledging how disastrous your policies have been for younger generations. You've bloated the paper wealth of everyone old enough to have bought a home 20, 30 or 40 years ago and who's had a Corporate America or government job who's seen their 401K or pension soar because "the Fed has our back" and Fed policies have inflated one bubble in stocks and bonds after another for 25 years.

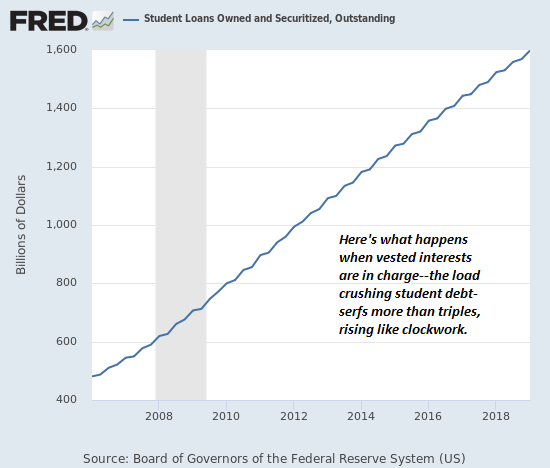

OK Fed: as a direct consequence of your free-money-for-financiers policies, inflation has gutted the purchasing power of younger generations. As the bogus consumer price (CPI) claims inflation is near-zero year after year, two generations of Americans have been crushed by student loan debt that tops $1.5 trillion-- a debt serfdom that would have been impossible had interest rates been settled by market forces.

The clueless higher education cartel would have been forced to innovate decades ago rather than pass on their administrative bloat to those least able to pay, the students. Without the Fed and other federal agencies, student debt would not have exploded.

OK Fed: as a direct consequence of your pump-up-speculative-excess policies, speculation has ruined the U.S. economy as banks, financiers and corporations all skim hundreds of billions of dollars via leveraging Fed cheap money while younger generations get credit cards with nosebleed interest rates and rapacious banks that charge $25 and up for every overdraft that they engineer by manipulating when deposits are credited.

OK Fed: while you've been hectoring young people to buy assets so they can join your speculative asset-bubble party, they've been dealing with the broken mess of an economy you've created while patting yourself on the back, an economy where only the already-wealthy can buy a house in hot job market regions, where young workers have to work crazy-hard to keep their precarious jobs or get by on the gig economy, a happy-story code phrase for an economy in which corporations have transferred the risk to their workers while they get rich buying back their own shares with cheap Fed money.

OK Fed: eventually the younger generations will connect all the economic injustices implicit in OK Boomer with the Fed that created the ever-widening wealth and income inequality between the generations: those who effortlessly rode the Fed's asset-bubbles to wealth and those who have been priced out of the assets and left the shards of a once-functioning economy, an economy destroyed by the Fed's toxic worship of speculative exploitation and serial asset-bubbles.

As I have repeatedly observed here: if we don't change the way money is created and distributed by the Fed, we change nothing.

My recent books:

Will You Be Richer or Poorer? Profit, Power and A.I. in a Traumatized World (Kindle $6.95, print $11.95) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($6.95 (Kindle), $12 (print), $13.08 ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the first section for free (PDF).

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, Ralph R. ($5/month), for your marvelously generous pledge to this site-- I am greatly honored by your support and readership.

|