Subtract their immense debts and they have negative net worth, and therefore the market value of their stock is zero.

To understand why the financial dominoes toppled by the Covid-19 pandemic lead to global insolvency, let's start with a household example. The point of this exercise is to distinguish between the market value of assets and net worth, which is what's left after debts are subtracted from the market value of assets.

Let's say the household has done very well for itself and owns assets worth $1 million: a home, a family business, 401K retirement accounts and a portfolio of stocks and other investments.

The household also has $500,000 in debts: home mortgage, auto loans, student loans and credit card balances.

The household net worth is thus $1,000,000 minus $500,000 = $500,000.

Let's say a typical financial crisis and recession occur, and the household's assets fall 30%. 30% of $1 million is $300,000, so the the market value of the household's assets falls to $700,000.

Deduct the $500,000 in debts and the household's net worth has fallen to $200,000. The point here is debts remain regardless of what happens to the market value of assets owned by the household.

Then the speculative asset bubbles re-inflate, and the household takes on more debt in the euphoric expansion of confidence to buy a larger house, expand the family business and enjoy life more.

Now the household assets are worth $2 million, but debt has risen to $1.5 million. Net worth remains at $500,000, since debt has risen along with asset values.

Alas, all bubbles pop, and the market value of the household assets decline by 30%, or $600,000. Now the household assets are worth $2,000,000 minus $600,000 or $1,400,000. The household net worth is now $1,400,000 minus $1,500,000 or negative $100,000. the household is insolvent.

On top of that, the net income of the family business plummets to near-zero in the recession, leaving insufficient income to pay all the debts the household has taken on.

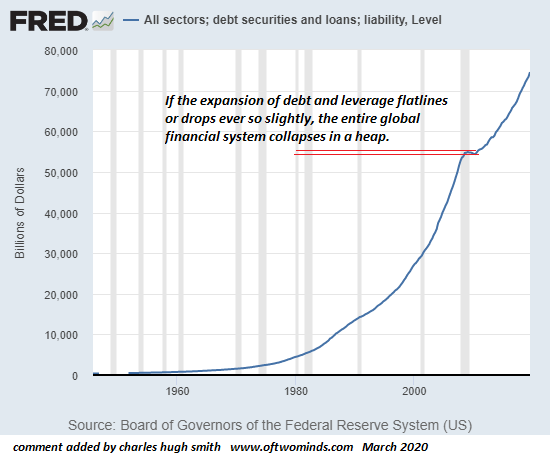

This is an exact analog for the entire global economy, which pre-pandemic had assets with a market value of $350 trillion and debts of $255 trillion and thus a net worth of around $100 trillion.

The $11 trillion that has evaporated in the market value of U.S. stocks is only a taste of the losses in market value. Global stock markets has lost $30 trillion, and once yields rise despite central bank manipulations (oops, I mean intervention), $30 trillion in the market value of bonds will vanish into thin air.

The market value of junk bonds has already plummeted by trillions, and that's not even counting the trillions lost in small business equity, shadow banking and a host of other non-tradable assets.

Then there's the most massive asset bubble of all, real estate. Millions of properties delusional owners still think are worth $1.4 million will soon revert to a more reality-based valuation around $400,000, or perhaps even less, meaning $1 million per property will melt into air.

Once the market value of global assets falls by $100 trillion, the world is insolvent.

Everyone expecting the financial markets to magically return to January 2020 levels once the pandemic dies down is delusional. All the dominoes of crashing market valuations, crashing incomes, crashing profits and soaring defaults will take down all the fantasy-based valuations of bubblicious assets: stocks, bonds, real estate, bat guano, you name it. (Actually, bat guano will be the keeper of all the asset classes listed.)

The global financial system has already lost $100 trillion in market value, and therefore it's already insolvent. The only question remaining is how insolvent?

Here's a hint: companies whose shares were recently worth $500 or $300 will be worth $10 or $20 when this is over. Bonds that were supposedly "safe" will lose 50% of their market value. Real estate will be lucky to retain 40% of its current value. And so on.

As net worth crashes below zero, debts remain. The loans must still be serviced or paid off, and if the borrowers default, then the losses must be absorbed by the lenders or taxpayers, if we get a repeat of 2008 and the insolvent taxpayers are forced to bail out the insolvent financial elites.

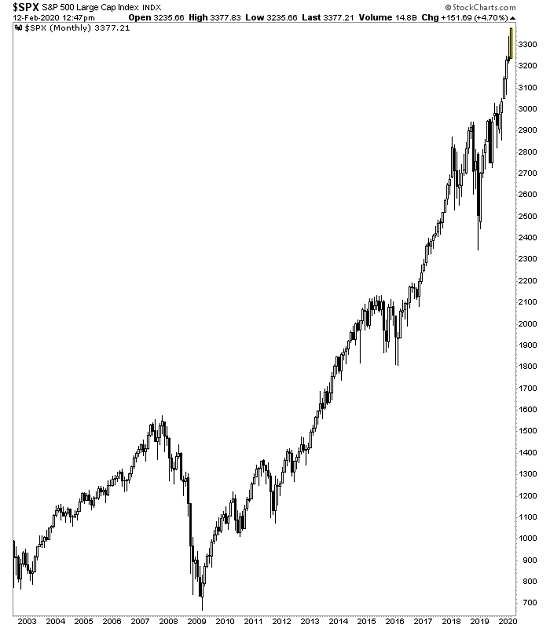

Here's the S&P 500. Where is the bottom? There is no bottom, but nobody dares say this. Companies with negative profits have no value other than the cash on hand and the near-zero auction value of other assets. Subtract their immense debts and they have negative net worth, and therefore the market value of their stock is zero.

Audiobook edition now available:

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World ($13)

(Kindle $6.95, print $11.95) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World ($13)

(Kindle $6.95, print $11.95) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($6.95 (Kindle), $12 (print), $13.08 ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the first section for free (PDF).

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, Dirk S. ($5/month), for your splendidly generous pledge to this site -- I am greatly honored by your steadfast support and readership.

|

Thank you, Eric R. ($5/month), for your monumentally generous pledge to this site -- I am greatly honored by your support and readership.

|