Once the pool of greater fools dries up, stocks crash regardless of what the Fed does or bleats.

The conventional view is the Federal Reserve creating trillions of dollars out of thin air will trigger inflation. Not so fast. Yes, creating trillions of dollars out of thin air will eventually devalue the purchasing power of each dollar--what we call inflation--but first all the unprecedented asset bubbles will pop and valuations will crash.

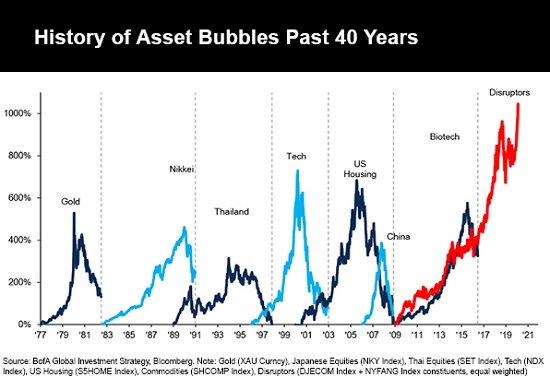

Let's call this a deflationary deluge as unsustainable asset prices are eroded by a hard rain of reality. To understand the enormity of the current bubbles, please glance at the charts below. The first chart depicts recent stock market bubbles; note the extreme height of the current bubble.

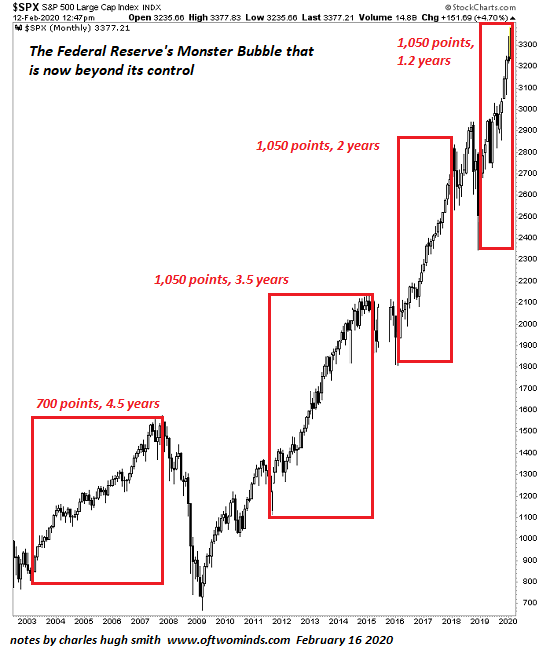

The next chart shows the S&P 500, and the extraordinary amplification of the bubble that reached its apex in February 2020. Note that each ramp higher takes less time to reach its peak. The most recent snapback rally gained about 870 points in a mere two months--a move that took roughly 5 years in the early 2000s.

Real estate and other assets have also soared in unprecedented bubbles. Old bungalows that sold for $150,000 less than 20 years ago are now supposedly worth over $1 million.

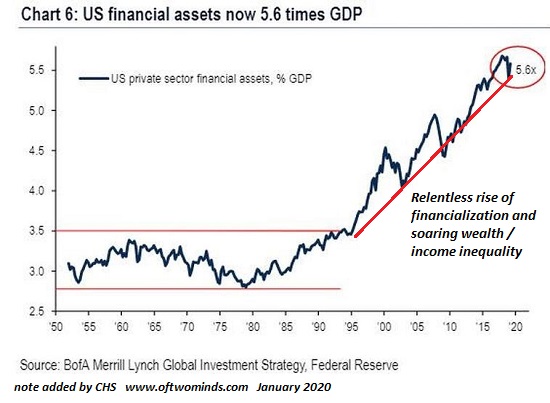

What made this possible? An equivalent bubble in debt. Every sector--household, corporate and government--has borrowed astronomical sums of money to keep the bubble economy glued together. In this rising tide of currency and capital, whatever had scarcity value--real estate, art, stocks--was purchased with the borrowed money as a store of value and / or as a source of income in a world starved of low-risk yields by central banks that dropped interest rates to near zero.

Assets don't have to rise, but the interest and principal on debt has to be paid. That's the rub with buying assets with borrowed money.

The price of assets is set on the margins. In a neighborhood of 100 houses, the price of all the houses is set by the most recent handful of sales. If each house was valued at $1 million, and three houses sell for $800,000, the value of the other 97 houses falls to $800,000 each.

All bubbles rely on a greater fool willing to pay a higher price than the previous somewhat lesser fool. The problem is the supply of greater fools quickly drops to zero when euphoria is replaced by fear and the marginal buyers are no longer willing to pay outlandish sums for houses, stocks, boats, etc.

Every greater fool who abandons a market sticks a pin in the bubble. As prices start eroding, those who bought the over-valued assets with borrowed money start realizing they have to make the interest payments even if the asset is losing value. The only rational choice is to run to the exit and sell the asset.

But since so many recent buyers bought with borrowed money, the exit is quickly jammed with desperate sellers. This triggers market crashes as marginal buyers desperate to sell will drop their price, while the delusional herd still believes the bubble valuations are not just fair but "under-valued."

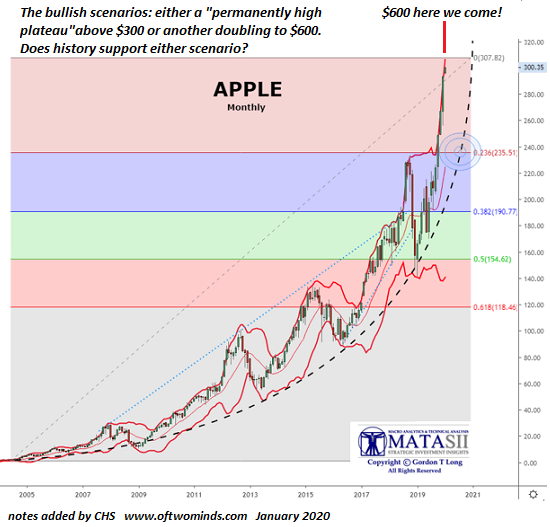

This is why the majority refuses to sell until it's too late. They believed the fairy tales that "real estate never drops," Apple is a bargain at $300 (see chart below), etc., and are unwilling to suspend those beliefs even as the deflationary deluge washes away their wealth.

By the time they realize the impossibility of getting their wealth back, it's too late to do anything other than salvage what's left by selling now rather than later.

Bubbles tend to rise and drop in rough symmetry, meaning they tend to retrace the entire bubble, though the descent is often much faster than the ascent.

The greatest fairy tale of them all is the Fed has our back. The belief here is that all the dollars created out of thin air by the Fed will flow into stocks. But there is no actual causal mechanism in this belief; the Fed can create dollars out of thin air but they don't have to flow into the stock market; they can go elsewhere. They only flow into stocks because the financiers, banks and other parasites and predators are counting on greater fools to pay ever higher prices for stocks based on their erroneous faith that the Fed's new money magically goes straight into stocks.

Once the pool of greater fools dries up, stocks crash regardless of what the Fed does or bleats, up to the point that the Fed is given the legal go-ahead to buy stocks directly. That's when the inflation everyone anticipates will begin. But inflation is just as unruly a beast as an asset bubble, and control is never quite as complete as the Fed claims.

First the deflationary deluge, then the tsunami of inflation. Both destroy the wealth of believers in fairy tales.

Audiobook edition now available:

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World ($13)

(Kindle $6.95, print $11.95) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World ($13)

(Kindle $6.95, print $11.95) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($6.95 (Kindle), $12 (print), $13.08 ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the first section for free (PDF).

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, Robert C. ($10/month), for your outrageously generous subscription to this site -- I am greatly honored by your steadfast support and readership.

|

Thank you, Terence S. ($5/month), for your marvelously generous pledge to this site -- I am greatly honored by your support and readership.

|