The Federal Reserve is reassuring us daily that inflation is temporary, but allow me to assure you that wage inflation is just getting started and will accelerate rapidly. As I noted yesterday, the Fed can create currency out of thin and funnel it to financiers, but the Fed can't create experienced, motivated workers out of thin air or entrepreneurs with the chops to launch and sustain real-world enterprises.

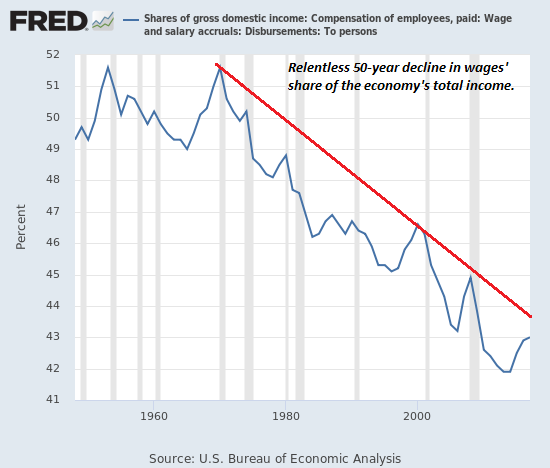

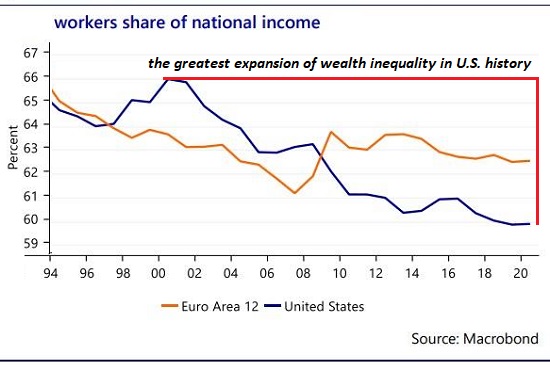

Let's start with a funny little thing called competition, which has been pushing wages down for the past 50 years. Globalization means you're competing with every other worker on the planet for jobs in tradable goods and services, and mass immigration and relatively high birth rates means there have been more potential workers than secure jobs.

Competition for paid work has been wonderful for global corporations, whose profits have soared five-fold thanks to labor arbitrage, also known as offshoring, where companies can pick and choose locales with the lowest cost labor.

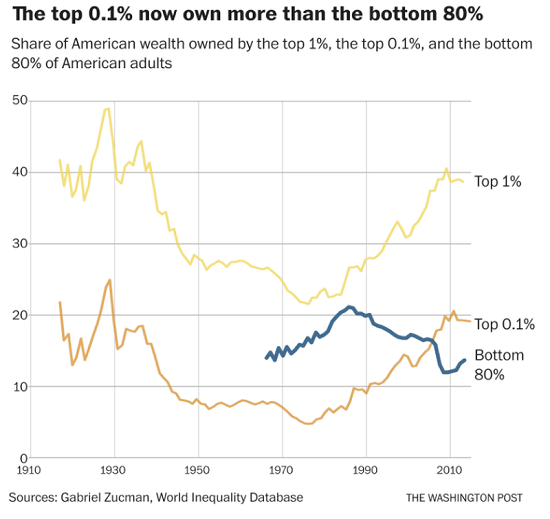

There's also been fierce competition for campaign contributions, as the cost of securing re-election has soared into the millions or tens of millions for congressional seats, and the bottom 90% can't compete with the top 0.1% in terms of lavishing millions on politicians who have become keenly attuned to the "needs" of their corporate handlers.

Thanks to global labor arbitrage and the outright purchase of our pay-to-play political system, capital has skimmed $50 trillion from labor over the past 45 years. It's all quantified in the RAND Corporation's 2020 report Trends in Income From 1975 to 2018 that documents the $50 trillion that's been transferred to the Financial Aristocracy from the bottom 90% of American households in the past 45 years.

Time magazine's article The Top 1% of Americans Have Taken $50 Trillion From the Bottom 90% -- And That's Made the U.S. Less Secure lays out the key role played by our political leadership:

No, this upward redistribution of income, wealth, and power wasn't inevitable; it was a choice-- a direct result of the trickle-down policies we chose to implement since 1975.

We chose to cut taxes on billionaires and to deregulate the financial industry. We chose to allow CEOs to manipulate share prices through stock buybacks, and to lavishly reward themselves with the proceeds. We chose to permit giant corporations, through mergers and acquisitions, to accumulate the vast monopoly power necessary to dictate both prices charged and wages paid. We chose to erode the minimum wage and the overtime threshold and the bargaining power of labor. For four decades, we chose to elect political leaders who put the material interests of the rich and powerful above those of the American people.

So now The Bill for America's $50 Trillion Gluttony of Inequality Is Overdue (9/21/21). Consider the minimum wage as a reflection of the structural stripmining of labor. According to the BLS inflation calculator, the $1.65 per hour minimum wage I earned in 1970 on Dole's pineapple plantation now equals $11.66 per hour--hence the calls for $12 per hour minimum wage.

But we all know the Consumer Price Index (CPI) has been gamed for decades to understate inflation, and in terms of the goods and services that could be bought with $1.65 in 1970, it would take at least $18 in today's money to buy the same basket of goods and services--if you include real-world prices for healthcare, childcare, higher education, rent, etc.

In terms of competition, the worm has turned, as the number of people who are competent, reliable and willing to work for lousy pay has dwindled. While our educational system was busy trying to make every student into an engineer, coder or at least a college graduate, all the real-world skills needed to keep the real world functioning were given short shrift and denigrated in the media as unworthy compared to the fantasy of coding something and selling it to Facebook, Apple or Google for millions.

The discussion about the decline of competence and reliability is one worth pursuing, but for now the point is that the decline is real, and so the competition for the competent, reliable and willing to work is heating up.

As I explained yesterday in The 'Take This Job and Shove It' Recession, a consequential percentage of the workforce is re-thinking trading their lives for Neofeudal Debt-Serfdom. Workers in all sectors and pay scales are seeking ways to escape the meaninglessness and dead-end nature of "work" in a neofeudal economy that taxes productive labor but lets Big Tech escape taxes and regulation.

There are two other dynamics in play in wages ratcheting higher: one is that wages, like taxes, ratchet higher but resist dropping back to previous levels. Once someone earns $15 an hour, they're less inclined to accept $12 an hour, just as local governments are never inclined to lower property taxes, excise taxes, etc. to previous levels.

Another is that when you have to pay one warehouse worker more money to fill the position, word gets out and every other worker in the warehouse will demand the same wage as the new hire. This is how pricing on the margins of the labor market ends up increasing the wages of the entire workforce.

Corporations love to demand everyone keep their salary secret to avoid this ratcheting up from the margins (and mask various biases in pay scales), but the political winds protecting corporations at all costs are finally shifting, and it's going to be more difficult to retain workers at $12 an hour after they heard the new employee is getting $15 an hour for the same work.

If we can risk a moment of honesty here, let's stipulate that real-world inflation has gutted the purchasing power of wages for 50 years while capital rigged the system to skim $50 trillion from those who work rather than speculate. A consequential percentage of the potential workforce simply doesn't have what it takes to work full-time in demanding jobs, and the blame-game about why this is so is fun but pointless.

An increasingly consequential percentage of the potential workforce is opting out of working for Corporate America or the government, preferring lower earnings and fewer hours.

Another consequential percentage of the potential workforce has gone on informal strike and refuses to work for wages so low that they're not even close to a living wage.

All of these dynamics will accelerate wage "inflation," Corporate Media-Speak for a long overdue shift back from capital to labor. The Fed has created trillions out of thin air to boost the speculative wealth of Wall Street, but it can't print experienced workers willing to work for low wages.

Now that McMansions are unaffordable, people are giving up their McMansion Dreams. And once people give up McMansion Dreams of debt-funded overconsumption, they also give up debt-serfdom and wage slavery.

Of related interest:

My book Get a Job, Build a Real Career and Defy a Bewildering Economy is a primer for those seeking sustainable self-employment in the nooks and crannies of the economy.

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

My new book is available! A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet 20% and 15% discounts (Kindle $7, print $17, audiobook now available $17.46)

Read excerpts of the book for free (PDF).

The Story Behind the Book and the Introduction.

Recent Podcasts:

Salon #43: History shows again and again how nature points out the folly of men...

Covid Has Triggered The Next Great Financial Crisis (34:46)

My COVID-19 Pandemic Posts

My recent books:

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($5 (Kindle), $10 (print), ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the first section for free (PDF).

Become a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Scot M. ($300), for your beyond-outrageously generous contribution to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, Christopher D. ($50), for your marvelously generous contribution to this site -- I am greatly honored by your steadfast support and readership. |