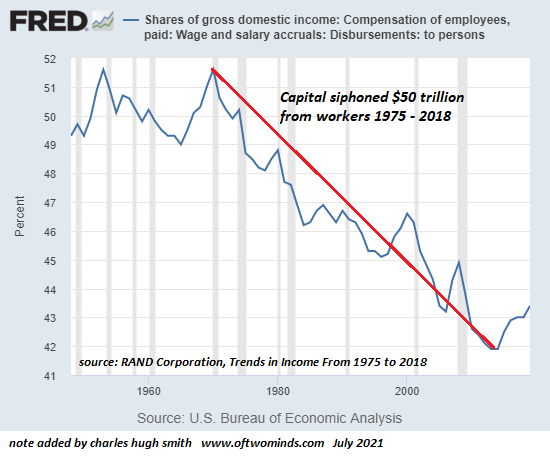

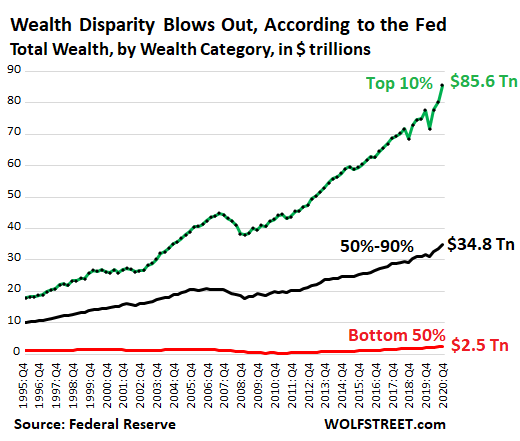

America's economy has changed in ways few of the winners seem to notice, as they're too busy cheerleading their own brilliance and success. In the view of the winners, who just so happen to occupy all the seats at the media-punditry-Federal Reserve, etc. table--the rising tide of stock, bond and real estate bubbles are raising all boats. What's left unsaid is except for the 50% of boats with gaping holes below the waterline, i.e. stagnant wages and a fast-rising cost of living.

The truth the self-satisfied winners don't include in their self-congratulatory rah-rah is there's no place for the bottom 50% of American households to go but down. All the winnings flow to those who already owned assets back when they were affordable-- the already-wealthy--whose wealth has soared as assets have shot to the moon while the the burdens of inflation and debt service hit the bottom 50% the hardest.

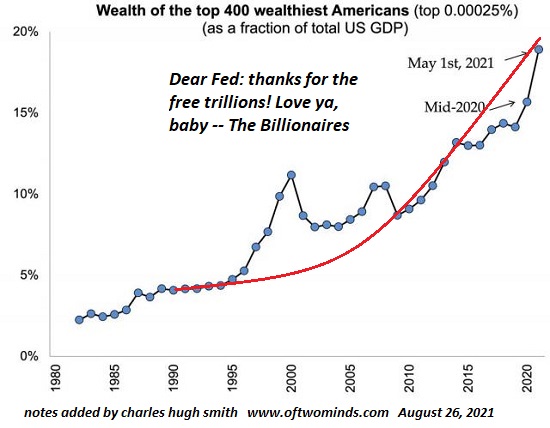

Meanwhile, the Federal Reserve is whining that inflation isn't high enough yet for their refined tastes. Boo-hoo, how sad for the Fed--inflation isn't yet high enough. Oh wait--didn't they each mint millions by front-running their own policies? No wonder they're not worried about inflation.

The reality few acknowledge is that globalization and financialization have stripped the American economy of low-skilled jobs that don't demand much of the employee. The reality is that a great many people don't have what it takes to learn high-level skills and work at a demanding pace under constant pressure--the description of the average job in America.

There were once millions of low-skill, low-pay jobs for people who for whatever mix of reasons were unable to muster the wherewithal to fulfill the fantasy of working extra hard, going to night school, soaking up high-level skills, moving quickly up the ladder to higher pay, buying the starter home and then moving up the food chain to middle class security from there.

The cost of living was low enough that those working these low-skill, low-pay jobs could still have an independent life. There were still low-cost rentals, often derided by the wealthy, in nooks and crannies of even the costliest cities. (I once lived in a room stuffed with old tax records in a poolside shack in an upscale neighborhood. The room had been cleared for a single bed and a path to the decrepit bathroom. Its most important attribute was that I could afford it on my low earnings.)

Affordable housing has vanished, eliminated by the financialization of America's economy. Once landlords pay double the price for the property, rents have to double to pay their higher expenses. The apartment didn't double in size or amenities--the rent doubled without any increase in utility to the renter. You get nothing more for double the price--nice.

Yes, people could make better choices, and some do. The point here is the game is rigged against those in the lower tier of the economy who can no longer afford a house or other stake in the only winning game in town--speculative asset bubbles. Go ahead and work a second job and go to night school--you'll still be left behind the already-rich.

Globalization opened every job in America to global competition via offshoring or the influx of undocumented workers so desperate to support their families back home that no pay was too low and no working condition too wretched to refuse.

Many overindulged pundits who never worked an honest day in their lives sneer about burger flippers without realizing how hard those burger flippers have to work. I doubt the well-dressed pundits, snobbish about their university degrees and general brilliance, could manage to work a single day in a demanding fast-food job.

As the price of housing and other assets have soared, enriching the already rich, they're out of reach for the bottom 50% who struggle to pay their bills as wages have stagnated and the costs of essentials have skyrocketed.

The rising cost of parking tickets, junk fees, user fees, utilities and food don't impact the well-paid top 5% technocrat class, whose stake in the Everything Bubble keeps expanding by tens or hundreds of thousands of dollars. But for the bottom 50%, those incremental increases are, when added to higher rents, absolutely crushing.

As for getting high-quality healthcare that includes mental health support--those are reserved for the rich. But no worries, self-medication is always a "choice."

Getting a boost in pay from $12 an hour to $15 an hour is welcome, but that doesn't put the worker any closer to affording a house or equivalent stake in the Everything Bubble.

The new feudalism is masked by the glossy SillyCon Valley PR of a gig economy where (per the PR fantasy) bright, shiny and totally independent workers freely choose to serve the winners in the rigged sweepstakes for low pay and zero benefits.

In the SillyCon Valley PR, serfs freely choose to serve their noble masters for nothing but survival because they love the "freedom" and "choice" of kissing the nobility's plump derrieres. (After all, there were "choices" even back in the good old days of feudalism--one could join the brigands in the forest, or enlist in a poorly paid mercenary army where the odds of dying were high--you know, "choices" of "gigs.")

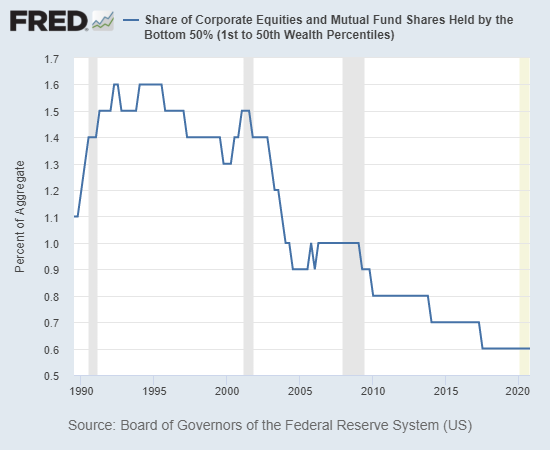

One might anticipate that the bottom 50%'s meager share of the nation's exploding wealth would have increased as smartly as the wealth of the billionaires, but alas, no--the bottom 50%'s share of stocks (equities) actually plummeted in the the glorious decades of Federal Reserve free money for financiers, stock buy-backs and asset bubbles.

All this suits the billionaires and those collecting the crumbs of the Everything Bubble just fine. So what if the bottom 50% have nowhere to go but down? There's plenty of room in the homeless encampment for another broken down station wagon or an old camper. There's lots of "choices."

And no consequences for the winners, of course, because The Fed has our backs.

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

My new book is available! A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet 20% and 15% discounts (Kindle $7, print $17, audiobook now available $17.46)

Read excerpts of the book for free (PDF).

The Story Behind the Book and the Introduction.

Recent Videos/Podcasts:

Charles Hugh Smith on the Failure of the Federal Reserve and Rising Secular Inflation (31:16) (with Richard Bonugli, FRA Roundtable)

My COVID-19 Pandemic Posts

My recent books:

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($5 (Kindle), $10 (print), ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the first section for free (PDF).

Become a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Bengen Financial ($50), for your most excellently generous contribution to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, Daniel L. ($5/month), for your marvelously generous pledge to this site -- I am greatly honored by your support and readership. |

|

|

Thank you, Michael R. ($5/month), for your fantastically generous pledge to this site -- I am greatly honored by your support and readership. |

Thank you, Antti K. ($200), for your beyond-outrageously generous contribution to this site -- I am greatly honored by your steadfast support and readership. |