All Six of the reasons corporate profits will decline by half are common sense:

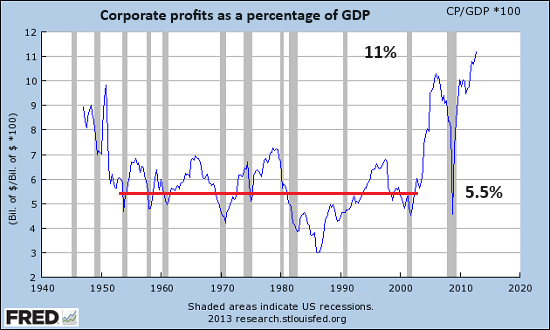

1. Reversion to the mean: profits that are double the historical average as a percentage of Gross Domestic Product (GDP) are highly likely not to be a sustainable New Normal. The far more likely track is a reversion to the historical average, which is about 50% below corporate profits' current 12% of GDP. Permanently elevated plateaus of stock valuations and corporate profits are both compelling chimera. (see chart below)

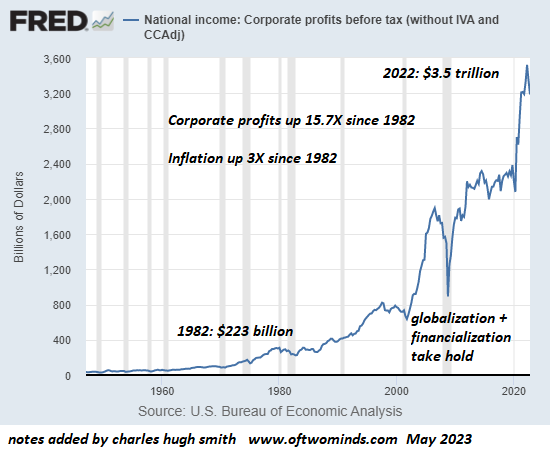

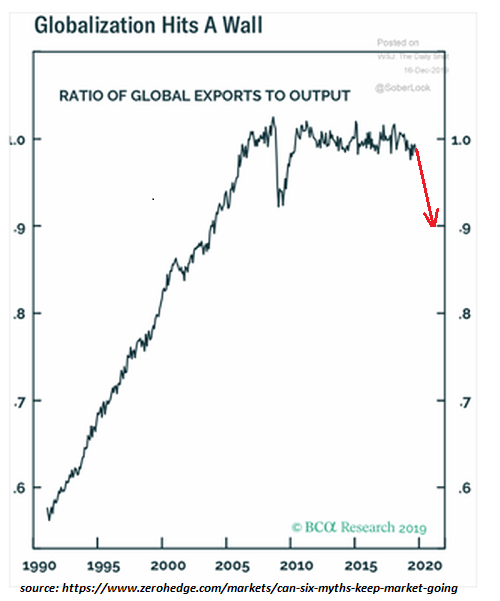

2. The Boost phase of Globalization has ended. The era of hyper-globalization is clearly visible on the charts of corporate profits and corporate profits as a percentage of GDP: right after China was accepted into the WTO in 2001, US corporate profits skyrocketed in both nominal dollars and as a percentage of the US economy (GDP).

Globalization's boost phase that sent corporate profits into orbit has rounded the S-Curve and is now in the stagnation / decline phase. (see chart below)

The reasons why hyper-globalization rocketed corporate profits to unprecedented heights are both well-known and terribly inconvenient to the happy story that globalization will magically generate unprecedented profits forever.

The primary drivers were global labor and environmental arbitrage, a.k.a. exploit cheap labor in sweatshops and dump all the toxic waste of industrialization in developing nations with lax environmental standards and enforcement. As the chart below shows, wages in China are no longer low, and China has begun improving its environmental standards.

3. Quality and durability have been gutted and there's no more profit to pluck from buying lower-quality components and inputs, as the cheapest, lowest-quality components and inputs have already been standardized.

Hyper-globalization provided the ideal cover for the systemic collapse of quality and durability. This corporate institutionalization of planned obsolescence, abysmal quality and shrinkflation all boosted profits enormously, but there's nothing left at the bottom of the barrel; corporations have licked the profitable slop of planned obsolescence, abysmal quality and shrinkflation clean.

The super-efficient global supply chains are also breaking under the strain of geopolitical and national security priorities, and the difficulties of replacing existing supply chains, which depend on cheap energy and transport and a massive infrastructure to serve trade that non-industrialized developing nations cannot duplicate.

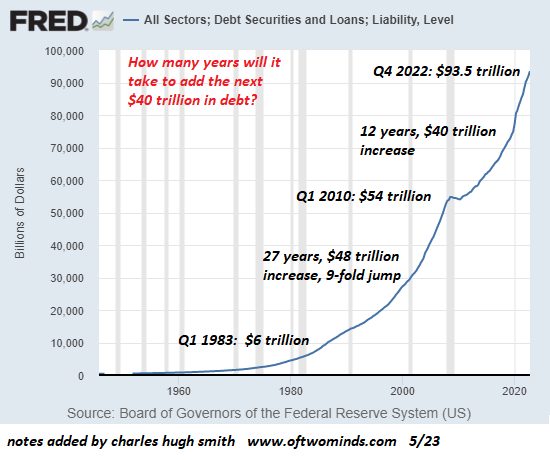

4. Hyper-financialization has also entered the decay-collapse phase. Hyper-financialization drove corporate profits in two ways:

A. As borrowing costs dropped to unprecedented lows, corporations could borrow vast sums at near-zero rates to scoop up other companies with positive cash flow, gut the quality and staff and scoop up the resulting cost reductions as profits.

B. Consumers could borrow vast sums at low rates to buy products that they would not have been able to afford at historically average interest rates. For example, with 1.9% (or even zero) financing, new autos and trucks became more affordable. With demand strong, corporations could keep prices high and reap the gains of stronger sales.

Now that zero-interest rate policy (ZIRP) has ended its disruptive reign, the tailwinds of zero rates have reversed into the headwinds of structurally higher rates.

5. The asymmetric distribution of the economy's output favoring corporations at the expense of labor is finally shifting. After 45 years of capital skimming $50 trillion from labor, rising rates of disability, unfavorable demographics, systemic healthcare inflation and social dynamics are pushing labor costs higher.

6. Debt saturation. Corporate profits soared from $800 billion annually to $3.5 trillion in 2022 on the tailwinds of public and private debt skyrocketing from $30 trillion in 2000 to $95 trillion today. With the era of zero cost of debt over, we've entered an era of debt saturation: households, government and enterprises can no longer afford to take on more debt without triggering unintended consequences or slashing discretionary spending to service the higher costs of new and existing debts.

Since growth depends on the ceaseless expansion of debt and the discretionary spending it enables, growth reverses along with discretionary spending. Corporations will find it impossible to keep prices at nosebleed levels as consumer demand plummets while costs remain sticky.

Rather than being the New Normal, corporations skimming 11% of GDP as profits was a one-time outlier resulting from the one-time boost of hyper-financialization, hyper-globalization and ZIRP. US GDP is around $26 trillion according to the Bureau of Economic Analysis (BEA). Corporate profits sagged a bit to $3.2 trillion in Q1 2023, roughly 12.3% of GDP.

Should profits decline to 5% of GDP ($1.3 trillion), this would be in the middle of the historic range. In a real recession, they could dip to 3% of GDP ($800 billion). At 5% of GDP ($1.3 trillion), corporations would still be making money but not at rates that would justify today's absurdly overvalued stock valuations.

The $2 trillion haircut equates to a 2/3 decline. Should stock valuations track this same decline in profits, it's entirely reasonable to expect the stock market to lose 2/3 of its valuation premium--a premium based not on anything remotely sustainable, but on a one-off of hyper-financialization, hyper-globalization and zero interest rates.

There's nothing wrong with a 5% of GDP run-rate for coporate profits. That's still a very healthy return. It's only a disaster in a highly distorted funhouse whose players have lost touch with reality.

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

Read the first chapter for free (PDF)

Read excerpts of all three chapters

Podcast with Richard Bonugli: Self Reliance in the 21st Century (43 min)

My recent books:

The Asian Heroine Who Seduced Me

(Novel) print $10.95,

Kindle $6.95

Read an excerpt for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal

$18 print, $8.95 Kindle ebook;

audiobook

Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

(Kindle $9.95, print $24, audiobook)

Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel)

$4.95 Kindle, $10.95 print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print)

Read the first section for free

Become

a $1/month patron of my work via patreon.com.

Subscribe to my Substack for free