Infrastructure and Gridlock: "Too Many Cooks"?

Let's start with another spot-on haiku from frequent contributor Jed H.:

Empire of DEBT's Woes

Depression Collapse is here !

Last Black Swan Landing ?

Right now the stock market and the economy seem to be "recovering," along with consumer confidence, the GDP and everything else except housing--if you believe the MSM headlines. But perhaps, as Jed suggests, a flock of Black Swans is just over the horizon, and we'll finally spot them in, say, October....

Housekeeping notes: 1. I am pleased to announce that my new young adult novel Claire's Great Adventure is now in print and available from amazon.com or from me, if you'd like a signed gift copy sent to a deserving teen (or even a recalcitrant teen).

2. To my astonishment, it seems this little outpost on the world wide web received its 2 millionth visit sometime this month. Thanks to the quality of you, the readers, correspondents and contributors, the "unique visitors per month" count has risen from 1,500 3 years ago at the start of this weblog to 65,000 or so this month. The site logs about 130,000 visits per month now, so every recipe, commentary and essay you write is finding readers. It is my honor to host this forum of ideas and solutions.

I know--blah blah blah. OK, on to the topic of the day.

Correspondent Jim S. checked in recently with this cogent take on the nation's urgent and increasingly grim infrastructure problems. The starting point of his analysis is T. Boone Pickens' recent call for a large-scale wind-generated electricity program for the U.S., and former V.P. Al Gore's call for a crash energy independence program in the U.S. (Emphasis added: CHS)

Gore is misguided, and Pickens is smart but incomplete. I watched Pickens govt hearing on C-Span...decent but significantly incomplete presentation for our govt. representatives. The entire electrical grid in the US goes back to before 1900. It has grown layer, upon non-standardized layer for all this time. Much is decrepit. Current solar and wind installations are off-line obligatorily, when the capacitance of the grid is not capable of absorbing the energy generated now...the absorption rates are INEFFICIENT, and determined by local conditions at the entry point.

The system, to absorb the 20% of national energy requirements envisioned by Pickens and alluded to by Gore requires a TOTAL restructuring and renewal of the ENTIRE ELECTRICAL GRID. Are there any cost estimates and time frame estimates for the entire grid to be rebuilt?...could the $875 billion in Obamas’ Senate bill for treating worldwide AIDS be channeled for the rebuilding of our energy grid??!!

Rebuilding the grid and the roads as well, as the grid rebuilding depends on good roads, are issues deserving recognition in our current Presidential campaign, along with so many other deserving, important, compelling, grossly inarticulated issues.

Without a new electrical updating of the old grid, the grid graph in green lines on Pickens map, is only a wind generating connection map of the new structure with no plan for integrating its distribution to the existing, incompetent grid. Major disconnect is built into the presentation by an absence of discussion of how the new energy will be absorbed into the system.

Well said, Jim, thank you. While we can all too easily "round up the usual suspects" for how we came to such dire straits, let's consider a larger society-wide cause: too many cooks.

As in, "Too many cooks spoil the broth." Although few seem to notice or comment on this flaw, it is difficult to get anything built in this country anymore except McMansions in rural counties desperate for a larger tax base. And with the housing bust in full swing, that's over now, too.

How about replacing an earthquake-damaged bridge in the nation's 6th largest urban area, San Francisco Bay? Try 20 years and counting. The Loma Prieta earthquake damaged the S.F. Bay Bridge back in 1989, and the replacement bridge is now under consruction--a mere two decades after it should have been started.

Needless to say, the costs has doubled or even tripled in the endless dilly-dallying, dickering, agency negotiations, etc.

Want to tear down that old crappy building to build some housing close to jobs, shopping and transit? Not so fast, pal--that building is historic. Or so I say. Here is a real-life scenario which is played out again and again in growing urban areas of the nation: a new building is proposed which requires the teardown of an existing structure. Obstructionists suddenly appear in great, keening numbers and squash the project for any number of reasons: preservation, density is too high, NIMBYism (not in my back yard) and so on.

All too often, a single obstructionist can kill a project which would have benefitted the entire community. In our urge not to repeat the terrible mistakes of early 1960s "urban renewal" which bulldozed irreplaceable theatres and destroyed entire neighborhoods, now we are fearful to take down shacks and decrepit buildings if even one "resident" raises a protest.

I know of several cases in which the obstructionist--often a retired person with plenty of time and a character which revels in their newfound power--kills a decent project and then 2 years later moves to another community.

How about adding a passenger station to an existing rail line? Who could complain about such a useful and seemingly benign addition to the infrastructure? Try five years of "process" and counting. It seems every agency under the sun has a say about the little station, and the railroad has its concerns--and so on. So the idea languishes year after year, and people who might have ridden the rails to work sit fuming in traffic, needlessly burning costly oil year after year.

Rebuild the nation's electrical grid? Nice, as long as you don't do it where anyone lives, where agencies galore have jurisdiction, or within line of sight of some well-heeled enclave.

One root of this crippling abundance of stakeholders can be found in the new book, The Gridlock Economy: How Too Much Ownership Wrecks Markets, Stops Innovation, and Costs Lives

Here is a summary from amazon.com:

Every so often an idea comes along that transforms our understanding of how the world works. Michael Heller has discovered a market dynamic that no one knew existed. Usually, private ownership creates wealth, but too much ownership has the opposite effect—it creates gridlock. When too many people own pieces of one thing, whether a physical or intellectual resource, cooperation breaks down, wealth disappears, and everybody loses. Heller’s paradox is at the center of The Gridlock Economy.

To ownership we can add stakeholding--anyone with a political or financial stake/"vote" in the approval of a project. Nowadays, that includes Fish and Wildlife, environmental agencies, air quality management, the neighbors (even if they are essentially temporary residents), cities, counties, states, the Federal agencies, private landowners, community groups, politicos and the teeming host of groups which control the money spigots.

Power to the people, right on--except when it takes 20 years to replace a dangerous bridge. If you drew a political "stakeholders" map of the U.S. in the manner of a map of "ownership," you would find almost countless overlaps.

Democracy is inherently messy. I know architects who gaze at China with great envy because there, your project is greenlighted in days or weeks and construction starts yesterday. Yes, it may have required a bribe or three, and maybe poorer residents were bulldozed out of the way, but infrastructure projects get built in China at astonishing rates.

Obviously, there is some sort of balance needed between "competing interests" and an obstructionism born of a profusion of demands, agendas and voices. Thus we recently were treated to the BLM (Bureau of Land Management), a Federal agency which oversees millions of acres of Federal land (essentially owned "by the people"), deciding to hinder the placement of solar electrical generation plants in its empire. Uh, right. Great thinking, folks.

A hue and cry was quickly raised from across the political spectrum and this bit of obstructionism was quashed--for the time being. The truth is a vast desert with no residents or private owners is just about the only place in the U.S. you can build infrastructure in a timely manner.

What is "timely" in the U.S. (i.e. mere months for approval as opposed to decades) would be painfully slow in China.

The "Ownership Society" was hyped during the housing bubble as a self-evident "good thing." Perhaps, but when everybody owns a piece of everything, then it's almost impossible to get anything done.

I personally am persuaded that offshore drilling can be done with sufficient precautions with current technology to render it a low-risk activity. With gasoline at $4/gallon, a number of citizens who were adamantly against the idea for legitimate environmental concerns about spills and coastlines are now open to the idea.

Care to hazard a guess as to how long it will take to actually get a permit to construct an offshore drilling rig? Please make your guess in years. the possibilities for obstruction are plentiful, and our courts guarantee years of countersuits, appeals, stays, etc.

Once the permits are finally in place--let's be optimistic and say it will only take 5 years--in 2014, then you have to drill some test wells, many of which might turn out to be dry. Add a few years for this process. After locating the petroleum, then you have to construct a huge offshore platform and rig it with reduntant safety features. Add a couple more years. Then there's the pipelines to the mainland, and so on.

It would be miraculous if the first drop of oozing oil were pumped before 2018. On a practical basis, wind farms and large solar arrays built on private lands could be up and running at least 8 years before this first drop of oil flows.

That's something to ponder as we consider: is there any way to "greenlight" basically benign alternative energy and electrical grid projects? How about a one-month process without appeal, and a special "infrastructure" Federal court which convenes solely to dispense with appeals in short order?

Various stakeholders will scream, just like all the patent holders who hoped to get rich off their stake in some "gold mine." Some reduction in the number and time scales of obstruction, i.e. the number of "stakes" and approval processes, is necessary on a national scale, or the "gold" of new infrastructure and alternative energy will never make it out of the ground.

Excellent New Readers Journal Essay:

Read all five of this month's superb essays if you missed them

Why the Trend in Oil Is Up (José de Freitas, July 30, 2008)

Although I'd be lying if I said I am certain of which direction the oil price is going, my gut feeling is telling me that it's going up as a general trend, despite brief respites. A few points have not been sufficiently made, and I think Rainer H.'s piece exhibits some of the problems those points would address.

Buy my new novel from amazon.com: Claire's Great Adventure or buy a signed copy from me (a great gift for teens)

Thank you, Cheryl A. ($50), for your second outrageously generous donation this year and for your many contributions of ideas, books and topics to this site. I am greatly honored by your support and readership.

Thursday, July 31, 2008

Wednesday, July 30, 2008

Oversupply and Compression: How the Median House Price Will Fall from $215K to $70K

I am constantly amazed (yes, I know I shouldn't be) by how many otherwise intelligent people expect housing to "recover" next year. I shouldn't be surprised, of course, because fantasy and hope are the key traits of all post-bubble busts.

Thus we had analyst after analyst in 2001 and 2002 calling "the bottom" in the Nasdaq, even as it fell from 5,000 to 3,000 to 2,000 and then finally to 1,000.

In a similar fashion, we now have a nearly universal belief that oil and commodities have "topped out" and the recent decline is a new trend. Happy days are here again, oil is heading back to $75/barrel, hoo-ha!

(NOTE: Before you jump on the "oil will just get cheaper and cheaper now" bandwagon, I heartily recommend the new Readers Journal essay by Portugal-based correspondent José de Freitas: Why the Trend in Oil Is Up.)

In a similar fashion, we should not be fooled that a brief market reaction is the start of a new trend, i.e. "housing will soon bottom." On the contrary, I predict the median price of a house in the U.S. will fall from $215,000 all the way down to $70,000.

According to the National Association of Realtors, the median home price was $215,100 in June 2008. These data sources suggest the median is around $230,00 and the average around $300,000: US: Median Price of Houses Sold including Land Price and US: Average Price of Houses Actually Sold.

Whatever number you pick, I predict a 2/3 decline from here, based on these long-term trends and historical patterns:

1. A further 30% decline is required to bring rents and the cost of ownership back into the long-term historical range/ratio. The only reason to buy a house/dwelling which costs far more than renting the equivalent residence is the investment belief that appreciation of the property will exceed (after all the tax benefits are calculated in, etc.) the appreciation of other asset classes. (Note: the ratio varies depending on locale, but in general it is still out of whack from the mean.)

In other words, it's an investment decision, not a decision about owning a place to live. If real estate proves to be a poor investment which only depreciates year after year, this belief (currently a near-religious belief of stupendous power in the U.S., based on the past 25 years of debt-fueled speculative frenzy), then housing will decline back to the historical ratio.

Now if rents are set to rise 30% above inflation, then the argument could be made that housing will not decline; but with wages in a long-term decline and the economy souring, what rise in income is foreseeable which would fuel a rise in rents? It is more likely that rents will decline in most markets as well, further pressuring the decline in housing values.

There are other reasons to believe buying will become ever more unattractive compared to renting:

2. The cost of money will rise for a generation. The two keys to appreciation in real estate are: cheap, easily available money/mortgages, and a highly liquid market in which any property can be quickly bought/sold.

Guess what's disappeared and won't be coming back: cheap, easy money and a liquid market. If you are fearful that you can't sell the house you're about to buy, then it's a Capital Trap you will want to avoid.

And if money becomes tight again, then a 20% down will be standard once again--and in a recession which has strangled credit, asset values and the economy, how many people will have saved up that much cash? How many will be willing to sink all that cash into a Capital Trap? Relatively few compared to the hordes who "qualified" in the era of liar-loans, no-down, interest-only loans, etc.)

3. Oversupply and vast overbuilding render the market illiquid. With almost 20 million empty dwellings (of which perhaps 4-5 million are true "vacation/second homes") and huge numbers of empty rooms in existing housing, the number of homes for sale will exceed the number of qualified buyers for a long time to come.

PIMCO's Bill Gross went on record recently suggesting 1 million homes should be dynamited; good idea, Bill, but that still leaves 15 million empty dwellings.

Please don't tell me about population growth: Immigration is already slowing because jobs are drying up, and household size in the U.S. can easily rise, enabling more people to live in the same number of dwellings.

The overbuilding was not the result of meeting demand for housing, it was all about meeting the demand for speculative vehicles. Once the speculators are slowly roasted year after year by declining prices, then eventually nobody will be thinking that housing is a "great investment." Once that belief system has been eradicated via everyone who acted on it being destroyed financially, then housing will once again be viewed as shelter rather than a speculative vehicle for investment or "get rich quick" deals.

I am continually astonished by the number of people who believe a house which tripled in price and has now fallen a mere 20% is "cheap." As I have written before, there are only two valid reasons for buying a dwelling, and appreciation is not one of them:

A. It's cheaper to buy than rent

B. You can make money on Day One by buying the dwelling and renting it out at local market rate rents.

Both carry this important caveat: you can afford to let your Capital be Trapped in an illiquid market for years. If you might have other uses for the cash, then it would unwise in the extreme to trap it in illiquid real estate.

4. Price-Earnings Compression occurs when risk re-enters a market. This is a well-known element in the stock market: in good times, a company earning a dollar per share will be valued at $25/share--a PE (price-earnings ratio) of 25. That is called PE expansion, and it results from euphoric belief that the economy will forever enable ever higher profits.

In recessions, losses reinject risk back into speculative and investment calculations, and PEs contract/compress. Thus the company may still be earning $1/share, but in a real recessionary trough it will be valued at a mere $8/share--a third of its euphoria-"real estate/tech/China/etc. only goes up" valuation.

Real estate is not immune to price-earnings compression. If a property keeps declining in value, then the ratio of its net income (from rents) to its value will shrink. Thus in a rising market a property might well be valued at $500,000 based on its rental income, but in a declining market its value may be compressed to $300,000 even if rents haven't dropped a dime. All the risks get priced in--risk that rents might drop, that vacancies may rise, etc.--and buyers turn wary and cautious.

5. Other investments will outshine real estate and money will continue to flow away from housing. If you could earn 10% on your cash, why sink it into a risky illiquid market in housing? Recall that real estate is based on leverage; if you put 20% down to buy a property and it drops 10% in value, if you have to sell you will lose 75% of your initial cash: 50% due to the decline in value and another 25% in transaction costs (realtors fees, closing costs, transaction taxes, etc.)

A mere 10% decline in a $500,000 house wipes out half the value of a $100,000 (20%) down payment. Leverage really destroys wealth quickly on the way down.

As interest rates rise globally, just parking your money in cash earning a nice return will look better than risking it in depreciating illiquid real estate.

Risk cannot be eradicated, it can only be obscured.

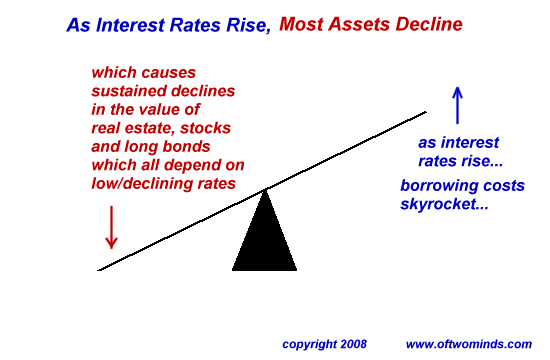

6. The inexorable rise in interest rates (i.e. the cost of money) will compress property values by as much as 50%. The reason is simple: if the average buyer can only afford (say) $1,500 a month for a mortgage and property taxes, then the value of the house will rise or fall in direct correlation with mortgage rates, i.e. what the buyer can afford.

If rates plummet, as they did in the past decade, then the buyer can afford (say) a $300,000 home for that $1,500/month at 5%. Magically, valuations rise to these levels. Conversely, when rates rise to 10%, the $1,500/month only enables the purchase of a $150,000 home--and so prices decline to what buyers can afford to pay.

This is simple supply and demand correlated to the cost of money, which is correlated to its own supply and demand and the level of risk.

Put another way: if you're lending money, and real estate has been declining for years, how much risk premium do you need to bury your bank's capital in a capital trap? As the recognition of risk rises, so do mortgage rates. And as risk rises, long-term fixed-rate mortgages vanish, effectively saddling the buyer with the risks that money will continue rising in cost. That adds another reason for buyers to hold off on sinking their capital and income into an illiquid property.

7. Residences near core jobs, transit and walkable neighborhoods will decline less than housing far from jobs and transit. Those houses will fall to zero value. Thus for median (and average) prices to fall to $70,000, we don't need a market overwhelmingly priced below $100,000--we only need millions of houses valued at near zero.

As readers of Jim Kunstler know, the suburban/exurban environment was based entirely on the presumption of endless cheap oil for transportation and commuting. Now that Peak Oil is cutting away at supply even as global growth catapults demand, then that presumption is no longer valid. There may well be oil available for decades, but it will no longer be cheap.

Demographically, there are many reasons for people to migrate from exurbs and suburbs to city cores. Cost of commuting is only one; another is health care. As hospitals and urgent care facilities close, aging Baby Boomers who want access to care must move back into cities and large towns.

Cities will remain comparatively job rich environments, and so staying close enough to get to work is another reason for migration to urban cores. Towns with a good hospital, clean water and some core of jobs (a college, a hydro-electric plant, farming, etc.) will attract residents who don't want to be stranded in an exurb graced with an abandoned strip mall and little else.

The poorer you are, the less money you have for cars, gasoline, etc., and so lower-income people have excellent motivations not to be warehoused in outlying worthless communities which are not served by rail or any public transit and which offer little or no social services (free clinics, libraries, parks, etc.).

These are all reasons to expect increasing numbers of residents per household and a reversal of the trend toward one-person households. As I have tirelessly proven in the case of the 2001 dot-bomb exodus from San Francisco and the Bay Area, cities can expand or contract in population by huge margins while their housing stock remains more or less constant. People move back home, people rent out an empty room, and so on. A 100,000 people can move in or out of a city without adding or subtracting a single dwelling.

Thus we can foresee housing and rents actually stabilizing in urban zones and towns with ready access to water, nearby cropland/food, jobs, transit, walkable neighborhoods, energy (think Oklahoma, Texas, locales with coal, large hydro-electric dams or huge solar or wind arrays, etc.) and some medical care (even the rationed sort will be welcome if the alternative is none at all). Areas with few to none of these assets will see their housing stock sink to near-zero in value.

Supply and demand will eventually rule, regardless of government bailouts, backstops, interventions, etc. There are at least 15 million surplus dwellings in the U.S., an overhang which will not disappear in a few quarters or years. Millions will lose value as they were built in an undesirable locale, while the rest will re-set according to the demand/supply/risk calculations based on the cost of money, demographics, Peak Oil and a number of other trends (scarcity of jobs and healthcare, reduction in government services, etc.)

Real estate, bonds and stocks rose during the generation-long trend of ever-lower interest rates from 1982-2005. Now that trend has reversed and cash will outperform all three assets which depend on ever-lower rates and ever-easier money to appreciate in value.

It's a shocking conclusion, I know: a house will return to being shelter, not an investment vehicle for staggering wealth generation.

Excellent New Readers Journal Essay:

Read all five of this month's superb essays if you missed them

Why the Trend in Oil Is Up (José de Freitas, July 30, 2008)

Although I'd be lying if I said I am certain of which direction the oil price is going, my gut feeling is telling me that it's going up as a general trend, despite brief respites. A few points have not been sufficiently made, and I think Rainer H.'s piece exhibits some of the problems those points would address.

Thank you, Alberto R. ($20), for your second generous donation and your ongoing contributions of ideas and essays to this site. I am greatly honored by your support and readership.

Tuesday, July 29, 2008

The Human Cost of Mal-investment and the Empire of Debt Collapsing

Writer/permaculturalist Noah Cicero (Ohio) recently submitted this poem on the human costs of oil's rise. I would say the cause is not just Peak Oil but decades of mal-investment and the collapse of the Empire of Debt.

Peak Oil Down Home

After a barrel hit a hundred no one got a raise anymore we stopped expecting them so we stopped working so hard

After a barrel hit a hundred My friend and I didn't take long vacations In our car to Disneyland in California anymore Disney made 300 dollars less dollars this year

After a barrel hit a hundred My 61 year-old friend who has been working for 23 years at the same plant producing parts for RVs only works every two weeks now and his pay is cut is half he's facing foreclosure

After a barrel hit a hundred my friend a mom with three kids trying to get through school trying hard like we are all couldn't afford to pay her mortgage and the house is gone

After a barrel hit a hundred my friend at work wife got laid off from a 12 dollar an hour job and so did 300 others

After a barrel hit a hundred an aluminum factory that employed over a hundred was totally closed down

After a barrel hit a hundred the restaurant where I worked changed their menus so they serve less food for the same price

After a barrel hit a hundred the corporation I work for closed 28 stores with 60 people working at each store

After a barrel hit a hundred my neighborhood started to become empty there are still houses but the lights are off and no one lives there anymore and in the winter the pipes will bust and they will be unusable

After a barrel hit a hundred things at work that came in plastic baggies come in cardboard boxes now

After a barrel hit a hundred the only person I know getting raises and overtime is a guy that works for a plant making parts for tanks and jet fighters

After a barrel hit a hundred I started growing a garden and found others growing gardens and my neighbors starting introducing themselves and I started introducing myself

Noah made these comments in a followup email:

People don't get it. A lot of people have jobs involving cars, RVs, four-wheelers, motorcycles, lawn mowers, semi trucks, etc. From driving them, selling them, making all the small parts that go in them. Like when Chevy, Ford and Winnebago closes a plant or stops a certain model from being made, they also closed down the plant that was making the cup holders and bolts that go on the tires, two different plants in two different locations, but both having employees that have mortages and mouths to feed. All those people are losing jobs, not getting raises, their health benefits aren't getting better, their lives are getting worse.

And then there are those people that say, "Look oil is 123 right now." Oil isn't down unless it is like 20 dollars a barrel. Every day that it is above that it erodes the economy.

Look at the mortage problem, too. Building a new house and getting people to move into it makes a lot of money for different people. From people at couch factories to the movers that put the couches in, to the carpenters that put in the drywall, the people that pour and finish the concrete driveway.

On his thought-provoking blog The Outsider, Noah recently posted some thoughts on poverty in America. I think they are highly relevant to any discussion of the recession/depression/bad times we face; here are some excerpts:

Personally what we have in America, well, what we used to have before the housing bubble burst and the energy crisis which I think will create actually poverty. But to go before these problems. A poor American has a television, heating, air-conditioning, a good amount have cars, they have garbage men and sewage. And there is a good list of social programs a poor person can use. What we have in America isn't 'poverty' but 'injustice' and 'greed.'

A poor person can go to the hospital, but they can't just to a doctor. If you don't have health care, you can't go to a dermatologist or any specialist, they won't take you. You have to go to a hospital and the an ER doctor will look at you for two minutes, give you a pill and leave.

What I mean by 'greed' is that Americans watch television and always want more. This culture breeds 'wants.' We have the antithesis to a Buddhist or Catholic culture which both in different but similar ways tells their people that it is okay to be poor, that just because you don't have everything, doesn't make you an asshole.

A poor person I know is getting a divorce. She faked a heart attack and had an ambulance come and get here to get attention and pity from people. I doubt Nigerians or Colombians fake heart attacks to get attention.

What I'm trying to say is that being poor in America is not the toughest thing in the world. If someone really wants to be poor they should just camp. Because that is what real poverty is, camping. Go buy some land, grow your own food, camp in a shack, cut down trees for fire wood and cook using the fire. Because what Americans view as poverty is just how people lived before oil.

Here are my comments. Noah's work stands on its own but this is what his excellent poem triggers in my mind.

This is the cost of decades of mal-investment and misallocation of capital.

Instead of funding the upgrading of our national electrical grid or rebuilding our bridges and railroads, instead of enforcing tighter energy efficiency standards at every level of our economy, we've chosen instead to invest trillions in surplus housing (20 million empty dwellings and rising) on the periphery of transport and employment. We've chosen to award huge pensions and healthcare benefits to public-sector elites. We've chosen to pay for expensive MRI and other high-tech tests and horrendously costly medications, which enrich an elite supposedly concerned with improving the health of our elderly (pharmaceutical companies and their ad agencies, etc.) even as the health of the average American degrades and the care they receive dwindles.

We've chosen to sink trillions in a foreign Desert War based on dubious intelligence and political motivations, squandering not just money but the lives of thousands of people, Iraqi and American alike. We've chosen to spend hundreds of billions on dubious "security" measures like Homeland Security, where knowledgeable insiders are raking off millions in bogus/worthless contracts they award to their pals.

The "free market" propaganda machine runs fulltime espousing how alternative energy is a "poor investment because oil and coal are so much cheaper." Really? Is sending $700 billion a year overseas for oil, mostly to our sworn enemies or those with conflicted interests in our well-being, a smart investment because it was "cheaper" than spending $1 trillion per year creating sustainable energy and sustainable jobs here in the U.S.? How about when the bill for imported oil rises to $1 trillion a year? Will alternative energy be a "wise investment" then?

Tough luck, America, because by then the endless well of borrowed money will be dry. Back when we could borrow $5 trillion off our houses and another $5 trillion from foreign entities to blow on excess Federal spending, then we blew it on consumer garbage, entertainment, a war and various forms of graft/waste. Now that we really need to invest $10 trillion in a new energy infrastructure and renovating our rail and electrical infrastructure, the money's gone and we're paying $600 billion in interest on the wasted money we borrowed so freely and thoughtlessly.

Well guess what, America--now we have to save the trillions of dollars we need ourselves. Yes, save. That is such an alien concept that I will explain: we will have to run foreign trade surpluses in the hundreds of billions of dollars a year, not trade deficits on the order of $700-$800 billion per year. We as a nation must pay more in taxes than we current spend on pensions, Medicare, military adventures, graft/corruption, bogus "security" measures, and so on. the Federal budget must run hundreds of billions in surplus which can then be allocated to infrastructure rebuilding and maintenance. Selling our highway and transport system to Gulf Oil sovereign funds is not a solution, it's a travesty.

As indviduals, we will have to save trillions which forms a pool of actual capital (as opposed to $1 which is then leveraged into $100 by slight of hand) which can be lent to fund real companies doing real work and not "innovating financial services."

I have to laugh to myself when somebody tells me they're saving money each month and the sum turns out to be $100. If you only make $1,000, then that's an OK sum, but these are people making multiple thousands a month. Real savings is on the order of 1/3 to 1/2 your take-home pay. Me and my friends routinely did that and even now it's entirely possible--but not if you live and consume like average Americans.

I have to laugh at the "saving money" tips which are popping up all over the mainstream media, ideas like buying new furniture on sale and "saving" as a result. The funny thing about all these ideas is they all require spending more money, and they all assume that any savings you manage off bargain-hunting will then be spent on a vacation or other form of consumption/entertainment.

Where is the article promoting the idea that a family taking home $3,000/month should be saving $1,000/month? Impossible! Yes, I know. But what's funny is that when that household was younger and getting by on less income, they somehow managed to live on $2,000/month and did not feel like they were living on the trash-heap of abject poverty. But once their income rose to $3,000/month, then that became the new "minimum baseline."

That "spending creep" has throttled our entire economy. Like "mission creep" which has occupied every level of government--we should be solving everyone's problems all the time, and if we're not, then we're depriving people of their rights to, well, everything--it's all been a fantasy based on borrowing money cheaply from someone who actually saved or made the money in the real world.

The fantasy is about to come to an abrupt end. Once the cost of borrowing rises, and once our overseas friends tire of propping up a failing Empire of Debt, then the costs of borrowing will eat into all the things we want: pensions and healthcare and education and a strong military and so on. Then it will finally be "cheaper" to save and be careful with our spending, and wiser to look at our long-term needs for sustainable energy rather than mostly useless MRI tests and entertainment, foreign wars, etc.

We will have to figure out what we can sell to others rather than just what we can borrow from others to consume what has been made (or pumped to the surface) by others.

Wrenching? Undoubtedly. Being kicked off the welfare of borrowed money is nobody's idea of fun. But it has other names, too, other than deprivation and suffering and woe-is-us, who's gonna pay my bills for me: it's called freedom and radical self-sufficiency.

That is what Noah's last stanza is all about, and that is a supremely positive way to end his poem.

Bush 2009 deficit will reach $482 billion, record driven by sagging economy

With typical obfuscation/slight of hand, $80 billion in Desert War expenses were left off, so the real deficit is $560 billion. If we bypass the trickery of "borrowing" (read "raiding") the Social Security Trust Fund, i.e. funds paid into Social Security, then the real deficit is more on the order of $700+ billion.

That's what we call society-wide welfare on a stupendous scale. Yes, we are all welfare recipients, because we are all complicit in borrowing $700 billion to fund an illusion of entitlements, tax breaks, corporate welfare, graft, war costs, "healthcare" a.k.a. sickcare and "security" each and every year.

Thank you, Dody B.-R. ($5), for your much-appreciated donation to this site. I am greatly honored by your support and readership.

It's nice that we all feel we "deserve" this welfare, but our kids and grandkids will be stuck with the bill. Do they "deserve" that as much as we "deserve" all our tax breaks, entitlements and other benefits? I think not.

Monday, July 28, 2008

The Grand Summary: Our Empire of Debt Is Collapsing

Every once in awhile it pays to stand back and locate one's position in reality, by dead reckoning if no better tools are at hand. With all the financial legerdemain in our system--bogus unemployment and CPI numbers, Level 3 assets held safely off balance sheet, and innumerable other financial rats scurrying for cover--we have no choice but dead reckoning.

And by my reckoning, our financial system is dead.

Right now, Bernanke and Paulson and Congress and the rest of the power elite have the shock paddles frantically pressed to the chest of the American financial system, hitting the erratic heart of our Debt Empire with shock after shock, hoping and praying the debt bubble of the past 25 years can somehow be extended.

Alas, the patient is already dead. But with reporters' noses pressed against the window a few feet away, the stalwart crew around the corpse is making a heroic show of lying: "The patient is stabilizing," "the patient is recovering nicely," and so on, and by artificially stimulating the heart to keep producing a weak but visible pulse for all to see.

But rather than be reassured, we are disgusted by the lies, for we have seen the patient bloat up and sicken and then weaken unto death for years.

Rather than try to describe the Empire's plight in words alone, here are some graphic illustrations for your review. Let's start with the housing bubble:

There are 10 charts today--please go to www.oftwominds.com/blog.html to view them.

By any possible measure, the housing bubble reached unprecedented heights-- all based on incredibly leveraged, incredibly easy, incredibly low-rate and incredibly risk-obscured debt.

The bubble has popped, never to rise again, for several simple reasons. Most profoundly, risk has re-entered the equation. U.S. lenders were able to originate trillions in mortgages and then pass them off to Fannie Mae and Freddie Mac (who own some $6 trillion in rapidly depreciating mortgage assets) and non-U.S. investors who unfortunately believed the AAA ratings on garbage mortgage-backed securities happily bundled at immense profit by U.S. investment banks.

Once burned, twice shy. Well over $1 trillion in bundled mortgages were sold in 2007; for the first 6 months of 2008, a paltry $48 billion found buyers. In other words, the market for U.S. mortgages has fallen to near-zero. Nobody's dumb enough to trust the ratings agencies and investment banks, and nobody's dumb enough to "catch the falling knife," i.e. buy mortgages on properties which are in a free-fall.

Game over, the debt machine is broken, patient has expired, end of story, etc. As the FDIC chart above reveals, virtually everyone in America above the poverty line bought a house in the bubble, and by their conservative estimate, 10% of recent buyers were simply unqualified to buy a house just based on income.

Since there are 75 million homeowning households in the U.S., we can infer that 7.5 million homes will transfer from never-should-have-qualified buyers back to unscrupulous/ incompetent lenders. This gives us some context when we read about 1.2 million foreclosures (or whatever the number is proported to be--we all know lenders are hiding distressed mortgages left and right): only 6 million to go.

And let's be clear about one thing: the entire bailout is being sold as a way to keep insolvent buyers in their homes by lowering the interest rates and loan amounts. Fair enough in theory, but if someone paid double what the house was worth and leveraged their cash 1,000 to one and only qualified for an interest-only super-low teaser-rate adjustable mortgage, then they can't make the payment regardless of what tweaks are made to the loan parameters.

Next, let's recall the precarious source of the housing bubble: a zero-savings society and massive derivatives and debt. Rather than save up and then lend the accumulated capital as per the classic capitalist model, banks generated new debt with magic.

With only 1% required for reserves, $1 million became the foundation for $100 million in new mortgages, which were quickly sold to investment bankers who sold the debt and then made even more money writing derivatives based on that "risk-free" (i.e. rated AAA by the ratings agencies) debt.

Let's also not forget that the stock market is a bubble, too, as this long-term chart clearly reveals:

Here is the once-mighty U.S. dollar, gutted by low interest rates, depreciating assets and all the other ills of an Empire of Debt:

Then there's our stunning dependence on overseas investors to soak up all our deficit-spending/debt via purchasing U.S. bonds:

And as we borrow freely from the rest of the world, soaking up some 85% of all global savings with our riotous borrow-and-spend lifestyles, guess what: we run stupendous trade deficits, buying more than we sell to the tune of $750 - $800 billion a year.

It's no surprise that consumer spending has risen from a long-term average of about 67% of GDP to 72%--we borrowed $4.2 trillion in the peak years of the housing bubble and blew it on a free-spending consumer binge. (Source: Tough Love for the U.S. Economy (BusinessWeek)

Needless to say, the deflation of the housing bubble and the decline in stocks has removed our ability to borrow and spend another $4-5 trillion. With that well gone dry, exactly how can consumer spending continue at this pace? Simple answer: it cannot.

As if that wasn't enough, we're facing unprecedented demographic and pension/ medical care cost expansion. Here is a chart of workers-to-retirees which is based on exceedingly rosy projections of continued strong growth in productivity and employment.

It simply isn't possible to tax three workers enough to pay for one retiree in a system which charges Medicare $100,000+ for a few days in a hospital and an operation and a test or two. (This was the bill for a friend of mine's father for gallstone removal--which didn't even successfully remove the gallstones! The elderly gent got better on his own despite the "care" and eventually demanded to go home. Taxpayers picked up the $100K+ tab for virtually nothing but aggravation and a single prescription for antibiotics which could have been administered at home.)

As the Empire of Debt collapses, so too will employment based on ever-more debt and borrowing, and it is easy to see the worker-retiree ratio dropping to 2-to-1 or even lower. That simply isn't sustainable.

And even as healthcare costs skyrocket, we as a nation seem to be acquiring ever more chronic health problems, many related to poor diet and lifestyle choices:

Another trend is weighing on every debt-based economy: the inexorable rise of oil as Peak Oil supply and cost restraints become undeniable:

In basic terms, oil is becoming ever costlier by every measure: in any currency, and even in gold. This makes perfect supply-demand sense: as demand rises, it exceeds the supply of cheap, easy to recover oil and prices rise. Once the easy oil is depleted (which is happening now), then the oil that's left will be very costly to extract and process. Does the poorly-informed pundit demanding offshore drilling have any idea of how much it costs to drill down two miles or more from an offshore rig?

How about those limitless shale oil fields? Have you seen any photos of the landscape this leaves behind? How about how much natural gas must be burned to extract the oily goo from the rocks or sand? How about $80/barrel costs for starters, and refining, transport, overhead and profit added on to that? How about ever-hgher costs as all the energy required to make this stuff goes ever higher?

Installing a wind-farm or solar collection facility isn't free; where are we, debt-laden and imprisoned by past borrowing, going to locate the $5-10 trillion we need to build an entirely new energy infrastructure?

We are in the midst of a long period of below-average returns which will eventually return us to average returns--in, say, 10-15 years.

Three final charts: disposable personal income, corporate profits and bonds.

Even as all asset classes have risen in unison (commodities, gold,stocks, real estate and bonds all rose together during the housing bubble)--another unprecedented trend, to be sure--wages have remained static or dropped in terms of purchasing power. Meanwhile, corporate profits have zoomed to unprecedented levels: a staggering 13% of U.S. GDP is corporate profits.

This has been a favorite chart of mine, for it illustrates how the low interest rates in the U.S. have been entirely dependent on the willingness of the Chinese banks and other non-U.S. entities (Japan and the Gulf Oil states, among others) to buy unprecendented trillions of U.S. debt.

As the dollar has tanked, these owners of U.S. debt have suffered stupendous losses; yet they've kept on buying for fear that if they stop funding the Empire of Debt their own sales to the Empire will decline.

Yet when does this propping-up of the Empire become "good money tossed in after bad"? When does the U.S. contraction of consumer spending start removing some of those surplus dollars from their hands? When does domestic political pressure build to invest some of those trillions in their own nations rather than toss them in the garbage heap of U.S. debt?

Bond trends are not sharply delineated like stock market trends. They are slow, saucer-shaped reversals which then endure for decades. The Empire of Debt's most reliable prop has been low interest rates, i.e. the willingness of non-U.S. players to invest their surplus dollars in U.S. debt for absurdly low rates of return.

(Recall the inflation rate in Gulf Oil states is 11% and climbing. How much sense does it make to buy U.S. debt which pays 4% and which declines along with the dollar?)

I believe the evidence is already plentiful that the trend of low interest rates has reversed and will rise for 15-24 years. (The average bond/rate cycle runs from 16-27 years in length.) Even as the Fed desperately slashed the Fed funds rate, mortgage rates have risen. Why?

The Empire of Debt is expiring, for a number of profound, difficult to reverse trends:

1. interest rates are now in a 20-year uptrend; cheap borrowing is gone

2. Peak oil will raise the price of energy, regardless of its source, creating a global tax on consumption

3. health costs continue to skyrocket as chronic health issues rise and the cost and range of available treatments expands

4. pension and entitlement programs designed for 10 workers for every retiree are now facing 3-to-1 or even lower worker-retiree ratios

5. the U.S. current account deficit (trade deficit) is unsustainable, as is its debt-swollen domestic consumer spending

6. stagnant/declining wages and rising unemployment are the inevitable result of reduced borrowing/spending by consumers and government alike.

I'm not trying to be negative: what's negative about facing reality? What's negative and destructive is covering up reality with obfuscations, lies and fairy tales.

There is a way out, and it's called replacing profligate borrowing with savings, and replacing mal-investment in unproductive assets (financial legerdemain and surplus housing) with productive investments (alternative energy, society-wide energy efficiency, true healthcare as opposed to our current "sickcare", etc.)

Thank you, Peter N. ($50), for your outrageously generous donation to this site and for your many intellectual contributions. I am greatly honored by your support and readership.

Saturday, July 26, 2008

Haiku and More on Oil (July 26, 2008)

We start today with a pithy haiku submitted by longtime contributor Jed H. which perfectly captures the core of the bailout of mortgage lenders:

Profits are Private

But Losses belong to ALL

Our New FED Slogan

Thank you, Jed. That sums it up perfectly. Let's not forget that all those executives at "quasi-public" Fannie Mae and Freddie Mac were paying themselves salaries and options in the millions, and that they gave away millions in contributions to politicos of every stripe.

Now all we can do is make sure we vote against every member of Congress who voted for this historic violation of public trust. Vote for the Green Party candidate, or the Libertarian, or the Democratic or Republican candidate--anyone running against the incumbent. There is so little we can do as individuals but throwing out the incumbents is one message which always resonates with politicos. Yes, I know it won't do much, but it's a start.

Let's look deeper into oil's sudden drop. First, here is an excellent analysis by Sir Charts A Lot (Gary Dorsch) via longtime contributor U. Doran on the many causes of oil's sharp decline: What’s behind the Slide in Oil and Commodities?

Note that demand from China continues rising sharply, supporting my view that a crummy 300,000 barrel/day reduction in U.S. demand is being more than offset by rising demand in other countries--including the oil exporters themselves.

Next, two readers offered interesting commentaries on yesterday's entry, Is Oil Set to Crash? Two Views (July 25, 2008).

First up, correspondent Bruce C. provided some technical analysis commentary:

Charles, FWIW, I agree with Ranier H. about oil. One potential confirmation of an imminent decline in the price of oil is the large head-and-shoulders (H&S) or broadening cyclical top formation for the XOI (Amex oil index), with the so-called neckline in the range of 1295 to 1320s-30s; the H&S target implies XOI ~1000 at a minimum (40% decline from the cyclical high for the XOI) and as low as the 500s-600s by '10 (60-65% post-bubble crash). (The test of the daily-close resistance at 1310-11 "might" have been the top for the current rally.)

Thank you, Bruce, for the informed analysis.

Next, longtime contributor Harun I. offered these comments:

The argument (in the July 25th entry) is interesting but I find no evidence of this argument:

"When someone comes up with a hypothetical oil price number then all I have to do is plug in the Gold/Oil ratio presently at about 7-8 to one and you will come up with what the gold price will be at $1000/ brl oil price. I make this about $7000-$8000 Gold price."

The ratio entered the band of 7-8:1 several times with Gold and Oil at different prices. Gold does not have to go to 8000 dollars/ounce in order for Oil to reach 1000 dollars/bbl. I do not assume and there is nothing that I know of that is sacrosanct about any particular ratio. For all we know the ratio might breakout to the downside and slip to 1:1.

I agree at the current ratio Crude Oil is very expensive. And there is a price point at which all societies will have to change habits whether voluntarily or by force. I know that, barring some chance discovery of new technology, we are decades behind the curve in developing alternative energy sources. Hope is not sound economic and/or energy policy.

Furthermore with all currencies losing purchasing power against gold we can't be too sure that some tipping point may not be breached that sets off a negative spiral of some sort, i.e., a deflationary collapse of currencies causing a hyper-inflationary spiral in prices.

I respect and use EW (Elliott Wave) but I also respect what I don't know. We are at an inflection point on a scale never seen before. The global economy is facing utter collapse. I prefer not to hang my hat on what I think cannot happen; I will simply follow the trend.

Once a trader understand the statistics of his methodology (his edge) he need not spend much time fretting over it. It is the low probability high impact event that he or she must guard against.

Thank you, Harun, for reminding us nothing is sacrosanct in technical analysis. With that in mind, I now offer up some analysis of two charts: crude oil, courtesy of Harun, and a chart of Anadarko Petroleum (APC).

Please go to www.oftwominds.com/blog.html to view the charts.

Note: I recently entered a long position (calls) in APC. Please read the "Huge Giant Big Fat Disclosure" below before proceeding.

As Harun has noted before, the decline in the Large Trader Index was diverging from the price rise.

Nonetheless, it is interesting to note that APC has declined to support/resistance it first established back in October 2007, when oil was a meager $80/barrel. Is an oil company now worth what it was at $80/barrel, even though oil is still 53% higher, at $123? If you believe oil is heading down to $80/brl or less, then the answer is yes.

But if you suspect the 30% decline in APC and other oil companies is due more to speculation receding than any actual change in supply and demand, then you might be looking for technical evidence the down move is overdone.

Let's start the analysis by noting the potential double top. Both tops and bottoms tend to be re-tested, hence the power of double tops and bottoms to indicate "the real top" and "the real bottom."

But as I also note, there was a clear double top formation earlier this year--one supported by a declining MACD. It doesn't get much better than this, yet nonetheless that turned out not to be "the real top" but merely a way station on the long-term uptrend. Thus we have to take calls of douible tops and head-and-shoulders formations with a big grain of salt. Long-term trends march ever higher and calling the definitive top or bottom isn't that easy.

Next, let's note the many extremes in the APC chart: extreme low in MACD, extremes in DMI and ADX, and the extreme plunge below the standard long-term support line of the 200-day moving average.

This looks like the chart of a financial institution heading for bankruptcy, not a highly profitable oil company. Without getting too fancy, it seems to me that a 30% decline in a matter of weeks in an oil company can only be justified by a belief that oil is heading for a near-complete price collapse, i.e. a 50% drop from $146 to $73.

With the U.S. consumption of oil mattering less and less (that is, representing a diminishing slice of the total global demand pie) and hundreds of millions of new consumers willing to pony up $2/liter (roughly $8-9/gallon) for their motorscooters and other transportation, then a modest reduction in U.S. demand (300K to 500K barrels/day) is the equivalent of a mosquito on an elephant.

As I have said and will continue to say: most Americans have no options but to buy gasoline and diesel at whatever the pump price may be. Not everyone has the cash or credit to go buy a new high-mileage vehicle, and not many Americans can turn to a train or subway who haven't already been riding public transportation for years.

Even worse, the tracks and infrastructure of mass transit are already maxed out.

I don't see oil dropping to $80/brl, but I could be wrong.

Thank you, John G. ($33.33), for your "long-playing" and extremely generous second donation to this site.

Is Oil Set to Crash? Two Views (July 25, 2008)

Knowledgeable reader Rainer H. recently provided two powerful arguments in support of the idea that oil has topped out and is set to decline. Rainer responded to my "head-fake" oil chart in which I predicted oil dropping in a global recession and then heading for the figurative moon ($1,000/barrel) once Peak Oil drove supply far below recession-reduced demand.

His counter-arguments are well-grounded in history and may well prove to be more accurate than my doom-and-gloom prediction. Here are his comments and a chart he submitted in support of the oil-will-decline thesis.

Please go to www.oftwominds.com/blog.html to view the charts.

First, with all due respect I disagree with this whole Peak Oil thing! If it came to picking Elliott Wave Theory over Peak Oil Theory I will pick EWT anytime of the day. My bet is that Crude Oil will hit between $75-$50 USD before it ever hits anything close to $1000. On top of that Peak Oil has been beat to death by the public already.

All those smart crude oil speculators have stop loss positions built in and a Bullish Oil trader bragging about being bullish instantly turns into a seller when his stops get hit. Just like snakes and ladders the stops get taken out and a new trend is born. You can see the stop sweepers at work on any Intraday chart or higher by looking for the spikes.

When someone comes up with a hypothetical oil price number then all I have to do is plug in the Gold/Oil ratio presently at about 7-8 to one and you will come up with what the gold price will be at $1000/ brl oil price. I make this about $7000-$8000 Gold price.

You are basically calling for a $8000 dollar gold price! Have you looked at the Commercial traders net short positions in Gold lately? Have you looked at the Market Vane report lately? The Market Vane Report I get weekly is one of the most important sentiment readings I can watch. When you get readings of 95% of the traders are bullish, this is extreme. This means there is nobody left to get in!

Is mankind really this stupid that they cannot come up with another fuel source? There are lots of ways and new technologies that can increase the supply of oil, totally by passing peak oil.

I have read that they are using "steam injection" to inject into oil fields to explode the production of old tired oil fields. They are also using CO2 injection to increase the production of oil fields. IPCC call's this CO2 sequestering.

Another big source of oil is called "Coal Oil". South Africa has been running on "Coal Oil" for decades! Some of the figures I read is that the US has 248 billion tons of coal and it takes about 2 tons of coal to produce one ton of oil. The Coal oil alone can run the US for hundreds of years! China is talking about building coal oil plants.

Another big source of new oil is the Green River Formation oil play in the Midwest states. The shale oil deposits there are far bigger than anything in Saudi Arabia. They are also drilling below the Shale oil and they are finding oil deposits.

Another very big source of oil is the "Green Oil" production using "Green Algae" Algae Oil production is the hottest thing going right now and once production picks up it alone can replace all domestic oil needs. All you need for Algae production is some sunlight and lots of CO2. Algae just loves CO2. They are even breeding special strains of Algae to produce higher "hydrogen Content" in the Algae.

Thank you, Rainer, for this cogent analysis. Just to provide some further data for analysis, here are two additional charts, courtesy of frequent contributor Harun I.: oil/gold ratio (as opposed to the gold/oil chart above) and US dollar/oil ratio.

What I find noteworthy in this chart which is missing in the gold/oil chart is the very visible and long-term uptrend/channel. Here we can see that the recent spike in oil is still well within the channel, and that it was actually less extreme than the spike caused by hurricane Katrina a few years ago or the first Gulf War oil spike back in 1990-91.

This chart also illustrates how the ratio can fluctuate via one element rising and the other simply stabilizing. In other words, for the ratio to drop, gold need only rise, while oil can remain in the $125-$150/barrel range.

Furthermore, we must consider the uptrend, which suggests the oil/gold ratio could continue marching ever higher. What was once "extreme" then becomes average.

Lastly, consider that in terms of Rate of Change (ROC), the current ROC is well below the extremes recorded in 1999 as oil dropped to $12/barrel in the "Asian Contagion" financial crisis. In other words: while we as consumers may feel oil at $150/brl is an extreme, in terms of the oil/gold ratio it is well within long-term trendlines.

No discussion of oil is complete without considering the currency it is priced in globally, the US dollar:

Here we see that oil at $147/barrel is still well within the long-term channel of the dollar-oil ratio. We must also note the long-term decline in this ratio, which suggests that the ratio can continue sliding ever downward without violating its long-term trendlines.

Both of these charts suggest oil could march higher without violating either long-term trend. If oil climbs to $200/brl and gold hits $2,000/oz, that would mean one ounce of gold would buy 10 barrels of oil--well within the range indicated on Rainer's chart.

Will the dollar reverse course and strengthen? That is the subject of another entry. For now, let's consider Peak Oil. While I agree with Rainer that other sources of energy are available, my sense is that the cost to develop them is staggering and the time needed to scale them up to replace 21 million barrels a day consumption in the U.S. and 85 million barrels a day globally will be long.

I see little evidence that "demand destruction" in the U.S. will make much of a difference in terms of global demand. As I noted in Saturday Quiz: Demand Destruction of Gasoline in the U.S. (July 12, 2008), a 300,000 barrel decline in gasoline demand in the U.S. is meaningless in a world where demand for diesel is still rising.

For every American who switches to a hybrid or stops driving a pickup in favor of the family sedan, there are 10 residents of China or India who are now riding a motorscooter instead of a bicycle. Their demand for a liter or two of gasoline just replaced whatever modest decline in demand the American chalked up.

I recently drove to Los Angeles, a trip of 375 miles. My (well-maintained) Honda Civic got 46 miles to the gallon, even with the climb up to the 4,000-ft summit of Tejon Pass and some stop-and-go traffic congestion in San Fernando valley. The trip cost me $37 each way. Even if oil doubled to $8/gallon, the $75 tab would be cheaper than flying. I saw little evidence of "demand destruction" on the freeways of LA, because the truth is there are few alternatives. Most people simply have to drive, regardless of the cost of fuel.

What we forget is that most stuff in the U.S. travels by truck. The railways are maxed out and it will cost billions to lay new track. In the meantime, everything moves by 18-wheeler.

At a truckstop on the way back from LA my wife asked a trucker about the mileage of his big-rig: 500-gallon tank, 5 miles to the gallon. There is simply no substitute for years to come to the demand for diesel.

Cutting demand more than a few measly barrels is difficult, as noted recently by the Wall Street Journal: Difficult Road Awaits For Energy Conservation:

1. The easy stuff is done.

2. We're bigger, busier and wealthier now.

3. And yet, globally, the U.S. matters less.

4. This time, it's supply and demand.

5. Recessions help.

Former Vice-President Al Gore recently challenged the U.S. electorate and "leadership" to replace foreign oil with home-grown electricity. Price tags for such an effort run from $1.5 trillion to $5 trillion; my own back-of-the-envelope figure for solarizing the economy was about $3 trillion, and that was not to replace transportation oil with electricity--that was just to replace oil-and-coal generated electricity.

Not only are there technical challenges, but I have to ask: in a nation with a near-zero savings rate, a nation burdened with horrendous debt, a nation facing staggering deficits in government spending, a nation which has misallocated trillions in capital which can never be extracted from the housing trap, a nation which faces financial losses in the trillions: exactly where will the $10 trillion needed to build an entire new energy infrastructure come from?

Let's not forget one other fact: cheap energy is gone. Shale oil costs about $70+/barrel to produce, as it requires prodigious amounts of energy to dig up and cook the oil out of shale or tar sands. Let's not forget solar, wind, tidal, etc. are all "competitive" with $100+/barrel oil, not $50/brl oil. That is, it costs a lot to replace the energy stored in oil. If you factor in the investment costs required to install solar, wind, algae, etc. and the new grid required to move all that energy around, it is not cheap.

In other words: the cost of energy from any source may well remain at or exceed the energy equivalent of $100+/brl oil.

There are 230 million vehicles in the U.S. Replacing them with higher-mileage or alt. energy-fuel-enabled technology will take at least 20 years. There are some 80 million buildings in the U.S. Lowering the energy use (increasing efficiency, insulation, etc.) of those structures will take time, too.

So while we move to alt. energies, slowly developing the capital, expertise and technologies to generate tremendous quantities of high-cost energy, what will we do in the meantime for energy? Oil is still "cheap" in many ways, easily transportable and high in energy density.

Maybe alternative sources of energy will be developed much quicker than I anticipate, but if so, the question remains: with what trillions, and from where, and at what cost? Neither money nor technology is cheap.

In trying to discern the future of energy consumption and generation, I hesitate to put much weight on any historical chart for a simple but profound reason: the permanent decline of cheap oil is a one-time event without precedent.

Two Excellent New Readers Journal Essays:

Political Wil' Discovers Fools Gold (Steve R., July 25, 2008)

I will be the last to tell you that government, just like the financial sector, is not mis-allocating resources. It most certainly is. And regulatory agencies like mine are no exception.

But the solution to over-allocating resources in government is somewhat more complex than just reducing entitlements, and my role in particular is a good example. My agency is charged with protecting and enhancing natural resources. However, environmental laws are not regarded as 'real laws' by the regulated community.

People of means are fond of saying, I do not get permits, I hire lawyers.

Back in the Village (Chris Sullins, July 24, 2008)

Three articles by Charles Hugh Smith this year have garnered my attention. The first was When Belief in the System Fades which struck a harmonized note for me as a former officer in the military reserve who had served in Iraq and recently resigned my commission.

The next two were The Art of Survival, Taoism and the Warring States and Where the Rubber Meets the Road. I had really liked the Survival + theme in both articles with the emphasis on building human relationships within a small community and strengthening personal skills over the retreat to the isolated bunker filled with gadgets and guns.

Thank you, Mary R.H. ($25), for your much-appreciated generous donation and kind words/contributions to this site. I am greatly honored by your support and readership.

Thursday, July 24, 2008

Yes, There Will Be Armageddon: Government Goes Bankrupt

One financial Armageddon is entirely, easily predictable: the bankruptcy of government in the U.S.A., at every level: Federal, State, County and City. The prediction follows from very simple mathematics: entitlements which grow at 8% a year cannot be supported by an economy which grows at 3% or less.

This simple truth is already playing out. San Diego is just one example. Here is a report which lays out the basis of San Diego's impending bankruptcy: structural deficits. The same can be said of California, which managed to increase state spending by 44% over the past few years even as the economy which must support those expenditures grew a total of less than half that rate.

This will sober you up, folks: CITY ATTORNEY ANALYSIS: CITY OF SAN DIEGO STRUCTURAL BUDGET DEFICIT

These benefits consisted of three rounds of retroactive benefits without funding which cost taxpayers $451 million. In addition, pension officials gave away 8,000 years of pension credits to city employees for free, at a cost to taxpayers of $146 million.

Another major unfunded benefit was the Deferred Retirement Option Plan ("DROP"). It was supposed to be operated on a cost neutral basis. However, the City’s outside actuary put the cost to taxpayers at more than $200 million.

Facing a billion dollar and growing pension deficit, City officials have traded away road repair, water security, and fire prevention to pay employees more to retire than to work. The IBA described the problem as a structural deficit.

The Securities and Exchange Commission (SEC) described the problem similarly: the "City would have difficulty funding its future annual pension contributions unless it obtained new revenues, reduced pension benefits, or reduced City services."

Year after year, the City has opted to cut services.It has not raised revenues nor has it cut employee benefits. Pension officials, with the blessing of high level City officials, have continued to issue rosy predictions.

The IBA Report has brought a much needed dose of reality to the situation. In the report the IBA notes that since 2003 the City has had to annually implement budget reductions (cut departmental budgets) which translate into reductions in city services.

The City is caught in a structural deficit trap. Total contributions from the City and City employees to the pension increased from $81 million in 2000 to $236 million in 2007. Total contributions during this period were $1.42 billion. But over the same period $1.7 billion or $300 million more than contributions, poured out of the pension in benefits and costs. These costs and benefits increased from $127 million in 2000 to $315 million in 2007. On-going pension expenditures consistently exceed on-going pension contributions.

Astute reader R. provides additional insight on public pensions:

I read the latest article. Are You Part of an Elite, and Don't Know It? (July 22, 2008).

A friend told me the other day that a fireman is getting $10,000 a month in a pension. I hear this all the time. Another friend says her 92 year old uncle gets $8,500 a month from being a fireman and he retired 45 years ago.

What people do not realize is this. At today's interest rates on cash at 3% or so, You and I have to save up 3 million dollars to get $90,000 in income per year. We also risk the chance of losing our capital by a fund failure or bank failure and more.

These government pensions are better than winning a million dollar lottery. A million dollar lottery pays less than $50K a year, and stops after 20 years, with no health care.

These pensions are like being a multi millionaire, like having saved, put away, 3 million dollars of after tax money. And we know it would have taken many more millions in order to save 3 million after taxes.

These pensions make people millionaires, or as you said, Elite. But the pensioners never had to save it up. It is one thing to pay someone while they are working, but it is outrageous to pay them that much when they are not working. And they are allowed to work elsewhere, collect other pensions, and earn income from other investments, while the taxpayer continues to support them.

I have saved up quite a bit, and bought income producing assets, but have much further saving to go in order to retire with a decent income from my savings or estate.

When you understand investing and passive income, you realize that the goal in life is to create an estate that pays you income later in life. You live off the income the money or estate generates. You don't spend your savings / capital. Then you can pass income generating assets to your children, or whomever you choose. So as I said, these pensions are like having millions in an estate that is producing income. Something that I have scrimped and scraped and saved to achieve. I rent a house now that prices are falling, and shop at garage sales. I rarely buy liabilities that lose value. Boat, RV, toys, etc. I almost always buy used items. Pensioners live much better than me, and drive brand new cars, boats, RV's and other liabilities.

Even better for example, a woman who marries a male government pensioner, and maybe soon for a man, LOL, is that a woman can come along and marry the government pentioner, then take the equivalent of half the future pension in a divorce, and pay no taxes on it like most divorces, or she can inherit the pension on his death after doing no work at all. Taxpayers then support her for no work ever done. It is insane. The entire government has a spending problem, not an income problem. Yesterday, my accountant told me I owe some more in taxes. The mainstream media blames "the housing slump" for government shortfalls--for example: States Slammed by Tax Shortfalls.

The problem isn't a tax shortfall, it's a structural deficit between outlandishly generous pensions and healthcare benefits and what the economy can support.

I have often reprinted this little chart to graphically illustrate what bankruptcy looks like. We all read these mind-numbing numbers--unfunded Medicare obligations, $43 trillion, and so on--and then move on to sports or celebrity gossip or the latest bread-and-circus political "news."

That structural deficit can only be resolved by complete bankruptcy of government at all levels. You can't fund $60 trillion with tax increases, or hope that some Oil Exporting Nation's sovereign investment fund will loan us $60 trillion (the Medicare shortfall alone is $43 trillion, but let's not forget all those other promises to pay pensions and healthcare made by Federal, local and state governments).

That Medicare expenses outstrip the growth of the underlying economy can be seen in this chart: please go to www.oftwominds.com/blog.html to view charts.

As I have documented elsewhere, Medicare costs continue to climb at a rate far above the growth rate of the U.S. economy, and there is virtually no evidence to support the fantasy that adjusting a few parameters of payments or services will do anything to change that.

Medicare now costs over $500 billion a year, larger than any expense except Social Security (which is supposedly self-funding via the FICA payroll taxes) and the defense budget (fighting two wars, global war on terror, etc.). The trends are inescapable: Medicare will soon surpass defense spending, and then keep right on going.

Will anyone accept a reduction in their "right" to entitlements? Heck no. Remember, "I earned this" and "it's my right" and "I paid my taxes, I deserve this." Ahem. Yeah, sure. Whatever.

There is no way to gracefully cut off entitlements, and politcally it is impossible. That's why it's easy to predict bankruptcy is the only outcome: a point will have to be reached when the government simply can't tax or borrow enough money to meet its obligations.

At the Federal level, that will be reached when interest rates skyrocket and the interest on the Federal debt (National Debt) exceeds all expenses but Medicare. The interest is already pushing $300 billion--yes, half as large as the entire Social Security budget--and it takes little imagination to see it doubling and then tripling as money becomes dear globally and our non-U.S. friends who have purchased all our debt finally tire of supporting our free-spending ways.

After all, every dollar they waste, oops, I mean invest, in U.S. bonds and mortgages (debt) is a dollar not invested in their own nations' well-being. Eventually their own people will demand that the surplus be invested in their own nation rather than propping up The Empire of Debt, a.k.a. the U.S.

At the local and state level, bankruptcy will become inevitable as soon as revenues are dwarfed by expenditures and pension/benefit promises. The city of Vallejo has offered us the template which will be followed hundreds of times in the coming decade: recalcitrant public unions demand more taxes to cover the structural budget shortfalls and complain "the money's gotta be here somewhere," and after cutting services to the bone the city finally declares bankruptcy.

Look for this play to come to your town, city, county and state soon.

There will be plenty of half-measures and fantasy "solutions" along the way, of course; here in California, the latest installment is a drastic pay cut for some state workers: Governor plans to slash state workers' pay.

It's not politics, it's math. As I noted in Is the U.S. Alcoholic, or Merely Schizophrenic? (July 15, 2008), we as a nation are in deep, inpenetrable denial about our fiscal binges and addictions to "borrowing our way out of debt," i.e. "the hair of the dog that bit us."

Open a spreadsheet and enter two columns of data. Take $100 and calculate its growth over 20 years at 3%. Now calculate 8% growth for 20 years.

The economy and tax revenues rose 75% in 20 years to $175. The entitlements/pension /Medicare costs more than quadrupled to $431.

No spin, no politics, nothing fancy: that's how expenditures outrun revenues to the point that bankruptcy is the only possible endpoint. Call it whatever you want--"structural deficit" has a nice, clinical sound--but anyone claiming there won't be financial Armageddon should fire up his/her spreadsheet and do the math. There will be Armageddon, as sure as 2 + 2 = 4.

Bailout Alerts:

Astute reader Mary R.H. recommended this Vanity Fair article on the Bear Stearns collapse: and offered this comment: