Purchasing power and exposure to real costs are more realistic measures of inflation than the consumer price index.

That the official rate of inflation doesn't reflect reality is easily intuited by anyone paying college tuition and healthcare out of pocket. The debate over the accuracy of the official consumer price index (CPI) and personal consumption expenditures (PCE--the so-called core rate of inflation) has raged for years, with no resolution in sight.

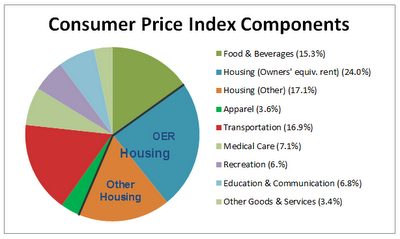

The CPI calculates inflation based on the prices of a basket of goods and services that are adjusted by hedonics, i.e. improvements that are not reflected in the price of the goods. Housing costs are largely calculated on equivalent rent, i.e. what homeowners reckon they would pay if they were renting their house.

The CPI attempts to measure the relative weight of each component:

Many argue that these weightings skew the CPI lower, as do hedonic adjustments. The motivation for this skew is transparent: since the government increases Social Security benefits and Federal employees' pay annually to keep up with inflation (the cost of living allowance or COLA), a low rate of inflation keeps these increases modest.

Over time, an artificially low CPI/COLA lowers government expenditures (and deficits, provided tax revenues rise at rates above official inflation).

Those claiming the weighting is accurate face a blizzard of legitimate questions. For example, if healthcare is 18% of the U.S. GDP, i.e. 18 cents of every dollar goes to healthcare, then how can a mere 7% wedge of the CPI devoted to healthcare be remotely accurate?

Those claiming that the CPI is more or less accurate point to the inflation rate posted by

The Billion Prices Project @MIT as real-world evidence. The Billion Prices Project collects real-world prices from online retailers for thousands of goods. The Project's rate of annual inflation closely tracks the official CPI, though recently it has diverged, climbing above 2.5% annually while the CPI is below 1.5%.

The fatal flaw in The Billion Prices Project is that it does not track the real-world cost of big-ticket services such as healthcare or tuition that dominate household budgets for those who have to pay for these services.

Those claiming the CPI grossly underestimates inflation often compare the current CPI with the CPI methodology of the 1980s. Using the old methodology, inflation is more like 9% rather than 1.5%.

Critics of this comparison claim the old methodologies were flawed and the new method is statistically superior.

Another way to track inflation is via households' actual spending as reflected in their budgets. Intuit collects anonymous spending data from 2 million users of Mint.com and posts the results:

Presenting Inflation... the rise in expenses 2011 - 2013 (Zero Hedge). This data suggests the cost of daycare, healthcare insurance, kids' activities and tuition have skyrocketed in the past few years, making a mockery of the official annual inflation rate of 1.5% to 2%.

Chartist Doug Short recently published this graph plotting college tuition, medical care and the cost of a new car. According to the Bureau of Labor Statistics

Inflation Calculator, $1 in 1980 = $2.83 in 2013. For example, the average cost of a new car in 1980 was $7,200, so the inflation-adjusted price in 2013 would be $20,376. The actual average price today is around $31,000, so after

adjusting for inflation the current average price of a new car is higher than in 1980.

This chart reflects the real increases in cost:

In my analysis, the debate over inflation misses two key points. What really matters is not the rate of inflation, which can be endlessly debated, but the purchasing power of earned income, i.e. wages.

Instead of fruitlessly arguing over hedonic adjustments and the weighting of components, we should ask: how many hours of labor (at the average hourly rate for full-time workers) does it take to buy a loaf of bread, a new car, a gallon of gasoline, a new TV, a new house, college tuition and fees, etc., and compare that to how many hours of labor it took to buy all those goods and services in the past.

This methodology eliminates hedonics (i.e. the computer you buy today is much faster than the one you bought 10 years ago), as this adjustment plays no part in the actual costs of manufacture or the consumer's decision: we don't have a choice to buy a computer with 1990-era specs, so the hedonic adjustment is merely a tool for gaming the CPI.

We should also recognize that the experience of inflation differs in each economic class. Government employees who pay a small percentage of their real healthcare insurance costs (or none at all) will experience little of the actual inflation in healthcare costs; it's the government agencies that are exposed to the real costs of healthcare insurance, which is why municipalities and agencies exposed to the skyrocketing costs of healthcare insurance are under financial pressure.

A retiree is naturally focused on the out-of-pocket share of medication costs; the soaring cost of college tuition is so remote it might as well be occurring on Mars.

Consider this real-world example. Let's say a household earning $60,000 a year (median household income is around $50,000) is suddenly exposed to the real cost of rising healthcare insurance. Maybe the primary wage earner lost the job that provided health coverage and now has to pay the full costs out of pocket as a contract worker.

In any event, their healthcare insurance now costs $500 more per month than it did last year. (By happenstance, this is how much my own healthcare insurance costs have risen since 2008.) This $500/month means the household is paying $6,000 or 10% of its gross income more for the same coverage it received last year. The household's annual rate of inflation just from healthcare costs is 12%, since net income is closer to $50,000 and the $6,000 in extra spending isn't buying any new good or service.

Let's say the household is paying $500 more per month for healthcare insurance than it was five years ago. That works out to an annual rate of 2.4% just from healthcare insurance inflation alone. Any other increases in costs would push that rate higher.

In other words, those households with zero exposure to college tuition and the full costs of daycare, medical care and healthcare insurance may well experience low inflation, while the household paying the full costs of daycare, college tuition and healthcare insurance will experience soaring inflation.

If we analyze inflation by purchasing power (which declines as real income stagnates and prices rise) and by exposure to real costs, we find the incomes of the upper 5% have typically outpaced CPI inflation, so the purchasing power of the high-income family has not suffered (unless of course they have no healthcare insurance and they have to pay the full real costs of a medical crisis. In that case they might be bankrupt.)

Households that receive multiple government subsidies and direct payments have little exposure to healthcare, since they are covered by Medicaid, and modest exposure to housing if they receive Section 8 benefits. Retirees on Medicare also have limited exposure to the real-world costs of their care paid by the government.

If we analyze inflation by these two metrics, we find the middle class is increasingly exposed to skyrocketing real-world prices. Pundits in the top 5% have the luxury of pontificating on the accuracy of the CPI while those protected by government subsidies and coverage have the luxury of wondering what all the fuss is about. Only those 100% exposed to the real costs experience the full fury of actual inflation.

Things are falling apart--that is obvious. But why are they falling apart? The reasons are complex and global. Our economy and society have structural problems that cannot be solved by adding debt to debt. We are becoming poorer, not just from financial over-reach, but from fundamental forces that are not easy to identify or understand. We will cover the five core reasons why things are falling apart:

1. Debt and financialization

1. Debt and financialization

2. Crony capitalism and the elimination of accountability

3. Diminishing returns

4. Centralization

5. Technological, financial and demographic changes in our economy

Complex systems weakened by diminishing returns collapse under their own weight and are replaced by systems that are simpler, faster and affordable. If we cling to the old ways, our system will disintegrate. If we want sustainable prosperity rather than collapse, we must embrace a new model that is Decentralized, Adaptive, Transparent and Accountable (DATA).

We are not powerless. Not accepting responsibility and being powerless are two sides of the same coin: once we accept responsibility, we become powerful.

Kindle edition: $9.95 print edition: $24 on Amazon.com

To receive a 20% discount on the print edition: $19.20 (retail $24), follow the link, open a Createspace account and enter discount code SJRGPLAB. (This is the only way I can offer a discount.)

| Thank you, Timothy T. ($5/month), for your wondrously generous subscription to this site -- I am greatly honored by your support and readership. | | Thank you, Stephen L. ($25), for your superbly generous contribution to this site -- I am greatly honored by your steadfast support and readership. |

Read more...

1. Debt and financialization

1. Debt and financialization