Lessons from The Great Depression

The risks of gambling in speculative frenzies and depending on serial asset bubbles continuing forever are easily observable, yet few act to reduce these risks.

Longtime correspondent Ishabaka recently shared key takeaways from a classic on-the-ground account of The Great Depression in the U.S.:,

The Great Depression, a Diary.

Another reader reminded me that The Great Depression was global, and occurred earlier that 1929 in other nations and had equally (or even more) calamitous consequences elsewhere. That said, humans are running Wetware 1.0 everywhere, so it's likely that many of these lessons are applicable to the collapse of speculative asset bubbles in other economies and eras--for instance, the global economy's Everything Bubble of 2023.

Here are Ishabaka's key takeaways from the book:

Mr. Roth was a lawyer in Youngstown, Ohio - a steel mill town, and near Weirton, West Virginia where I worked for two years. He kept a diary from 1929 through the entire Depression. He seems an intelligent guy who sort of drove himself crazy trying to figure out economics and investment timing. Some of the lessons are timeless:

1. Diversify - in the USA, people who held stocks and real estate were wiped out, while people who held Treasury bonds did great. In Germany, people who held government bonds were wiped out, while people who held real estate did great - especially if they had a mortgage. He relates the story of one American client who owned a piece of property in Germany with a $5,000 mortgage, which he was able to pay off with US $18 when hyperinflation hit Germany.

2. Have some cash - the biggest problem in general was lack of actual money - nobody had any, for anything. Over and over Roth laments having no cash to buy stock or real estate bargains in '32 and '33.

3. People never learn - In 1936, the Depression seems to be over and the stock market is booming. The same people who were wiped out in the crash of '29 are investing like crazy again - the US stock market crashed 50% the next year, 1937.

4. Timing the market is one of the best ways to go broke. Despite being a student of markets, and intelligent, Roth again and again is wrong in his market and US economy predictions.

5. Professions fared badly - there were weeks he made no money as a lawyer. People stopped seeing the dentist for anything but abscessed teeth that needed pulling. They couldn't pay the doctor - he relates that one week a doctor friend of his made a grand total of one dollar. My paternal grandfather was a livestock veterinarian during the Depression. He told me a grim fact - he was better off as a vet than an MD. If a child got sick and died and the parents couldn't afford a doctor's visit it was sad, but the family survived. If their cow got sick and died the whole family might starve - so he got paid.

6. Herd mentality is a thing. The runs on banks REALLY made the lack of cash situation worse. A lot of it was driven by irrational fear. Banks that would have survived if their clients had remained calm went under, wiping the banks and the clients out. Makes you glad we have the FDIC.

7. The "preppers" have a point - he relates that local violent crime, including murders, reached unprecedented levels, and Youngstown isn't a particularly violent place.

Most salient take-home points for me are: 1. diversify 2. nobody is good at predicting the market - doesn't stop anyone and his uncle from trying though 3. avoid margin - that's what really ruined people in 1929 - a lot of people were investing in stocks using 25% margin i.e they borrowed 75% of their investment.

Recurrent themes: investment manias keep happening, despite everything that has gone before. Many people who owned stocks that went down a lot would have been OK eventually, except they bought on margin and were ruined. The best performing investments during the Depression were government bonds (many corporations stopped paying interest on their bonds) and annuities.

What I call the "Enron Effect" - people put all their money in one stock - generally a corporation in their home town that was doing well, when things got bad they were ruined - lost work and stock crashed - probably would have been survivable if they were diversified.

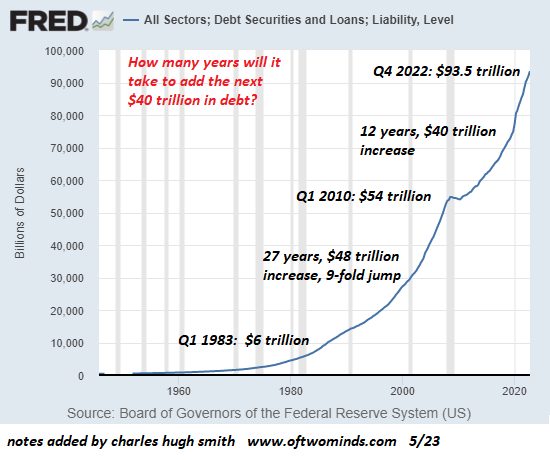

Politicians don't get elected and re-elected for fiscal prudence - they get elected and re-elected for printing money, having the government go into debt, and handing out free stuff - sound familiar? Back then Roth was horrified that the federal deficit hit $47 billion in 1940. Haha!

Thank you, Ishabaka for the summary of timeless takeaways. I would emphasize two:

Fewer bad things can happen if you're debt-free. Margin is debt backed by collateral. A mortgage is margin, too, debt backed the collateral of the house and land. All such debt has an inherent risk: the value of the collateral may drop below the debt owed on thr asset. When the debt is called, i.e. repayment demanded (or cash must be paid to lower the debt to the current value of the collateral), the borrower either pays up in cash or the asset is forfeited.

As noted, debts become feather-light in hyper-inflation, which is why banks won't let hyper-inflation be the "solution".

Germany was under geopolitical pressure to pay its external debts to the victors of World War I, which was the ultimate source of the central government deciding hyper-inflation was the only "solution" within reach.

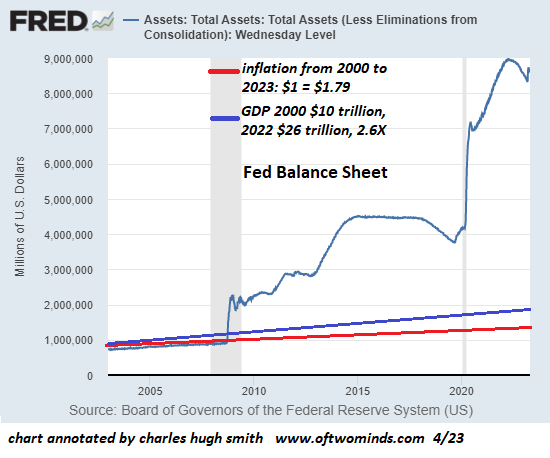

This is why many expect asset deflation to occur, i.e. asset bubbles will pop. Central banks will avoid generating hyper-inflation because: 1) geopolitics (destroying the nation's currency has virtually no upside and catastrophic downsides); 2) the central bank exists to protect the interests of banks, and hyper-inflation wipes out debts, loans and banking; 3) th risks of political disorder skyrocket: favoring the already-wealthy and capital is tolerated as long as the middle and working classes feel they're prospering or have hope of prospering. But when the middle and working classes are wiped out, favoring the wealthy (the default setting of the status quo everywhere) triggers blowback that very quickly goes nonlinear, i.e. chaotic overthrow of the status quo.

The risks of gambling in speculative frenzies and depending on serial asset bubbles continuing forever are easily observable, yet few act to reduce these risks. The easiest way to minimize these risks is stop going to the casino. Another is to ask how dependent we are on the serial asset bubble economy: if "The Everything Bubble" pops and cannot be re-inflated, what will the likely consequences be for our household?

Another is to need less, waste less of everything: income, energy, food, etc.: get lean.

Another is to invest in what we personally control. Owning a productive plot of land with a livable micro-house and no debt is lower risk than owning a grand house with an even grander mortgage and property tax bill.

Owning 100% of tools and assets that generate essentials of fundamental value to human life provides us agency and control of how best to deploy those assets. Being dependent on central bank "saves" of speculative bubbles and assets held 10,000 miles away that may be expropriated by other governments is the acme of uncontrollable risk.

All of these are key strategies of

Self-Reliance.

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

Read the first chapter for free (PDF)

Read excerpts of all three chapters

Podcast with Richard Bonugli: Self Reliance in the 21st Century (43 min)

My recent books:

The Asian Heroine Who Seduced Me

(Novel) print $10.95,

Kindle $6.95

Read an excerpt for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal

$18 print, $8.95 Kindle ebook;

audiobook

Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

(Kindle $9.95, print $24, audiobook)

Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel)

$4.95 Kindle, $10.95 print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print)

Read the first section for free

Become

a $1/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, rdjhoya ($50), for your marvelously generous Substack subscription to this site -- I am greatly honored by your support and readership. |

Thank you, jksocal ($50), for your splendidly generous Substack subscription to this site -- I am greatly honored by your support and readership. |

|

Thank you, ard65 ($50), for your superbly generous Substack subscription to this site -- I am greatly honored by your support and readership. |

Thank you, Harley O. ($50), for your outstandingly generous Substack subscription to this site -- I am greatly honored by your support and readership. |