Ahead Lies Ruin: The Decay of Social Trust

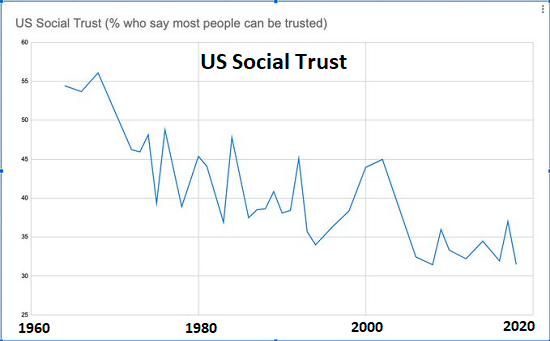

Loss of social trust has consequences.

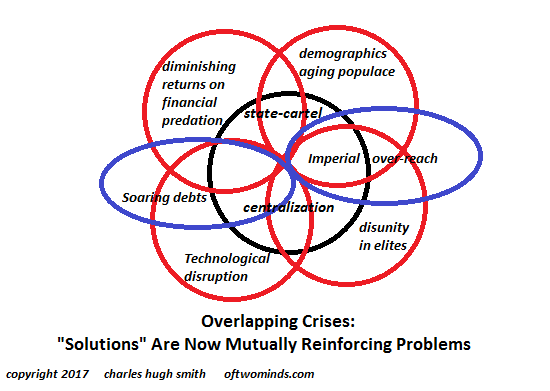

There are three solvents of social trust: 1) the self-aggrandizement of insiders; 2) decay of competence, and 3) precarity, generated by soaring inequality / cost of living and the decay of social mobility, all of which erode confidence in the social contract, i.e. our confidence that the system isn't rigged to benefit the few at the expense of the many.

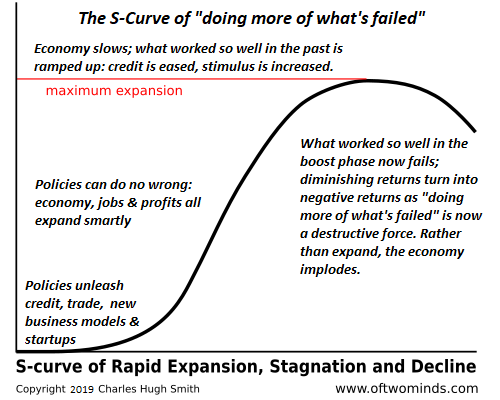

These are of course related, but let's tease them apart. Once insiders focus on maximizing their personal gain as the purpose and goal of their employment, the value of the institution's service to the public / customers decays behind a flimsy screen of self-serving PR promoting the successes of the hollowed-out institution.

Even if insiders are devoted to serving the public, if their ability to perform the necessary work is impaired due to under-competence, the public's trust decays. Rather than look for incompetence, which presumably could be fixed by replacing the incompetent with the competent, the real problem is under-competence, a subject I addressed in

The Catastrophic Consequences of Under-Competence (subscribers/patrons only).

The basic idea here is the organization has lost the core competencies needed to handle anything other than day-to-day processes. In other words, those inside the organization think they have what it takes, until challenges arise that they do not fully recognize or understand due to institutionalized under-competence. Here is an excerpt from my essay:

We all understand human error: someone was tired and misread the situation, or they were impatient. We also understand incompetence: the individual simply didn't have the knowledge and experience needed to make the right decisions and take corrective action.

Author Charles Perrow studied organizational weaknesses that generate flawed responses to what he calls "normal accidents," responses that made the situation far worse. In other words, the system itself increases the risks of normal accidents becoming catastrophic accidents.

In other words, as organizations become more complex, the staff no longer has the competence required to manage challenges and crises that were previously considered part of the job.

When self-interested insiders no longer care about the organization's under-competence, this is toxic to social trust. On a society-wide scale, this decay erodes the social contract, the unstated but implicit understanding that the system is functional and fair, i.e. a level playing field, and we "get what we pay for," i.e. we will receive fair value for our work and money.

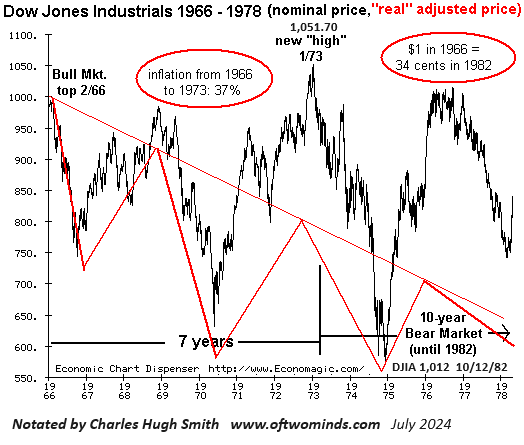

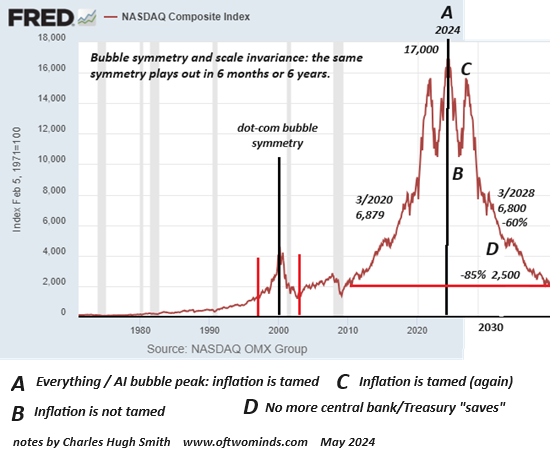

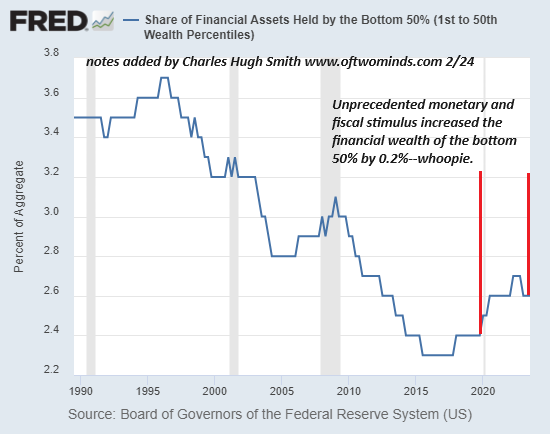

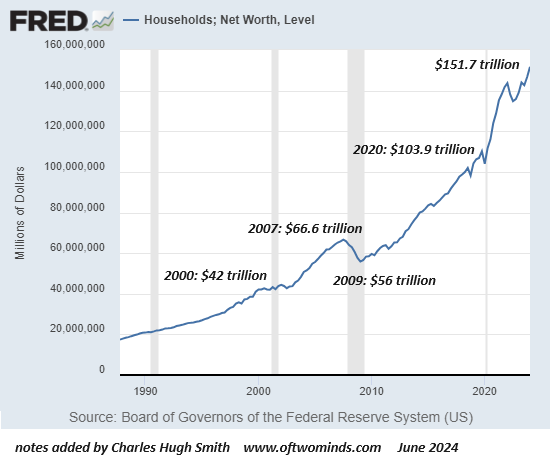

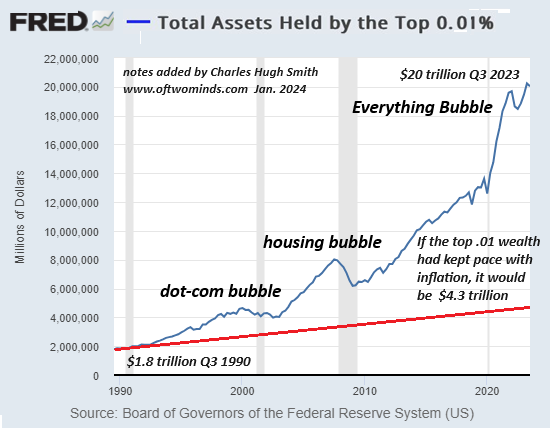

Soaring inequality, the rising cost of living and the decay of social mobility are all indicators of an increasingly unlevel playing field and a decline in the value of our work and money, even as we're constantly assured that we have the best of everything.

This reliance on artifice and propaganda is also toxic to social trust. When we sense that we're just marks / chumps being ripped off by corporations and institutions, and the gains are going to the few at our expense, we lose trust in the system.

No wonder social trust has been declining for decades. This is inversely correlated to rising inequality: as inequality increases, social trust declines.

The widening gap between the the few and the many is reflected by this chart: those who find the system works very well for me have great trust in the institutions that employ and enrich them, while the rest of us, i.e. the marks and chumps being stripmined, have very little trust in our elites or the institutions that empower them.

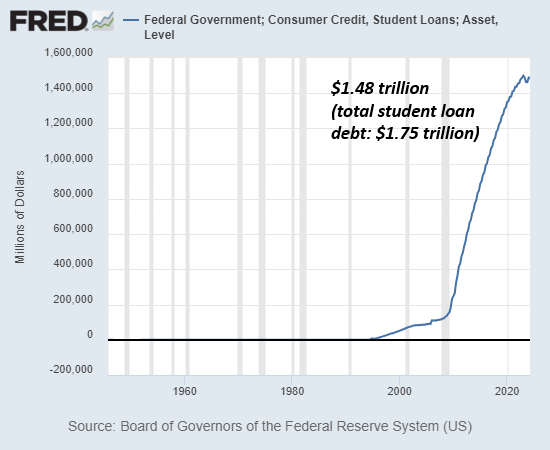

Consider Higher Education, the vast "industry" of universities and colleges tasked with imparting higher levels skills and knowledge. That the emergence of student loans--from near-zero two generations ago to $1.75 trillion in "free money" to higher education--enabled a vast expansion of shiny new buildings and well-paid administrators is beyond question.

This chart shows federally backed student loan debt--$1.48 trillion--out of a total (federal and private-sector debt) of $1.75 trillion. Note that Higher Education managed to expand for decades without any federally backed student debt. In 20 years, federally backed student debt rose from $87 billion to $1.48 trillion. How did the "industry" survive all those postwar decades as it expanded at an unprecedented rate?

Two generations ago, critics inside and outside the "industry" were already questioning the value of the education being offered to students, for example Ivan Illich's Disabling Professions and Deschooling Society , and Donald Schon's The Reflective Practitioner: How Professionals Think In Action, in which Schon, a professor at M.I.T., explored how little was understood about how students learn real-world skills in management and other professions.

That student enrollment in the Higher Education industry has plummeted from 18 million to 15 million in the past few years reflects not just demographics but an erosion of trust in the value of what's being taught. The real test of the value of what's been sold as a valuable education lies ahead, when extraordinary challenges will reveal that what's been taught largely qualifies as under-competence.

The same can be said of what's being sold by Corporate America, as the quality, durability and value of goods and services has declined to the point of parody: in effect, Corporate America's "party line" is: our products and services are garbage, but if you upgrade to Premium, you'll suffer less.

That this doesn't inspire trust in the status quo is obvious to the many, but the few continue living in their protected bubble, confident that since I'm doing so well, everyone is doing well.

Loss of social trust has consequences which are difficult to predict. The first-order effect is precarity, the general sense that life is increasingly precarious on multiple levels. The second-order effects start with the unraveling of the social order and proceed from there.

New podcast:

How Asset Deflation Could Play Out (35:37 min)

My recent books:

Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site.

Self-Reliance in the 21st Century print $18, (Kindle $8.95, audiobook $13.08 (96 pages, 2022) Read the first chapter for free (PDF)

The Asian Heroine Who Seduced Me (Novel) print $10.95, Kindle $6.95 Read an excerpt for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal $18 print, $8.95 Kindle ebook; audiobook Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $9.95, print $24, audiobook) Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel) $4.95 Kindle, $10.95 print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print) Read the first section for free

Become a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Sue K.W. ($184.40), for your beyond-outrageously generous subscription to this site -- I am greatly honored by your support and readership. |

Thank you, John F. ($108), for your outrageously generous subscription to this site -- I am greatly honored by your support and readership. |

|

|

Thank you, Sue R. ($70), for your marvelously generous subscription to this site -- I am greatly honored by your support and readership. |

Thank you, Pickles ($7/month), for your splendidly generous subscription to this site -- I am greatly honored by your support and readership. |