I reckon it prudent to see the next decade as a journey through a wilderness few of us have experienced.

Marketing has seized "your journey" by the throat. The marketing of everything from storage facilities to downtowns now references "your journey," with the primary message being your journey will be fruitful, fun, exciting--but also safe and secure. In other words, our journey will follow well-worn, well-marked trails, and the outcome will always be positive. If anything untoward happens, someone will be available to get "the journey" back on track.

In other words, "the journey" is never through a wilderness without trails or markers where help is unavailable, where we're on our own and the journey's outcome is uncertain, and fear is the companion who is always by our side.

In the marketed "journey," all you need is money: to rent a storage space or an apartment, to pay tuition or a plane ticket and sturdy boots. This is the essence of what I call Ultra-Processed Life: adventure that is safe and certain can be purchased off the shelf.

We take all the intricate structures that make this possible for granted, and have little grasp of what life is like without them. As long as we have money, we have power. But in a wilderness, there's nothing to buy and no one to pay to make it all go away. In a wilderness, we experience the limits of our power. Stripped of all the structures that make life certain and safe, we come face to face with our own powerlessness.

Many of us have already experienced powerlessness in our childhood. We were repeatedly moved around against our wishes by adults, step-parents were imposed on us and then dispensed with, and we were dropped into schools where we were vulnerable to bullying. Certainty and safety were ephemeral, and we lacked the tools and strengths offered by adulthood.

It is not surprising that many of the elements of Ultra-Processed Life are child-like: we're offered "adventures" that are safe and certain, as in "let's play adventure" but in a safe, protected environment.

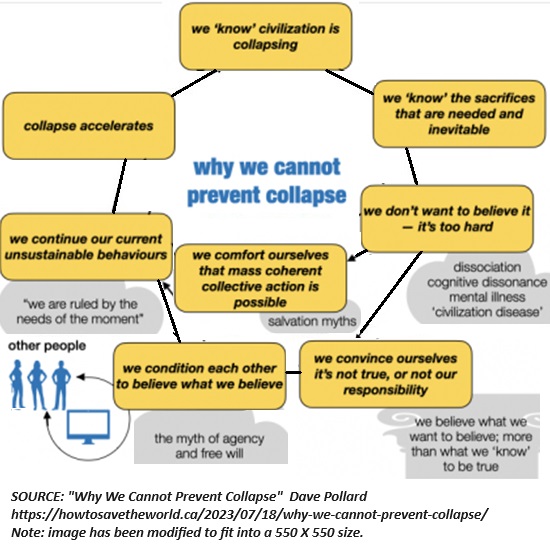

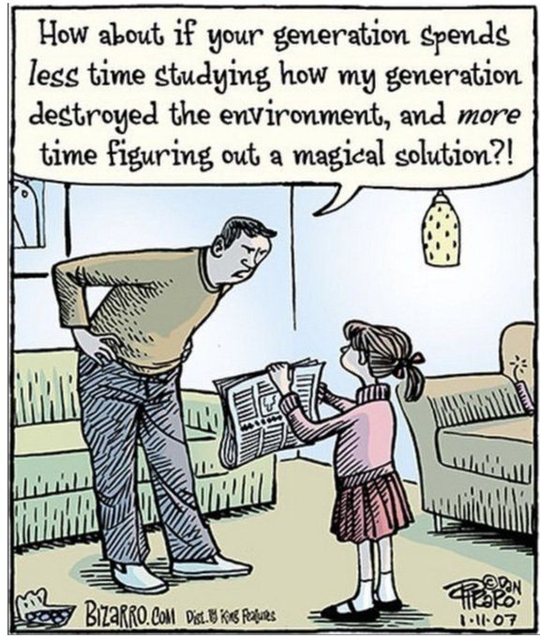

The problem with packaging life based on the ubiquity of complex structures that protect us from contact with uncertainty, risk and powerlessness is we're completely unprepared for the real world when we do finally encounter it. We cannot imagine experiences that unravel and cannot be reversed with a phone call or credit card.

Unaccustomed to being totally on our own in situations we've never experienced before, we're ill-prepared to function in a fast-moving environment of uncertainty and risks we cannot fully grasp. These environments can be external--the real-world unraveling--and/or internal: the unraveling of burnout or breakdown.

I've written a lot about self-reliance, as this is the penumbra (Latin for "almost shadow") of powerlessness: self-reliance is never limitless, for we do not have god-like powers. It is intrinsically limited. But it does generate agency, the capacity to direct our lives by exerting our will, skills and effort.

One analogy for "the journey" is driving a car. Our experience is 100% low-risk predictability and control until we experience an accident, and so our experience doesn't prepare us for things going awry. We have no tools for dealing with sudden extremes or unexpected failures in the systems we take for granted. It's only after such experiences do we learn our limits an gain an appreciation for what might happen even in low-risk settings.

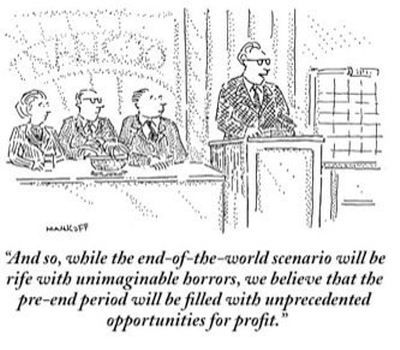

Those of us who have had such experiences tend to think along "worst-case scenario" lines as the means of avoiding being caught off-guard by "longtail risks," i.e. events deemed unlikely but still well within the realm of the possible.

For example, if I climb on a roof, I assume I'm going to slip and fall, so I take precautions that look excessive to those who haven't fallen off roofs.

In a similar fashion, it seems risky to have no water, food and fuel stored up for the unlikely eventuality that the systems we rely on to provide these essentials break down or are disrupted. It seems equally risky to have few skills in fashioning shelter, growing food, organizing security, and planning scenarios to deal with breakdowns in what we take for granted based on real-world experience.

We're accustomed to emergencies being temporary, the result of a natural disaster that responses are in place to deal with. We have little or no experience of systems decaying and not returning to the status quo.

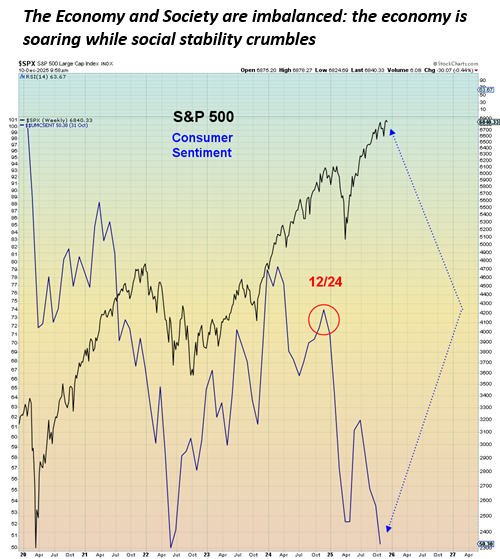

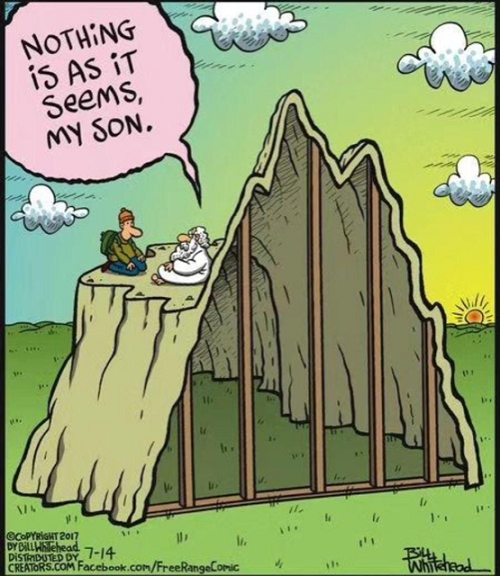

My sense is that we're entering an extraordinary period that is more like a wilderness than a well-marked path with help around every corner. Beneath the surface of normal life, the systems we take for granted are eroding. Since we have no experience of this, we're unprepared for a journey that is intrinsically uncertain and brimming with risks we cannot assess because they are contingent, novel and non-linear, i.e. unpredictable.

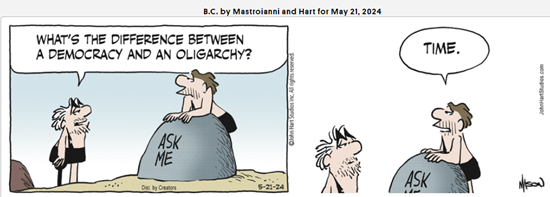

The consensus is such a situation is not in the realm of possibility. Everything we take for granted is permanent. My view is the next 7 to 10 years will present us with challenges few are prepared to manage based on previous experience and their existing reserves of agency, skills and resources, reserves based on the expectation of permanent structures providing security and safety.

The phrase "situational awareness" is bantered about, but as a general rule we can only be aware of situations we've experienced before. We're blind to what we have yet to experience. Without experience, we tend to over-estimate our readiness to deal with extraordinary circumstances because we've successfully managed everyday life.

Fear is a useful tool that few learn to use because they don't have enough experience with it. Fear is a spectrum, one that spans from caution to panic. The difficult part is avoiding the slide into disorientation and panic. Like self-reliance, this is imperfect. Our ability to assess risks and threats is also imperfect. No matter how well prepared, we can still be surprised, unwary, blind to what we haven't experienced.

Knowing this is also a tool.

Some things happen so fast we don't even have time to become afraid. We just react instinctively. In slow-moving crises, uneasiness dissipates all too easily into passive acceptance.

We habituate to decay so readily that it's hard to anticipate where it's heading. We assume the current level will hold, when the reality is the current level is only temporary, and the next step down is just ahead. Our ability to distinguish a step down from a precipice is limited.

I reckon it prudent to see the next decade as a journey through a wilderness few of us have experienced. It may appear to be financial or political, but fundamentally it is a journey each of us will take to some degree on our own.

We will be powerless to restore the systems that have decayed. Our only power will be what we provide ourselves. Empowerment will likely take multiple forms, manifesting as self-reliance, experimentation, failure, shared experiences and cooperation with others.

These ruminations were inspired by this work, which I leave unattributed so you can read it as it is without any preconceptions generated by authorship, place or time.

A Manner Of Traveling

I awoke and found myself walking

along a muddy road,

dim with filtered light and an uncertain sun.

My feet were cut and bleeding.

I glanced back at my tracks and recognized nothing,

and saw small patches of my blood

in the dark damp depressions of my footsteps.

Yes, anger and love can co-exist.

This I know for I am both.

I am in an unfamiliar place.

The leaves and branches are wet with recent rain

and I cannot tell if I have been crying

or just walking with my face turned up to the sky.

I find my feet marching forward, steadily,

and I am astounded at the effort they are making

without my will.

Yes, decisions and no will can co-exist.

This I know for I am both.

I consider turning back but I do not remember

coming here. There is nothing to return to.

I am alone, though I see the eroded,

water-filled spoor of other walkers.

I am afraid, for I cannot see ahead

and do not know the future that my mind

is striving to see.

Yes, certainty and the unknown can co-exist.

This I know for I am both.

There are deep scratches on my exposed arms;

I do not recall crashing blindly through

wilderness, but clearly, I have done so.

I am thirsty and tired but there is no place to rest.

I feel this power pulling me forward.

I am trying to return to the birthplace

I have never seen, as birds and fish do.

I will not recognize it with my eyes but with my belly.

I want to feel sorry for myself, to have someone

comfort me in my distress, but I am alone,

with only my mind and body for company,

and the insects buzzing unseen above my head,

oblivious to my aching feet and confused mind.

Yes, pain and love can co-exist.

This I know for I am both.

There is the rich scent of vegetation around me,

fecund, growing, matted, decaying, life and death

in the same place and time.

I walk on and the smell lies heavily over

the damp vines and reaching trees above me.

My new book Investing In Revolution is available at a 10% discount ($18 for the paperback, $24 for the hardcover and $8.95 for the ebook edition).

Introduction (free)

Check out my updated Books and Films.

Become

a $3/month patron of my work via patreon.com

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email

remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Tom ($200), for your beyond-outrageously generous subscription

to this site -- I am greatly honored by your support and readership.

|

|

Thank you, Mike H. ($70), for your marvelously generous subscription

to this site -- I am greatly honored by your support and readership.

|

|

Thank you, Ramon M. ($7/month) for your superbly generous subscription

to this site -- I am greatly honored by your support and readership.

|

|

Thank you, Kirk C. ($7/month), for your splendidly generous subscription

to this site -- I am greatly honored by your support and readership.

|

Read more...