Lost in the Vast Wasteland of Social Media

Once we've made "digital visibility" the primary source of our identity, status and self-respect, we've doomed ourselves to wandering, compass-less, in a vast artificial wasteland.

That social media is addictive is self-evident. The temptation to continue scrolling is as limitless as the vast wasteland of content.

The destructive nature of this addiction is also self-evident. The net result of this addiction is depression, anxiety and rising rates of self-harm and suicide.

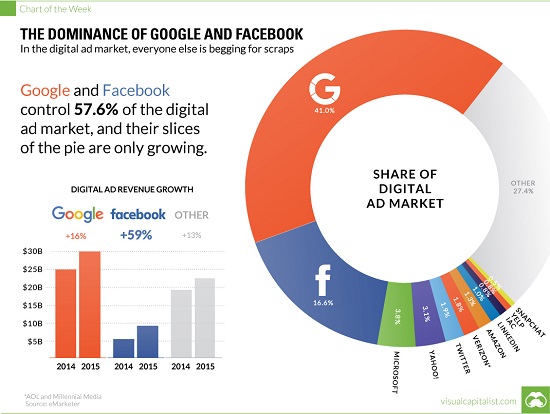

The immense profitability of addiction to screens and social media establishes the corporate incentives to increase their addictive power and thwart attempts to limit this profitable power. Who cares about self-harm and depression when shareholder value is at stake?

Though social media is pitched as connecting us all, it's actually about control: the platforms control the flow of user-created content, the addictive mechanisms and the monetization of user engagement.

What's less obvious is the incentive for users to keep creating content for the tech platforms to monetize. This is of course the great "innovation" of social media: entice users to create content so the corporation gets all this content for free. The second "innovation" is to monetize the users' attention / "engagement," a two-fer: monetize the free user-created content and then monetize the addicted users who can't stop scrolling.

The incentive for users is core to human nature: to gain recognition and respect. We observe the tremendous status and respect lavished on those with high digital visibility on screens, and this ignites our Mimetic Desire--we want what we see others wanting and value what others desire--to increase our digital visibility so we too can enjoy some of the status and respect heaped on those with screen presence.

Concurrent with the rise of digital visibility as the key source of status and respect is the decline of other social means of gaining status and respect. The economy places a premium on mobility of both capital and labor, so the workforce and neighborhoods are in constant flux. Unlike the previous economic model of stable employment, where people routinely worked for the same company for decades, as did their peers, now there's no stable community at work that provides social ties and respect: everyone is an atomized, free-floating individual.

Sure, we can pass physical prints of our selfies in famous locales around to our stressed-out, here-today, gone-tomorrow co-workers, but who cares? How much status and respect can we possibly gain in the limited, unstable circles of work and neighborhood? Very little.

The same is true of neighborhoods: here today, gone tomorrow. There is no stable social order left in the real world to provide the recognition and respect every human needs. So we turn to the artificial media-world of screens and social media.

What defines the media? That it's staged, scripted, enhanced, edited, artificial. TV programs are artificial representations of real life, not real life: the boring bits have been edited out, the drama enhanced, the actors made up and the scenes staged.

Real life can't compete with this carefully edited, distilled, enhanced simulation of real life. We understand this and so our goal on social media is to stage, script and edit our real-world selves and lives into an enhanced artificial facsimile that is worthy of a higher status than that earned by our unstaged real life.

So even as we share a crowded apartment with five other low-paid workers, we post photos of ourselves in luxe bars holding $20 cocktails. This is only half the battle for digital visibility; the other half is building an audience so our visibility increases. As our visibility increases, the status and respect we gain increases proportionately.

As the means to gain status and respect in the real world have diminished, the potential to increase our status in the digital realm has skyrocketed. This is the difference between the old legacy mediums of TV and print: we could only be passive observers, as it was extremely difficult to get through all the gatekeepers and actually get on TV or in print media.

Anyone can get on the screen and page in social media. There are three billion Channels of Me, and so the Darwinian struggle is to stage, edit and enhance one's channel to somehow become more appealing and compelling than the millions of competing channels.

This generates another addictive dynamic: did anyone "like" my last post or comment? The desire for an audience introduces an emotional vulnerability: we want the higher status awarded to larger audiences, and so we become obsessed with monitoring our "likes" and views. We become easy targets for trolls who relish crushing the hopes and spirits of those seeking to out-stage and out-enhance everyone else trying to increase their digital visibility.

This is the potent source of much of the depression, anxiety and self-harm stripmining the mental health of the younger generations. Once we've made digital visibility the primary source of our identity, status and self-respect, we've doomed ourselves to wandering, compass-less, in a vast artificial wasteland.

To avoid self-destruction, we must understand the nature of social media--that it's been carefully crafted to addict us--and to free ourselves of the illusion that an enhanced digital representation of ourselves is a worthy foundation for our identity, social status and self-respect.

The artificial digital realm is not a substitute for real life, nor is "status" gained on social media a substitute for an authentic identity and selfhood. We reach through the screen for the proffered feast and are left even more starved when we finally turn the screen off.

Addiction is profitable:

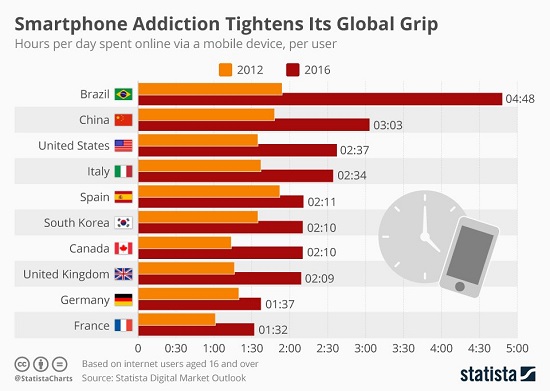

Smartphone addiction:

I've written dozens of essays on social media over the past 13 years; here are a few:

Social Media Week: 800 Million Channels of Me (February 21, 2011)

Why Is Social Media So Toxic? (October 31, 2018)

Is Social Media the New Tobacco? (December 28, 2019)

Social Media's Plantation of the Mind (May 28, 2020)

I've been discussing the neocolonial-plantation structure of the U.S. economy since 2008, and now this model has reached perfection in social media's Plantation of the Mind.

New podcast: CHS on Leafbox (1:20 hrs)--authentic community, going grey, Doom Loops and more.

My recent books:

Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site.

Self-Reliance in the 21st Century print $18, (Kindle $8.95, audiobook $13.08 (96 pages, 2022) Read the first chapter for free (PDF)

The Asian Heroine Who Seduced Me (Novel) print $10.95, Kindle $6.95 Read an excerpt for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal $18 print, $8.95 Kindle ebook; audiobook Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $9.95, print $24, audiobook) Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel) $4.95 Kindle, $10.95 print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print) Read the first section for free

Become a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Gery S. ($70), for your splendidly generous subscription to this site -- I am greatly honored by your support and readership. |

Thank you, Stephen H. ($7/month), for your magnificently generous subscription to this site -- I am greatly honored by your support and readership. |

|

|

Thank you, Mark D.M. ($7/month), for your marvelously generous subscription to this site -- I am greatly honored by your support and readership. |

Thank you, Moon Ribs ($70), for your monstrously generous subscription to this site -- I am greatly honored by your support and readership. |