How Does a Hedge Work? Here's How

I recently asked longtime contributor Harun I. to explain (again) how hedging works. The reason is simple: though hedging is generally presented as something reserved for corporations and large funds, I have learned from Harun that the concept can be applied by us "regular investors." For instance: want a hedge against a declining dollar? Buy a gold ETF (exchange-traded fund) or physical gold or perhaps gold mining stocks (not a perfect hedge due to these being stocks, but stil....) All offer some hedge against a declining dollar.

Concerned oil might rise? Then a hedge might be futures on oil contracts, or even an oil ETF. Price of grain rising? Then a futures contract on wheat provides a hedge.

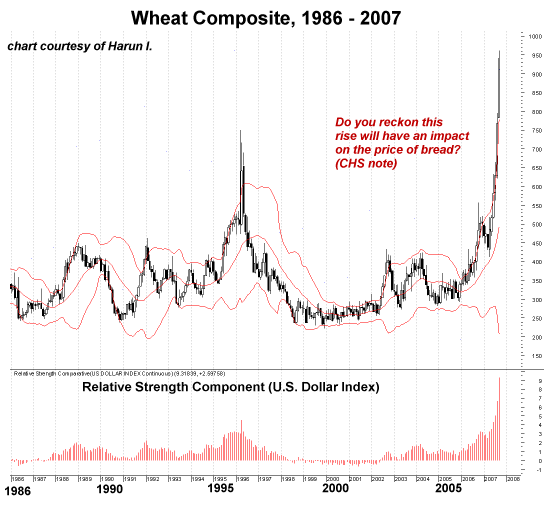

We start with a striking chart of wheat Harun supplied:

"I sense that your attention is drawn more to hedging so therefore it is that with which I will begin.

First, due to definition, we must understand the public will be considered speculators. Bona Fide Hedgers are those actually engaged in the business of producing or manufacturing a good or service of which the risks of doing so is what they attempt to offset. Life as a business doesn’t qualify.

So a bona fide hedger either has a cash position (long cash or actuals) that will be sold at a later date and therefore has the risk of declining prices or he has to purchase raw materials to manufacture a product or deliver a service (short cash or actuals) and therefore has the risk of prices increasing. Processors can carry both risks of increasing and decreasing prices.

For example, an oil refinery must buy crude oil and is worried about rising crude oil prices. It must also be concerned about falling prices of the products it delivers, i.e., unleaded gas or heating oil. A soybean processor must worry about rising soybean prices and falling prices of soybean meal and soybean oil.

Bona fide hedgers are not trying to make money; they are trying to control costs (protect their bottom line). As pointed out in The book Way of The Turtle, Southwest Airlines was able to remain profitable while other airlines struggled because it was able to effectively hedge its fuel costs. In other words through hedging operations SWA was able to purchase fuel at a lower effective cost than many of its competitors and pass along the savings to its customers through lower airfares and profit to its shareholders through higher stock prices.

Another way of looking at this is to say that SWA effectively transferred the risk of higher fuel prices (operating costs) to speculators who were willing to assume that risk in expectation of a reasonable return on investment.

The ability to transfer risk (uncertainty) to those willing to accept it is what enables stable prices. In the short term price volatility may be substantial but over the long term prices will be less volatile. Crude oil prices have raised several folds but the major refineries have remained profitable for the most part and prices at the gas pump have not risen on a one to one basis with crude oil.

The ability hedge the purchase of Light Sweet Crude in the futures markets have cushioned the blow of parabolic increases of the raw materials necessary for the production of energy products.

Whether people like it or not the fact remains that if not for futures markets retail prices would gyrate wildly as would corporate earnings and therefore stock prices would gyrate wildly as well as every new development causes stampedes to pass on costs in order to remain profitable while attempting to keep products affordable.

How does this work at the corporate level? Let say that a major oil refiner, General Guzzler, has a research report that indicate higher crude oil prices, it is November 2006 when the hedge was placed and November 2007 when the hedge was lifted. What was the effective or true cost of the crude oil to General Guzzler?

Cash Market price - Futures Market Price = Basis

$55.00/bbl $57.00/bbl -2 (cash under futures)

$80.00/bbl $83.00/bbl -3 (cash under futures)

(+/- ) in cash market Futures Position Gain (+/-) -1 change ($25.00/bbl) $26.00/bbl in basis

From the information above we can see that when the hedge was placed the cash market price Gen Guzzler was trying to protect was $55.00/bbl., futures were at $57.00 when purchased. When crude oil was purchased in the cash market a year later it was $25.00/bbl more expensive. However the futures market position when offset was profitable having made $26.00/bbl.

If we subtract the futures market gain of 26 from the cash market purchase price of 80 we see that not only was the 55 target price protected, Gen Guzzler actually made $1.00/bbl as the effective price was $54.00/bbl., reducing costs even further.

Another way to figure the effective cost is to simply add or subtract the gain/loss of the change in basis from the original cash market price of $55.00/bbl.. Even though prices are now substantially higher production costs have been kept in line and Gen Guzzler can deliver a product that is affordable and earn a profit.

Had Gen Guzzler not hedged, it would have had to purchase oil at $80.00/bbl instead of $54.00/bbl which means in order to stay profitable the increase has to be past on to the consumer. This increase would likely crush the end user and therefore the economy within a year.

Do all hedges work out this way? No. But being exposed to basis risk (the ability to transfer risk) instead of full price risk helps to stabilize profit margins to corporations and prices to end-users. Yes, prices are high but without hedging it could be much worse.

As consumers we conduct the business of life. The business of life is fraught with risks. There is currency risk, which is the risk that our dollars will buy less tomorrow than today. There is supply/demand risk, which is the risk that demand will increase for a product or service forcing prices higher or that supplies will be inadequate forcing prices higher. This is inclusive of the cost of money. These risk affect everyone from small business owners to the bagger at your supermarket.

Therefore it could be inferred that one must have a plan to offset these risks to at least maintain ones standard of living. We can do that by educating ourselves to understand our risks and then find suitable ways to hedge those risks. How many remember the high price of sugar in the 1970s?

Wheat has experienced a rather parabolic bull run of late (see chart). Should high prices persist or increase even more how will that affect ones ability to purchase the foodstuffs derived from wheat? And now that you are spending more for food out of a given amount of money, on what areas of spending will you cut back? By using the real principles of hedging as used by the fictitious Gen. Guzzler Corporation can I keep my effective costs reasonable and therefore protect my standard of living? The answer is yes.

Is this without risk? No. There is always risk. As in the example above basis risk reduces risk it does not eliminate it. The leverage in futures markets due to small margins is a double-edged sword and to the uneducated or irresponsible can create losses beyond ones means. There are ways to control or reduce risk whether through option strategies or just arranging with the broker not to use full margin (putting up the full value of the contract). One can use the stock market, e.g., purchasing gold miners instead of gold. There are ETFs and commodity index funds.

Is this advice? No. It is an invitation to think differently. The Internet and libraries are full of information on how to assess your financial condition so that you may make prudent decisions about what investment risks are suitable. Of course this assumes that one is honest with oneself. By taking charge and controlling your financial state you become less dependent on the government (in reality other tax payers) for your existence. This reduces the need for large, intrusive government."

Thank you, Harun, for an excellent explanation of an often-mystifying subject. This idea of hedging is a powerful concept in times when our purchasing power is declining, either via obvious inflation or slight-of-hand via our currency being destroyed.

Thank you, Anthony S., ($20) for your much-appreciated third donation to this humble site. I am greatly honored by your contribution and readership. All contributors are listed below in acknowledgement of my gratitude.

Wednesday, October 03, 2007

Terms of Service

All content on this blog is provided by Trewe LLC for informational purposes only. The owner of this blog makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. The owner will not be liable for any errors or omissions in this information nor for the availability of this information. The owner will not be liable for any losses, injuries, or damages from the display or use of this information. These terms and conditions of use are subject to change at anytime and without notice.

Our Privacy Policy:

Correspondents' email is strictly confidential. This site does not collect digital data from visitors or distribute cookies. Advertisements served by a third-party advertising network (Investing Channel) may use cookies or collect information from visitors for the purpose of Interest-Based Advertising; if you wish to opt out of Interest-Based Advertising, please go to Opt out of interest-based advertising (The Network Advertising Initiative). If you have other privacy concerns relating to advertisements, please contact advertisers directly. Websites and blog links on the site's blog roll are posted at my discretion.

PRIVACY NOTICE FOR EEA INDIVIDUALS

This section covers disclosures on the General Data Protection Regulation (GDPR) for users residing within EEA only. GDPR replaces the existing Directive 95/46/ec, and aims at harmonizing data protection laws in the EU that are fit for purpose in the digital age. The primary objective of the GDPR is to give citizens back control of their personal data. Please follow the link below to access InvestingChannel’s General Data Protection Notice. https://stg.media.investingchannel.com/gdpr-notice/

Notice of Compliance with

The California Consumer Protection Act

This site does not collect digital data from visitors or distribute cookies.

Advertisements served by a third-party advertising network

(Investing Channel) may use cookies or collect information from visitors for the

purpose of Interest-Based Advertising. If you do not want any personal information

that may be collected by third-party advertising to be sold, please

follow the instructions on this page:

Limit the Use of My Sensitive Personal Information.

Regarding Cookies:

This site does not collect digital data from visitors or distribute cookies. Advertisements served by third-party advertising networks such as Investing Channel may use cookies or collect information from visitors for the purpose of Interest-Based Advertising; if you wish to opt out of Interest-Based Advertising, please go to Opt out of interest-based advertising (The Network Advertising Initiative) If you have other privacy concerns relating to advertisements, please contact advertisers directly.

Our Commission Policy:

As an Amazon Associate I earn from qualifying purchases. I also earn a commission on purchases of precious metals via BullionVault. I receive no fees or compensation for any other non-advertising links or content posted on my site.