Has Central Bank Management of the Economy Failed?

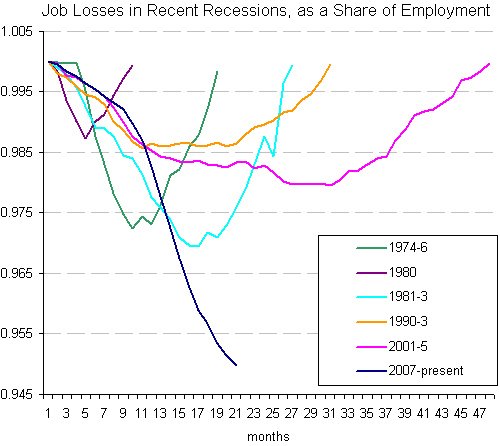

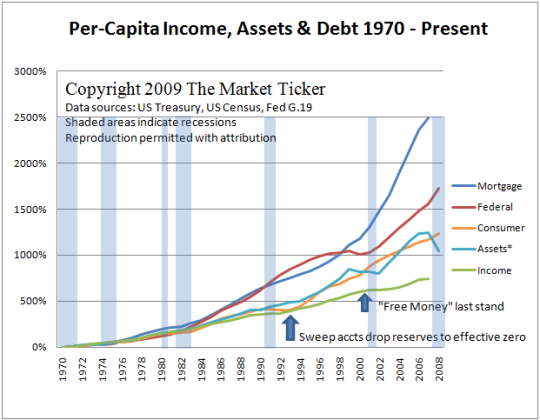

Perhaps the larger narrative playing out is that central bank manipulation/ management of the economy has reached its ultimate end-point: failure. The conventional wisdom is that the current financial meltdown resulted from the failure of "capitalism" (As if crony/State capitalism was ever anything but a simulacrum of free market enterprise.) But perhaps the current slow-moving collapse is merely the final failure of the Grand Experiment: that central banks can manipulate the economy to some steady-state "growth" without end. It is an irony, to be sure, that the emergence of central banks in the early years of the 20th century was in reaction to short-lived but scary financial seizures like the 1907 Panic. The irony is that such panics were sharp but also short-lived. Now that the central banks have spent decades manipulating the economies of the world with mad "behind the scenes" pulling of monetary and fiscal levers, downturns are not getting shorter but longer, and not getting shallower but deeper. I think the following charts make a good case that the Grand Experiment was ontologically doomed to fail. I would argue that policy is not a feedback loop like the market; you cannot eliminate feedback from the real world and substitute manipulation in its stead. This is akin to enforcing the "policy" that relieving the patients' symptoms is equivalent to restoring their health. Relieving symptoms is not equivalent to being healthy, as these charts suggest. Courtesy of my astute colleague Karl Denninger at Market Ticker: It is not coincidence that the deep recessions of 1974-75 and 1981-83 were followed by a rise in debt. Look at the first chart and then the second one. Note the ramp-up of debt after the Federal Reserve realized that its usual levers of monetary "loosening" were ineffectual. Their "solution" was to create credit--lots of it. the credit machine started gaining speed and finally achieved lift-off when Greenspan countered the modest 2001 recession with a full-blown explosion of low-interest-rate credit expansion. Predictably, this explosion of debt triggered an asset bubble in a variety of asset classes, most notably real estate. The results are visible here: Easy margin requirements and free-flowing credit helped boost the dot-com boom in the late 90s, which resulted in a rise in equity. As that bubble burst, the Fed turned the spigots wide open and a much greater flood of credit washed into housing and commercial real estate. Household equity responded to this credit nitro-in-the-tank by exploding upward along with real estate valuations. Alas, it has round-tripped, dropping to levels (as a percentage of GDP) not seen since the deep 1975 recession over three decades ago. These charts reveal the complete and utter failure of the past 34 years of manipulation "management" by the Fed and U.S. administrations (Republocrats and Demopublicans alike). Citizens have less equity and more debt--the classic definition of debt-serfdom. The manipulation of the economy is now yielding its grim harvest: a jobs base founded on ever-expanding credit is collapsing along with wealth (equity). Fewer jobs, declining wealth, higher debt payments: what will this do to tax revenues? The government response is of course to borrow ever greater sums to compensate for this massive drop in tax revenues. The two levers of central bank/government are monetary (expand credit) and fiscal (borrow and spend vast sums of money to "stimulate" the economy). Both are like drugs: you need ever greater "hits" to have any "feel-good" effect. But the end-point of drug addiction and credit addiction are the same: the addict, ever more desperate for a "high," overdoses and expires. We are now witnessing a global credit OD. The addict has two choices: cold-turkey (no more credit expansion) or implosion. "Your book is truly a revolutionary act." Kenneth R.

Permanent link: Has Central Bank Management of the Economy Failed?

If you want more troubling/revolutionary/annoying analysis, please read Free eBook now available: HTML version: Survival+: Structuring Prosperity for Yourself and the Nation (PDF version (111 pages): Survival+)

Of Two Minds is now available via Kindle: Of Two Minds blog-Kindle

Thank you, Jennifer G. ($10), for your unfailingly generous donations to this site. I am greatly honored by your support and readership. Thank you, Susan P. ($1), for your most welcome generous donation to this site. I am greatly honored by your support and readership.