Is Buying a House in 2010 a Good Idea?

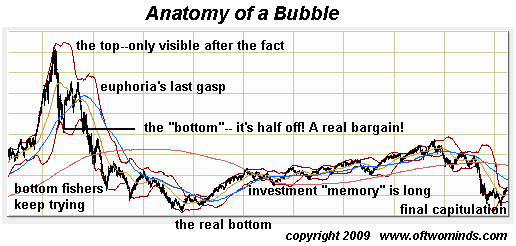

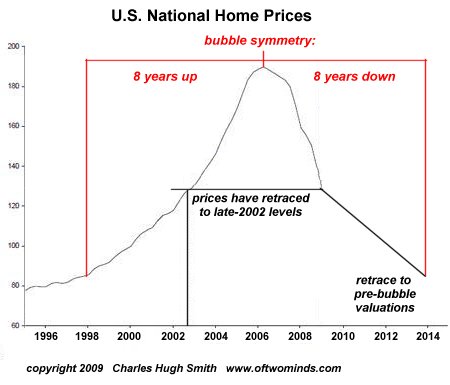

Readers regularly ask me to weigh in on the question "should I buy a house now or not?" Here are a few key considerations. Has the housing market bottomed? Is now a good time to buy a house if you've been waiting patiently for years? I receive queries like this on a regular basis, and my responses do not take the form of advice--after all, how can anyone know the reader's full financial/ family situation except the reader? And how can anyone outside the area possibly know the many variables of the local real estate market? The only thing I can offer is a context for analysis and decisionmaking. Let's start with the big question: Is this the bottom? Despite a very sharp bounce in sales and prices in some beaten-down markets like San Diego (please seeCalifornia Housing Forecast for particulars on the multiple bidding environment which took hold there in 2009), the short answer is "probably not, based on bubble symmetry and the fundamentals of supply and demand." Let's stipulate two points: 1. Housing/real estate was a classic speculative bubble. 2. All speculative bubbles tend to track a symmetrical pattern. Simply put: if the bubble took seven years to reach its blow-off top, then its decline will typically take a similar length of time as prices fully retrace to pre-bubble levels. Here are some charts that illustrate the point. This is the Nasdaq dot-com speculative bubble, which traced out a sharp rise and decline somewhat like the Tulip Bulb Mania and other previous speculative bubbles. The key feature to note is how eager "bottom fishers," still caught up in the false promise of "easy wealth in real estate/tulip bulbs/the Internet" etc. jump in far too early, creating brief spikes in demand and thus price. Then supply once again overwhelms demand, which falters, and prices resume their decline. As for falling demand: Existing home sales plummet 16.7% in December. As for supply: it is common knowledge that hundreds of thousands of homes are currently in the limbo of "shadow inventory"--homes the lenders won't foreclose for fear they can't be sold, homes held off the market by owners who are deeply underwater on their mortgages, etc. As soon as demand appears, then supply rockets up as those anxious to sell move properties from the "shadow inventory" into the market. The other feature to note in this chart is that the dominant speculative belief (in this case, that "real estate is the foundation of easy wealth creation") takes years to expire. This is a chart I prepared as the housing bubble climbed toward its ultimate peak in 2006/early 2007. It suggests that the next leg down in still-overpriced markets is about to begin, and that the final bottom will probably not be reached until the 2013-2014 time frame. So the answer to the question "what is fair value?" is consistent: pre-bubble prices, that is, whatever the house fetched in the 1994-7 timeframe. Here we see that national home prices have already retraced to 2002 levels--about halfway down the slope to a full retrace. Once again we see that bubble symmetry suggests the final bottom will not be reached until 2013-2014. In some once-hot areas, prices have already returned to pre-bubble valuations, or even lower. If this metric has been reached, then we need to ask these additional questions about any potential purchase: 1. Does the property have any inherent value, i.e. is it close to centers of jobs and commerce, have deep soil and good water, solidly constructed, etc.? A poorly constructed McMansion sitting forlornly in an exurban development that's unoccupied and falling to pieces, far from jobs and any social life, is doomed to be bulldozed. Its location and construction served no purpose except speculation. Since it is poorly built, then even a price of $1 is too expensive because it will be a money pit to maintain/repair. 2. Is the total cost of ownership--mortgages, insurance, property taxes and routine maintenance expenses--substantially lower than renting an equivalent home? One reader recently purchased a home with a substantial down payment with the net result that his monthly housing costs (not counting any large maintenance expenses like a new furnace or roof, of course) dropped to below $600/month compared to $900/month for the house he was renting. The danger here is that as the supply of rental homes and apartments rises, rents are already dropping in any locales. That is, rent is not a fixed number but a moving target. Rents may decline for years if demand remains lower than supply. On the other hand, areas close to jobs and commerce might see rising rental demand as people try to move closer to jobs, schools, social life, etc. as rents in these desirable areas decline. 3. Can you afford to have the capital (down payment) tied up in illiquid real estate? Given the financial uncertainties, it might not be wise for anyone to dump all their cash savings into a house which cannot be readily sold should some other pressing need arise. 4. Are your sources of household income stable and not subject to the whims of Corporate America's penchant for transfers? There are few better ways to churn through a fortune than to buy a house in a disintegrating market and then be forced to sell due to a Corporate relocation, then buy another home near your new assignment. Losing money every month supporting two homes, both of which are losing value and neither of which can be sold for their purchase price--this is a financial nightmare to be avoided at all costs. 5. Can the mortgage, taxes, insurance and maintenance be paid by one income in a two-income household? Job security is a relative term as corporations shed jobs, small businesses fold and local government finally faces the double-bind of declining tax revenues and increasing pension costs. Thus it is prudent to align housing expense such that one income can cover the bills if someone in the household loses their job. For renters, the loss of one income can be met by moving to a cheaper rental. A homeowner has no such flexibility. Bottom line: what are the consequences if housing continues declining for 3-4 more years? If housing in a locale has already fully retraced to pre-bubble valuations, then the rest of the questions can be used to construct a decison tree. In an economy which is disintegrating on multiple levels, it's prudent to ask "what if?" questions and think through "worst-case scenarios" before committing capital and making a long-term commitment to a property. DailyJava.net is now open for aggregating our collective intelligence. Of Two Minds is now available via Kindle: Of Two Minds blog-Kindle

Order Survival+: Structuring Prosperity for Yourself and the Nation from your local bookseller or from amazon.com or in ebook and Kindle formats. A 20% discount is available from the publisher.

Thank you, Matt G. ($20), for your extremely generous contribution to this site. I am greatly honored by your support and readership. Thank you, Eileen F. ($10), for your very generous contribution to this site. I am greatly honored by your support and readership.