The Great Disconnect (The Bullish Case for Stocks Part 2)

The U.S. stock market is largely disconnected from the U.S. economy, as are the 5% who own most of the stocks and other assets.

Please read the HUGE GIANT BIG FAT DISCLAIMER below before reading furtherbecause I am conducting a highly speculative thought experiment, NOT offering investment advice. This is the freely offered ramblings of an amateur observer, and nothing else.

For some reason, people seem to expect the stock market to reflect the real-world economy. It doesn't, for several fundamental reasons. The stock market is nominally based on the idea of "discovering the price" of various assets and income flows, but in reality it is mostly a reflection of human emotions relating to hope, greed and fear.

Thus the only connections between the market and the real economy are the human emotions that swirl around both. At some points, a price-earnings ratio of 30 (in effect, paying $30 for $1 of earnings) makes sense to participants, while at other points a P/E of 10 is unattractive.

While the case can be made that this is "caused" by data, that is false; the "cause" is the perception of risk and the relative strength of hope, greed and fear in the herd mentality of the moment.

Thus the market can rise even as the underlying economy is fundamentally unsound, and it can also remain in the doldrums despite many positives in the real economy. We might invoke the philosopher David Hume here and suggest that all the supposedly causal relations between stock valuations and the real economy be viewed with skepticism.

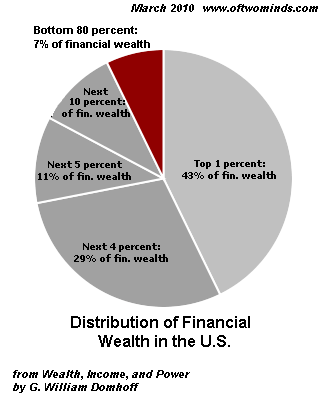

The other profound disconnect is between global U.S. corporations and the 5% of the U.S. populace who own the vast majority of stocks, and the the bottom 95% of Americans in the U.S. economy. I know this may sound harsh to some ears, but global American companies and their owners don't really need a healthy, vibrant U.S. economy to make scads of money and live very, very well.

All they need is a compliant, complicit populace who muddles along with some help from the Savior State, not making any serious political waves, and spending every scrap of income that comes their way servicing their debts. Those at the top of the heap who own most of the assets are doing extremely well: the top 1/10 of 1% is pulling away from the top 1%, the top 1% is pulling away from the top 5%, and the top 5% is pulling away from the bottom 95%: Soak The Very Very Rich (The New Yorker)

Many top U.S. companies earn more than half of their revenues and profits overseas. A moribund U.S. economy doesn't really impact their bottom line much, and zero growth or even declining sales in the U.S. are not really much of a problem: they have mastered the art of slashing payrolls and other expenses to keep ahead of declining domestic revenues. They will remain very profitable even as the U.S. economy shrinks.

The growth in earnings is coming from Brazil and other dynamic, increasingly global economies. All Corporate America/Savior State fiefdoms/cartels and their owners andupper-caste technocrats really need from America is a stable currency (declining gradually is perfectly fine, that can be hedged), a stable Global Empire that continues to protect the sealanes/oil supply lines and threaten disruptive nations with annihilation, and a stable (declining for the bottom 95% is perfectly fine) domestic political/economic status quo.

The top 5% of the workforce who own most of the assets and earn most of the money are doing just fine; there are tens of thousands of well-paid, affluent top-level Federal employees, Federal contractors (all those National Security State and Military-Industrial contracts are fat, fat, fat), corporate managers, entrenched fiefdom types (city officials pulling in $150K or retiring with pensions of $120K a year), etc.

According to research from Moody’s Analytics, the top 5% of Americans by income are responsible for 37% of all consumer spending--about the same as the entire bottom 80% by income (39.5%).

The bottom 95% can only fantasize about the benefits, salaries and wealth being piled up by the top 1% and the top 5%. But like the slaves/serfs on Roman estates in the glory years of Empire, they don't really matter much as long as they do their jobs or remain distracted by Savior State bread and media circuses.

As a result, unemployment in the U.S. can top 20% and it really doesn't matter to the stock market or the top 5% Power Elites and the well-compensated legion of upper-caste technocrats and factotums who toil away, keeping the vast global machinery humming and the serfs productive or distracted (either one is fine, it doesn't really matter--as long as they're quiet and/or paying their debts).

The costs of keeping 40 million people quiet is trivial to the U.S. Savior State/Global Empire; $40 billion for food stamps is a mere 1.1% of the Federal budget ($3.6 trillion). Those with unearned income pay much lower taxes than those with earned income, so even the burden of paying taxes is not that bad. There are plenty of loopholes, deductions and give-aways to exploit, and pliant congresspeople to buy/lease should the need arise.

Life is good for the owners of capital in the U.S., and so why shouldn't the stock market do well? Profits can rise from global operations and Savior State contracts/"welfare" and as for the domestic economy--even if sales drop, expenses can always drop even faster, leaving hefty profit margins for the major players.

If much of urban America slips into "Fourth World" status, it's not an issue; the wealthy have their enclaves in Manhattan, San Francisco, Malibu, etc. and if life gets ugly in the States then the top 1% can spend more time overseas in other enclaves.

The Empire continues to export paper in exchange for real goods, the world continues to buy the Empire's bonds in their endless trillions, and life for the top 5% and their employers continues to be very good. Overseas revenues and profits are climbing, so why shouldn't the U.S. stock market be rising? The 95% of the domestic populace who are debt serfs are not an issue as long as they're productive, servicing their debts, silent or distracted with Facebook and other entertainments.

As I describe in Survival+, the whole world is a Plantation, including the U.S. The bottom 95% of Americans who own almost no U.S. capital and who faithfully re-elect status-quo incumbents every two years (or better yet, don't even vote) matter as much as the bottom 95% in China or Nigeria, which is to say very little.

Given these profound disconnects, why shouldn't the market rise smartly?

Full disclosure: I have been long the DIA from $98 in early July and have some highly risky, highly speculative calls on BAC. This is a disclosure, NOT an implied recommendation to buy, sell or trade any security, currency, bond, futures contract, or quatloo hedge. Do your own due diligence, research and risk management if you have money at risk.

If you would like to post a comment where others can read it, please go toDailyJava.net, (registering only takes a moment), select Of Two Minds-Charles Smith, and then go to The daily topic. To see other readers recent comments, go to New Posts.

Order Survival+: Structuring Prosperity for Yourself and the Nation and/or Survival+ The Primer from your local bookseller or from amazon.com or in ebook and Kindle formats.A 20% discount is available from the publisher.

Of Two Minds is now available via Kindle: Of Two Minds blog-Kindle

HUGE GIANT BIG FAT DISCLAIMER: Nothing on this site should be construed as investment advice or guidance. It is not intended as investment advice or guidance, nor is it offered as such. It is solely the opinion of the writer, who is NOT an investment counselor/professional. All the content of this website is solely an expression of his personal interests and is posted as free-of-charge opinion and commentary. If you seek investment advice, consult a registered, qualified investment counselor (As with any other professional service, confirm their track record and referrals).

Thank you, Michael H. ($100), for your astoundingly generous donation to the site-- I am greatly honored by your support and readership.