Leviathan and Meme Theory (guest essay)

Leviathan and Meme Theory By Eric A.

Meme Theory and Markets

I wrote last time about how a nation might undergo the same psychological process as an individual, such as Kubler-Ross' "Stages of Grief." Is this in any way real or appropriate? We talk about nations as if they are people: phrases such as the existence of “Young nations”, “National Character”, and “National Embarrassment,” so clearly in the colloquial sense we generally believe it, and it broadly makes sense. But why?

In speaking of how a nation is like a person a picture is worth a thousand words:

This is the illustration from Thomas Hobbes book “Leviathan”,

But a cursory glance shows this extends to human thought as well. What are OUR bodies made of? Where do we get OUR thinking? While no one really knows, one could say that physically we’re composed of millions of individual cells, each with their own specialization and needs, each dependent on the whole body. Cells cannot live outside the body: food, water, energy is delivered to the cells, and wastes are taken away. In exchange for this, the cells collectivize, cooperate, and work, each to their own specialty. Is this somehow different than US households getting their food, water, and energy delivered to them, their sewage and garbage taken away, in exchange for the work they do for the national body? Not really. It’s embarrassing how similar they are.

And psychologically, where do our thoughts come from? It is not, as some meme theories suggest, that we have a crowd of competing thoughts most of the time, and the loudest or most persuasive thoughts prevail, in the same way that an election crowd shouts to a candidate? If you watch your own thoughts as they arise, you can see this effect in yourself, and how our own decisions are made.

Interesting how much a simple form, a cell, has consciousness and is like more advanced, complex forms like individuals or nations. A sort of fractal form appearing again and again from the small to the large. Is there really any difference between individual, living cells creating your body and the individuals, the household cells creating the nation? Between the agitation for pre-eminent ideas in your mind and those agitating for attention and enforcement in public interest groups, think-tanks, and the media? Not really.

Interesting theory. But what good is it?

Remember I spoke of the Kondratiev Cycle, a 72-year wave of human activity?

What a coincidence that the wave exactly matches the average age of a human being! What a coincidence that as the human lifespan has increased, the cycle has lengthened to match! In fact, too much a coincidence to be believed.

What if instead of looking at Kondratiev, we expand our theory and say this is the chart not of a nation, an economy, but of an individual instead? An individual who has a specific birthday, specific events that shape his life which occurred at specific, measurable times. Up-Down, Up-Down, like the turning seasons. In-Out, In-Out, like breathing. It’s a big body: it should breathe slower, think slower, move slower than the quickly respiring and passing cells that compose it.

What does this have to do with markets? Easy. This has to do with what Ben Bernanke, Timmy Geithner and all the other rocket scientists in power are trying. The idea is to “stimulate” the economy. To prevent it from going down the long, dark slope into a 70% contraction in prices, a 25% drop in economic activity.

Why?

Aren’t they saying we should have a summer without a winter? An up without a down? We can forever breathe in, getting larger and larger, and never exhale?

Let’s look closer. Notice that the uptrend takes the 3 quarters, the “seasons” of spring, summer and fall, but that timewise, winter is roughly 1/3rd of the whole wave.

What is “winter” anyway? Quiet. Rest. Withdrawal. But something else too: renewal. Getting back to brass tacks. Shrinking back to what’s important and what needs to be done. Getting your feet back on the ground.

“Winter” in seasonal terms is what “Sleep” is in human terms.

Alan, Ben, Hank, Timmy and the rest are often accused of “Spiking the punchbowl” –a reference to William McChesney Martin’s famous quote that the Central bank is “the fellow who takes away the punch bowl just when the party is getting good.” http://en.wikipedia.org/wiki/William_McChesney_Martin,_Jr.#cite_note-0

Instead of taking away the punchbowl, they are accused of spiking it with yet more easy money to keep the party going. How does this work for our theory?

Pretty good. Look at that red line of wholesale prices. Straight up past its topping date and although it took an initial topple in ’08, is still going up to this day. Clearly, spiking the punchbowl with 0% rates and unlimited quantities of free money in the multi-trillions is working: the National Body is still wide awake. GDP may have flatlined, but it hasn’t crashed. Stock prices are on par with 10 years ago instead of cut in half. The national government and consumer model hasn’t had to cut back. All good things, right?

That depends. What happens when there’s a raucous party and it’s after midnight and people are trying to go home? In fact, why DO we go home? Because we need to rest; we need to return to work in the morning. The market called the party over in 2001 with the stock boom. That was the scheduled date for the Kondratiev winter to begin.

Greenspan said in 1966 and afterwards that he wished he could be Fed Chairman when the winter began to stop it from happening. He had to hold the chair well beyond retirement to the age of 75, but he finally got his chance. In 2001, he used every policy measure in the Fed’s arsenal to prevent Kondratiev's winter. He quickly slashed interest rates to 1%, but more than that, he used his position as key bank regulator and adviser to Congress to allow and encourage lending standards to deteriorate to the point where it was common for homeless men to buy multiple houses with no money down. http://thehousingbubbleblog.com/?p=465

Now THAT’S what I call stimulus. That’s not spiking the punchbowl, that’s piping the room with crystal meth.

And it worked! The revelers did not go home! They partied for another seven years, proving the Federal Reserve and Federal Government had the power to hold back winter; and like King Kanute, to command the tide to come ashore no more!

Greenspan was vindicated; showing the Central powers, the insider billionaires their power over reality was truly unlimited! This was popularized in a quote at the same time, commonly attributed to Karl Rove:

“guys like me [are] "in what we call the reality-based community," which he defined as people who "believe that solutions emerge from your judicious study of discernible reality." ... "That's not the way the world really works anymore," he continued. "We're an empire now, and when we act, we create our own reality. And while you're studying that reality—judiciously, as you will—we'll act again, creating other new realities, which you can study too, and that's how things will sort out. We're history's actors…and you, all of you, will be left to just study what we do."[2] http://en.wikipedia.org/wiki/Reality-based_community --NY Times

They had done it! They were smarter, stronger, better than all the kings and emperors who had ever gone before. By controlling perception, http://en.wikipedia.org/wiki/Edward_Bernays through psychological control and propaganda, they now controlled reality itself!

…Until 2005, that is. By then, cracks in the housing bubble were already showing. Although the new Masters of the Universe DID control perception and use the media to re-create history, they neglected to re-construct one other thing: the laws of mathematics. Without increasing incomes, it was mathematically impossible for asset prices such as housing to rise, just as it was mathematically impossible for ever-increasing debt to be serviced, much less repaid. Keynesianism was now officially dead, as the largest stimulus the world had ever known remained helpless before the simple power of mathematical law.

Seeing this, Greenspan began a hasty search for a suitable replacement, as all the other Greenspan-era Fed Governors demurred and quickly retired. It was difficult to find someone who still believed in Keynes and yet couldn’t see it coming, but in 2006 Greenspan retired, Bernanke was installed, and predictably in 2007, the housing market imploded anyway, and with it the stock market, the financial sector, and the economy itself. Although on Greenspan’s advice Congress had doubled the national debt from $6 to $12 Trillion, and the Greenspan-led public doubled their per-capita debt from $30,000 to $55,000 in 4 years, bankrupting the nation—yet the predicted Kondratiev winter was delayed by only 6 years:

Today, Bernanke and Geithner continue the same failed effort, a rear-guard action as the Insiders feverishly sell out at ratios of 1000:1 and plan the inevitably monetary collapse and transition to a new system.

Question: if the market needs to rest, if the people need to sleep, what happens if you don’t let them? What happens if you take their car keys and force them to mainline cystal meth after their eyes are already red for want of 30 years' rest?

Let’s look:

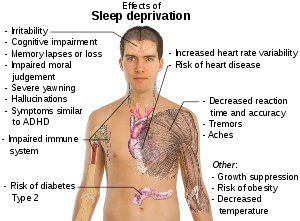

http://en.wikipedia.org/wiki/Sleep_deprivation

“Sleep deprivation is the condition of not having enough sleep; it can be either chronic or acute. A chronic sleep-restricted state can cause fatigue, daytime sleepiness, clumsiness and weight loss or weight gain.[1] It adversely affects the brain and cognitive function.”

Among other symptoms:

Really? How interesting. And what is this “psychosis”?

“…a generic psychiatric term for a mental state often described as involving a "loss of contact with reality"… People experiencing psychosis may report hallucinations or delusional beliefs, and may exhibit personality changes and thought disorder. Depending on its severity, this may be accompanied by unusual or bizarre behavior, as well as difficulty with social interaction and impairment in carrying out daily life...” http://en.wikipedia.org/wiki/Psychosis

Sound like anything that’s been happening nationally since 2001?

Q: What happens when you don’t let the national body rest and sleep when it should, when it needs to?

A: It exhibits classic signs of sleep deprivation.

Is the National body—a supra-body composed of all of us—similar to an individual’s body? You decide.

Regardless, the lesson is the same. Life moves in cycles. You can’t have an eternal summer without a winter. You can’t have an up without a down. You can’t forever inhale and not exhale. And no matter how many drugs you take, you can’t stay awake forever.

How do we solve the national crisis, with over-wrought people increasingly violent and divorced from reality? How about a little financial rest, some time to come back to reality and get our feet back on the ground?

That’s what these economic “Depressions” are in human cycles: winter, sleep, rest, recuperation.

Contrary to the present theory, the Depression, the contraction isn’t the problem: the boom is. The boom over-expands, over-stimulates, over-creates, overdoes it in every way, most noticeably in the creation of unsustainable debt, and “malinvestment” in the capacity to make things people don’t actually need. Reminds that what comes before, “If you find you're in a hole, stop digging” is “if you don't want a hole, don't start digging.”

Once there’s a boom, then to get the economy and finance back to a level matching real demand and real people requires contraction: all the dumb and reckless companies, the dumb and reckless party people are wrung out and their assets are handed to the smart, prudent, and hard-working. The assets aren’t destroyed; they’re simply transferred to stronger owners. Depression doesn’t wipe out anything but our illusions about what is possible on a limited planet with limited resources—just as our self-aggrandizement on alcohol or drugs is merely an illusion easily rectified by the painful reality of the morning after. More drugs will not help but only fray the health of the body more. The only way to sense and good health is to sleep, rest, recover and restore. And that takes time--8 hours of your day, 1/3 of your human life. It takes rest and a lot of doing nothing, or at least very little. Same as a “Depression”, where the country rests, repairs, and restores.

Now this isn’t my theory: this is your basic Austrian economic theory, the theory that, before Keynesianism was considered simple common sense, back when the idea of printing your way to prosperity was the purview of madmen and crackpots. But it was true then and it’s true now.

If you have too much debt in the system, adding more debt won’t help.

If your people are cracking up from stress and overwork, demanding more work by raising their costs and lowering their wages won’t help.

If you already built too much capacity, adding more capacity with the mantra of “Growth” and “Expansion” won’t help.

If your people are over-stimulated nearly to death, more “stimulus” won’t work.

What will work? Well, clearly LESS debt, LESS capacity, LESS work, LOWER prices and an end to artificial stimulation via free money and 0% interest rates. –Just as happened in every other cycle before going back 500 years. Kings, Emperors, Despots—all powerless to stop it, despite every threat, death penalty, and intervention.

One other thing. People wonder why Americans aren’t marching, rioting, protesting, fighting. And the simple answer is in this theory: they’re tired. But more than that, now is not the time for fighting or protesting. It’s time for resting. Demographically the US is aging, just as happened in 1930 and other Depressions in history, just as happens in the “4th Turning” of Strauss and Howe. The Boom and bust were predicted decades before by demographers such as Harry Dent. http://en.wikipedia.org/wiki/Harry_Dent

It’s common, natural, and perfectly predictable. We’re not in the “marching and rioting” phase of life—young nations such as Egypt and the Middle East are. Nationally, we’re in the resting and recovering stage. Government, bankers, policy makers are doing everything they can to keep us awake, overworked, and on ever-increasing quantity of their drug, debt. It will fail or we will collapse trying, then fail anyway.

As Zeus said, what is most likely to happen from here? Further growth? No. Riots and civil wars? Not now. People simply withdraw from a system that no longer works for them and stop supporting it. They simply stop working so hard. In common language, they rest. GDP falls and we adjust to reduced activity and expectations. Later—much later—it starts over again, perhaps with a “Great War” internal or external, but later. Not in the “sleep” cycle.

Q: When you’re in too much debt, what happens?

A: You default or pay it back.

Q: When there’s too much capacity, what happens?

A: Factories close and real estate falls as the overcapacity is absorbed.

Q: When taxes are too high to bear, what happens?

A: They must fall.

Q: When government is too big to support, what happens?

A: It shrinks.

Q: When people are over-worked, over-stimulated, overwrought, what happens?

A: They either rest voluntarily or become so overstimulated they collapse.

Economic Conclusion

We’re going to reduce debt, have high personal and corporate bankruptcy, and high long-term unemployment. In fact, Ben has already publicly admitted as much. With it, GDP and in real terms the stock market will inexorably fall, economic growth will slow, and with it commodity prices. People will be forced back home to do what little there is to do and all that they can, shifting to much more modest and realistic expectations and direct actions. Being at home, family and community will return, small sustainable businesses will form, and economic and personal safety will return. Drug and debt use will fall. As the economy inexorably shrinks, tax revenue shrinks and the government shrinks as well, being seen as incompetent and irrelevant by a whole generation, who no longer looks to it for answers, but works and creates for itself, expecting nothing.

You might notice that increasing relative wages, decreasing debt, decreasing income disparity, repair of family and community, increase in small business, decrease in government and increase in Liberty and a return of common sense is what our leaders and policymakers call a “Depression,” to be avoided at all costs.

Put that way does “Depression” sound so bad, and does “Stimulus” seem like a practical alternative?

Rest. There’s a long battle out there, an epic struggle years in the future, and we’ll need all our strength at that time to face it.

And that is the story of Leviathan, of the nation viewed as one person.

If you would like to post a comment, please go to DailyJava.net.

Order Survival+: Structuring Prosperity for Yourself and the Nation or Survival+ The Primer from your local bookseller or in ebook and Kindle formats.

Of Two Minds is also available via Kindle: Of Two Minds blog-Kindle

Thank you, James P. ($50), for your splendidly generous contribution to this site-- I am greatly honored by your support and readership. Thank you, William M. ($5/mo), for your remarkably generous subscription to this site-- I am greatly honored by your support and readership.