Could Declining House Values Spark the Next Taxpayer Rebellion?

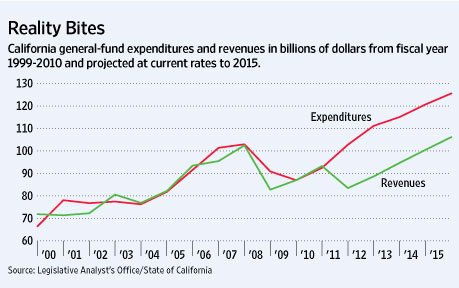

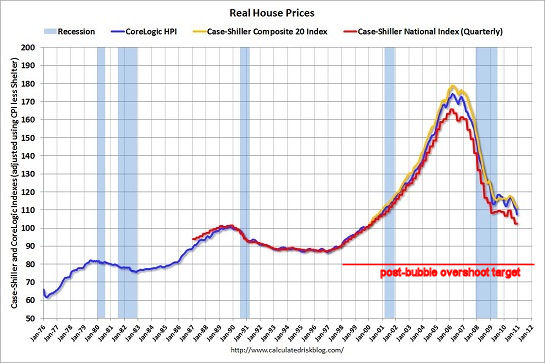

You might think property taxes have declined 30%, paralleling declines in housing values. But nope--property tax revenues have shot up 27% just since 2006. Something remarkable happened to property taxes in the U.S. while housing lost 31% of its value from 2006 to 2009: they went up by $100 billion (27%). Equally remarkably, as we can see from this U.S. Census Bureau data on state and local tax revenues, property taxes went up even when housing slumped in the early 1990s. So though U.S. housing continues losing value--U.S. home prices declined in January,continuing a downward trend that began in August, with average U.S. home prices retreating to summer 2003 levels, according to the S&P Case-Shiller home-price indexes--property tax revenues continue their inexorable rise. I've plotted out the total national property tax revenues on a chart of the Case-Shiller home-price index. According to the Bureau of Labor Statistics inflation measures, if property taxes had risen along with inflation, the total property tax revenues nationally would have risen from $210 billion in 1996--more or less about the start of housing's decade-long bubble--to $296 billion in 2011. But property taxes totaled $476 billion in 2009, a solid 60% ($180 billion) above inflation. So even as the net worth of property has fallen by a third, the property taxes collected from the owners have risen 27%. Exhibit A in this ceaseless rise of property tax revenues is the structural shortfalls in state and local government budgets between what was promised to various fiefdoms and constituencies at the apex of various bubbles, and what is sustainable in non-bubble times. Here is a chart of California's systemic gap between revenues and expenditures. Please note that the apparent alignment of revenues and expenditures in 2010-11 is entirely illusory: the budget gap is $26 billion or perhaps more, once the fantasy accounting is removed. And here is a chart of house prices in a classic symmetrical post-bubble deflation. I've drawn a target which is drawn from the reversion-to-the-mean model that the majority of bubbles track: prices don't just retrace to the starting lift-off point, they overshoot to a level below that initial line. As I reported in House Values Fall 30%, But Property Taxes Keep Rising (December 22, 2010), the nation's state and local governments will collect an estimated $476 billion in property taxes in 2010--about 90% of state income tax revenues of $250 billion and sales tax revenues of $286 billion combined. A decade ago, property taxes were roughly equivalent to sales taxes. In 2000, property taxes totaled $247 billion and sales taxes came in at $223 billion-- a differential of roughly 10%. Sales taxes have increased by 28% since 2000-- roughly in line with the rise in consumer prices. State income taxes have risen nationally from $217 billion in 2000 to $250 billion in 2010, after peaking at $303 billion in 2008, just as the global financial meltdown began. That's a rise of $33 billion, or 15%--actually less than inflation (27% from 2000 to 2010). Add all this up and we can see that local governments have become far more dependent on property tax revenues than they were in 2000. Thanks to stiff increases in junk fees and taxes of all kinds, state and local government revenue has climbed back to its pre-recession height of $1.29 trillion, roughly equal to the $1.32 trillion collected in 2008. In terms of total tax revenue, the recession is over--yet the gap between expenditures and revenues continues to widen in most states and local governments. As their properties continue sliding in value, devastating their net worth, do you reckon the average homeowner might start resenting the rapid rise of the taxes they pay for the privilege of owning real estate? Imagine if your income taxes rose by 27% even as your income declined by 30%. The ultimate tax hostage is the property owner. The business owner can pull up stakes and leave, the wage earner can transfer or get another job elsewhere, and the consumer can restrict his/her consumption to lower the burden of sales taxes, but the property owner is the perfect tax donkey because the transaction costs of selling are so prohibitive. With some 11 million homeowners owing more on their mortgage than their house is worth, i.e. they are underwater, then selling is no longer an option unless the bank accepts a short-sale--something the lenders are loathe to do. Given that there's about 48 million mortgaged homes now, then those 11 million represent about 23% of all homeowners. How long will property owners keep swallowing significantly higher property taxes even as the value of their real estate continues declining? It's an open question. I suspect the answer won't be known until some invisible breaking point is reached, and voters simply rebel against higher taxes while their own net worth and incomes stagnate. Just because there is little visible resistance to sharply higher property taxes (and other taxes and junk fees as well, of course) doesn't mean resistance isn't building below the surface, unreported by a financial media obsessed with the S&P 500 as the only metric of wealth and prosperity and unnoticed by state and local governments obsessed with stripmining more tax revenues by any means at hand. The tax donkey is already weighed down with a heavy load, and it won't take much more than a double-dip recession, higher prices for essentials and declining home values to snap the pack animal's weakened back. The rising S&P 500 looks good as propaganda, but for most Americans, that's about as edible and nourishing as an iPad. Long-time financial supporters of this site: email me if you'd like to receive the (subscribers-only) Weekly Musings email. Of Two Minds Kindle edition: Of Two Minds blog-Kindle

Readers forum: DailyJava.net.

Order Survival+: Structuring Prosperity for Yourself and the Nation (free bits) (Mobi ebook) (Kindle) or Survival+ The Primer (Kindle) or Weblogs & New Media: Marketing in Crisis (free bits) (Kindle) or from your local bookseller.Thank you, Mike S. ($20), for your much-appreciated generous contribution to this site-- I am greatly honored by your support and readership. Thank you, James M. ($20), for your extremely generous contribution to this site -- I am greatly honored by your support and readership.