The Devolution of the Consumer Economy, Part II: Rising Costs, Declining Wages

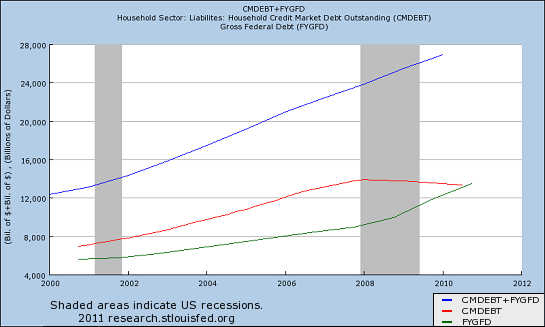

The widening gap between declining incomes and higher costs has been filled with borrowed money. Now that borrowing has reached its limit, and the consumer economy is devolving. Earlier this week I discussed the devolution of the consumer economy with a focus on the diminishing returns of consumption and the limits imposed by servicing ever-growing debts. Today I will address a series of other interconnected reasons why the consumer economy is devolving. The cost structure of the entire U.S. economy has bloated to unsustainable levels.I have discussed this rarely-covered issue for years, for example Lowering the Cost Structure of the U.S. Economy (August 29, 2008) Here's the basic mechanism: when money is "free," costs rise. If you had to explain why sickcare in the U.S. consumes 17% of our nation's GDP while other developed nations provide universal care for half that cost per capita (7-9% of their GDP), the answer boils down to "there's an unlimited amount of free money here for sickcare." There are no real limits on Medicaid or Medicare spending, and none on insurance cartels (it's a free market for health insurance, except there's only two providers in your area and their prices are the same--welcome to a "free market," hahahahaha). In other words, thanks to lack of competition via Central State-granted quasi-monopolies to cartels, and virtually unlimited sums of money for Federal programs, then the sky's the limit on cost. If Medicare limits the cost of an MRI, just triple the number of MRIs you give. Don't laugh--that's exactly what happens. Then there's the hundreds of billions of dollars in outright fraud the system routinely pays. You provide endless free money, costs go up. Look at the education cartel, another parasitic system latched onto the Central State. Once you enable students to borrow $36,000 a year, then magically the costs of a year in college (or for-profit school offering worthless "skills" that do no more for the hapless student than a high school diploma) rise to $36,000. The same dynamic results when oceans of credit are available: assets inflate into bubbles, and costs rise concurrently. The commercial space that once was valued at $1 million magically rises to $3 million when cheap, abundant credit sparks a real estate bubble. As hot money chases higher returns, the costs of servicing that debt rise with every flip and purchase. And it's not just debt servicing which costs more as a result--property taxes jump, too. After a few lucrative flips, the new owner is staggering under a huge mortgage and crushing property taxes. So the space which only a few years ago rented for $1 a square foot now costs $3.50 a foot, just for the owner to break even. That pushes the higher costs down on the small business tenant, who sees their profits vanish. When business sours in the inevitable credit-bubble bust downturn, then the tenant bails, and the landlord is underwater. Bureaucracies and institutions may suffer from Baumol's Disease, but they also suffer from the Ratchet Effect: they only know how to add expenses and scale up.Productivity, Baumol's Disease and the Cliff Just Ahead (December 8, 2010) Baumol's Disease describes the rising costs of sectors whose productivity gains lag behind more productive sectors. Thus education costs more even as manufactured goods fall in price, as labor-intensive education doesn't lend itself to leaps in productivity. But Baumol's Disease doesn't explain why fighter aircraft now cost $300 million each when the "best of the best" five years ago cost $56 million, or how Medicare has leaped from $52 billion a year to $600 billion a year in a decade. Nor does it explain why property taxes have risen 60% above inflation in the past 10 years. What does explain these gigantic increases is monopoly powers granted to cartels by unaccountable State fiefdoms. With the Federal government able to borrow and spend without any visible limits, then the sky's the limit on everything from MRI tests to Medicaid to foreign wars. With the public unable to opt out of local government, then local government expands and passes the costs onto the private-sector tax donkeys. Real wages have been stagnant for decades--but in the last decade, they actually fell by 8%. Median household income of the U.S. fell from over $52,000 in 1999 to $49,777 in 2010: The Lost Decade. As costs for medical care, education, property taxes, etc. skyrocketed far above inflation, credit-driven asset bubbles drove up the cost of housing. Tax policies provided ample incentives to borrowers while super-low interest rates punished savers. The key feature of financialization is that the outsized profits and opportunities come not from producing goods and services but from leveraging, borrowing, obscuring risk and gaming widely ignored regulations. Banks made money not from prudent loans but from taking $1 in deposits and originating $50 of risk-laden loans from that paltry capital. Wall Street reaped billions by packaging high-risk mortgages as "low-risk" investments. The housing bubble offered the ambitious debt serf a rare opportunity to lie and leverage just like Wall Street. Anyone with sufficient chutzpah could buy a number of houses with no-document "liar loans" with option-adjustable rate loans at super-low rates of interest, hold the homes for a few months and then flip them for profits. A few thousand dollars in closing and carrying costs could be leveraged into tens of thousands of dollars in profits which could then be pyramided into more leverage. Debt serfs soon discovered a key difference between their own reckless speculation and Wall Street's reckless speculation: the over-leveraged debt serf was chided as irresponsible when his mini-empire of debt collapsed in a heap, while Wall Street was "saved" by trillions of dollars in Federal cash, credit, backstops and guarantees. With incomes declining, assets imploding and reckless banks suddenly risk-averse, consumers can no longer borrow to fill the widening gap between their income and their consumption. Not to worry--the Federal government has stepped in and borrowed and blown the $5 trillion that the consumer would have borrowed in the past four years if he'd been able to. (Make that $6.5 trillion by October 2012.) So now one unsustainable course of debt expansion has been replaced by another unsustainable course of debt expansion. The apologists and apparatchiks of the Status Quo keep claiming that the State is borrowing 11% of GDP only until private demand roars back to life. This conveniently overlooks the fact that the private sector has been squeezed by declining incomes and rising costs to the point that it no longer has any discretionary spending money nor does it have the leverage to borrow more. It also no longer has enough assets to support reckless bubble borrowing. Debt has this funny characteristic: interest must be paid. Even at low interest rates, this interest becomes an ever-larger drag on income. At some point the interest costs take every last dollar of disposable income, and carefree consumption disappears from the economy. That point was reached in 2008. The Federal debt orgy has simply created an illusory stability and normalcy via "extend and pretend" manipulation and intervention. But the debt serf and his bubble-era mini-empire of expanding debt has been insolvent for three years. The two-decade game of backfilling the widening gap between stagnant income and carefree consumption can no longer be filled with borrowed money. Of Two Minds Kindle edition: Of Two Minds blog-Kindle

Readers forum: DailyJava.net.

Order Survival+: Structuring Prosperity for Yourself and the Nation (free bits) (Mobi ebook) (Kindle) or Survival+ The Primer (Kindle) or Weblogs & New Media: Marketing in Crisis (free bits) (Kindle) or from your local bookseller.Thank you, Nathan J. ($5/mo), for your exceedingly generous subscription to this site-- I am greatly honored by your support and readership. Thank you, Perry C. ($5), for your much-appreciated generous contribution to this site -- I am greatly honored by your encouragement and readership.