About Those Permanently Rising Corporate Profits...

We're constantly assured stocks can't go down because corporate profits are rising. So what happens when they start falling as global recession takes hold and the U.S. dollar stops falling?

The entire "story" of the Bull market is stocks rests on one reed: permanently rising corporate profits. Too bad those profits are set to fall. Like everything else about the "recovery," the "rising corporate profits" story is founded on financial flim-flam, starting with the boost provided by a sinking dollar.

A simple example reveals how a declining dollar has grossly inflated U.S. global corporate profits. Let's say Johnson & Johnson made a 1 euro profit from a sale of toothpaste in Europe in 2003. Translated into U.S. dollars for its financial reports, that 1 euro became $1, as the euro and dollar were at parity.

Now when J&J earn that same 1 euro in profit, it translates into $1.40 in profit. The revenue remained the same, and the profit remained the same, but profits stated in dollars rose 40%.

And this effect isn't limited to Europe. Global Corporate America's profits made in China have risen 20% over the past few years when stated in U.S. dollars (USD) as the yuan has strengthened from 8 to the USD to 6.4 to the dollar.

To truly grasp the monumental scope of this smoke-and-mirrors game of "profits" rising from currency arbitrage, we have to recall that most of the big U.S. global corporations earn between 50% and 65% of their profits overseas. Since the dollar has weakened about 30% in the Fed's free-money campaign (quantitative easing), then we can guesstimate that fully 15% of all profits from global corporations is phantom: if half their profits are earned overseas, and the dollar declined 30%, then their overseas profits rose by 30%. Since that is half of all profit, then that 30% rise boosts total profits by 15%.

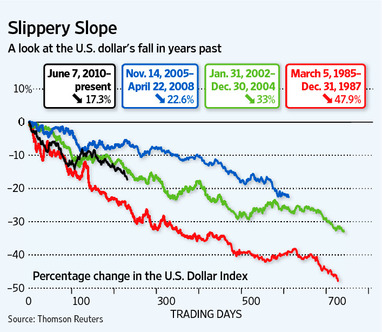

This gaming of corporate profits via weakening the dollar has long been a favorite Fed pastime:

Notice how the long slide in the dollar coincides with the Bull market 2002-08:

As noted on the chart, the game has been disrupted recently as global financial turmoil has led to the dollar slowly rising. Most commentators see the dollar as losing its "safe haven" standing, but safe haven has little to do with demand for dollars: it's much more a matter of needing dollars to pay down debt that is denominated in dollars.

As global financial crisis triggers margin calls and counterparty settlements in dollars, the demand for dollars rise. That's why the dollar spiked during the 2008 meltdown.

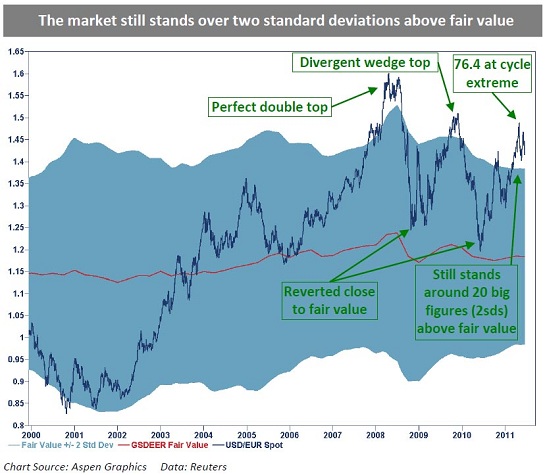

Now there is a second factor driving the dollar higher: the slow but sure demise of the euro. European authorities are rather naturally doing their best to slow the collapse, but their efforts will fail for the all the fundamental reasons I have covered here at length, for example Why the Eurozone and the Euro Are Both Doomed (June 23, 2011).

Since the euro is 60% of the dollar index (DXY), then the euro and the USD are on a see-saw: if the euro declines, the dollar must rise, and vice versa. The euro's current valuation looks extremely high in terms of standard deviation:

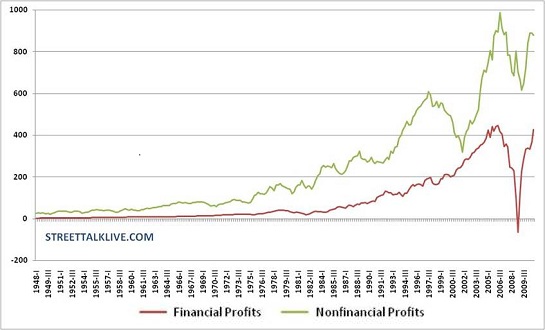

Notice how non-financial (i.e. global) corporate profits spiked up from 2002:

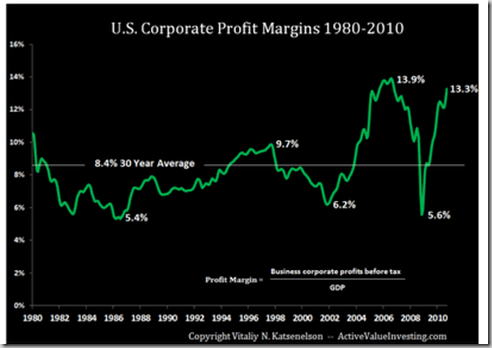

Here we see just how outsized corporate profits have become in historical terms:

What happens to corporate profits if the dollar stops declining? They take a huge hit, that's what.

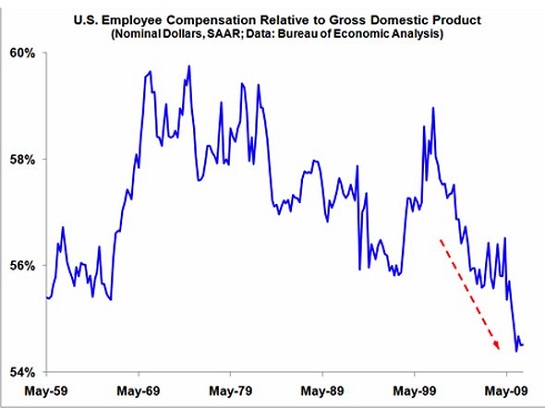

The second reason why corporate profits have soared is labor costs have been slashed via layoffs, early retirement and the wholesale movement to contract/free-lance workforce. Put another way, labor's share of corporate revenues has plummeted, a fact reflected in this chart:

While mass layoffs may be declining, that doesn't mean Corporate America is hiring domestically. Rather, the slash-and-burn campaign to lower labor costs to boost profits continues with undimmed ferocity, as those of you within the gurgling bowels of Corporate America know all too well.

The third factor is the global recession. While headlines this morning are cheering a blip up in retail sales in America as "proof the recovery is intact," the majority of other data from the nation and around the globe indicate a slowing global economy. Corporate America has squeezed vast profits from slashing costs and the weak dollar, but it's reached the point where no more big profits can be reaped from those factors. If revenue slips, so will profits.

A fourth factor is the flow of government largesse will no longer be expanding.Corporations have been reaping guaranteed profits from government spending (not hiring people, just skimming profits), and now that the fiscal flood is facing some constraints, that trillion-dollar prop under Corporate America is weakening.

The easy money's been made from slashing costs and dollar arbitrage; all four supports of corporate profits are at risk. With these props gone, how are corporate profits going to keep rising? If the "rising corporate profits" story dissipates, so does the Bull market.

PODCAST ALERT: Steve over at Two Beers With Steve kindly interviewed me last week, and here's the podcast of the discussion on investing and much more. Thank you, Steve, for the chance to talk about my new book and the future of investing.

If you have some doubts about Wall Street's permanently Bullish "guidance," you might be interested in my new book An Unconventional Guide to Investing in Troubled Times, now available in Kindle ebook format. You can read the ebook on any computer, smart phone, iPad, etc.Click here for links to Kindle apps and Chapter One.

Order Survival+: Structuring Prosperity for Yourself and the Nation (free bits) (Mobi ebook) (Kindle) or Survival+ The Primer (Kindle) or Weblogs & New Media: Marketing in Crisis (free bits) (Kindle) or from your local bookseller. Of Two Minds Kindle edition: Of Two Minds blog-Kindle

Readers forum: DailyJava.net.

My new book An Unconventional Guide to Investing in Troubled Times is available in Kindle ebook format. You can read the ebook now on any computer, smart phone, iPad, etc. Click here for more info about Kindle apps and the book.Thank you, Norman W. ($50), for your phenomenally generous contribution to this site -- I am greatly honored by your support and readership. Thank you, Sean S. ($35), for your wondrously generous contribution to this site -- I am greatly honored by your support and readership.