Tree Hugging and the Limits of Wall Street's Free-Market Theology

"Price discovery" and the ideology of "free global markets" contain a number of intrinsically self-destructive flaws.

I was recently accused of being a tree hugger, with all the negative connotations and disdain implied by that label. Now hear this: I categorically deny being a tree hugger. Like every other red-blooded American, I am a believer in Wall Street's theology of "free and open global markets," which is shorthand for plundering natural resources for my private gain, exploiting labor and corrupt governments around the globe, corrupting our own government with campaign contributions and a 70,000-strong Panzer Division of lobbyists to enhance private gain, and last but not least, investing heavily in evil because the yield is attractive.

In other words, I do not hug trees, I see them as profit centers. Log, baby, log, drill, baby, drill, slash-and-burn, baby, slash-and-burn, and so on, as long as the gain is private.

Oops. Busted. Alright, I confess. I am a tree hugger.

Setting aside the attempt at humor, what we are really dealing with on a global scale is the failure of the reductionist "free market model" of resource, labor and financial exploitation. Proponents of a "free market economy" believe with quasi-religious fervor that open markets solve all problems.

In essence, it all boils down to this: when we as a species/nation/individual have stripmined a resource to near-zero, the cost of the remaining shards will skyrocket due to scarcity. At that point, a mad and highly productive/profitable scramble for alternatives will take place, and magically (another example of cargo cult magic--don't ask for an explanation of the mechanism, just believe), presto-magico, cheap and abundant alternatives will arise out of the boundless Earth and/or humanity's boundless ingenuity.

The problem with this faith is that a great number of things are irreplaceable, and the free-market theology has no mechanism for recognizing this or for "price discovery" of values that cannot be tallied in an intrinsically short-term "open market."

In Survival+ (book), I use the last wild tuna as an example of this dynamic: the last wild tuna will fetch an excellent price on Tokyo's fish market, and so it is highly "rational" in a "free market economy" to fish the species to extinction.

Though the free-market fanatics will claim that "the market" will quickly recognize cod or some other fish species as a replacement/alternative for wild tuna, or that fish-farmed tuna is exactly the same as wild tuna in market terms, both of these claims overlook the fact that the wild tuna is unique in the niche it fills in the ocean ecosystem, and that fish-farming is not a substitute for a wild ocean.

The magic of "price discovery" is inherently and fatally flawed, for it is incapable of pricing in delayed consequences, the value lost in extinction, the social costs of unfettered private gain and the future costs of short-term exploitation.

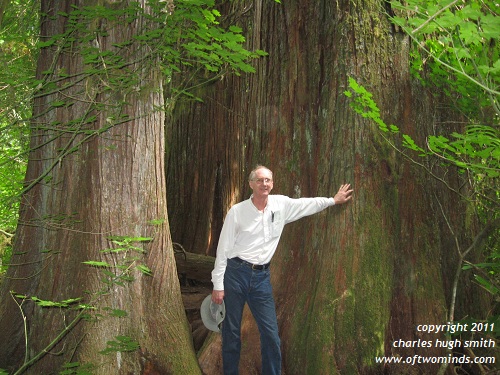

On our recent camping trip, we visited a number of old growth forests which are protected by the National Park Service in the Northern Cascades and around Mount Rainier, both in Washington state.

The "value" of an old-growth forest in free-market ideology is either the board-feet of lumber which can be harvested by clear-cutting the trees, or the value of the preserve as a "tree museum" which can charge an entrance fee, as per Joni Mitchell's song Big Yellow Taxi (1970):

Took all the trees, put 'em in a tree museum

(Adjusted for inflation, we might update the song to "fifteen dollars just to see 'em")

The claim that old-growth forests can be "rationally" reduced to board feet of lumber is to take free-market reductionism to a level which can only be termed insane: old-growth forests are rather visibly more than a stockpile of 2X6s. They have value as irreplaceable storehouses of ecological diversity, as cultural stores of meaning, as placeholders of national identity, as spiritually imbued places, and much more.

To reduce this to a price "discovered" by the market of the moment is delusional. Why would proponents defend this reductionism? Because that reductionism is necessary to justify their personal gain from stripmining a common/social asset.

Old-growth forest (Wikipedia)

96 percent of the original old-growth coast redwoods have been logged.

Are Old-Growth Forests Protected in the U.S.? How much area in the U.S. is still covered with ancient forests? (Answer: remarkably little, less than 1% in most of the country and perhaps 5% in the Northwest.)

There's other intrinsically self-destructive mechanisms within Wall Street's "free global markets" ideology, most notably speculative bubbles. While it is common to blame the global housing bubble on central banks and a perverse lack of official oversight, the reality is that "free markets" are intrinsically prone to speculative bubbles as the "rational" course of action is to chase scarcity/demand trends for speculative profits, regardless of the underlying fundmentals.

We are about to learn another fatal flaw in Wall Street's "free global markets" ideology, something I call the Replacement Fuel Paradox. This joins a list of existing energy-related paradoxes, notably Jevons Paradox, also called The Paradox of Efficiency, which notes that as energy efficiency increases, we use more energy, not less.

There is also The Fossil Fuel Paradox Means Perpetual Recession.

My definition of the Replacement Fuel Paradox is as follows: though they will fluctuate in market value, fossil fuels will remain cheap enough and abundant enough to suppress the rise of alternative fuels, until a phase shift of rapidly declining supply occurs. Since development and investment of alternatives were suppressed by "rational financial considerations," at the point alternatives become "financially rational," the physical plant needed to replace fossil fuels will require at least a decade of massive investment to construct.

As fossil fuels will be scarce, then the pool of investment will be drained by the rising cost of consumption. Alternative fuels will be theoretically available, but the physical reality will be that widespread, abundant alternatives will require more time and capital than the "rational market" can effectively price in or anticipate.

Despite quasi-religious claims to the contrary, oil is not as replaceable as many assume, any more than wild tuna or old-growth forests are replaceable, though for different reasons. I will discuss this in more detail next week.

For more on the possibility that oil supply could decline precipitously rather than gradually, I recommend The Seneca Effect: Why Decline Is Faster Than Growth (The Oil Drum)Production can collapse rather than decline in symmetry with its rise.

If this recession strikes you as different from previous downturns, you might be interested in my new book An Unconventional Guide to Investing in Troubled Times, now available in Kindle ebook format. You can read the ebook on any computer, smart phone, iPad, etc.Click here for links to Kindle apps and Chapter One. The solution in one word: Localism.

Order Survival+: Structuring Prosperity for Yourself and the Nation (free bits) (Mobi ebook) (Kindle) or Survival+ The Primer (Kindle) or Weblogs & New Media: Marketing in Crisis (free bits) (Kindle) or from your local bookseller. Of Two Minds Kindle edition: Of Two Minds blog-Kindle

And charged the people a dollar and a half just to see 'em.

Readers forum: DailyJava.net.

My new book An Unconventional Guide to Investing in Troubled Times is available in Kindle ebook format. You can read the ebook now on any computer, smart phone, iPad, etc. Click here for more info about Kindle apps and the book.Thank you, Jerome M. ($25), for your splendidly generous contribution to this site -- I am greatly honored by your support and readership. Thank you, passgeorgiascience.com ($15), for your much-appreciated generous contribution to this site -- I am greatly honored by your support and readership.