Essays in Fragility: Our One-Off Economy

If you set out to create an increasingly fragile economy, you'd do precisely what the Federal Reserve and our political "leaders" have done.

All the extraordinary measures deployed since 2008 to jumpstart the U.S. economy are one-offs: either they cannot be repeated or they have lost their effectiveness.

These two dynamics--declining effectiveness and unrepeatability--have created a uniquely fragile economy. Once you become dependent on extraordinary fiscal and monetary stimulus, withdrawing the stimulus will trigger a recessionary cascade. But continuing the stimulus cannot duplicate its initial effectiveness, as malinvestment and unintended consequences degrade the initial boost.

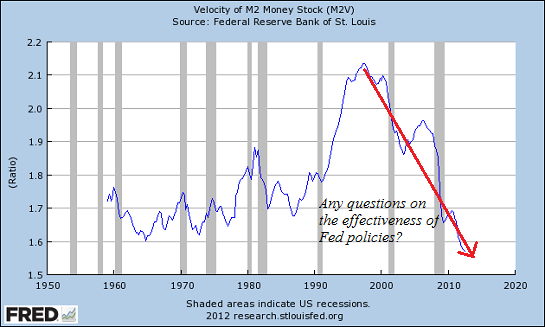

We cannot add another $1 trillion in borrowed money to the $1.3 trillion we're already borrowing every year. The Federal Reserve could expand its balance sheet by another $2 trillion, but in sharp contrast to its earlier injections, the "high" from its latest QE stimulus was next to non-existent.

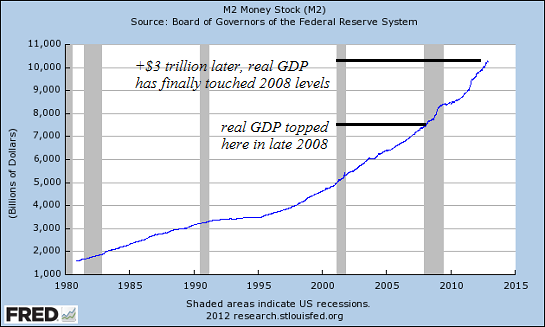

Consider the effects of expanding money supply and lowering interest rates, the Federal Reserve's two primary policies of sparking escape velocity, i.e. a self-sustaining recovery.

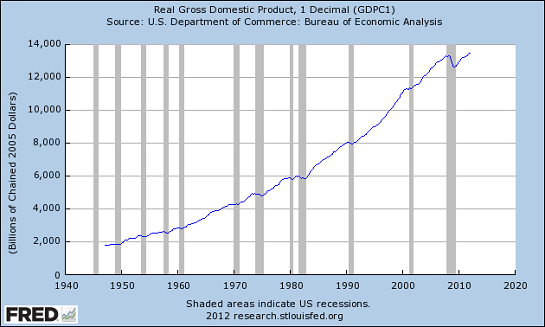

Now look at M2 money supply. It has shot up by about $3 trillion since late 2008. All that expansion accomplished was a return to pre-recession levels. But this is only part of the picture, as unprecedented Federal fiscal deficits pumped $6 trillion in borrowed money into the GDP in that time frame.

So $9 trillion in "free money" merely kept the economy flatlined. If this is a self-sustaining recovery, then we should be able to eliminate the $1+ trillion we're borrowing and blowing every year above and beyond 2008's $300 billion deficit, and we should be able to restrain money supply expansion, too.

The Status Quo is now trapped in a brittle hall of mirrors. Its fiscal profligacy has fueled malinvestment on a grand scale, not a self-sustaining recovery, and its reckless monetary policy of endless easing and zero-interest rates (ZIRP) have led to a dead-money economy: there is plenty of money sloshing around but either A) those who want to borrow it are not qualified to borrow it or 2) those who are qualified to borrow it have zero interest in borrowing it; they are desperately trying to pay down their existing debts, not acquire more debt.

My new book Why Things Are Falling Apart and What We Can Do About It is now available in print and Kindle editions--10% to 20% discounts.

1. Debt and financialization

1. Debt and financialization2. Crony capitalism and the elimination of accountability

3. Diminishing returns

4. Centralization

5. Technological, financial and demographic changes in our economyComplex systems weakened by diminishing returns collapse under their own weight and are replaced by systems that are simpler, faster and affordable. If we cling to the old ways, our system will disintegrate. If we want sustainable prosperity rather than collapse, we must embrace a new model that is Decentralized, Adaptive, Transparent and Accountable (DATA).

We are not powerless. Not accepting responsibility and being powerless are two sides of the same coin: once we accept responsibility, we become powerful.

10% discount on the Kindle edition: $8.95(retail $9.95) print edition: $24 on Amazon.com

To receive a 20% discount on the print edition: $19.20 (retail $24), follow the link, open a Createspace account and enter discount code SJRGPLAB. (This is the only way I can offer a discount.)

| Thank you, Stephen W. ($20), for your wondrously generous contribution to this site -- I am greatly honored by your support and readership. | Thank you, Karl L. ($50), for your stupendously generous contribution to this site --I am greatly honored by your continuing support and readership. |