Eight Trends to Watch in 2014/2015

Here are eight more trends to watch in 2014-2015.

At the beginning of this year (2013), I identified eight key dynamics that will play out over the next two to three years (2013-2015):

Let’s see how the trends developed in 2013:

Additional Trends to Watch in 2014

Since the trends listed above are still operant, these eight are additional rather than replacement trends:Trend #1: The Number One growth industry in the private sector will increasingly be lobbying the government for favors. When the State selects the winners and losers throughout the economy, then companies are essentially forced to make their case for special dispensations via campaign contributions and unrelenting lobbying. Elected officials benefit from their centralized powers as the line of corporations anxiously pressing campaign cash on them lengthens in direct proportion to the expansion of State power.

This is the essence of what some call the Corporatocracy that effectively governs the U.S.A. and what I call the Neofeudal Cartel/State system, as the State and its chosen cartels dominate the economy and society in a fashion that can only be described as neofeudal.

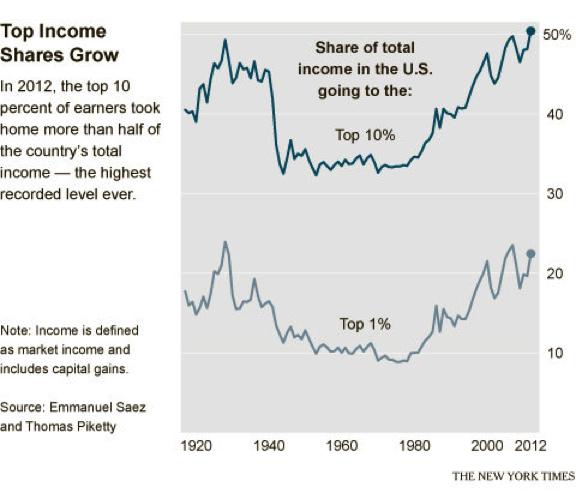

Since organic growth from increases in wages and purchasing power are limited to the top 10%, the only sectors that can possibly gain growth from rising sales are Porsche dealerships and other luxury outlets that cater to the top 10%. But since the number of households adding income is a thin 10 million out of 121 million households, moving more luxury goods offers little growth opportunities for the rest of the economy, which is stagnant at best.

As a result, lobbying the central State for favors is the default “growth industry.”

Trend #2: The difference between anemic growth and recession will increasingly be semantic. This is another “How many angels can dance on the head of a pin?” debate in which Ivory Tower/State economists parse juiced or manipulated data to conclude the economy is “growing slowly” or slipping into negative growth; i.e., recession.

Experientially, if purchasing power and discretionary income (what’s left after paying taxes, rent, mortgages, food, utilities, etc.) are both declining for 90% of households, the “growth” in inventories, exports, and other factors that feed into gross domestic product (GDP) are not reflecting the economy we actually inhabit.

Trumpeting what amounts to signal noise as “steady growth” is adept perception management (i.e., propaganda), but if it doesn’t include increases in purchasing power and discretionary income for the bottom 90%, it’s a propaganda embarrassment, like the Fed official hyping the declining cost of tablet computers while someone in the audience shouts, I can’t eat an iPad!

Trend #3: The decline in local government services will accelerate as rising pension/healthcare costs squeeze budgets. Local governments (city, county, state) have avoided the politically combustible collision of rising pension/healthcare costs and angry taxpayers tired of service cuts by accounting trickery and jacking up fees and taxes. Crunch-time has also been put off by rising home values that pushed property tax revenues higher.

These solutions are running out of rope: Property values have topped out, and accounting trickery hasn’t solved the fiscal impossibility of maintaining services and meeting pension obligations in a stagnant economy. When push comes to shove, services must be cut, either by bankruptcy or by negotiation.

Since the likelihood that taxes will drop is zero, taxpayers will get fewer services for their taxes.

Trend #4: Middle-class income, purchasing power, and discretionary income will all continue to stagnate. Unless you define “middle class” as those households earning $150,000 and up (9.1% of households)—and if you define the top 9% as “middle” class, your definition has lost all meaning—what’s left of the middle class will see real and discretionary income continue to stagnate. The causes of this decline in labor’s share of the economy are structural and cannot be remedied by lowering interest rates to zero or jacking up the stock market: Zero-interest rates have deprived households of income, and few in the bottom 90% own enough stock to affect their wealth. (Source: The Distribution of Household Income and the Middle Class)

Trend #5: Junk fees will continue to replace legitimate taxes. Fearful of blowback from ever-rising taxes, local governments have turned to junk fees as the preferred method of “revenue enhancement.” These include sharply higher fees for recreation, parking tickets, permits, etc., and a multitude of add-ons to property taxes and other existing tax structures. Local authorities are counting on the taxpayers to sigh but do nothing as long as the fee increases are small enough to avoid triggering political resistance.

In our small California town, the city has raised the fees for trash pickup by more than 100% in recent years—ironically, their reason is that recycling (which they encourage) has reduced the amount of trash being collected. This sort of nonsensical rationalization for radically higher fees will join the usual justifications; i.e., We can no longer fill potholes and pave streets unless we raise your taxes.

How did they manage to perform these basic services 10 or 20 years ago with much smaller budgets? The answer: See Trend #3, skyrocketing pension and healthcare costs.

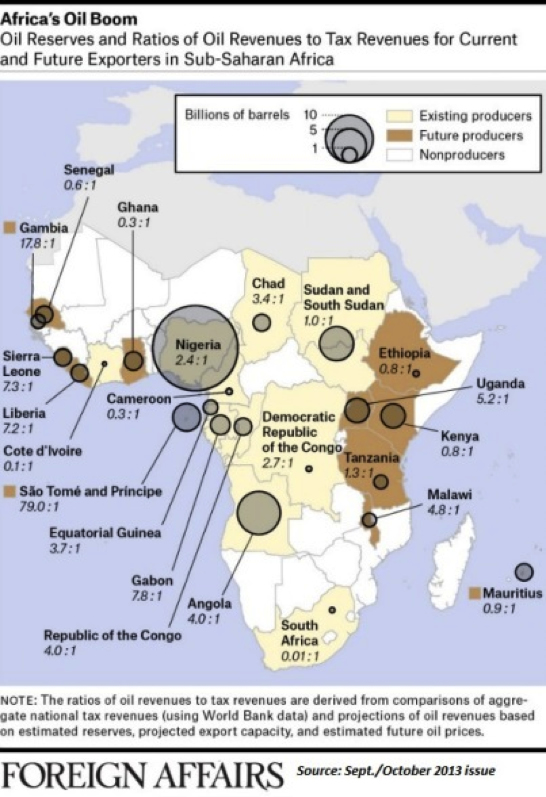

Trend #6: The African oil exporting nations will move from the back burner to the front ranks of geopolitical flashpoints, joining the South China Sea, the Mid-East, and North Korea. I recently discussed The Scramble for Africa's Oil and the “resource curse” that is fueling the potential for conflict over Africa’s untapped oil wealth:

Trend #7: Americans will continue to passively accept the rise of the Police/National Security State. This may eventually change, but for the next few years the existing motivations for passive acceptance of increasing centralization of power will continue to hold sway.

The first is complicity: The 49% of all Americans—156 million out of 317 million—who receive direct transfers/benefits from the Federal government see little reason to rock the boat or put their cash from the government at risk. (Source)

The second reason is a rational fear of State power: fear of getting tear-gassed and arrested should you join a protest, for example, and a generalized fear of putting whatever you still have at risk by confronting a government given to secrecy and retribution against whistleblowers, protesters, etc.

Trend #8: The Federal government will quietly absorb the rising losses from defaulting student loans rather than reveal the bankruptcy of the entire Higher Education/Student Loan Cartel. There are myriad ways to quash the recognition that the Higher Education/Student Loan Cartel is failing to provide useful education while it burdens younger generations with $1+ trillion in high-interest debt: quietly forgive some defaulted loans, stop enforcing collection of defaulted loans, etc. The Federal government doesn’t want to call attention to its management of this powder keg, as widespread recognition that the system is broken will unleash calls for a general debt amnesty that will blow the big-debt-for-worthless-degrees system wide apart.

In Part II: Outcomes to Bet On in 2014, we’ll forecast the most likely consequences of these trends. With such understanding comes the opportunity to position ourselves in front of them for protection and/or profit.

Click here to access Part II of this report (free executive summary; enrollment required for full access).

This essay was first published on peakprosperity.com.

The Nearly Free University and The Emerging Economy:

The Revolution in Higher Education

Reconnecting higher education, livelihoods and the economy

We must thoroughly understand the twin revolutions now fundamentally changing our world: The true cost of higher education and an economy that seems to re-shape itself minute to minute.

Things are falling apart--that is obvious. But why are they falling apart? The reasons are complex and global. Our economy and society have structural problems that cannot be solved by adding debt to debt. We are becoming poorer, not just from financial over-reach, but from fundamental forces that are not easy to identify. We will cover the five core reasons why things are falling apart:

1. Debt and financialization

1. Debt and financialization2. Crony capitalism

3. Diminishing returns

4. Centralization

5. Technological, financial and demographic changes in our economy

Complex systems weakened by diminishing returns collapse under their own weight and are replaced by systems that are simpler, faster and affordable. If we cling to the old ways, our system will disintegrate. If we want sustainable prosperity rather than collapse, we must embrace a new model that is Decentralized, Adaptive, Transparent and Accountable (DATA).

We are not powerless. Once we accept responsibility, we become powerful.

Kindle: $9.95 print: $24