Doomed If We Do, Doomed If We Don't

Even if we used a 10:1 fractional reserve ratio, the Fed’s $85 billion per month QE was creating $10 trillion per year in liquidity.

The point to understanding the Status Quo financial system is doomed is not to revel in the doom but to understand why we have to look past the current corrupt, predatory, parasitic system to a better arrangement. That's positive.

Longtime correspondent Harun I. submitted this quote from John Ing and a commentary on simple arithmetic. In “We Are Nowhere Near The Chaos That I Expect", John Ing observes the consequences of deleveraging a highly leveraged system:

"We have already had $3 trillion in stock market capitalization wiped out. It is amazing that just a $20 billion tapering has been enough to cause all of this chaos around the globe.”Harun then explained why it isn't amazing at all--it's entirely predictable:

Simple arithmetic will do. The Fed is leveraged 72:1. For every dollar it removes, it actually removes 72. The product of 72 and 20 is 1,440. The Fed has actually removed nearly $1.5 trillion of liquidity with its $20 billion tapering.

It is a mathematical certainty that this geometric progression of debt growth will end (remember, for everything that is growing geometrically, that upon which the growth is dependent is contracting at the same rate). The contraction (deleveraging) must necessarily be as geometric as the expansion (leveraging).

The Fed can try to keep interest rates at zero but there will be dire consequences. The Fed can try to “taper” but there will be dire consequences.

What I find amazing is that even if we used a 10:1 fractional reserve ratio, the Fed’s $85 billion per month QE was creating $10 trillion per year in liquidity.

The World Economic Forum reported in 2011 that $100 trillion in new credit would be needed for world growth going forward. How long does anyone think tapering will last?Trying to force simplistic results out of complex systems inevitably generates unintended consequences. Liquidity and credit expansion act like pressure in a closed system; central planners look at the site of the last financial break and see no leaks, so they assume they've got the system under control.

Over US$ 100 Trillion Additional Credit Needed to Support Global Growth(World Economic Forum)

But the next failure in the system will occur where no one is looking--the points in the system that everyone assumes are "safe."

The system is doomed if central banks continue creating trillions of dollars in new leveraged credit and liquidity to keep the system from imploding, and it is also doomed if they cease creating new leveraged credit (i.e. taper their geometric expansion of credit). Doomed if you do taper, doomed if you don't taper.

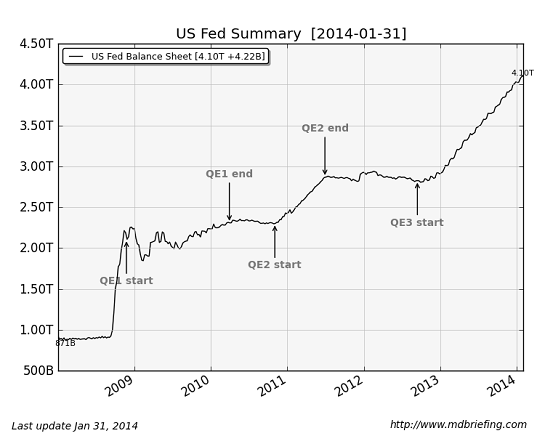

Here's the Fed balance sheet. If you get a magnifying glass, you might discern some tapering.

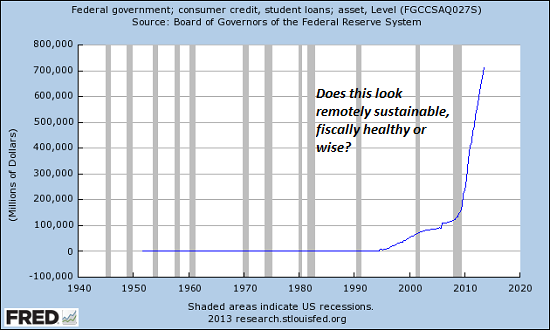

Geometric expansion of credit is visible throughout the system. Never mind the infamous shadow banking system--look at the insane expansion of credit/debt in student loans:

Of related interest:

Resolution #1: Let's Call Things What They Really Are in 2014 (January 15, 2014)

The Federal Reserve's Nuclear Option: A One-Way Street to Oblivion (February 5, 2014)

Want to Reduce Income/Wealth Inequality? Abolish the Engine of Inequality, the Federal Reserve (January 28, 2014)

The Nearly Free University and The Emerging Economy:

The Revolution in Higher Education

Reconnecting higher education, livelihoods and the economyWith the soaring cost of higher education, has the value a college degree been turned upside down? College tuition and fees are up 1000% since 1980. Half of all recent college graduates are jobless or underemployed, revealing a deep disconnect between higher education and the job market.

It is no surprise everyone is asking: Where is the return on investment? Is the assumption that higher education returns greater prosperity no longer true? And if this is the case, how does this impact you, your children and grandchildren?

We must thoroughly understand the twin revolutions now fundamentally changing our world: The true cost of higher education and an economy that seems to re-shape itself minute to minute.

The Nearly Free University and the Emerging Economy clearly describes the underlying dynamics at work - and, more importantly, lays out a new low-cost model for higher education: how digital technology is enabling a revolution in higher education that dramatically lowers costs while expanding the opportunities for students of all ages.

The Nearly Free University and the Emerging Economy provides clarity and optimism in a period of the greatest change our educational systems and society have seen, and offers everyone the tools needed to prosper in the Emerging Economy.

Read Chapter 1/Table of Contents

print ($20) Kindle ($9.95)

Things are falling apart--that is obvious. But why are they falling apart? The reasons are complex and global. Our economy and society have structural problems that cannot be solved by adding debt to debt. We are becoming poorer, not just from financial over-reach, but from fundamental forces that are not easy to identify. We will cover the five core reasons why things are falling apart:

1. Debt and financialization

1. Debt and financialization2. Crony capitalism

3. Diminishing returns

4. Centralization

5. Technological, financial and demographic changes in our economyComplex systems weakened by diminishing returns collapse under their own weight and are replaced by systems that are simpler, faster and affordable. If we cling to the old ways, our system will disintegrate. If we want sustainable prosperity rather than collapse, we must embrace a new model that is Decentralized, Adaptive, Transparent and Accountable (DATA).

We are not powerless. Once we accept responsibility, we become powerful.

Read the Introduction/Table of ContentsKindle: $9.95 print: $24

| Thank you, Gary G. ($150), for yet another outrageously generous contribution to this site -- I am greatly honored by your steadfast support and readership. | Thank you, John F. ($5/month), for your most generous re-subscription to this site -- I am greatly honored by your steadfast support and readership. |