How The Fed Has Failed America, Part 2

The only way to eliminate the financial parasites is to stop subsidizing their skimming and scamming, and the only way to stop subsidizing the financial parasites is to shut down the Fed.

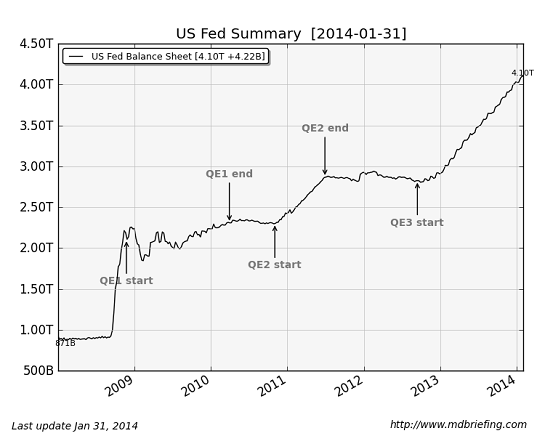

Before I explain how the Federal Reserve has failed America, let's do a little thought experiment. Let's imagine that instead of creating $3.2 trillion and giving it to the banking sector to play with--funding carry trades and high-frequency trading, for example--the Fed had invested in carry trades itself and returned the profits directly to taxpayers.

Before we go through the math, let's recall how a carry trade works: Financiers borrow billions at near-zero interest from the Fed and then use the free money to buy bonds in other countries where the return is (say) 5%. The financiers are skimming 4.75% or more for doing nothing other than having access to the Fed's free money.

If the bonds rise in value (because interest rates decline in the nation issuing the bonds), the financiers skim additional profit. If the trade can be leveraged via derivatives, then the annual return can be bumped up from 5% to 10%.

OK, back to the experiment. The Fed created $3.2 trillion in its quantitative easing (QE) programs. let's say the Fed's money managers (or gunslingers hired by the Fed to handle the trading) earn around 5% annually with various low-risk carry trades.

That works out to an annual profit of $160 billion (5% of $3.2 trillion). Now let's say the Fed divvied the profit up among everyone who paid Social Security taxes the previous year. That's around 140 million wage earners. Every person who paid Social Security taxes would receive $1,100 from the Fed's carry trade profits.

The point of this experiment is to suggest that there were plenty of things the Fed could have done with its $3.2 trillion that would have directly benefited taxpaying Americans, but instead the Fed funneled all those profits to financiers and banks.

The Fed apologists claim that lowering interest rates to zero benefited American who saw their interest payments decline. Nice, but not necessarily true. Try asking a student paying 9% for his student loans how much his interest rate dropped due to Fed policy. Or ask someone paying 19.9% in credit card interest (gotta love that .1% that keeps it under 20%)--how much did your interest drop as a result of Fed policy?

Answer: zip, zero, nada. The Fed's zero interest rate policy (ZIRP)funneled profits to the banks, not to borrowers.

And let's not forget that many Americans chose not to borrow at all. What did the Fed do for them? It stole the interest they once earned on their savings. Estimates vary, but it is clear that the Fed's ZIRP transferred hundreds of billions of dollars in interest to the banking sector, income forceably "donated" by savers to the banks.

Lowering interest rates to zero is effectively a forced subsidy of borrowers by savers. But that's not the only subsidy: who makes money from originating and managing loans? Banks. The more loans that are originated, the higher the transaction fees and profits flowing to banks. So incentivizing borrowing generates more profits for banks.

Humans make decisions based on the incentives and disincentives in place at the time of their decision. Lowering the cost of money (interest) to zero creates an incentive to gamble the money on low-yield bets. After all, if you can earn 3% on the free money, then why not skim the free 3%?

If speculators had to pay 6% for money and 7.5% for mortgages (the going rate in the go-go 1990s), then the number of available carry trades plummets. The only carry trades that make sense when you're paying 6% for money are those with yields of 10%--and any bond paying 10% carries a high risk of default (otherwise, the issuer wouldn't have to offer such a high rate of interest to lure buyers).

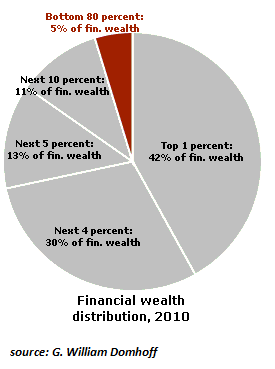

All of these incentives to borrow money at zero interest rate are only available to banks and financiers. And that's the point of the Fed's policies: to stripmine the bottom 99.5% and transfer the wealth to banks and financiers. Lowering interest rates to zero incentivizes carry trades and speculative bets that do absolutely nothing for America or the bottom 99.5% of taxpayers.

A self-employed worker pays 50% more tax than a hedge funder skimming billions of dollars in carry trades. A self-employed worker pays 15.3% in Social Security and Medicare taxes and a minimum of 15% Federal income tax for a minimum of 30.3%. (The higher your income, the higher your tax rate, which quickly rises to 25% and up.) The hedge funder pays no Social Security tax at all because the carry trade profits are "long-term capital gains" which are taxed at 15% (20% if the Hedgie skims more than $400,000 a year).

Despite the Fed apologists' claims that ZIRP and free money handed to banks and financiers create jobs and start businesses, there is absolutely no evidence to support this claim. The only beneficiaries of Fed policies are tax accountants for the banks and financiers and luxury auto dealerships. Since Porsches and Maseratis are not made in the U.S., the benefits of the top .5% buying costly gew-gaws and evading taxes is extremely limited.

Attention, all apologists, lackeys, toadies, minions and factotums of the Fed: is there any plausible explanation for the wealthiest .5% pulling away from everyone else since the Fed launched ZIRP and QE other than Fed policies? And while we're at it, how about publishing a verifiable list of companies that were founded and now employ hundreds of people because the owners could borrow millions of dollars at zero interest?

Get real--no new business can borrow Fed money for zero interest. The only entities that can borrow the Fed's free money are banks and other financial parasites.

The truth is the Fed incentivizes and rewards the most parasitic, least productive sector of the economy and forcibly transfers the interest that was once earned by the productive middle class to the parasites. Though the multitudes of apologists, lackeys, toadies, minions and factotums of the Fed will frantically deny it, the inescapable truth is that the nation and the bottom 99.5% would be instantly and forever better off were the Fed closed down and its assets liquidated.

The only way to eliminate the financial parasites is to stop subsidizing their skimming and scamming, and the only way to stop subsidizing the financial parasites is to shut down the Fed.

Source: Wealth, Income, and Power (G. William Domhoff)

The Nearly Free University and The Emerging Economy:

The Revolution in Higher Education

Reconnecting higher education, livelihoods and the economyWith the soaring cost of higher education, has the value a college degree been turned upside down? College tuition and fees are up 1000% since 1980. Half of all recent college graduates are jobless or underemployed, revealing a deep disconnect between higher education and the job market.

It is no surprise everyone is asking: Where is the return on investment? Is the assumption that higher education returns greater prosperity no longer true? And if this is the case, how does this impact you, your children and grandchildren?

We must thoroughly understand the twin revolutions now fundamentally changing our world: The true cost of higher education and an economy that seems to re-shape itself minute to minute.

The Nearly Free University and the Emerging Economy clearly describes the underlying dynamics at work - and, more importantly, lays out a new low-cost model for higher education: how digital technology is enabling a revolution in higher education that dramatically lowers costs while expanding the opportunities for students of all ages.

The Nearly Free University and the Emerging Economy provides clarity and optimism in a period of the greatest change our educational systems and society have seen, and offers everyone the tools needed to prosper in the Emerging Economy.

Read Chapter 1/Table of Contents

print ($20) Kindle ($9.95)

Things are falling apart--that is obvious. But why are they falling apart? The reasons are complex and global. Our economy and society have structural problems that cannot be solved by adding debt to debt. We are becoming poorer, not just from financial over-reach, but from fundamental forces that are not easy to identify. We will cover the five core reasons why things are falling apart:

1. Debt and financialization

1. Debt and financialization2. Crony capitalism

3. Diminishing returns

4. Centralization

5. Technological, financial and demographic changes in our economy

Complex systems weakened by diminishing returns collapse under their own weight and are replaced by systems that are simpler, faster and affordable. If we cling to the old ways, our system will disintegrate. If we want sustainable prosperity rather than collapse, we must embrace a new model that is Decentralized, Adaptive, Transparent and Accountable (DATA).

We are not powerless. Once we accept responsibility, we become powerful.

Read the Introduction/Table of ContentsKindle: $9.95 print: $24

| Thank you, Claire B. ($50), for your superbly generous contribution to this site -- I am greatly honored by your steadfast support and readership. | Thank you, Guy T. ($50), for your splendidly generous contribution to this site -- I am greatly honored by your steadfast support and readership. |