The solution to the erosion of the middle class lifestyle is to destroy debt and other fixed costs and eliminate self-sabotaging discretionary consumption.

Last week I covered the structural dynamics causing the decline of the middle class. In general, the costs of untradable services (healthcare, higher education, government) and the rot of financialization have increased while wages have stagnated. The Federal Reserve's "solution" was to make everyone who owned a house a speculator who could only keep even with rising costs by riding the asset bubbles higher and then extracting the "free money" generated by these bubbles before they popped.

Let's take two representative households to understand the decline of the middle class and the solution. Let's say both households earn $81,000 annually, virtually all from wages and salaries. This puts the family at around the 70% mark of U.S. households, just within the top 30%. (For context, the 2011 median household income was $50,054.)

This income is solidly middle class: not low enough to qualify for much in the way of government subsidies but not high enough to avoid prioritizing and trade-offs.

Household A has a big mortgage on a house they bought near the top of the market with a minimal down payment, student loans, two auto loans and credit card balances. After making the loan payments and paying for utilities, transportation, groceries, employees' share of healthcare costs, eating out, mobile phone/broadband/TV service plans, there is little money left to save for emergencies, travel, college for the kids, home maintenance, etc.

How do we describe this family: middle class or debt-serfs? Actually, they're both:measured by what they superficially own (home, two vehicles, communication and entertainment devices, college degrees, etc.), this household is solidly middle class. But measured by how much income is spent servicing debt, how much is left to accumulate or invest, the family's net worth (their assets' market value minus debt) and generational wealth, this household is mired in debt-serfdom: their debts will never be paid off.

The mortgage will never be paid off, and by the time the parents' student loan debt is reduced, the next generation's student loans are piling up. The auto loans may eventually be paid off, but it will look cheaper to buy a new vehicle with a modest monthly payment than to pay costly auto maintenance with scarce cash.

Debt anchors this household's fealty to the state and financial sector as securely as any medieval peasant household's bond to the noble's manor house. This is the basis of my characterization of the U.S. economy as a neofeudal arrangement based on debt.

Household B shares the family home that is owned free and clear (mortgage has been paid off) with other family members, owns debt-free vehicles and maintains the cars themselves, rarely eats out, has no student loans (either paid cash for college, used scholarships and grants or paid their loans off), buys cheap catastrophic medical insurance and invests money in staying healthy/preventative care, i.e. eating and preparing real food and enjoying regular fitness, lives close to work, invests some of the ample family savings in enrichment (lessons for the kids, etc.), occasional frugal travel and income-producing assets and retains the rest for emergencies such as vehicle breakdown, medical emergency, etc.

If this scenario seems "impossible," recall that 1/3 of all homes (roughly 26 million houses) in the U.S. are owned free and clear, i.e. there is no mortgage.

How do we describe this family: middle class or wealthy? Actually, they're both:this household has a solidly middle class income, but because they've eradicated fixed costs (most importantly, debt, costly "gold-plated" healthcare insurance, etc.) and discretionary luxuries such as eating out, costly entertainment plans, etc., but measured by their values, behaviors and net income saved and invested, this household is upper-middle class or wealthy, having achieved a level of prosperity that eludes free-spending households with double their annual income.

The solution to the erosion of the middle class lifestyle is to destroy debt and other fixed costs and eliminate self-sabotaging discretionary consumption that cripples the household's ability to accumulate capital that generates income. There is nothing magical about the values and behaviors that enable this; it boils down to choosing to leave the permanent adolescence of debt-based consumerism behind and move up to a more prosperous, productive way of living: doing more with less.

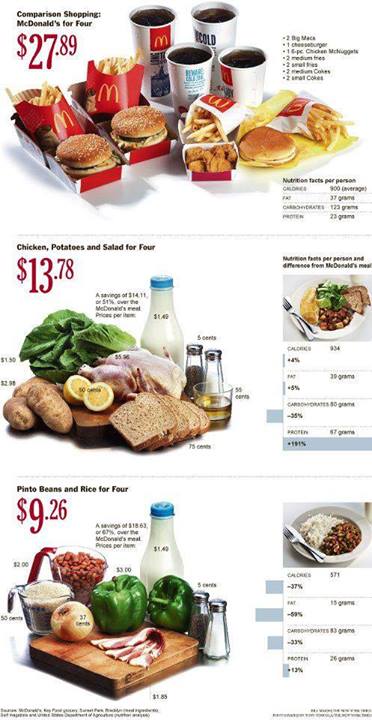

I am indebted to Paul C. for this graphic depiction of how instant-gratification consumption that appears "cheap" is actually horrendously expensive when the consequential costs and alternatives are considered:

This is but one example of many in which the lower-cost alternative is the better choice, not just in value but in opportunity costs. We assess the opportunity costs of every purchase or loan by asking one simple question: what else could we have done with this money?

It's a question that is scale-invariant, that is, it works as well for a nation as it does for an individual, and every organization between these two ends of the economic spectrum.

In the case of the debt-serf "middle class" household, the answer to the question, "what else could we have done with our money?" is slowly build productive assets and prosperity that is within your own control.

Get a Job, Build a Real Career and Defy a Bewildering Economy(Kindle, $9.95)(print, $20)

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible.

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible.

And like most of you, the way I've moved toward my goal has always hinged not just on having a job but a career.

You don't have to be a financial blogger to know that "having a job" and "having a career" do not mean the same thing today as they did when I first started swinging a hammer for a paycheck.

Even the basic concept "getting a job" has changed so radically that jobs--getting and keeping them, and the perceived lack of them--is the number one financial topic among friends, family and for that matter, complete strangers.

So I sat down and wrote this book: Get a Job, Build a Real Career and Defy a Bewildering Economy.

It details everything I've verified about employment and the economy, and lays out an action plan to get you employed.

I am proud of this book. It is the culmination of both my practical work experiences and my financial analysis, and it is a useful, practical, and clarifying read.

Test drive the first section and see for yourself. Kindle, $9.95 print, $20

"I want to thank you for creating your book Get a Job, Build a Real Career and Defy a Bewildering Economy. It is rare to find a person with a mind like yours, who can take a holistic systems view of things without being captured by specific perspectives or agendas. Your contribution to humanity is much appreciated."

Laura Y.

| Thank you, John K. ($100), for your outrageously generous contribution to this site -- I am greatly honored by your steadfast support and readership. | | Thank you, Matt P. ($50), for your splendidly generous contribution to this site -- I am greatly honored by your support and readership. |

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible.

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible.