We've put all our hopes, dreams and chips on Plan A, as if security flows from institutional promises rather than from being adaptable, resilient and able to create value in a variety of circumstances.

Setting aside monsters under the bed, the Ebola virus and fanatical terrorists bent on our destruction--what are we so afraid of? It must be something, because fear is the ever-present backdrop in America.

If you don't get a college degree, it's widely assumed that you're doomed to a life of involuntary poverty of part-time toil in a coffee bar or big-box retailer--if you're lucky enough to find a job at all.

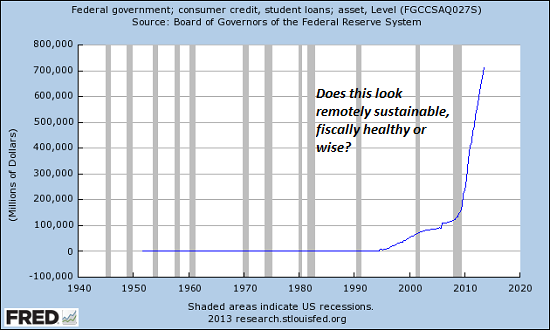

Fear drives students and their families to borrow immense sums for mostly marginal college educations: here are Federal student loans--is anybody on this debt-rocket-ride to the moon asking if there is a Plan B or C that doesn't require a life of debt-serfdom/indentured servitude?

But the fear of being inadequate to the Darwinian scramble for security starts much earlier than college. The anxiety starts in kindergarten, as ambitious parents sweat the application process to prep schools, knowing that getting their little darling in at age 5 is easier than trying to get them through the even more brutal competition at age 8, 10 or 12.

The undergraduate anxiety is soon replaced by an even more costly fear: that the graduate won't ascend the academic ladder and gain acceptance to a prestigious law, medical or graduate school.

Alas, the fear of insecurity doesn't end with a graduate degree. In many cases, the deeply indebted graduate finds thousands of other job seekers have equivalent degrees and equally carefully groomed resumes.

Those who secure corporate-government jobs that qualify them for home ownership discover new sources of fear: for example, that home valuations might not keep rising. That the value of their house might decline or even collapse strikes terror in the hearts and minds of mortgage holders.

Then there's the fear surrounding that proxy of prosperity, the stock market. If stocks crater enough to return to reasonable valuations, countless retirement plans will be turned to ash. The other supposed bulwark of financial security, corporate and government bonds, generate their own high levels of anxiety: should interest rates return to historic levels from the current near-zero rates, the value of long-term bonds will tank.

I've been told that some college students exit with degrees in hand and are lost when a secure, high-paying job doesn't manifest. It seems these graduates had no Plan B or Plan C: they gambled tens of thousands of dollars in student loan debt and 4+ years on Plan A with no thought to their future should Plan A fail.

This seems to be apt analogy of America as a whole: we've put all our hopes, dreams and chips on Plan A, as if security flows from institutional promises rather than from being adaptable, resilient and able to create value in a variety of circumstances.

Fear is the backdrop of experience in America because we're terrified of the prospect that Plan A--the status quo promises of secure lifetime employment and early retirement funded by endlessly rising wealth--will fail. Beneath the surface of this everpresent fear lies the real source of our insecurity and terror: in our heart of hearts, we already know that Plan A has failed, but we're too afraid to face the consequences of this systemic failure.

It seems to me that durable security arises from embracing insecurity and contingency and building a wide spectrum of skills and human, social and real-world assets rather than seeking the illusory security offered by an institution whose promises rest on phantom wealth and claims on future taxpayers.

Get a Job, Build a Real Career and Defy a Bewildering Economy(Kindle, $9.95)(print, $20)

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible.

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible.

And like most of you, the way I've moved toward my goal has always hinged not just on having a job but a career.

You don't have to be a financial blogger to know that "having a job" and "having a career" do not mean the same thing today as they did when I first started swinging a hammer for a paycheck.

Even the basic concept "getting a job" has changed so radically that jobs--getting and keeping them, and the perceived lack of them--is the number one financial topic among friends, family and for that matter, complete strangers.

So I sat down and wrote this book: Get a Job, Build a Real Career and Defy a Bewildering Economy.

It details everything I've verified about employment and the economy, and lays out an action plan to get you employed.

I am proud of this book. It is the culmination of both my practical work experiences and my financial analysis, and it is a useful, practical, and clarifying read.

Test drive the first section and see for yourself. Kindle, $9.95 print, $20

"I want to thank you for creating your book Get a Job, Build a Real Career and Defy a Bewildering Economy. It is rare to find a person with a mind like yours, who can take a holistic systems view of things without being captured by specific perspectives or agendas. Your contribution to humanity is much appreciated."

Laura Y.

Gordon Long and I discuss The New Nature of Work: Jobs, Occupations & Careers(25 minutes, YouTube)

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

| Thank you, Paul C. ($150), for your outrageously generous contribution to this site-- I am greatly honored by your steadfast support and readership. | |

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible.

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible.