Given the presumed 17% expansion of the global economy since 2009, the tiny increases in production could not possibly flood the world in oil unless demand has cratered.

"First, it is an outlier, as it lies outside the realm of regular expectations, because nothing in the past can convincingly point to its possibility. Second, it carries an extreme 'impact'. Third, in spite of its outlier status, human nature makes us concoct explanations for its occurrence after the fact, making it explainable and predictable."

Simply put, black swans are undirected and unpredicted. The Wikipedia entry lists three criteria based on Taleb's work:

1. The event is a surprise (to the observer).

2. The event has a major effect.

3. After the first recorded instance of the event, it is rationalized by hindsight, as if it could have been expected; that is, the relevant data were available but unaccounted for in risk mitigation programs.

It is my contention that the recent free-fall in the price of oil qualifies as a financial Black Swan. Let's go through the criteria:

1. How many analysts/pundits predicted the 37% decline in the price of oil, from $105/barrel in July to $66/barrel at the end of November?Perhaps somebody predicted a 37% drop in oil in the span of five months, but if so, I haven't run across their prediction.

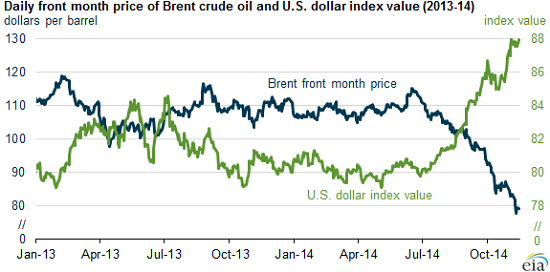

For context, here is a chart of crude oil from 2010 to the present. Note that price has crashed through the support that held through the many crises of the past four years. The conclusion that this reflects a global decline in demand that characterizes recessions is undeniable.

I think we can fairly conclude that this free-fall in the price of oil qualifies as an outlier outside the realm of regular expectations, unpredicted and unpredictable.

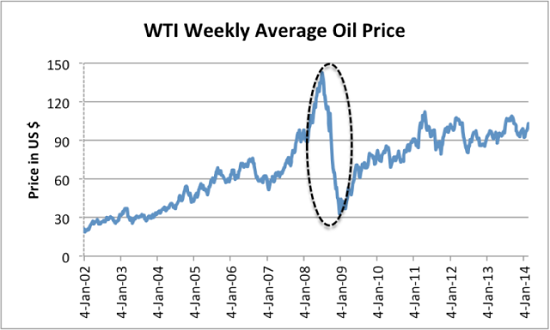

Why was it unpredictable? In the past, oil spikes tipped the global economy into recession. This is visible in this chart of oil since 2002; the 100+% spike in oil from $70+/barrel to $140+/barrel in a matter of months helped push the global economy into recession.

The mechanism is common-sense: every additional dollar that must be spent on energy is taken away from spending on other goods and services. As consumption tanks, over-extended borrowers and lenders implode, "risk-on" borrowing and speculation dry up and the economy slides into recession.

But the current global recession did not result from an oil spike. Indeed, oil prices have been trading in a narrow band for several years, as we can see in this chart from the Energy Information Agency (EIA) of the U.S. government.

Given the official denial that the global economy is recessionary, it is not surprising that the free-fall in oil surprised the official class of analysts and pundits. Since declaring the global economy is in recession is sacrilege, it was impossible for conventional analysts/pundits to foresee a 37% drop in oil in a few months.

As for the drop in oil having a major impact: we have barely begun to feel the full consequences. But even the initial impact--the domino-like collapse of the commodity complex--qualifies.

I will address the financial impacts tomorrow, but rest assured these may well dwarf the collapse of the commodity complex.

As for concocting explanations and rationalizations after the fact, consider the shaky factual foundations of the current raft of rationalizations. The primary explanation for the free-fall in oil is rising production has created a temporary oversupply of oil: the world is awash in crude oil because producers have jacked up production so much.

Even the most cursory review of the data finds little support for this rationalization. According to the EIA, the average global crude oil production (including OPEC and all non-OPEC) per year is as follows:

2008: 74.0 million barrels per day (MBD)

2009: 72.7 MBD

2010: 74.4 MBD

2011: 74.5 MBD

2012: 75.9 MBD

2013: 76.0 MBD

2014: 76.9 MBD

The EIA estimates the global economy expanded by an average of 2.7% every year in this time frame. Thus we can estimate in a back-of-the-envelope fashion that oil consumption and production might rise in parallel with the global economy.

In the six years from 2009 to 2014, oil production rose 3.9%, from 74 MBD to 76.9 MBD. Meanwhile, cumulative global growth at 2.7% annually added 17.3% to the global economy in the same six-year period. What is remarkable is not the extremely modest expansion of oil production but how this modest growth apparently enabled a much larger expansion of the global economy. ( Other sources set the growth of global GDP in excess of 20% over this time frame.)

Given the presumed 17% to 20+% expansion of the global economy since 2009, the small increases in production could not possibly flood the world in oil unless demand has cratered. The "we're pumping so much oil" rationalizations for the 37% free-fall in oil don't hold up.

That leaves a sharp drop in demand and the rats fleeing the sinking ship exit from "risk-on" trades as the only explanations left. We will discuss these later in the week.

Those who doubt the eventual impact of this free-fall drop in oil prices might want to review The Smith Uncertainty Principle (yes, it's my work):

Every sustained action has more than one consequence. Some consequences will appear positive for a time before revealing their destructive nature. Some will be foreseeable, some will not. Some will be controllable, some will not. Those that are unforeseen and uncontrollable will trigger waves of other unforeseen and uncontrollable consequences."

I call your attention to the last line, which I see as being most relevant to the full impact of oil's free-fall.

Get a Job, Build a Real Career and Defy a Bewildering Economy(Kindle, $9.95)(print, $20)

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible. And like most of you, the way I've moved toward my goal has always hinged not just on having a job but a career.

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible. And like most of you, the way I've moved toward my goal has always hinged not just on having a job but a career.

You don't have to be a financial blogger to know that "having a job" and "having a career" do not mean the same thing today as they did when I first started swinging a hammer for a paycheck.

Even the basic concept "getting a job" has changed so radically that jobs--getting and keeping them, and the perceived lack of them--is the number one financial topic among friends, family and for that matter, complete strangers.

So I sat down and wrote this book: Get a Job, Build a Real Career and Defy a Bewildering Economy.

It details everything I've verified about employment and the economy, and lays out an action plan to get you employed.

I am proud of this book. It is the culmination of both my practical work experiences and my financial analysis, and it is a useful, practical, and clarifying read.

Test drive the first section and see for yourself. Kindle, $9.95 print, $20

"I want to thank you for creating your book Get a Job, Build a Real Career and Defy a Bewildering Economy. It is rare to find a person with a mind like yours, who can take a holistic systems view of things without being captured by specific perspectives or agendas. Your contribution to humanity is much appreciated."

Laura Y.

Gordon Long and I discuss The New Nature of Work: Jobs, Occupations & Careers(25 minutes, YouTube)

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

| Thank you, Andre K. ($10), for your much-appreciated generous contribution to this site-- I am greatly honored by your support and readership. |

|

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible. And like most of you, the way I've moved toward my goal has always hinged not just on having a job but a career.

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible. And like most of you, the way I've moved toward my goal has always hinged not just on having a job but a career.