No one can answer that question for anyone else, but it seems prudent to ask the question in the context of an Echo Bubble in valuations that appears to be deflating.

Readers often ask me if now is a good time to buy a house. This question has appeared in my inbox for the past nine years, as the Housing Bubble reached its climax, burst, and an Echo Bubble arose in its place.

It’s a tough question, as you know, for reasons that are inherent to buying and owning real estate, and to the uniqueness of every household's finances and needs. So I always start by saying I can't offer any advice or even suggestions, because everyone's situation is unique.

In many cases, readers are seeking reassurance that it's OK to buy a house for reasons other than financial: they're having another child, their parents need them close at hand, and so on.

This is the dual nature of housing: it is both an enormous financial commitment and home/shelter.

The problem with being an enormous financial commitment is two-fold:

1. The size of the financial commitment outweighs every other expense and risk of capital. Mortgage, property taxes and maintenance typically consume more of the household budget than any other item.

2. Housing is illiquid and the transaction costs are high. If I want to sell $200,000 of Apple shares, the cost is a trivial sum and the transactions is completed in a few seconds, as Apple stock, like most large corporate shares, is highly liquid.

If I want to sell a $200,000 house, the process typically takes months and costs between 7% and 10% of the asking price in commissions, closing costs and fees.

Should I buy a house in 2015? Rather than seek a yes/no answer, let's try to identify some key reference points to consider.

1. Length of occupancy. If somebody buys a house with a fixed-rate mortgage and has a realistic plan to live in the house for 20+ years, fluctuations in value and demand don't matter much.

2. The potential consequences of a decline in value if the Echo Bubble pops. If, on the other hand, somebody is buying a house that they plan to sell in a few years to fund their retirement, that's a very different set of risks.

If somebody buys a house for long-term shelter and location for $400,000, and it drops to $200,000 five years into their ownership, it hurts their net worth but has no real effect on their daily life. As long as they can continue to pay the mortgage, life goes on.

The person who has to sell to fund their retirement, on the other hand, is devastated by the decline from $400,000 to $200,000. Daily life is much harder after the loss of $200,000+ in irreplaceable capital.

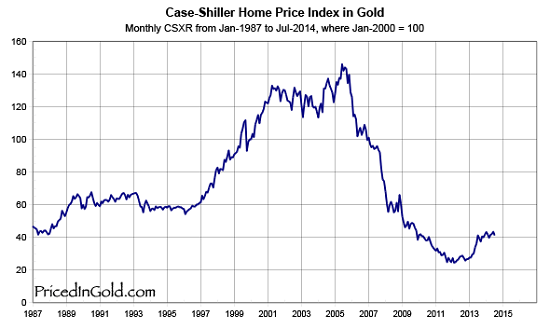

3. What else could you do with the capital sunk into a house? One way to consider this question is to consider the relative value of housing in something other than dollars, for example, to price housing in alternative investment options such as gold and stocks.

The website Priced in Gold has some interesting charts reflecting the ratio of gold to housing, as measured by the Case-Shiller Index.

One way to think about this is to ask: how many ounces of gold does it take to buy the median-value home in my area?

As investors, we ideally want to buy assets at their relative bottom and sell them at their relative top, and switch out from fully valued assets into relatively cheap assets.

4. Can you pay all housing costs out of one paycheck? People naturally calculate their ability to pay on their present circumstances, but the possibility of global recession and financial instability should give us pause.

Rather than assume household income will remain stable or increase in the years ahead, it is prudent to consider the possibility that one earner loses their job and is unemployed for an extended period of time.

If the house cannot be paid for out of one income, the household is risking default and loss of all the invested capital should one wage earner lose their job.

This is the problem with the fixed costs of owning a house: the costs are inflexible. The county doesn't care that you lost your job; the property taxes must be paid or the county will pursue auctioning off your property to pay the tax liability.

Renters can move much more easily than home owners, so one cost in buying a house is a loss of flexibility and the burden of fixed costs.

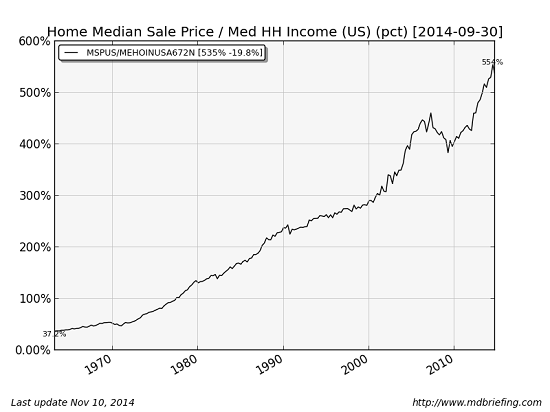

5. How is housing priced in terms of median household income? Another way of assessing the relative value of housing is to measure the price in terms of median household income. Yes, low mortgage rates means mortgage payments are smaller than they were in previous eras, but income is still the foundation of debt, including mortgages.

Courtesy of Market Daily Briefing, here is a chart of the case-Shiller Index and median household income:

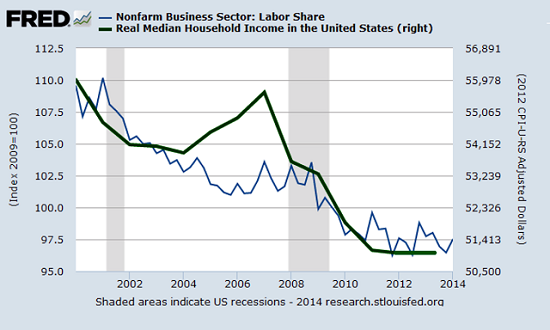

By this measure, housing has never been more expensive. The reason why: household income has stagnated or declined for years while the price of housing has surged:

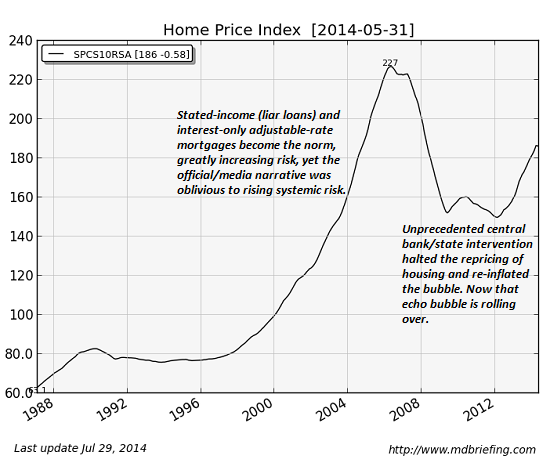

Meanwhile, home values rose in an Echo Bubble, which is now rolling over:

Should I buy a house in 2015? No one can answer that question for anyone else, but it seems prudent to ask the question in the context of an Echo Bubble in valuations that appears to be deflating and household income that is potentially at risk of declining further in a global recession that eventually impacts the U.S. economy.

Get a Job, Build a Real Career and Defy a Bewildering Economy(Kindle, $9.95)(print, $20)

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible.And like most of you, the way I've moved toward my goal has always hinged not just on having a job but a career.

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible.And like most of you, the way I've moved toward my goal has always hinged not just on having a job but a career.

You don't have to be a financial blogger to know that "having a job" and "having a career" do not mean the same thing today as they did when I first started swinging a hammer for a paycheck.

Even the basic concept "getting a job" has changed so radically that jobs--getting and keeping them, and the perceived lack of them--is the number one financial topic among friends, family and for that matter, complete strangers.

So I sat down and wrote this book: Get a Job, Build a Real Career and Defy a Bewildering Economy.

It details everything I've verified about employment and the economy, and lays out an action plan to get you employed.

I am proud of this book. It is the culmination of both my practical work experiences and my financial analysis, and it is a useful, practical, and clarifying read.

Test drive the first section and see for yourself. Kindle, $9.95 print, $20

"I want to thank you for creating your book Get a Job, Build a Real Career and Defy a Bewildering Economy. It is rare to find a person with a mind like yours, who can take a holistic systems view of things without being captured by specific perspectives or agendas. Your contribution to humanity is much appreciated."

Laura Y.

Gordon Long and I discuss The New Nature of Work: Jobs, Occupations & Careers(25 minutes, YouTube)

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

| Thank you, Pad S. ($60), for your stupendously generous contribution to this site-- I am greatly honored by your support and readership. |

|

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible.And like most of you, the way I've moved toward my goal has always hinged not just on having a job but a career.

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible.And like most of you, the way I've moved toward my goal has always hinged not just on having a job but a career.