China: Doomed If You Do, Doomed If You Don't

Thank you, Donald B. ($50), for your sumptuously generous contribution to this site-- I am greatly honored by your steadfast support and readership.

|

Self-Reliance in the 21st Century

When You Can't Go On: Burnout, Reckoning and Renewal

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

Will You Be Richer or Poorer? Profit, Power and A.I. in a Traumatized World

Inequality and the Collapse of Privilege

Spanish edition: Un Mundo Radicalmente Prospero

Why Our Status Quo Failed and Is Beyond Reform

A Radically Beneficial World: Automation, Technology and Creating Jobs for All

Get a Job, Build a Real Career and Defy a Bewildering Economy

The Nearly Free University and The Emerging Economy

Resistance, Revolution, Liberation

An Unconventional Guide to Investing in Troubled Times ) Survival+: Structuring Prosperity for Yourself and the NationWeblogs & New Media: Marketing in Crisis

Novels:

The Secret Life of an Asian Heroine

The Adventures of the Consulting Philosopher

I-State Lines

Our print books:

Ultra-Processed Life

Self-Reliance in the 21st Century

When You Can't Go On: Burnout, Reckoning and Renewal

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet

Will You Be Richer or Poorer?: Profit, Power and A.I. in a Traumatized World

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic

Inequality and the Collapse of Privilege

Why Our Status Quo Failed and Is Beyond Reform

A Radically Beneficial World: Automation, Technology and Creating Jobs for All

Get a Job, Build a Real Career and Defy a Bewildering Economy

The Nearly Free University and the Emerging Economy

Resistance, Revolution, Liberation: A Model for Positive Change

An Unconventional Guide to Investing in Troubled Times

Weblogs & New Media: Marketing in Crisis

Audiobooks

The Mythology of Progress

Self-Reliance in the 21st Century

When You Can't Go On: Burnout, Reckoning and Renewal

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the U.S.

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

Will You Be Richer or Poorer? Profit, Power, and AI in a Traumatized World

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic

Inequality and the Collapse of Privilege

Why Our Status Quo Failed and Is Beyond Reform

A Radically Beneficial World: Automation, Technology and Creating Jobs for All

Get a Job, Build a Real Career and Defy a Bewildering Economy

NOVELS

The Secret Life of an Asian Heroine

Thank you, Donald B. ($50), for your sumptuously generous contribution to this site-- I am greatly honored by your steadfast support and readership.

|

Thank you, Jeff P. ($100), for your outrageously generous contribution to this site-- I am greatly honored by your steadfast support and readership.

|

Thank you, Julius P. ($20), for your marvelously generous contribution to this site-- I am greatly honored by your support and readership.

|

Thank you, Laura D. ($50), for your stupendously generous contribution to this site-- I am greatly honored by your steadfast support and readership.

|

Thank you, Mark M. ($25), for your much-appreciated generous contribution to this site-- I am greatly honored by your support and readership.

|

Thank you, Charles B. ($50), for your exceedingly generous contribution to this site-- I am greatly honored by your steadfast support and readership.

|

All content on this blog is provided by Trewe LLC for informational purposes only. The owner of this blog makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. The owner will not be liable for any errors or omissions in this information nor for the availability of this information. The owner will not be liable for any losses, injuries, or damages from the display or use of this information. These terms and conditions of use are subject to change at anytime and without notice.

Our Privacy Policy:

Correspondents' email is strictly confidential. This site does not collect digital data from visitors or distribute cookies. Advertisements served by a third-party advertising network (Investing Channel) may use cookies or collect information from visitors for the purpose of Interest-Based Advertising; if you wish to opt out of Interest-Based Advertising, please go to Opt out of interest-based advertising (The Network Advertising Initiative). If you have other privacy concerns relating to advertisements, please contact advertisers directly. Websites and blog links on the site's blog roll are posted at my discretion.

PRIVACY NOTICE FOR EEA INDIVIDUALS

This section covers disclosures on the General Data Protection Regulation (GDPR) for users residing within EEA only. GDPR replaces the existing Directive 95/46/ec, and aims at harmonizing data protection laws in the EU that are fit for purpose in the digital age. The primary objective of the GDPR is to give citizens back control of their personal data. Please follow the link below to access InvestingChannel’s General Data Protection Notice. https://stg.media.investingchannel.com/gdpr-notice/

Notice of Compliance with

The California Consumer Protection Act

This site does not collect digital data from visitors or distribute cookies.

Advertisements served by a third-party advertising network

(Investing Channel) may use cookies or collect information from visitors for the

purpose of Interest-Based Advertising. If you do not want any personal information

that may be collected by third-party advertising to be sold, please

follow the instructions on this page:

Limit the Use of My Sensitive Personal Information.

Regarding Cookies:

This site does not collect digital data from visitors or distribute cookies. Advertisements served by third-party advertising networks such as Investing Channel may use cookies or collect information from visitors for the purpose of Interest-Based Advertising; if you wish to opt out of Interest-Based Advertising, please go to Opt out of interest-based advertising (The Network Advertising Initiative) If you have other privacy concerns relating to advertisements, please contact advertisers directly.

Our Commission Policy:

As an Amazon Associate I earn from qualifying purchases. I also earn a commission on purchases of precious metals via BullionVault. I receive no fees or compensation for any other non-advertising links or content posted on my site.

What subscribers are saying about the Musings (read samples):

"What makes you a channel worth paying for? It's actually pretty simple - you possess a clarity of thought that most of us can only dream of, and a perspective that allows you to focus on the truth with laser-like precision." Jim S.

The "unsubscribe" link is for when you find the usual drivel here insufferable.

"Why Are You So Negative?" Good Question. 4 Answers from Real Life

Our Mutually Reinforcing Crises

No, The Economy Is Not Wonderful

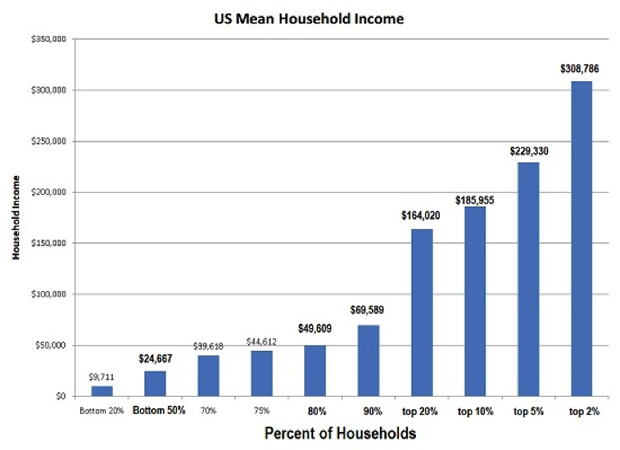

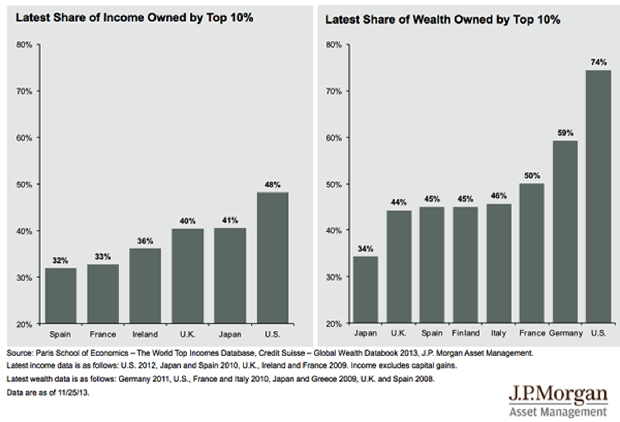

The Wealthy Are Not Like You and Me: Our Terminally Stratified Society

I'm Not Really Enjoying the Show

The Child Within Is More Than "The Child Within"

Our Three Taboos (2023)

Weaponizing Global Depression (2023)

Our Economy In a Nutshell (2022)

Livelihoods in a Degrowth Economy (2022)

Doom Porn and Empty Optimism (2022)

A Note on my One-Star Reviews (2022)

The Community Economy Needs Its Own Money (2022)

The Only Non-Totalitarian Solution to Resource Scarcity: Decentralized Degrowth

CLIME: Community Owned Corporations

The Architecture of a Labor-Backed Cryptocurrency (2016)

A Teachable Moment: Being Fired from Yelp

For Aspiring Writers: the Worst Advice You'll Ever Read (2005)

China: An Interim Report: Its Economy, Ecology and Future (2005)

© Blogger templates Newspaper III by Ourblogtemplates.com 2008

Back to TOP