If others in our class are still rising while we're stagnating, we sense a great disturbance in the financial and political Force.

Rising economic inequality tends to generate political instability for all the obvious reasons: the rich get richer, the poor get poorer, the rich say let them eat brioche and next thing you know, the ungrateful wretches are tearing down the Bastille and a youthful army officer has to restore order with a whiff of grapeshot. After which he launches a war of conquest that kills hundreds of thousands and bankrupts nations.

So yes, economic inequality can generate quite a spot of bother.

Historian Peter Turchin identified "the degree of solidarity felt between the commons and aristocracy," the sense of purpose and identity shared by the top, middle and bottom of the wealth/power pyramid, as a key ingredient of social unity and political stability.

One measure of this unity of purpose and identity is the degree of inequality between commoners (the lower 90% of American households by wealth/income), the top 10% professional/technocrat class that owns 74% of the wealth and pays almost 80% of the federal income taxes, and the Power Elite aristocracy (the top .1%).

History supports two narratives of rising inequality leading to social disintegration and political instability: one is inequality between the top classes and everyone else, and the the other is rising inequality within the top classes.

When the pie starts shrinking and there aren't enough slices to satisfy the rising expectations of the top class, the elites splinter in profound political disunity. In other words, when the offspring of the top 10% earn MBAs from respected universities and can only find internships, their parents become extremely dissatisfied with the status quo.

Josh and Maddie living at home or being subsidized by Mom and Dad was not part of the expected payoff for reaching the top tier of American society. Toss in a stock market crash or two, a medical emergency with co-pays larger than the GDP of small nations and a slump in business/fees/bonuses, and what people who expected to live comfortably on Easy Street are experiencing is downward mobility.

Many in the bottom 90% are also experiencing downward mobility, but their expectations tend to be less elevated than the professional/technocrat class.

Studies have found that our sense of wealth is less a matter of the actual dollar amount and more a matter of how we measure up to our peers. If our entire class is experiencing stagnating income, we're less likely to feel a sense of social inequity.

But if others in our class are still rising while we're stagnating, we sense a great disturbance in the financial and political Force. If our neighbor's kids are landing partnerships (due to superior connections, of course) while Josh and Maddie struggle to escape Intern-Hell, we sense a huge gulf opening that isn't necessarily reflected in income/wealth statistics.

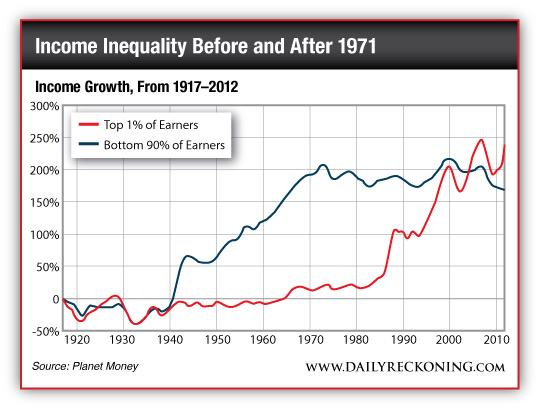

As this chart shows, income of the bottom 90% has been stagnating for decades.

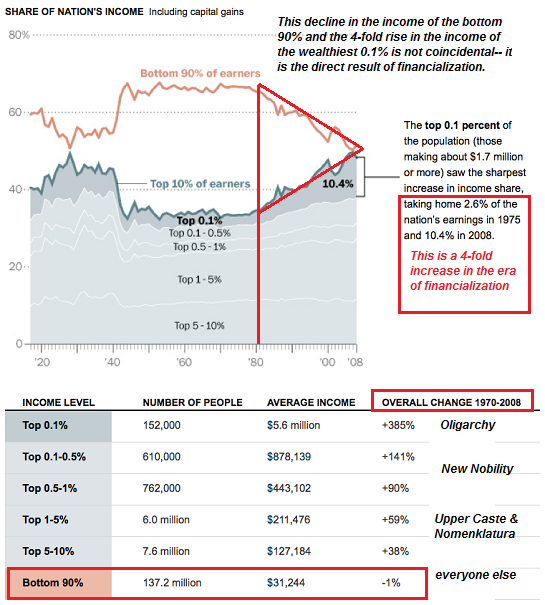

Here's another look at the same dynamics:

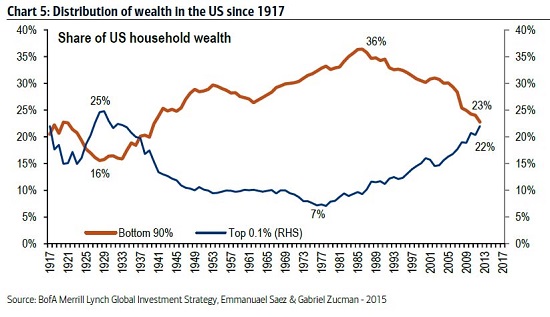

While the top .1%'s share of the pie has been rising, everyone else's share has declined:

Slowly but surely, the downward mobility of the upper class is fracturing the expectations and sense of social justice of those who own 74% of the wealth and take home 50% of the income. This class has the expectations, the sense of injustice, the wealth and the income to cause political trouble.

Once the upper class fractures, you get profound political disunity.

Of related interest:

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, Ramon E. ($10/month), for your outrageously generous subscription to this site -- I am greatly honored by your support and readership.

| |

Thank you, William F. ($10), for your most generous contribution to this site -- I am greatly honored by your support and readership.

|