Once private credit rolls over in China and the U.S., the global recession will start its rapid slide down the Seneca Cliff.

Few question the importance of private credit in the global economy. When households and businesses are borrowing to expand production and buy homes, vehicles, etc., the economy expands smartly.

When private credit shrinks--that is, as businesses and households stop borrowing more and start paying down existing debt--the result is at best stagnation and at worst recession or depression.

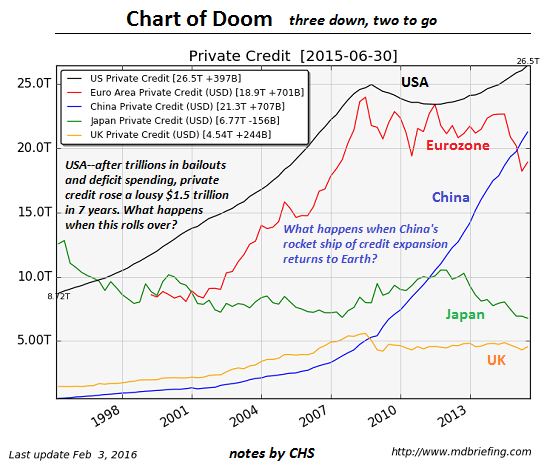

Courtesy of Market Daily Briefing, here is The Chart of Doom, a chart of private credit in the five primary economies:

Why is this The Chart of Doom? It's fairly obvious that private credit is contracting in Japan and the Eurozone and stagnant in the U.K.

As for the U.S.: after trillions of dollars in bank bailouts and additional liquidity, and $8 trillion in deficit spending, private credit in the U.S. managed a paltry $1.5 trillion increase in the seven years since the 2008 financial meltdown.

Compare this to the strong growth from the mid-1990s up to 2008.

This chart makes it clear that the sole prop under the global "recovery" since 2008-09 has been private credit growth in China. From $4 trillion to over $21 trillion in seven years--no wonder bubbles have been inflated globally.

Combine this expansion of private credit in China with the expansion of local government and other state-sector debt (state-owned enterprises, SOEs, etc.) and you have the makings of a global bubble machine.

In other words, the faltering global "recovery" and all the tenuous asset bubbles around the world both depend on a continued hyper-velocity rocket rise in China's private credit. What are the odds of this happening? Aren't the signs that this rocket ship has burned its available fuel abundant?

Three out of the five major economies are already experiencing stagnant or negative private credit growth. Three down, two to go. Helicopter money--government issued "free money" to households--is no replacement for private credit expansion.

Admin note: I will be busy with family commitments until mid-month. As a result, blog posts will be sporadic and email responses will be near-zero. Thank you for your understanding.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, Judy W. ($50), for your sumptuously generous contribution to this site -- I am greatly honored by your steadfast support and readership.

| |

Thank you, Brendan M. ($50), for your monstrously generous contribution to this site -- I am greatly honored by your steadfast support and readership.

|