Central bank policies have generated a truly unprecedented "trickle-up" of wealth and income to the top .5%.

Over the past 20 years, central banks have run a gigantic real-world experiment called "trickle-down." The basic idea is Keynesian (i.e. the mystical and comically wrong-headed cargo-cult that has entranced the economics profession for decades): monetary stimulus (lowering interest rates to zero, juicing liquidity, quantitative easing, buying bonds and other assets-- otherwise known as free money for financiers) will "trickle down" from banks, financiers and corporations who are getting the nearly free money in whatever quantities they desire to wage earners and the bottom 90% of households.

The results of the experiment are now conclusive: "trickle-down" has failed, miserably, totally, completely.

It turns out (duh!) that corporations didn't use the central bank's free money for financiers to increase wages; they used it to fund stock buy-backs that enriched corporate managers and major shareholders.

The central bank's primary assumption was that inflating asset bubbles in stocks, bonds and housing would "lift all boats"--but this assumption was faulty. It turns out most of the financial wealth of the nation is held by the top 5%.

As for housing--yes, a relative few (those who happened to own modest bungalows in San Francisco, Seattle, Portland, Toronto, Vancouver, Brooklyn, etc.) on the left and right coasts have registered spectacular gains in home appreciation as the housing bubbles in these cities now dwarf the 2006-07 real estate bubble. But on average, the gains in home appreciation have barely offset the declines in real (adjusted for inflation) household income.

These charts illustrate the abject failure of the "trickle-down" economic theory.The majority of the assets that have soared in value are owned by the top 5%:

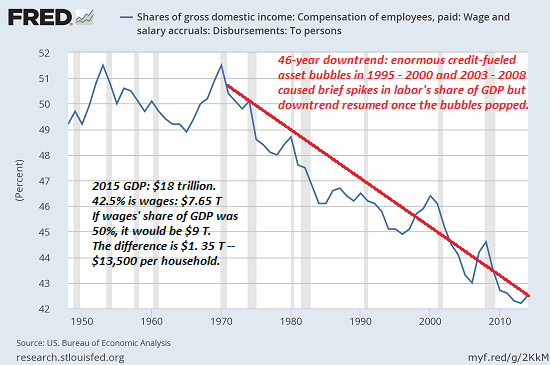

Wages as a share of GDP (gross domestic product, i.e. the nation's total economic activity) has been declining for decades:

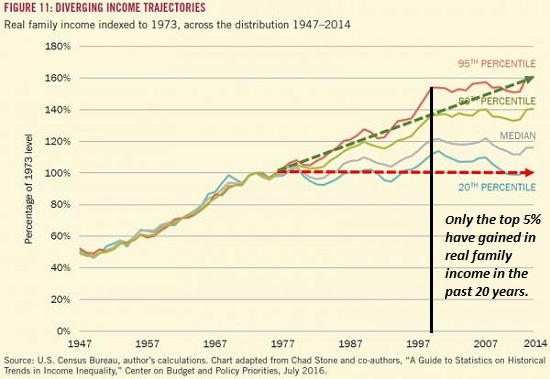

The only segment of households who have registered gain in real income over the past 20 years is the top 5%:

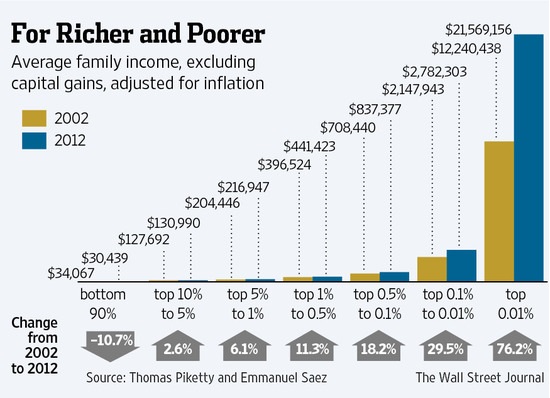

Even excluding capital gains--the source of much of the wealthiest class's income--wealth disparity has reached astonishing asymmetries: most of the gains are flowing to the top 0.5%:

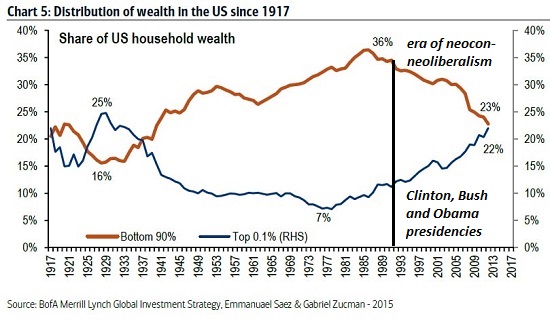

The Clinton, Bush and Obama presidencies shared one commonality: the wealth of the bottom 90% cratered in their presidencies while the wealth of the top .1% skyrocketed.

Central bank policies have generated a truly unprecedented "trickle-up" of wealth and income to the top .5%. Evidence supporting "trickle down" is nowhere to be found, at least in the real world.

Recent podcasts/video programs:

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, Millie N. ($60), for your fantastically generous contribution to this site -- I am greatly honored by your steadfast support and readership.

| |

Thank you, Dugaboys ($50), for your supremely generous contribution to this site -- I am greatly honored by your support and readership.

|