Yes, this time it's different: all the foundations of a healthy economy are crumbling into quicksand.

The rallying cry of Permanent Bulls is this time it's different. That's absolutely true, but it isn't bullish--it's terrifically, terribly bearish. Why is this time it's different bearish going forward? The basic answer is that nothing that is structurally broken has actually been fixed, and the policy "fixes" have fatally weakened the global financial system.

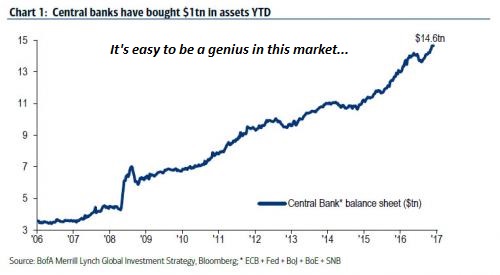

Let's go over a handful of the many ways that this time it's different, starting with the unprecedented level of central bank support of asset prices via the purchase of financial assets such as stocks and bonds.

A trillion here, a trillion there, and pretty soon you're talking real "money":

As virtually everyone who follows finance knows, these monumental purchases have pushed bond yields / interest rates lower and stocks higher, while super-low mortgage rates have inflated a new global housing bubble that's now bigger than the previous bubble that burst with such devastating consequences.

The net consequence of this 8-year long orgy of inflating global assets has backed the central banks into a corner, as the asset bubbles demand two incompatible policies:

1. "normalize" rates and central bank balance sheets by reducing / ending central bank purchases of assets

2. continue the rampant expansion of central bank balance sheets / purchases of assets lest these bubbles pop, destroying tens of trillions in "wealth" (more properly, phantom wealth).

You can't have it both ways, and so the central bankers keep their sweaty palms on the steering wheel and their foot on the accelerator, speeding for the cliff, i.e. the point at which bubbles pop despite central bank buying.

This time is also different in the unprecedented mis-alignment of labor markets, worker skills, productivity and wage growth. As I have explained many times here, wage growth is the essential foundation for self-sustaining economic expansion based on purchases funded by debt. (The current global economy requires expanding debt to fund expanding consumption and the servicing of existing debt.)

This time it's different, as wages have stagnated for the bottom 95%. Even with full employment and 6 million job openings, wages aren't rising because they can't rise; employers can't afford to pay more and labor overhead costs like healthcare insurance and workers compensation are siphoning off income that could have gone to wages.

This time it's different because productivity is also stagnating, despite the many trillions dumped into financial markets. All the trillions flow into speculative gambles backstopped by central banks, not productive investments--those are too risky. It's much smarter to put free cash into speculative financial games (stock buy-backs, etc.) that are backstopped by central banks or state agencies.

Meanwhile, low-income workers can't afford to live in high-cost cities, and small businesses can't afford to pay higher wages for low-productivity jobs. It must be extremely frustrating to central bankers and politicos: they can force-feed corporations and financiers with limitless free money for speculation, but they can't force people to start and operate small businesses or take on more debt--except those mired in the delusion that college diplomas are the guaranteed key to financial security.

As a result of these structurally broken systems, there are millions of low-productivity jobs and many high-skill positions that can't be filled. The dynamic nexus of labor markets, education/training, productivity and wage growth is broken, utterly and completely, despite the "all is well" bleatings of the self-serving cartels reaping billions from the current parasitic feudalism.

Yes, this time it's different: all the foundations of a healthy economy are crumbling into quicksand. Nothing that is broken has been fixed, and the central banks' one "fix"--inflating asset bubbles--guarantees the destruction of all the phantom wealth this "fix" has generated.

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, Jorgan C. ($5/month), for your splendidly generous pledge to this site -- I am greatly honored by your support and readership.

| |

Thank you, Chavara B. ($5/month), for your superbly generous subscription to this site -- I am greatly honored by your support and readership.

|