So who's holding the hot potato of systemic risk now? Everyone.

One of the greatest con jobs of the past 9 years is the status quo's equivalence of risk and volatility: risk = volatility: so if volatility is low, then risk is low. Wrong: volatility once reflected specific short-term aspects of risk, but measures of volatility such as the VIX have been hijacked to generate the illusion that risk is low.

But even an unmanipulated VIX doesn't reflect the true measure of systemic risk, a topic Gordon Long and I discuss in our latest program,

The Game of Risk Transfer.

The financial industry has reaped enormous "guaranteed" gains by betting against volatility. As volatility steadily declined over the past two years, billions of dollars were reaped by constantly betting that volatility would continue declining.

Other "guaranteed" trades have been corporate buybacks funded by cheap credit and passive index funds Central bank policies--near-zero interest rates and "we've got your back" asset purchases that made buying every dip a no-brainer trading strategy--have changed as banks attempt to dial back their stimulus and near-zero rates, and as a result volatility cannot continue declining in a nice straight line heading toward zero.

Higher interest rates have introduced a measure of uncertainty in another "guaranteed gains" trade--betting that interest rates would continue declining. All of these trades were "guaranteed" by central bank stimulus and intervention. In effect, price discovery has been reduced to betting that central banks will continue their current policies--'don't fight the Fed."

Now that central banks have to change course, certainty has morphed into uncertainty, and risk is rising, regardless of what the VIX index does on a daily basis.

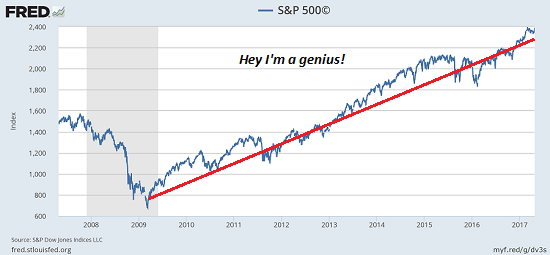

Here is what a "guaranteed gains by buying the dip" market looks like: just bet that central banks will buy every dip and suppress volatility, and you're a genius.

Until the recent spot of bother that destroyed the short-volatility trade, betting on declining volatility "guaranteed gains":

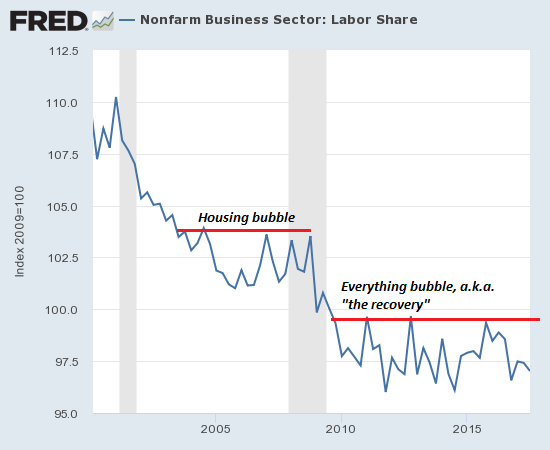

Meanwhile, back in the real-world economy, wage earners' share of the economy continues stair-stepping down as every risk-asset bubble eventually pops:

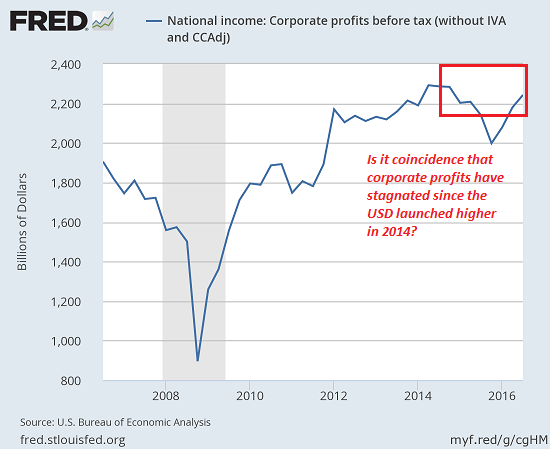

Back in the good old days, corporate profits were the foundation of rising stock valuations. But corporate profits have stagnated while stocks have soared.

Gordon and I discuss the inconvenient reality that risk cannot be destroyed, it can only be transferred to others. So who's holding the hot potato of systemic risk now? the short answer: every participant holding risk assets, which now includes virtually every asset class.

Suppressing volatility does not mean risk has vanished; rather, it means that risk is increasing as accurate information on systemic risk is being suppressed. The global financial system is becoming increasingly fragile and thus more prone to collapse, and an artificially low measure of volatility doesn't change this reality.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, Caleb C. ($5/month), for your marvelously generous pledge to this site -- I am greatly honored by your support and readership.

| |

Thank you, Max D. ($5/month), for your splendidly generous pledge to this site -- I am greatly honored by your support and readership.

|