The other deflationary pressure is the stagnation of wages for the bottom 90%.

Apple's slumping sales growth in China re-energized discussions on the commoditization of smart phones: the basic idea is that once devices, services, goods, platforms, etc. are interchangeable and can be produced/generated anywhere, they are effectively commodities and their value declines accordingly.

In the case of Apple's iPhone, many observers see diminishing returns on the latest model's features as the price point (around $1,000) now exceeds what many customers are willing to pay for the status of owning an Apple product and the declining differentiation of the iPhone when compared to other smart phones available at a fraction of the iPhone's price.

Commoditization doesn't just affect the top tier of the food chain; it affects the entire food chain. The commodity $400 smart phone has diminishing returns over the commodity $200 smart phone, and the $200 smart phone has diminishing returns over the commodity $100 smart phone.

Commoditization ravages price and profitability. Once the production facility is paid for by the first run, the cost basis of future production drops, enabling the producer to reap profits even as price plummets.

This is why perfectly good tablets cost $35 wholesale in some Asian markets.

Commoditization doesn't just affect tech devices: passive index funds have commoditized investing. Why pay a hedge fund's steep fees when a passive index fund may beat the net return (i.e. after fees) of the hedge fund?

No wonder hedge funds are closing left and right; investing is being commoditized by passive funds, funds managed by software, etc.

Commoditization is inherently deflationary as prices and profits are pushed down along the entire food chain.

As Marx explained in the 19th century, the only way to preserve pricing power and profits is to eliminate competition by establishing a monopoly or cartel. And indeed, the sectors which continue to jack up prices and rake in outsized profits are cartels: healthcare, national defense, pharmaceuticals, higher education, etc.

Companies such as Microsoft, Google and Facebook have established quasi-monopolies via the network effect, buying up potential competitors, etc.

While globalization has fueled the commoditization of goods such as phones and services such as tech support, commoditization can also be homegrown.Consider how tax software has reduced the demand for tax preparation services, or how the cost of digitally distributing content such as films is near-zero.

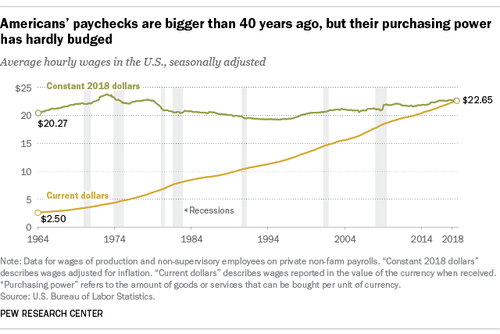

Labor has also been commoditized, and this is one reason why wages have stagnated. If someone somewhere else (in another state, in another country, etc.) can produce the same output for less total compensation, then that pushes employers to move production to lower costs.

Direct delivery of goods and services to the consumer is also commoditized: do you really care whether your package is delivered by the US Postal Service, UPS, FedEX, or a gig-economy Amazon driver? No.

The scarcity value and pricing power of brands, retail outlets, malls, etc. are all plummeting for structural reasons.

The other deflationary pressure is the stagnation of wages for the bottom 90%: consumers might desire the status of a new iPhone but be unable to justify the expense or the financial sacrifices that are required to make such a discretionary purchase.

If we consider the digitization powering the 4th Industrial Revolution and the rising political demands for renewed anti-trust scrutiny of monopolistic behemoths, it's not difficult to discern a continuation of the deflationary trends of commoditization and stagnant wages.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, Wojciech N. ($50), for your massively generous pledge to this site -- I am greatly honored by your steadfast support and readership.

| |

Thank you, Eugene R. J. ($5/month), for your monstrously generous up-pledge to this site -- I am greatly honored by your steadfast support and readership.

|