The Fed must now accept responsibility for what happens in the end-game of the Moral-Hazard Monster Bubble it created.

Contrary to popular opinion, the Federal Reserve didn't set out to create a Monster Bubble that has escaped its control. Also contrary to popular opinion, the Fed will be unable to "never let stocks fall ever again--ever!" for the simple reason that the monster it has created-- a monster mania of moral hazard in which all risk has vanished because the Fed will never let stocks fall ever again--ever!--is now beyond its control.

And that's a problem for the Fed, which above all else needs control of interest rates, financial markets and the economy.

The problem is that bubbles always pop, and they pop regardless of what central banks do. This is contrary to the popular opinion that if only the Fed had saved Lehman Brothers, the Global Financial Meltdown of 2008 would never have happened.

Wrong. Bubbles pop when too much risky debt unbacked by collateral is issued to marginal borrowers who inevitably default, triggering massive losses in the financial sector, an equally massive unwind of speculative debt and risky gambles and a deep recession as all the debt-fueled malinvestment dries up and blows away.

The 2008 Global Financial Meltdown was the inevitable result of subprime and other debt bubbles bursting which then triggered a panic to unwind trillions of dollars in high-risk speculative gambles in stocks, real estate, junk bonds, etc.

The Fed has another problem which it hasn't been able to solve despite 12 years of trying: to save the financial system from collapse, the Fed has to re-inflate the debt-fueled speculative mania that just popped from unstable excesses of debt, leverage and moral-hazard speculative fever, all piled on a diminishing foundation of actual collateral.

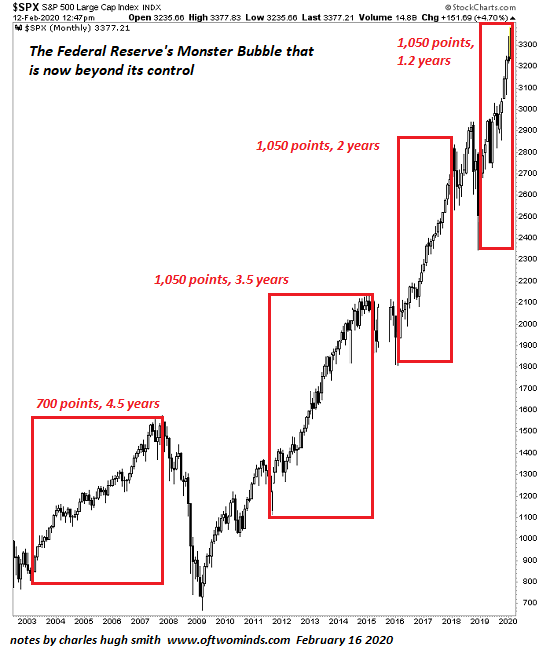

We can see the manic progression of each Fed rescue in this chart: note the compression of time as the periods between each Fed rescue shrink and the spectacular rocket-ship ride of debt, leverage and moral-hazard speculative fever adds another 1,000 points to the S&P 500 in ever shorter manic stampedes of front-running the next the Fed will never let stocks fall ever again--ever! bubble.

Advances that recently took years now take months. The 700 point advance that required 4.5 years back in the previous bubble of 2003-2007 now required only 4.5 months. The next iteration is 700 points in 4.5 weeks, then in 4.5 days, and then the oblivion of collapse.

The Fed's balance sheet has gone nowhere for eight weeks while the bubble in stocks gathered the manic momentum of

the Fed will never let stocks fall ever again--ever!:

12/25/19 $4.165 trillion

1/1/20 $4.173 trillion

1/8/20 $4.149 trillion

1/15/20 $4.175 trillion

1/22/20 $4.145 trillion

1/29/20 $4.151 trillion

2/5/20 $4.166 trillion

2/12/20 $4.182 trillion

That's a total range of $0.017 trillion--essentially signal noise. This strongly suggests that the Fed is hoping--foolishly, of course, as it stumbles around in a hubris-soaked fantasy that it can really, really, really control the moral-hazard monster it created--to keep stocks on a "permanently high plateau" which somehow avoids the two disasters that history records as inevitable: either an immediate collapse of the bubble or a Fed-fueled "rescue" that adds another 1,000 points in six months, and then another 1,000 points in three months, and then a collapse that cannot be rescued, as the entire financial system implodes.

The Fed managers are foolish but not stupid. They realize they cannot let the moral-hazard mania move into the phase where an irretrievable collapse becomes inevitable.

The problem here is history has never recorded a bubble which settled magically onto a "permanently high plateau" and stayed there for months or years. So the Fed has finally reached the point of no return: either it accepts a painful bursting of the monster moral-hazard bubble it has created or it lets the monster lead the stampede over the cliff to a financial collapse that the Fed can't rescue with the usual tools of lowering interest rates and bailing out banks.

It's worth recalling that the Fed can't actually force insolvent lenders to lend more money to insolvent borrowers. It also can't squeeze blood from stones; insolvent borrowers default, period. The losses can be buried in the Fed balance sheet but that doesn't create income for shuttered enterprises or laid-off workers, or generates taxes for local governments watching their tax base melt away.

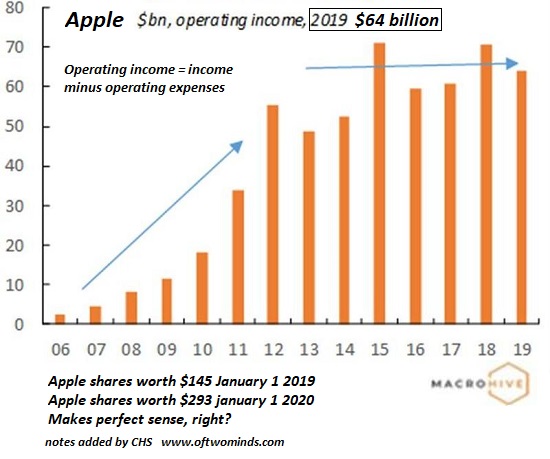

Even the hubris-soaked fools in the Fed realize this bubble has disconnected from financial realities. One glance at the operating income of Apple shows that everyone's favorite stock has soared even as operating income has been essentially flat for years. There's a phrase for this: disconnect from reality, all driven by the manic certitude that the Fed will never let stocks fall ever again--ever!

After 12 long years of ever-riskier bubble-blowing, the Fed is now boxed in. Instead of reassuring markets that the next 1,000 points are guaranteed and all in only a few more months of mania, the Fed will either have to offer false assurances while it attempts an impossible "soft landing", i.e. a controlled deflation of the Monster Bubble, or it grimly accepts that a 1,000 point decline in the S&P 500 now is a better choice than an implosion later if the Monster Bubble breaks completely free and rampages higher even as the Fed pulls the plug.

Moral-Hazard Monster Bubbles cannot be controlled. Human greed guarantees that the Fed will never let stocks fall ever again--ever! will generate self-reinforcing stampedes of speculative mania that no long respond to the signals of the Fed balance sheet.

At this point, the Fed will be hoist on its own petard: by claiming god-like control of interest rates, financial markets and the economy, the Fed must now accept responsibility for what happens in the end-game of the Moral-Hazard Monster Bubble it created: either allow a 25% to 30% wipeout of speculative excess now or feed the final stampede to financial collapse.

It's not a happy choice, but if we're honest (gasp), there really is no choice: the Fed cannot let the moral-hazard mania run to complete collapse, which is now only one iteration away.

My recent books:

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, Dennis G. ($75), for your marvelously generous contribution to this site -- I am greatly honored by your steadfast support and readership.

| |

Thank you, Robert M. ($50), for your superbly generous contribution to this site -- I am greatly honored by your steadfast support and readership.

|