This is the key dynamic of the economy going forward: defaults on debt, declining wealth as assets are relentlessly repriced lower and sharp declines in income due to layoffs and debt defaults.

The economy is like an elephant surrounded by blindfolded economists and pundits: what each blindfolded person reports about the elephant depends on what part they happen to touch.

This is why aggregate measures such as gross domestic product (GDP) and the consumer price index (CPI) will be misleading and therefore useless going forward: different parts of the economy might experience sharp deflation while other parts are experiencing rapid inflation. What each household and enterprise will experience depends on their exposure to these cross-currents.

Adding up sharply deflationary and equally severe inflationary trends to get a total inflation reading near zero will be utterly meaningless. Let's review a few key sectors of the economy to see how different participants' experiences of the economy will be.

Let's start with two of the apple carts the pandemic has knocked over: retail and commercial office space.

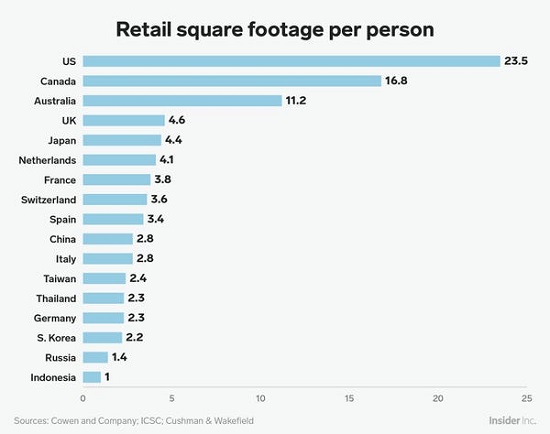

The first chart reveals the enormous surplus of retail space in the U.S. compared to other developed nations. Half of all U.S. retail space could vanish and we'd still have more than twice as much retail space per person as most of the developed world.

Such a vast surplus and the implosion of demand suggests a highly deflationary future for retail space rents. Furthermore, empty retail = no income for landlords = default on mortgages = bank losses = banking crisis. How much is empty retail space worth when the prospects of ever getting a paying tenant are poor? The answer is zero, or even less than zero, since the owner still has to pay property taxes, liability insurance, maintenance, utilities, etc.

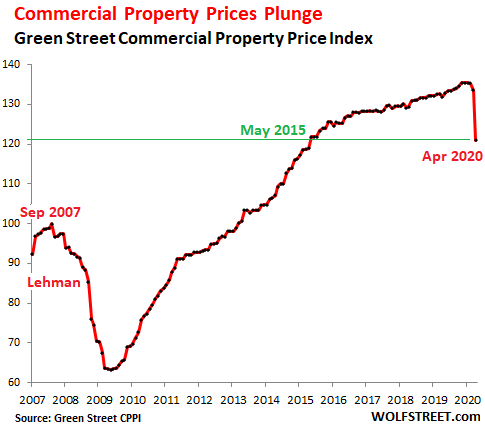

The same dynamic dominates the commercial office space there's a massive surplus of office space while demand is imploding as marginal businesses fold and remote work becomes the desired setting for millions of digital workers and the default setting for employers anxious to avoid lawsuits arising from needlessly exposing their workforce to crowded offices.

What's the value of an empty office tower if the current owner overpaid and has a mortgage that far exceeds any realistic valuation based on 50% vacancy rates for the foreseeable future?

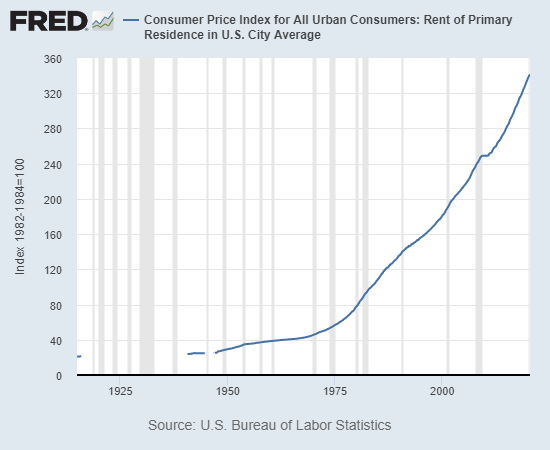

Next up--lofty rents for apartments in previously hot metro areas like San Francisco and NYC. Rents in the S.F. Bay Area are up 60% from 2009, far more than most renters' income gains in the same period. If the exodus from these hot markets accelerates as layoffs gather momentum, rents could fall far more than many expect.

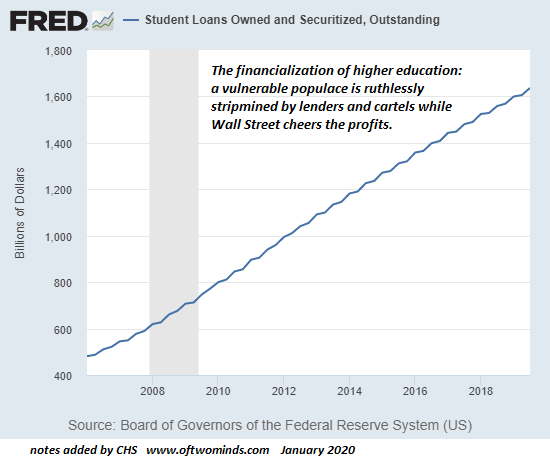

Then there's the core problem with our entire economy: debt payments are fixed, income and profits are not. Take a quick glance at the chart of student loans, now pushing $1.7 trillion, and ponder how many of the Millennials who have to make these fixed debt payments were employed in sectors that have collapsed: tourism, restaurants, musical venues, gig economy, etc.

Recall that every debt that crushes the borrower is an asset that yields monthly interest to the affluent owners of that debt. When unemployed people default on their student loans, the value of those loans falls, and the income flowing to the affluent owners of the debt drops to zero.

This is the key dynamic of the economy going forward: defaults on debt, declining wealth as assets are relentlessly repriced lower and sharp declines in income due to layoffs and debt defaults.

Recent Podcasts:

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, Adam C. ($50), for your superbly generous contribution to this site -- I am greatly honored by your support and readership.

| |

Thank you, Martin E. ($5/month), for your splendidly generous pledge to this site -- I am greatly honored by your support and readership.

|