It Always Ends The Same Way: Crisis, Crash, Collapse

Risk has not been extinguished, it is expanding geometrically beneath the

false stability of a monstrously manipulated market.

One of the most under-appreciated investment insights is courtesy of Mike Tyson:

"Everybody has a plan until they get punched in the mouth." At this moment in history,

the plan of most market participants is to place their full faith and trust in the status quo's

ability to keep asset prices lofting ever higher, essentially forever.

In other words, the vast majority of punters are convinced they will never suffer the indignity

of getting punched in the mouth by a market crash. What makes this confidence so interesting

is massively distorted markets always end the same way: crisis, crash and collapse.

The core dynamic here is distorted markets provide false feedback and misleading information

which then lead to participants making catastrophically misguided decisions. Investment decisions

made on poor information will also be poor, leading participants to end up poor, to their very

great surprise.

The surprise comes from the falsity of the feedback, as those who are

distorting markets want punters to believe "the market" is functioning transparently. If you're

manipulating the market, the last thing you want is for the unwary marks to discover that the

market is generating false signals and misleading information on risk, as knowing the market

is being distorted would alert them to the extraordinary risks intrinsic to heavily distorted

markets.

The risks arise from the disconnect between the precariousness of the manipulated market

and the extreme confidence punters have in its stability and predictability. The predictability

comes not from transparent feedback and market signals but from the manipulation. This stability

is entirely fabricated and therefore it lacks the dynamic stability of truly open markets.

Markets that are being distorted/manipulated to achieve a goal that is impossible in truly

open markets--for example, markets that only loft higher with near-zero volatility--lull participants

into a dangerous perception that because markets are so stable, risk has dissipated.

In actuality, risk is skyrocketing beneath the surface of the artificial stability because the

market has been stripped of the mechanisms of dynamic stability. This artificial stability

derived from sustained manipulation has the superficial appearance of low-risk markets, i.e.,

low levels of volatility, but this lack of volatility derives not from transparency but from

behind-the-scenes suppression of volatility.

Another source of risk in distorted markets is the illusion of liquidity: in low-volume

markets of suppressed volatility, participants are encouraged

to believe that they can buy and sell whatever securities they want in whatever volumes they want

without disturbing market pricing and liquidity. In other words, participants are led to believe

that the market will always have a bid due to the near-infinite depth of liquidity: no matter how

many billions of dollars of securities you want to sell, there will always be a bid for your shares.

In actual fact, the bid is paper-thin and it vanishes altogether once selling rises above very

low levels. Heavily manipulated markets are exquisitely sensitive to selling because the

entire point is to limit any urge to sell while encouraging the greed to increase gains by buying more.

The illusions of low risk, essentially guaranteed gains for those who increase their positions

and near-infinite liquidity generate overwhelming incentives to borrow

more and leverage it to the hilt to maximize gains. The blissfully delusional punter

feels the decision to borrow the maximum available and leverage it to the maximum is entirely

rational due to the "obvious" absence of risk, the "obvious" guaranteed gains offered by markets

lofting ever higher like clockwork and the "obvious" abundance of liquidity, assuring the punter

they can always sell their entire position at today's prices and lock in profits at any time.

On top of all these grossly misleading distortions, punters have been encouraged to believe

in the ultimate distortion: the Federal Reserve will never let markets decline again, ever.

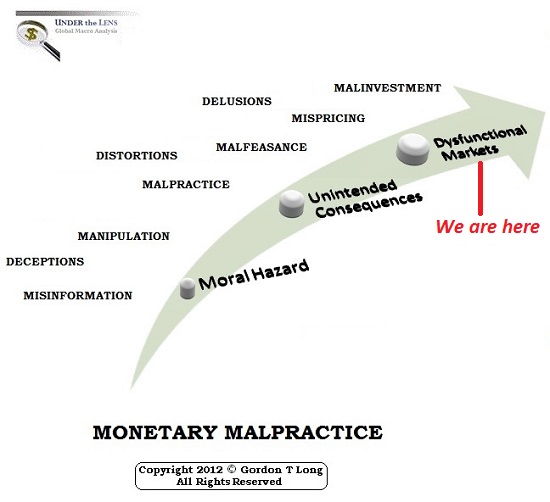

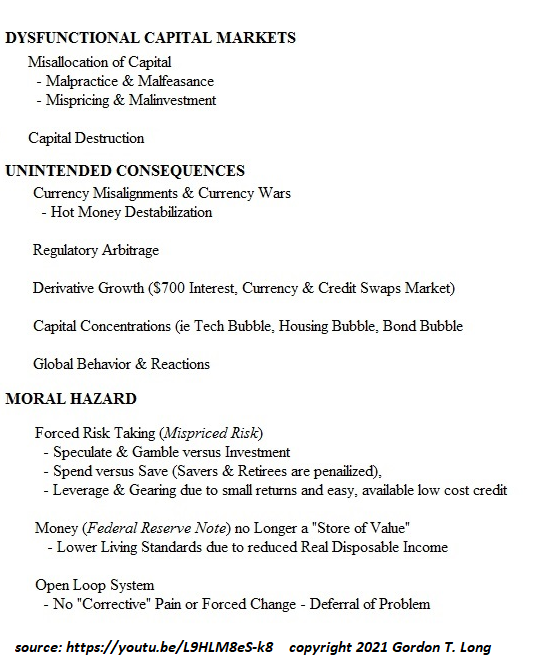

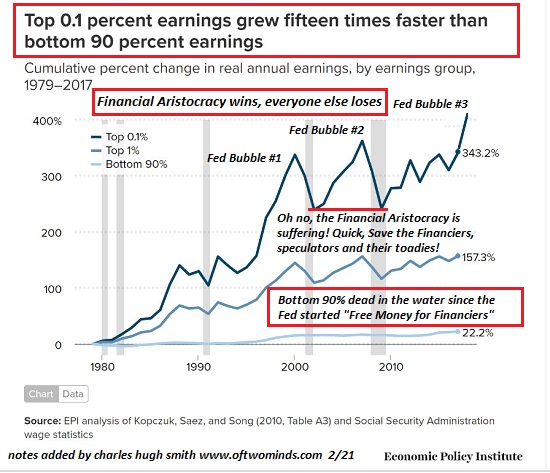

This is the perfection of moral hazard: risk has been disconnected from consequence.

In this perfection of moral hazard, punters consider it entirely rational to increase

extremely risky speculative bets because the Federal Reserve will never let markets decline.

Given the abundant evidence behind this assumption, it would be irrational not to ramp up

crazy-risky speculative bets to the maximum because losses are now impossible thanks to the Fed's

implicit promise to never let markets drop.

This is why distorted, manipulated markets always end the same way: first, in

an unexpected emergence of risk, which was presumed to be banished; second, a market crash

as the paper-thin bid disappears and prices flash-crash to levels that wipe out all those

forced to sell by margin calls, and then the collapse of faith in the manipulators (the Fed),

collapse of the collateral supporting trillions of dollars in highly leveraged debt and

then the collapse of the entire delusion-based financial system.

Gordon Long and I illuminate the many layers of distortion, manipulation and moral hazard

in our new video presentation,

It Always Ends The Same Way (34:33). Amidst the ruins generated by well-meaning

manipulation and distortion, the "well meaning" part will leave an extremely long-lasting

bitter taste in all those who failed to differentiate between the false signals and distorted

information of manipulated markets and the trustworthy transparency of signals arising in

truly open markets.

In summary: risk has not been extinguished, it is expanding geometrically beneath the

false stability of a monstrously manipulated market. As I often note here, risk cannot

be extinguished, it can only be transferred. By distorting markets to create an illusion

of low-risk stability, the Federal Reserve has transferred this fatal supernova of risk to

the entire financial system.

If you found value in this content, please join me in seeking solutions by

becoming

a $1/month patron of my work via patreon.com.

My new book is available!

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

20% and 15% discounts (Kindle $7, print $17,

audiobook now available $17.46)

Read excerpts of the book for free (PDF).

The Story Behind the Book and the Introduction.

Recent Videos/Podcasts:

It Always Ends The Same Way (34:33) (with Gordon Long)

My COVID-19 Pandemic Posts

My recent books:

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic

($5 (Kindle), $10 (print), (

audiobook):

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake

$1.29 (Kindle), $8.95 (print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print)

Read the first section for free (PDF).

Become

a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Joy U. ($5/month), for your exceedingly generous pledge to this site -- I am greatly honored by your support and readership. |

Thank you, Jim S. ($10/month), for your outrageously generous pledge to this site -- I am greatly honored by your support and readership. |