Yes, It Is Different This Time

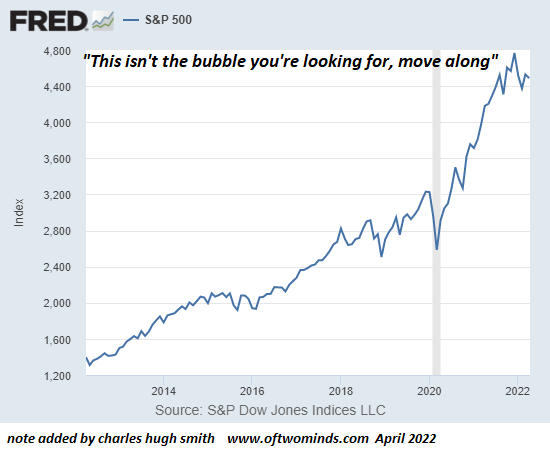

Most people would be horrified by a 40% decline in their "investments." When bubbles pop, speculative assets

don't drop 40%, they drop 90% or even 98%.

The irony of the sudden panic about real-world inflation generated by rising wages is two-fold:

1. The status quo never mentions the rampant inflation in assets, because the already-wealthy got wealthier,

so asset inflation is wonderful and deserves to be permanent

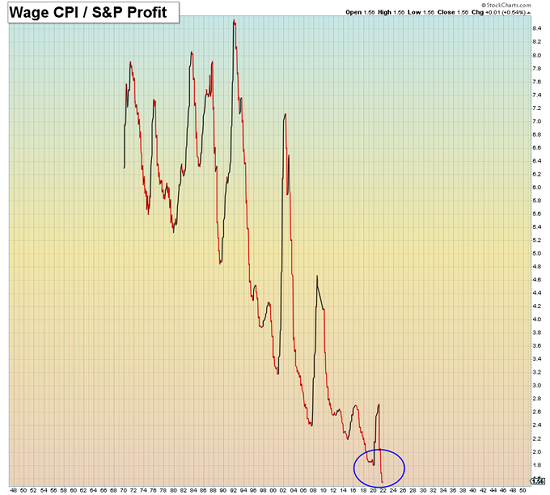

Look at the chart below (courtesy of Mac10) of the S&P 500 / wages adjusted for the CPI (consumer price index):

corporate profits have soared against wages since 2009.

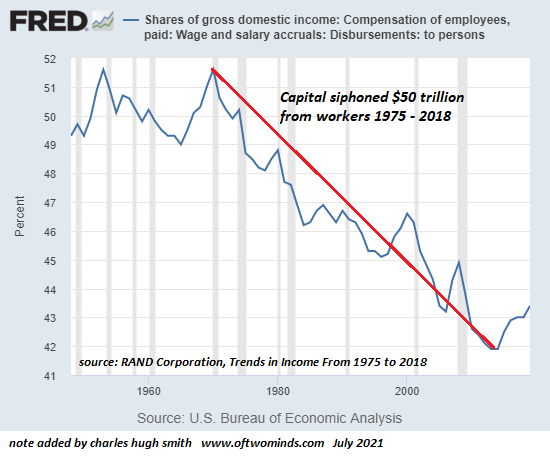

2. Wages have been hammered since 1975, as RAND Corporation research found $50 trillion has been

transferred from the workforce to capital in the past 45 years. (see chart below)

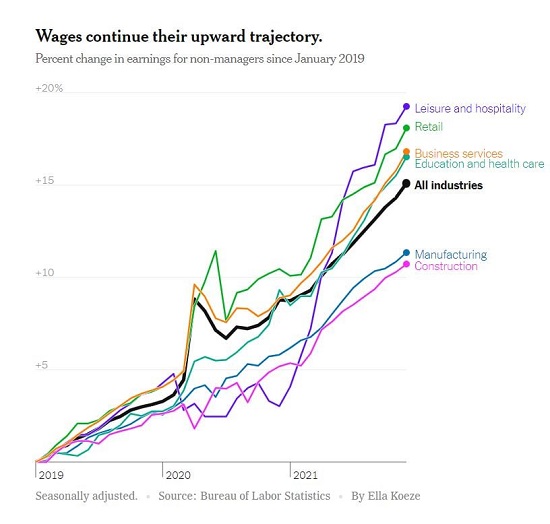

The wealthy had no complaint about wages losing purchasing power for 45 years, but the first little blip up in wages'

purchasing power causes a panic.

Now that the trends of soaring asset inflation and deflation of labor have reversed, assets will deflate

and wages will rise, sending the wealthy and their apologists, toadies and media tools into panic.

"Markets rise on a escalator and fall in an elevator" is a Wall Street saying, but there is more than reversion

to the mean or other technical dynamics at work: the obscene wealth that's been transferred to the top 0.1% is

now a political target.

Being self-supporting at 19 years of age sharpens one's memory of earnings, costs and the purchasing power of

a day's labor.

I kept a logbook of all expenses, no matter how modest, in my early 20s when my wages were low due to limited

hours (being a full-time university student) and low pay.

By the absurdly understated official inflation calculator

(https://www.bls.gov/data/inflation_calculator.htm),

the $1.65/hour we earned as minimum wage in 1970 is now worth $12.17.

But when I recall what I could buy with my modest wages, I think the more realistic equivalent is $16 to $18/hour.

The $3.50/hour I made in 1974 is officially worth $20, but in terms of what I could buy with that $3.50, it's

more like $30/hour.

For example: in 1974, the rent for my low-end studio in Honolulu was $125/month. (Recall that Honolulu has long

been one of the most expensive cost-of-living cities in the U.S.) It took 35 hours of labor to pay the rent

(ignoring taxes for simplicity).

Today, it takes about 60 hours of labor at $20/hour to pay the rent on a studio in Honolulu ($1200/month).

Much is made about the higher quality of goods today and the lower cost of electronics, etc.

But we forget that TVs, appliances, etc. lasted a long time back then, so such purchases were rare.

Used goods were available for a fraction of new.

The worker making $3.50/hour in 1974 could buy more and save more than the worker

making $20/hour today.

As an experienced (but not yet full journeyman) non-union carpenter in 1977 (age 23), I was earning $7.50/hour.

According to official inflation, that's worth almost $36/hour today.

How many experienced 23-year old carpenters make $36/hour today? My guess is relatively few, though short-term

piecework and boomtown jobs may offer high wages for brief periods.

By my calculations of what I could buy then for $7.50/hour, the equivalent today is more like $45/hour.

Back then, I paid rent, ownership of a vehicle, taxes, dining out, etc. and still saved 50% pf my net pay.

Is that possible for someone earning $36/hour paying open-market prices for rent, healthcare, vehicle ownership,

dining out, etc. to save half their net earnings? Not without a "special deal" on rent or extraordinary sacrifices.

I didn't sacrifice much of anything in 1977, I simply didn't squander my earnings. There's a big difference between

sacrifices and merely being frugal / careful to get full value.

When I was a builder in the mid-1980s, we paid 100% of our employees' full-coverage healthcare insurance.

It was about $50/month for each individual and around $150/month for a family.

According to official inflation, $50 in 1985 is now worth $132. Can you buy full-coverage healthcare insurance

for an individual for $132 a month now? No. "According to research published by the Kaiser Family Foundation in 2019,

the average cost of employer-sponsored health insurance for annual premiums was $7,188 for single coverage and

$20,576 for family coverage." That's $600/month for a single individual.

As a result of cartels, monopolies and asset inflation, real-world costs have eaten wage-earners alive for decades.

Asset inflation will reverse into asset deflation for many reasons, and wage deflation will reverse into inflation

(i.e. gaining purchasing power) for many reasons.

When cycles turn, we seek specific explanations, but the reality is often more systemic: extremes reached limits,

diminishing returns turned into negative returns, the pendulum consumed all the available momentum and is

now swinging back to the opposite extreme.

Look at the chart of wages share of GDP (gross domestic product) below. If wages gained 8% and returned to levels

of the mid-1970s, that would be 8% of $21.5 trillion GDP (2021) or $1.7 trillion.

That equals $13,000 a year for each of the 130 million workers in the U.S.

Corporate profits have risen from $400 billion to $2.4 trillion. What would it take for those profits to decline

back to $700 billion?

Most people gambling in assets don't think they're gambling; they think "investing" isn't gambling. But asset bubbles

are not the result of investing, they're the result of speculation running to extremes.

Most people would be horrified by a 40% decline in their "investments." When bubbles pop, speculative assets

don't drop 40%, they drop 90% or even 98%. Many tech companies that were $100+ in early 2000 were $4 or even $2 by 2003.

This is not at all unusual. We've simply forgotten what happens when bubbles pop.

The U.S. stock market was worth $53 trillion at the beginning of 2022. If corporate profits fall to $1 trillion

annually, and the price/earnings ratio drops to a historically reasonable 11, U.S. stocks will be worth $11 trillion,

a decline of roughly $40 trillion or 80%.

Recall that U.S. stocks fell to $11 trillion in value in 2002 and again in 2008.

"Impossible!" Yes, of course. That's what everyone thought in 2000 and 2008 just before the bubbles popped.

This is the third bubble, and it is the most gargantuan, the most stretched, and so the reversal will be

the most extreme.

Think elevator, not escalator. Generational inequality, class inequality, wage deflation and the worship of

the false gods of "wealth without work" the have all reached extremes. This time is different, but not in the way

the status quo expects.

My new book is now available at a 10% discount this month:

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $8.95, print $20)

If you found value in this content, please join me in seeking solutions by

becoming

a $1/month patron of my work via patreon.com.

Recent Videos/Podcasts:

The Dam Has Cracked (37 minutes, with Gordon Long)

My recent books:

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

(Kindle $9.95, print $25, audiobook)

Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic

($5 Kindle, $10 print, (

audiobook):

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake

$1.29 Kindle, $8.95 print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print)

Read the first section for free

Become

a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Arthur W. ($50), for your magnificently generous contribution to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, Gary H. ($5/month), for your splendidly generous pledge to this site -- I am greatly honored by your support and readership. |